Meta

$MEGA Sale & Return of ICO

Crypto Twitter is chasing a new token.

MegaETH is conducting another token sale. If you're interested, you should register before October 27th.

The exact details of the valuation aren't out. But the chain has a lot of hype. The testnet already has many cool apps, and it'll be the most performant blockchain at launch.

This announcement shows where the latest opportunities in crypto are.

The sale will happen on Sonar. It allows projects to compliantly sell tokens to KYC'd buyers. It's part of the latest generation of ICO platforms.R

egulatory acceptance of crypto means projects can legally sell tokens. So now, opportunities that were only available to VCs are opening up to retail.

There's an ICO 2.0 meta:

- $XPL did >30x for sale participants. This reminded people of "token sale" opportunity.

- Other recent ICO sales like Limitless, YieldBasis, Umbra, etc., were heavily oversubscribed.

I'll introduce you to top ICO platforms so you can catch those opportunities.

#1. Echo & Sonar

They are ICO platforms created by Cobie, a crypto OG with significant influence.

Echo has high barriers to entry. After signing up, you need to request an invite to various groups. The deal flow is collected by group leaders. So the really good investments might not be easily accessible to everyone.

Sonar is the more open platform of the two. It allows the project itself to sell the tokens, and anyone who's KYCd can theoretically buy the tokens.

Notable raises include Plasma, MegaETH, and Ethos.

#2. Kaito

Kaito is much more than a Twitter mindshare analytics platform.

Its Capital Launchpad allows projects to find dedicated community members. So, Kaito ICOs are typically gated to top yappers of the project or to Kaito stakers. Like others, you will need to KYC to get in on them as well.

Limitless, a recent ICO on the platform, was oversubscribed by 77x.

#3. Legion

This platform focuses on finding investors who can genuinely contribute to project development.

They have something called "Legion Score". It is calculated quantitatively by combining various on-chain and off-chain data, including on-chain activity history, social media influence, and GitHub activity scores.

It went viral for the YieldBasis raise.

There are many more platforms. Instead of going through all of them, I'll just list them below

Some projects like Pump.fun, often host public sales using their own infrastructure. CEXs like Binance & Kraken also have their version of launchpads as well.

With these platforms, you're connecting your wallets & government IDs. So there can be some privacy concerns. But right now, big opportunities are on these platforms.

That doesn't mean everything on these platforms is a winner. They're still early-stage companies, aka risky protocols. You have to do due diligence on them.

Sponsored by Lit Protocol

Lit Protocol: The Key to Unlocking Autonomy

AI Agents with crypto capabilities have insane potential.

But there's a major blocker: devs can't safely delegate keys to AI Agents. The agents might run amok with it.

Enter Lit Protocol. It's a decentralized key management and private compute network for signing and encryption, the two fundamental technologies that underpin the majority of our digital interactions.

Lit already powers live AI agents. Vincent Yield is the flagship app that securely rotates your Base USDC into the highest-yielding vaults on Morpho every week.

Additionally, some of the biggest products in our industry are powered by Lit, including Gitcoin, Lens Protocol, Emblem Vault, Humanity Protocol, Spheron Network, Genius Protocol, and more.

So its metrics are great.

- ~$300M in trading volume processed

- 1.68M+ wallets created on Lit's Datil mainnet beta

- $344M+ in Assets Under Decentralized Management (AUDM).

Applications will pay for Lit services using $LITKEY. And node runners will have to stake it.

So all the value from Lit activities will accrue to the upcoming $LITKEY token.

Drama

The Price for CEX Listings

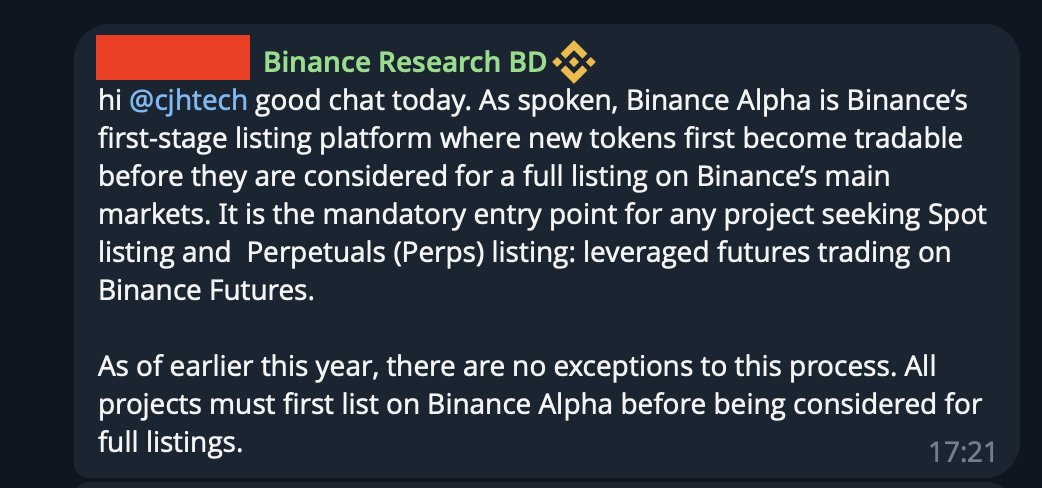

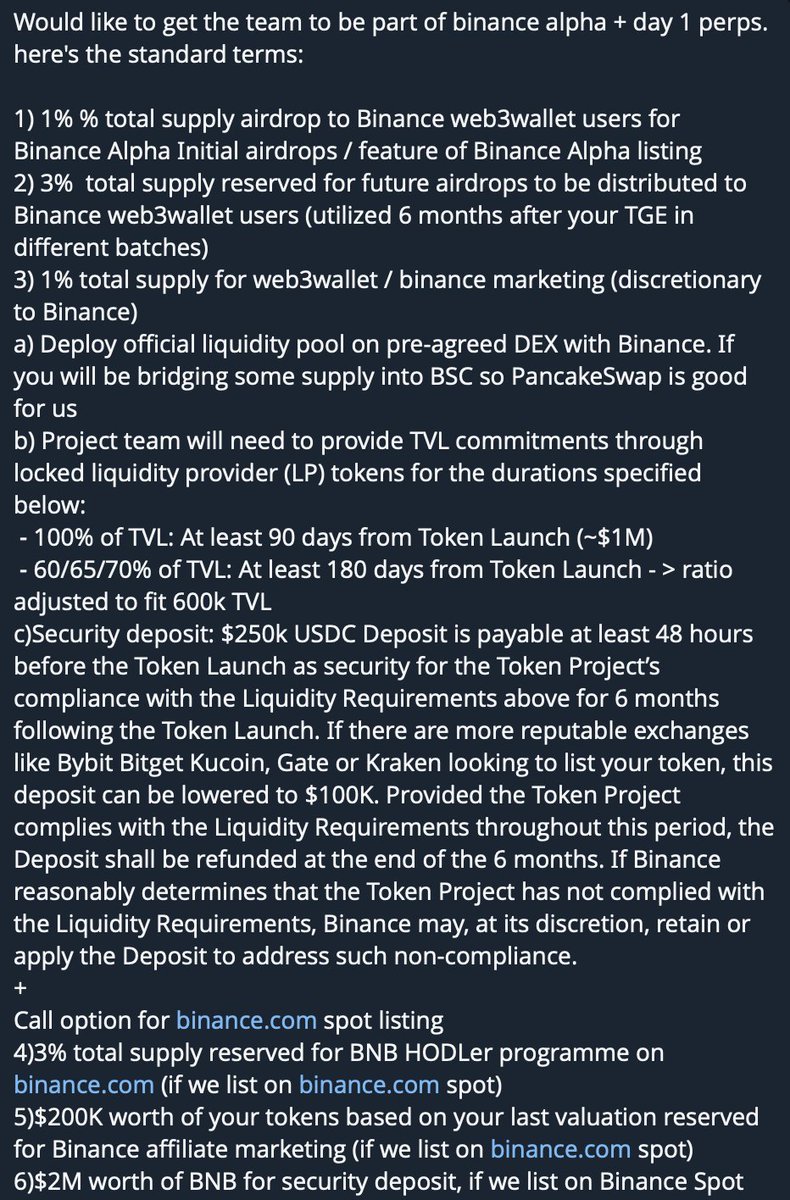

What happened? CJ Hetherington, the founder of Limitless, revealed that Binance asked for insanely high fees ($2M in $BNB & 8% of the token supply) for launching his token on Binance.

Binance had refuted this claim. But CJ came with the receipts.

Jeffy Yu, the founder of Zerebro, said the same story. According to him, Binance asked for $1M.

Now, there's a caveat. Jeffy had faked his own death to avoid $ZEREBRO tokenholders. So his credibility is a bit sus.

But still, huge exchange listing fees are an open secret. Other founders have said similar stuff in the past. But most founders have signed NDAs and cannot reveal details.

Plus, these fees are often disguised under various names such as "marketing budgets," "security deposits," and "advisory fees".

If CEX listings are that extractive, then

Why do projects chase CEX listings? Despite the growth of the onchain ecosystem, the majority of traders remain on CEXes. Last month, >81% of the total crypto volume was on CEXes.

So, if projects want to attract more token holders and volume, they need CEX listings.

In an ideal world, the relationship between projects and CEXes is mutually beneficial. If CEXes want users, they'll have to list good tokens that can go up.

So theoretically, good projects shouldn't find it difficult to get a CEX listing.

However, this isn't true in practice. $HYPE is one of the best-performing tokens of this cycle. Still, it isn't listed on any of the major exchanges.

(Reason for not listing $HYPE isn't just HyperLiquid hate tho. Its code being closed-source can create security concerns for exchanges. But that's a topic for another time.)

In contrast, many low-value tokens are listed on CEXes. >80% of the tokens listed by Binance in 2024 are down >50%. That's really bad.

These low-quality projects are listed by paying these "advisory fees".

Some say that exchanges need the token allocations from projects to provide liquidity for the tokens. If they don't get it from the projects, they'll have to buy it from the open market.

But in an ideal scenario, exchanges should not be responsible for providing liquidity on exchanges. Projects can directly reach out to market makers to provide liquidity on exchanges. So the liquidity excuse isn't really justifiable.

What's next?

In the short term, we can hope that CEXes can make the listing process and criteria more transparent.

- Coinbase has released a new process for listing tokens.

- Binance has an FAQ on it from 2021. But it's not as detailed as I'd have liked.

I also like Coinbase's approach of listing DEX tokens.

Coinbase allows users to trade tokens on Base DEXes. So any project that lists its tokens on Base DEX will be able to access the Coinbase distribution.

In the long term, I do hope onchain completely replaces offchain exchanges. We just need a couple of pieces for the onchain to match CEX UX.

- Privacy. Nobody wants the public to track your trades and financial life.

- Good on/off ramps to onchain trading venues. Current wallet onramps offer very bad prices.

Once enough traders and liquidity move onchain, then projects can no longer be dependent on CEXes.

🚀 DeFi Catalysts

MetaMask is integrating with Polymarket to bring prediction markets to the MetaMask wallet.

Monad claim portal for airdrop recipients has gone live. Onchain power users across EVM & Solana are qualified. The claim period is until November 3rd.

Sky has released the stUSDS on the Sky Money App. It lets users supply USDS and capture a larger share of protocol rewards. Launch APY was at 40%.

Uniswap has integrated Jupiter into its web app to enable swapping Solana tokens. They're exploring more options like cross-chain swapping.

Stable is teaming up with Morpho Labs to bring lending and borrowing solutions to their ecosystem. Plasma had partnered with Aave for the same.

Drift Protocol has introduced the Trading Rewards Program. A few selected markets are incentivized for taker volume.

Polymarket has enabled deposits and withdrawals from HyperLiquid. Adds more utility and liquidity for HyperLiquid and Polymarket, respectively.

Believe.app is changing their token from $LAUNCHPAD to $BELIEVE. The move is called scammy for several reasons, like inflating the token supply.

Strata mainnet went live. It converts crypto-native returns via scalable, composable structured products designed for tailored risk-reward exposure.

Zora introduced the Believe Fund. It'll begin deploying capital and deepening liquidity for creator coins within Zora's growing economy.

Turtle Protocol calls itself the Liquidity Distribution Protocol. It has introduced TURTLE. You can now check your eligibility.

📰 Industry News

Stripe has enabled the use of stablecoins for accepting recurring payments. Customers can use crypto wallets for subscriptions.

Alipay, a fintech giant with over a billion users, has launched Jovay, an Ethereum L2. This chain is related to the Chinese giant Alibaba.

a16z Crypto has made a $50M investment in Jito, the Solana infrastructure project that focuses on the block-building pipeline.

🐦⬛ X Hits

- Monad technical deep dive.

- Why isn't $HYPE not on CEXes?

- HyperLiquid thesis from Arete Capital.

- Insights for reading market microstructure.

- Advancements in zkEVM & Ethereum roadmap.

😂 Meme

Until next time,

Edgy

Today's email was written by Edgy and Yayya.

DISCLAIMER: I'm NOT a financial advisor. This content is for education and information purposes only. Crypto and DeFi are risky and speculative. Please do your research before investing.

| | Be Early to the Next Opportunities TDE Pro gives you direct access to our research, our portfolios, and the gems we're betting on.

It's your unfair advantage to move before the crowds.

|

Whenever you're ready, here's how we can help you:

- ⚙️ The DeFi Edge PRO - Designed for busy people who want to stay ahead of the curve. Leverage our research to save you hours each week, and to see what we're personally investing in. Join today.

- 🚀 The DeFi Edge Ventures - We identify, invest, and help amplify DeFi Protocols that positively impact the Crypto space.

You're receiving this email because you signed up for my newsletter. You can update your Preferences or Unsubscribe here.

113 Cherry St #92768, Seattle, WA 98104-2205

No comments:

Post a Comment