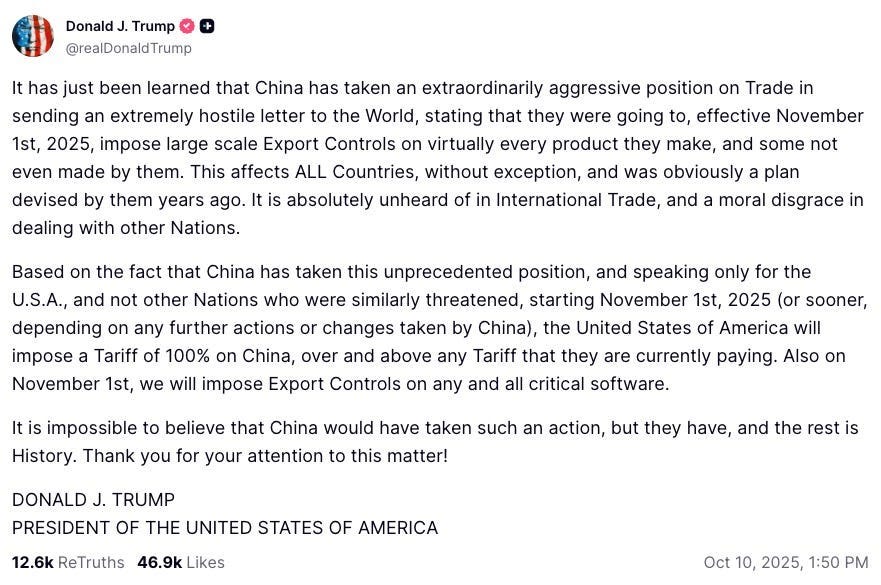

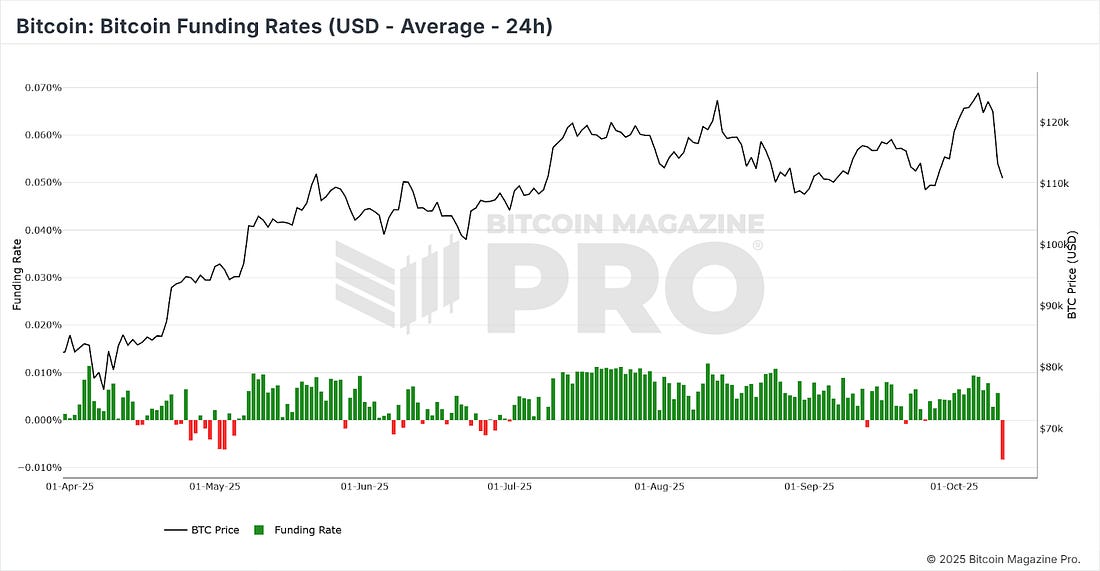

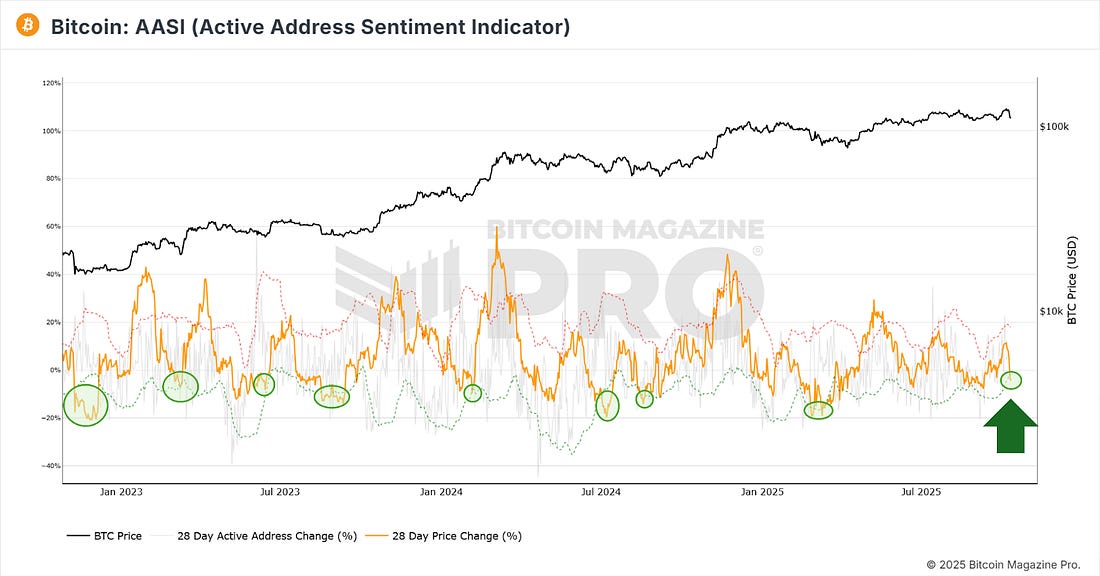

Weekly Alpha: The Great Leverage ShakeoutFrom Panic to Power: Bitcoin's Swift Rebound After the $19B WipeoutNews HeadlinesWeekly Alpha: The Great Leverage ShakeoutThis week’s Weekly Alpha focuses entirely on the wild Bitcoin price swings we saw over the weekend, a move so significant that it deserves our full attention. The sheer size of the liquidation event sent shockwaves across the entire market, resetting leverage, sentiment, and positioning. In this issue, we’ll look at what happened, why it happened, and what might come next. Let’s go. On Friday, Trump’s comments about potential new tariffs on China rattled global markets. Figure 1: Trump’s post spooked markets. Traditional equities fell sharply while Bitcoin (and especially crypto) amplified the move. Fear swept through the market, triggering a cascade of liquidations as over-leveraged traders and market makers were forced to unwind their positions. While our focus is always around Bitcoin, it is worth noting that 1.6 million crypto traders were liquidated in a single day on Friday, with total liquidations amounting to $19.1 billion! That is a staggering flush-out that wiped out much of the excess leverage that had built up in recent months. While Bitcoin held up better than most altcoins, the price still tumbled below the 128-day moving average, with a sharp wick taking it as low as $107,000. Figure 2: Bitcoin back above its key moving averages already. What is interesting to note is that BTC price spiked down to the 200-day moving average and has now already bounced back above the 128-day moving average. We see this as a very encouraging sign for Bitcoin. Despite all the leverage wipeout and panicked traders, they couldn’t hold BTC down below its 128-day moving average for more than 48hrs. However, while that is our bullish view, it is clear to see that much of the market is in a state of shock and fear. The Fear & Greed Index, which was up in Greed territory only last week, plunged into Extreme Fear over the weekend as market participants rushed for the exits. Figure 3: Fear & Greed Index in Extreme Fear zone. At the same time, funding rates turned sharply negative. This means derivatives traders were being liquidated, opening shorts, and/or hedging in panic. In bull markets, such extremes in funding typically signal extreme capitulation and are often followed by strong reversals to the upside. This is precisely what we are experiencing so far! Figure 4: Bitcoin Funding Rates turned sharply negative (red). Additionally, several of our proprietary indicators suggest that Bitcoin may have bottomed out over the weekend. One example is the Active Address Sentiment Indicator, which measures network activity versus price performance. When the indicator touches the lower band, it shows that network participation has held strong even as price weakens. This is a pattern that historically marks local bottoms and precedes bullish reversals. See the green circles on the chart, they align with local lows in BTC price. Figure 5: Active Address Sentiment Indicator. We have seen this play out countless times in both bull and bear markets for BTC over the years, and it has happened again now. Long Term Intact From a higher-timeframe perspective, this recent volatility remains a minor blip in the broader Bitcoin bull cycle. The MVRV Z-Score, which compares Bitcoin’s market value to its realized value to identify cyclical extremes, has just retested the 2.0 level. That is a zone that has repeatedly acted as a launchpad in previous cycles as price accelerates into the later stages of the bull run. Figure 6: MVRV Z-Score. So could this have been the necessary leverage washout that clears the path for Bitcoin to move higher? We think so. The Bitcoin Magazine Pro Team Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, October 13, 2025

Weekly Alpha: The Great Leverage Shakeout

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Our bi-weekly quantitative risk report for TBL Pros: May 14th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

While the token 'exploration' comment from last week stole headlines, the Base Camp event showcased the network's scal...

-

Plasma launched last week. Everyone is now chasing the new "stablecoin chain". ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment