Bitcoin’s Correlation to Equities Keeps It Under PressureAlso Trade Tensions and Leverage Are Driving a Familiar Drawdown Pattern & Low Volatility Signals Bitcoin’s Growing Market MaturityEach week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

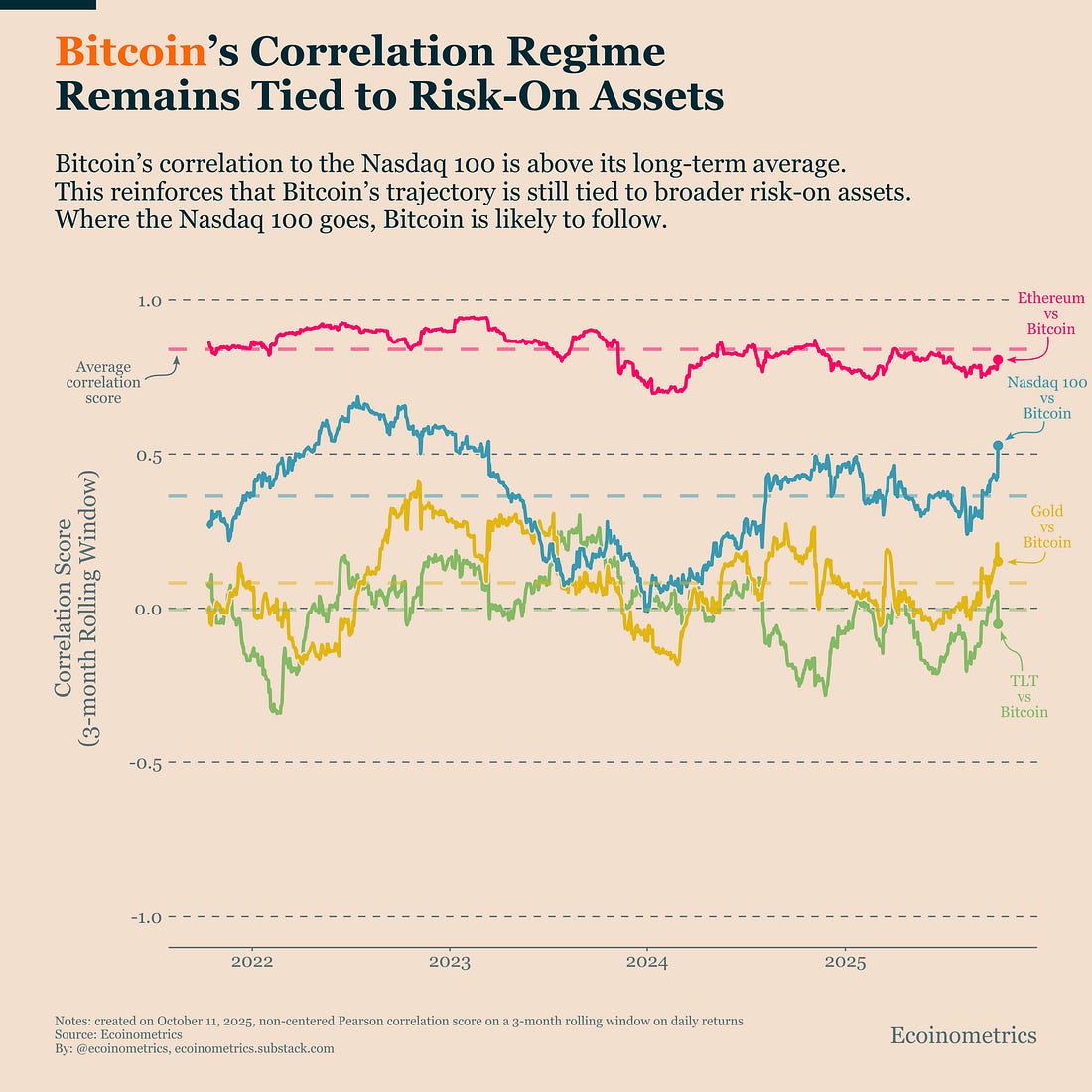

This week’s market action is a reminder that Bitcoin still trades within the same risk framework as other growth assets. When sentiment turns, correlations tighten, leverage unwinds, and liquidity becomes the main story. The data show that Bitcoin remains tethered to equities, that current pressures echo earlier drawdowns, but that despite the noise, volatility has stayed remarkably contained. In case you missed it, here are the other topics we covered this week: Bitcoin Market Monitor - Key Drivers in Ten Charts: Get these professional-grade insights delivered to your inbox: Bitcoin’s Correlation to Equities Keeps It Under PressureA wave of risk aversion has swept through markets this week. Regional bank worries and renewed U.S.–China trade tensions, have pushed investors toward safety and away from growth assets. Gold’s record-high price is simply the mirror image of that rotation, the capital that’s leaving equities and crypto is finding refuge in safe havens. Bitcoin’s reaction fits that pattern. When fear dominates, it trades in step with U.S. equities, not against them. This is the same behaviour we’ve seen in every risk-off episode of the past few years: equities slide, Bitcoin follows, and gold moves in the opposite direction. The correlation data back that up. Bitcoin maintains a moderately strong, persistent correlation with the Nasdaq 100 and almost none with gold. That correlation to risk assets holds even during stress periods. What changes is the contrast with gold, whose safe-haven flows push it in the other direction. Once volatility fades and risk appetite returns, Bitcoin rebounds alongside equities as part of the same risk-on complex. This isn’t a failure of the digital gold thesis. It’s a reflection of Bitcoin’s place in the global liquidity cycle. When financial conditions tighten, Bitcoin behaves like a high-beta growth asset and when liquidity expands, it amplifies the upside. So what we’re seeing now is typical behaviour for a market under pressure. Bitcoin isn’t directly affected by tariffs or bank stress, but as long as investors are de-risking, it will stay constrained. When sentiment stabilizes, it should move higher in sync with equities. But we aren’t there yet.

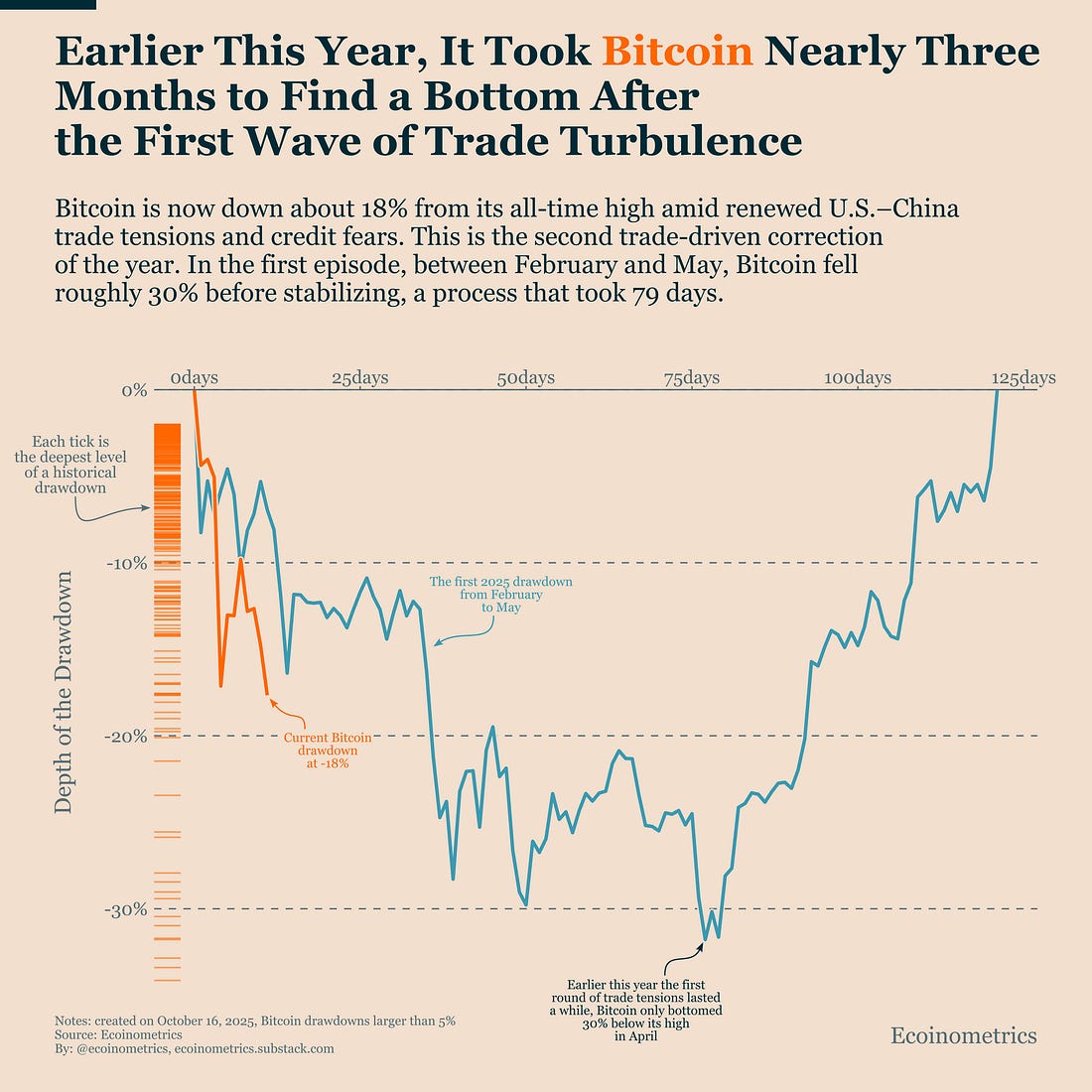

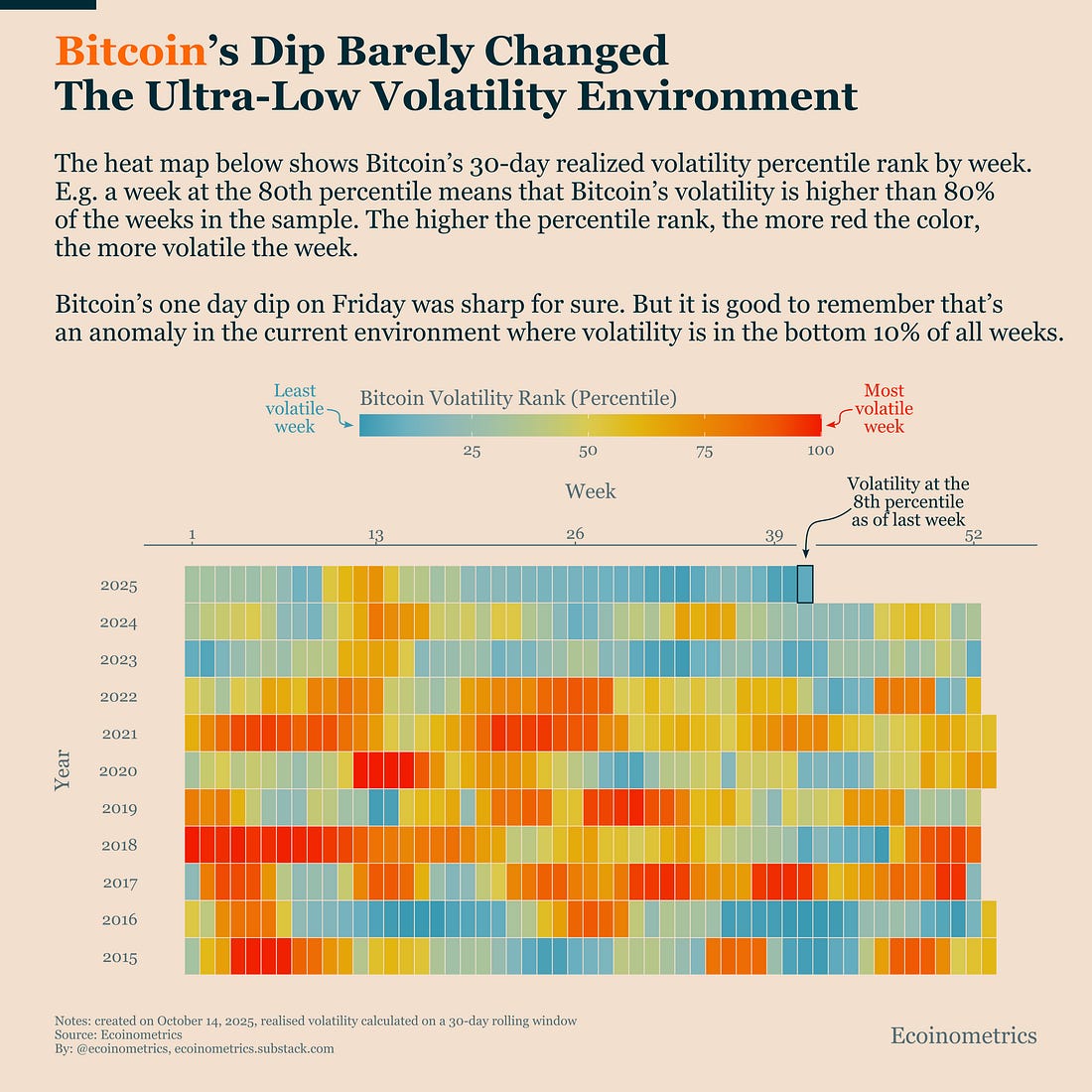

Trade Tensions and Leverage Are Driving a Familiar Drawdown PatternBitcoin’s latest decline fits a pattern the market has seen before. This year’s second wave of U.S.–China trade tensions and fresh credit worries have triggered a correction that looks strikingly similar to the one from earlier in 2025. Between February and May, the first bout of trade turbulence knocked Bitcoin down about 30%, dragged the Nasdaq 25% lower, and lifted gold 11%. It took roughly 80 days for Bitcoin to find a bottom before risk appetite returned. The current sequence is unfolding along the same lines. Bitcoin is now down about 18% from its high, and if the timeline repeats, the pressure could persist through November. Still, the setup isn’t identical. Markets have learned to discount trade headlines, expecting that Washington ultimately backs off (the T.A.C.O. trade), so the downside reaction to tariffs might prove milder this time. But the new twist is leverage. Margin debt is roughly 40% higher than it was in Q1 2025, and part of that exposure had rotated into Bitcoin during the early-Q4 rally. Now that positions are being cut, the deleveraging itself becomes a headwind. That process often ends abruptly, not gradually. In past cycles, forced deleveraging phases have reversed once liquidity stress peaked. But if deleveraging continues unchecked, the risk isn’t just another month of selling pressure. It’s that by the time conditions stabilize, the bullish momentum that defined early Q4 won’t be able to rebuild. The key metrics to watch over the next few weeks are liquidity conditions and market leverage. Once liquidity tightens enough and leverage comes down, the worst will likely be behind us. Low Volatility Signals Bitcoin’s Growing Market MaturityBitcoin’s short-term picture isn’t great. Sentiment is shaky, ETF flows have turned negative, and macro stress is dominating the narrative. But even in this environment, the absence of panic is notable. ETF outflows are modest (so far at least), and volatility has barely moved. Despite a fresh local high followed by an 18% drawdown, Bitcoin’s 30-day realized volatility remains in the bottom 10% of all weeks over the past decade. The Bitcoin of today is very different from the Bitcoin of just five years ago. And that stability tells a bigger story. Bitcoin’s market structure has evolved: deeper liquidity, a growing institutional base, and smoother price discovery all help dampen volatility. In effect, Bitcoin is behaving less like an ultra-speculative asset and more like a maturing component of the global risk complex. For investors, that’s good news. Lower volatility means smaller tail risks and more time to adjust portfolios when conditions change. It also makes Bitcoin more attractive to institutional allocators, creating a positive feedback loop: more adoption brings more stability, which in turn attracts more capital. That doesn’t mean the next few weeks will be easy. As long as trade tensions persist and leverage unwinds, Bitcoin won’t magically decouple from risk assets. But the low-volatility backdrop shows that the foundation of this market is getting stronger, not weaker. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, October 17, 2025

Bitcoin’s Correlation to Equities Keeps It Under Pressure

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Plasma ICO participants made >30x. Many of the new ICOs are seeing insane demand. Here's how you can get st...

-

Stripe’s deep embrace of crypto has marked a big moment for the industry, but it’s time to think deeper about alignment. ...

-

Market Jitters or Strategic Buying? Decoding Bitcoin's Price Retracement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Also Trade Tensions and Leverage Are Driving a Familiar Drawdown Pattern & Low Volatility Signals Bitcoin’s Growing Market Maturity ͏ ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment