Bitcoin’s Nasdaq-Implied Fair Value Shows a 31% DiscountAlso Bitcoin’s Drawdown Looks Sentiment-Driven, Not Structural & The Bond Market Is Signalling Easier Conditions AheadWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

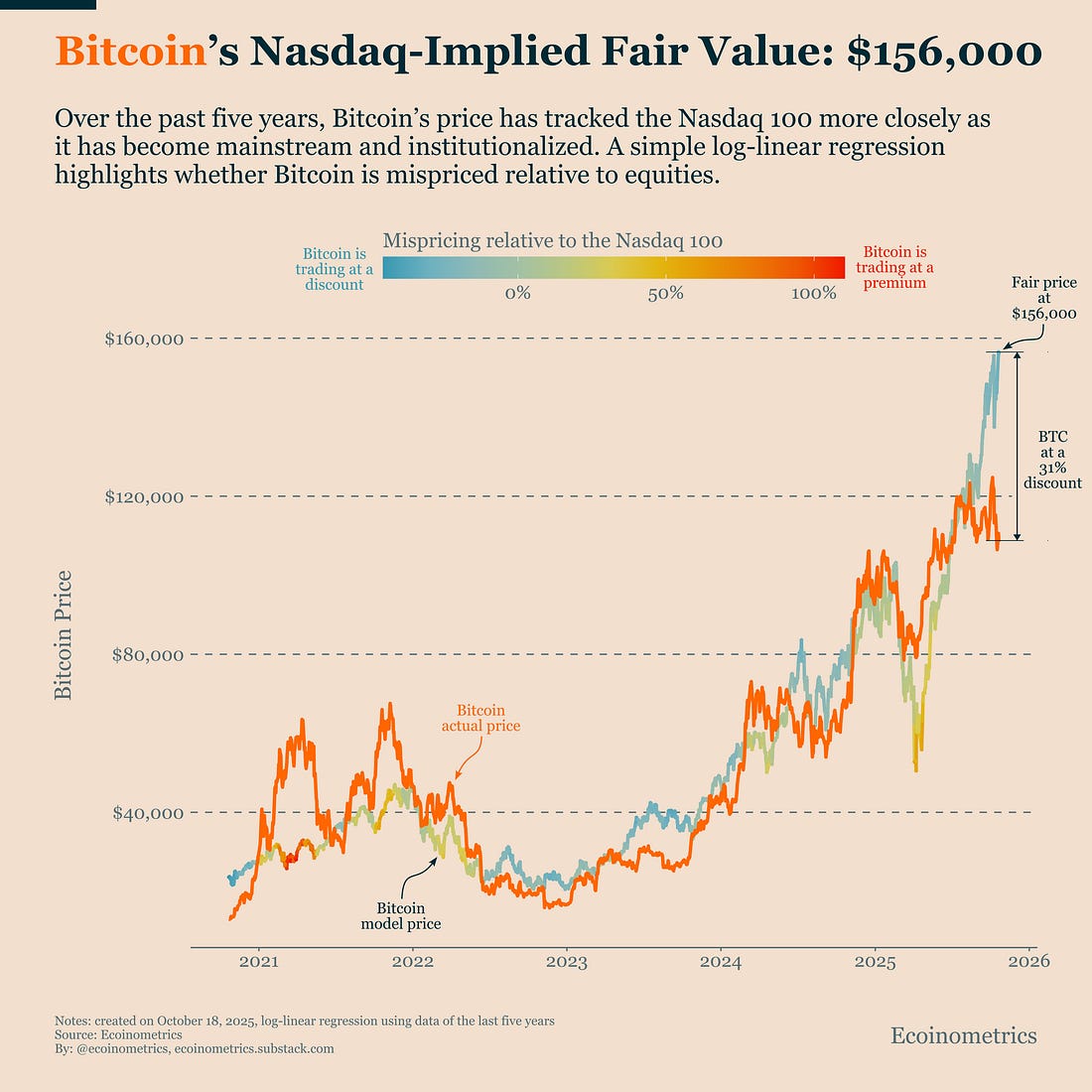

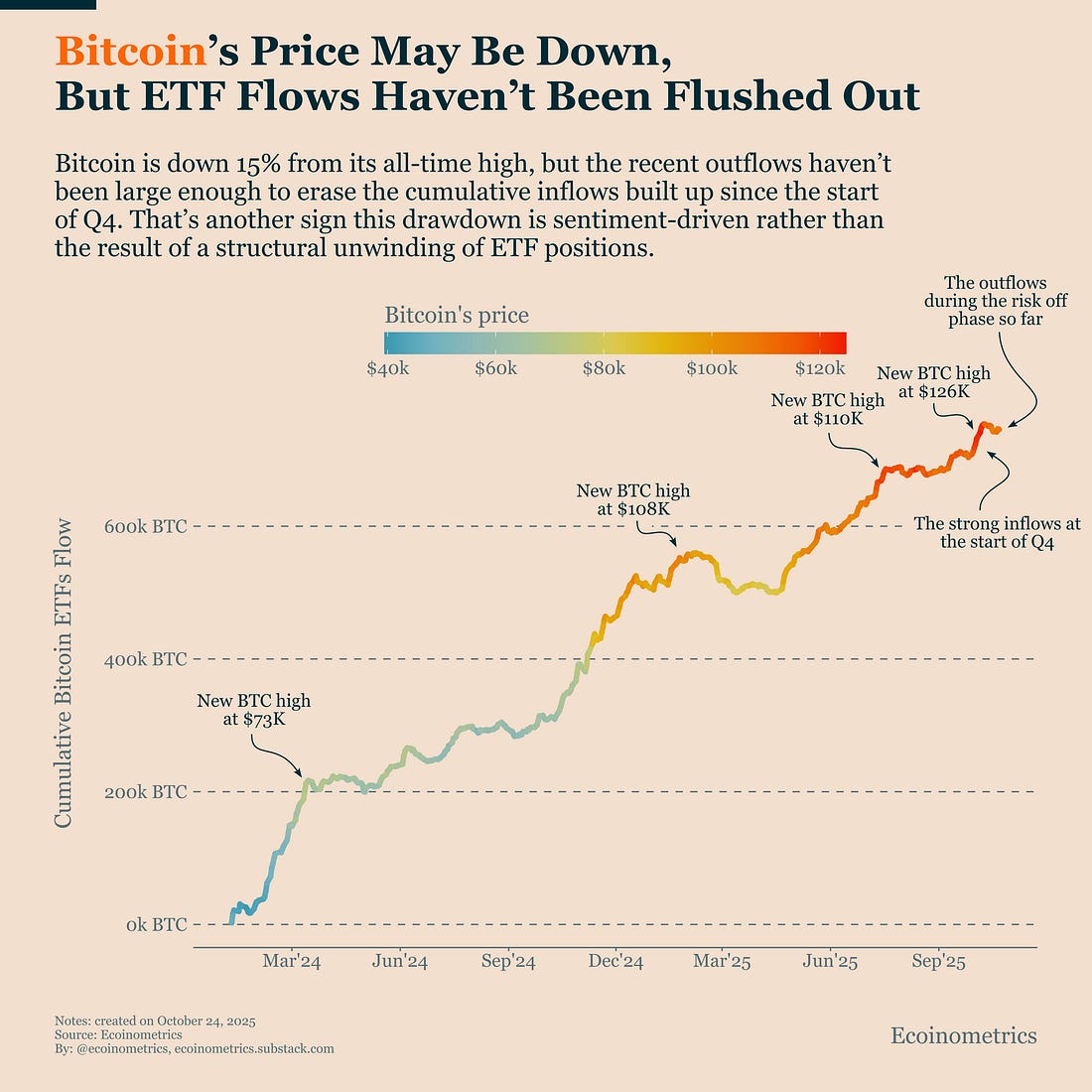

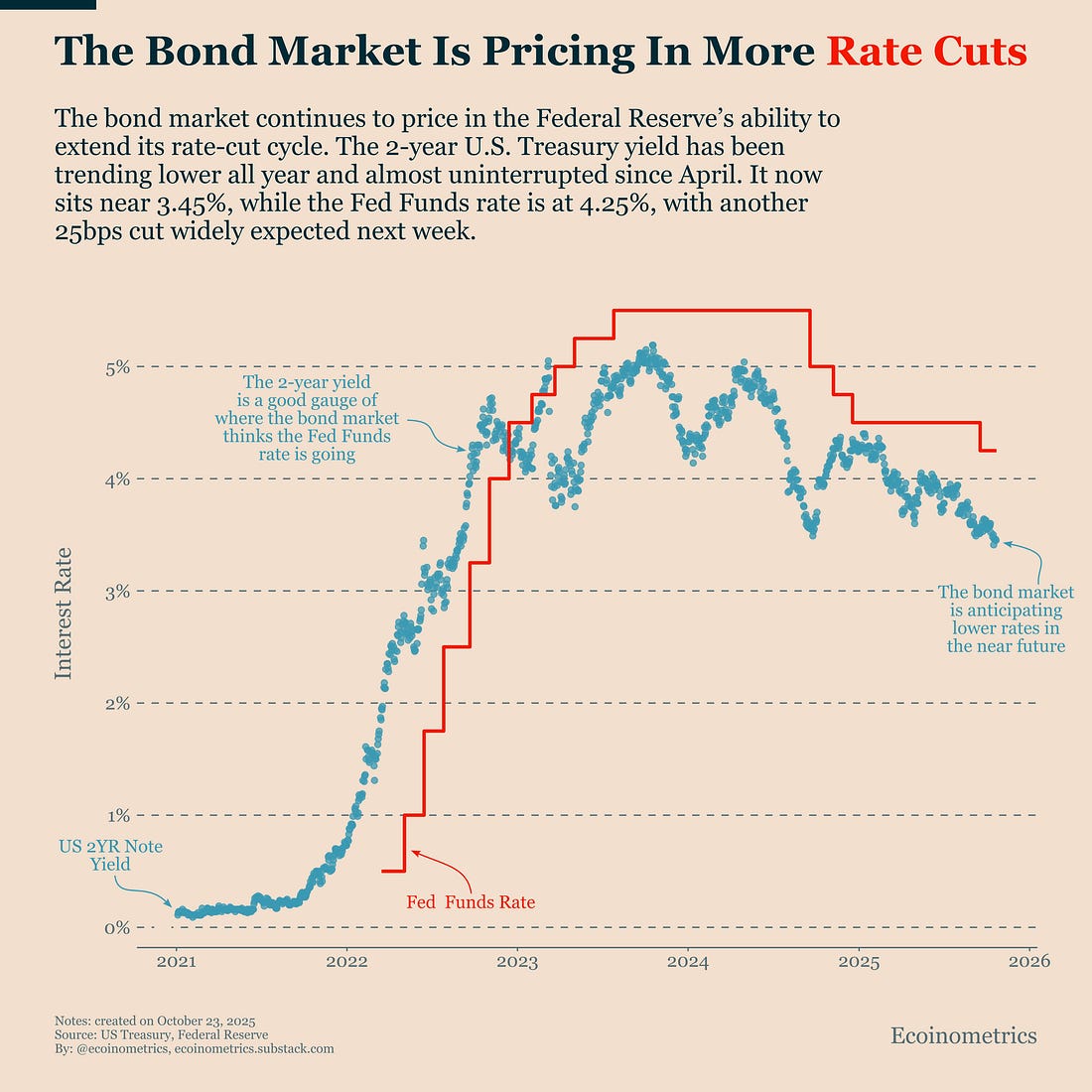

Together, these charts paint a picture of a market that’s cooling off in sentiment but not in structure. Bitcoin looks undervalued relative to equities, institutional demand remains firm, and the bond market is laying the groundwork for looser liquidity. In other words, short-term caution is warranted, but the macro setup still tilts in favor of recovery. In case you missed it, here are the other topics we covered this week: Bitcoin Market Monitor - Key Drivers in Ten Charts: Get these professional-grade insights delivered to your inbox: Bitcoin’s Nasdaq-Implied Fair Value Shows a 31% DiscountThere’s no point being bullish just for the sake of it, especially when the data tells you to stay cautious. Still, in markets, optimism often makes money while pessimism mostly earns the satisfaction of being right. But right now, the optimists have numbers on their side. Bitcoin is trading at a sizeable discount relative to equities. As discussed in our latest correlations report, Bitcoin has become deeply tied to risk-on assets, particularly the Nasdaq 100. Since COVID, the influx of institutional capital has tightened that relationship, making Bitcoin behave more like an extension of the equity risk cycle. A simple five-year log-linear regression between Bitcoin’s price and the Nasdaq 100 captures that connection very well. It tells us what Bitcoin’s fair value would be if it were trading in line with its historical relationship to equities. Today, that fair-value estimate sits near $156 K, while Bitcoin’s actual price is roughly 31 % lower. That’s a gap we have not seen since 2023. In plain terms, equities have already recovered from their recent drawdown, but Bitcoin hasn’t caught up yet. And that creates a big discount. If you assume the broader bull market isn’t over, that discount is unlikely to last. As the Nasdaq continues to recover and liquidity remains supportive, the relative-value gap should narrow through Bitcoin moving higher. And actually, we’ll look at more data in the next section that helps us see that optimism is justified. Bitcoin’s Drawdown Looks Sentiment-Driven, Not StructuralShort-term price swings can distract from what really matters. On any given day, Bitcoin’s price can jump or drop sharply because of liquidations, derivatives positioning, or sudden shifts in sentiment. None of that tells you much about the underlying trend. To see the real story, you need to look at structural data. And Bitcoin ETF flows are one of the cleanest measure we have of institutional demand. Unlike futures positioning, they reflect cash moving in or out of the market. As the chart below shows, cumulative ETF inflows have barely dipped even though Bitcoin is down about 15 % from its all-time high. The outflows during this risk-off episode are small compared with the strong inflows that began in early Q4. That’s a clear sign the bull market hasn’t been structurally unwound. Institutional holders aren’t redeeming, they’re holding through volatility. Combined with the rebound in the Nasdaq 100, this resilience suggests improving odds that Bitcoin’s correction could soon shift into a recovery phase, barring any major macro shock or other news events coming out of the U.S. that might spook the market further. Since ETFs pool long-term capital, they tend to act as an anchor of demand. Until sustained multi-week outflows appear, it’s premature to read this drawdown as the start of a broader bear phase. The Bond Market Is Signalling Easier Conditions AheadAnother reason to think the bull market isn’t over is that financial conditions keep improving. The bond market clearly believes the Federal Reserve will stay on its easing path. The best indicator of that is the 2-year Treasury yield, which tracks where investors expect the Fed Funds rate to head over the coming months. It’s not a perfect predictor, sometimes it runs ahead of the Fed, but it’s an excellent gauge of expectations. As shown on the chart below, the 2-year yield has been trending lower all year and now sits near 3.45 %, well below the Fed Funds rate at 4.25 %. That gap and that continued trend tells us the market expects more rate cuts soon. On top of that according to Fed Funds futures, there’s almost full pricing for another 25 bps cut next week, and the same again at the following meeting. In other words, investors broadly agree that policy is turning more accommodative. When markets expect easier policy, liquidity conditions start improving even before the Fed acts. Credit spreads tighten, dollar funding stabilizes, and risk appetite returns. If sentiment shifts back to risk-on, that backdrop will almost certainly benefit Bitcoin’s recovery. When short-term yields fall ahead of realized cuts, equity and crypto markets often respond early, because capital rotates toward assets that benefit most from looser liquidity. Bitcoin is one of them.

That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, October 24, 2025

Bitcoin’s Nasdaq-Implied Fair Value Shows a 31% Discount

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Taking the pulse of Mantle, one of the hottest Ethereum L2s in recent months. ...

-

From Panic to Power: Bitcoin's Swift Rebound After the $19B Wipeout ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Synthetix and Lighter are melding fast perpetuals trading with Ethereum finality! ...

-

Stripe’s deep embrace of crypto has marked a big moment for the industry, but it’s time to think deeper about alignment. ...

-

Corporate BTC Hoard Tops 1M – But Miners Are Outpacing the Surge ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment