Strong Crypto Inflows, Bitcoin Still LeadsAlso Bitcoin and Gold Remain Top Performers in a Hard-Asset Cycle & The Federal Reserve Turns Less HawkishWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

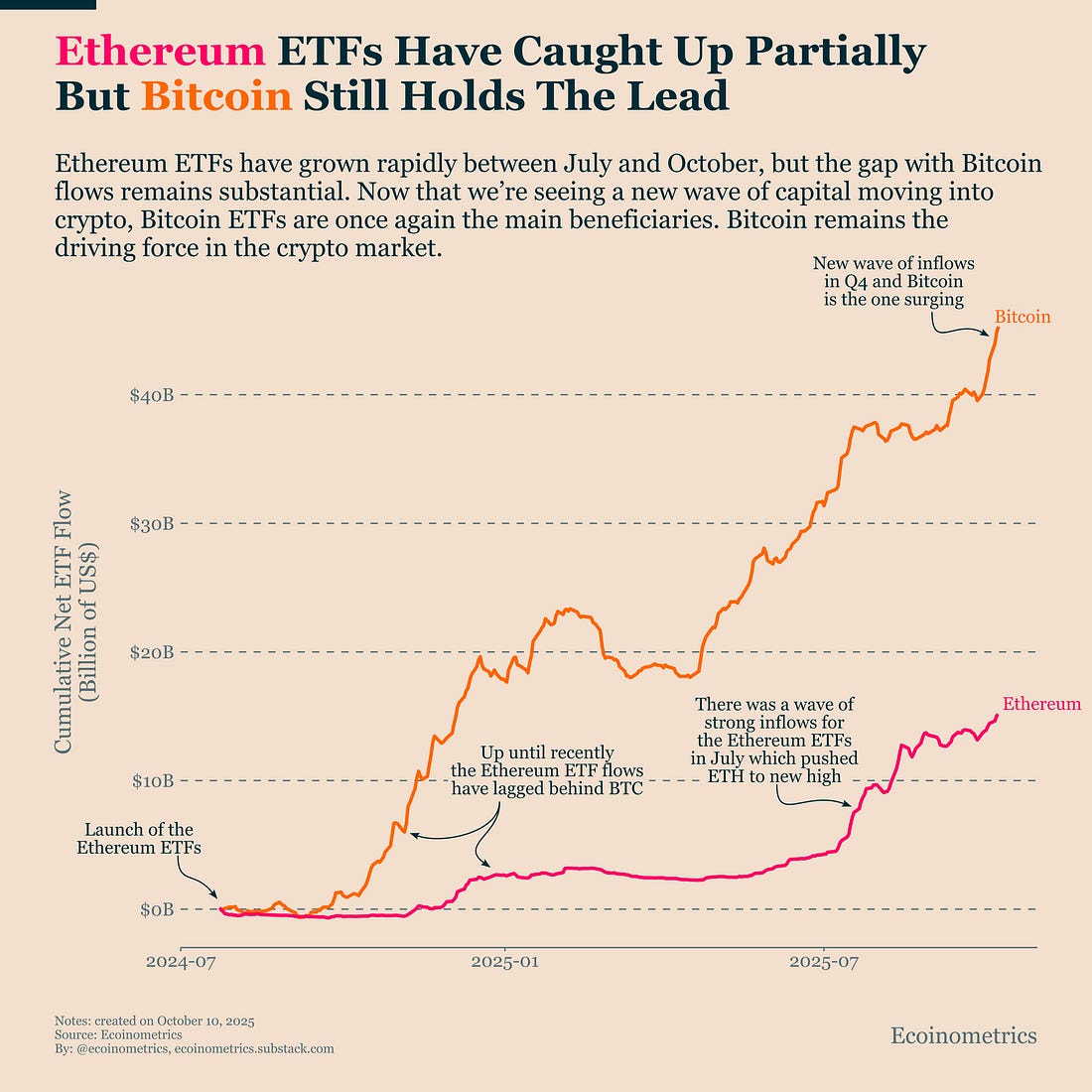

Together, these signals point to a market entering a new phase of the macro cycle in Q4. Liquidity is improving, capital is rotating toward hard assets, and the Fed’s tone is softening. All of this reinforce a favourable backdrop for Bitcoin. The message is clear: the drivers that fuelled last year’s growth are back in motion. In case you missed it, here are the other topics we covered this week: Bitcoin Market Monitor - Key Drivers in Ten Charts: Get these professional-grade insights delivered to your inbox: Strong Crypto Inflows, Bitcoin Still LeadsBitcoin just logged seven straight days of net inflows into its ETFs. On Monday alone, inflows topped $1.2 billion, the second-largest single day since launch. That supports our view that Q4 is shaping up as a rotation into crypto and hard assets. If the current pace holds, our ETF-flows-to-price model points to Bitcoin near $135K by month-end. Ethereum ETFs are also seeing renewed demand, but they still trail Bitcoin by a wide margin. ETH’s July surge helped narrow the gap, yet BTC remains the primary gateway for institutional capital entering crypto. We are not in a traditional alt-season. And the historical dynamic of alt-seasons might have changed. With ETFs now channeling new money from traditional finance, gains in Ethereum don’t need to come at Bitcoin’s expense the way they often did in past cycles. If ETH’s share of total crypto ETF inflows continues to rise while Bitcoin’s absolute inflows stay strong, that would signal a healthier broadening of institutional allocations, bullish market breadth without undermining BTC leadership. That said, ETH still looks appealing on a relative-value basis. Compared to its long-term relationship with BTC, it trades at a noticeable discount of 45%. If ETF demand keeps expanding, that spread could tighten. Watching the flow differential between BTC and ETH ETFs will show how that plays out.

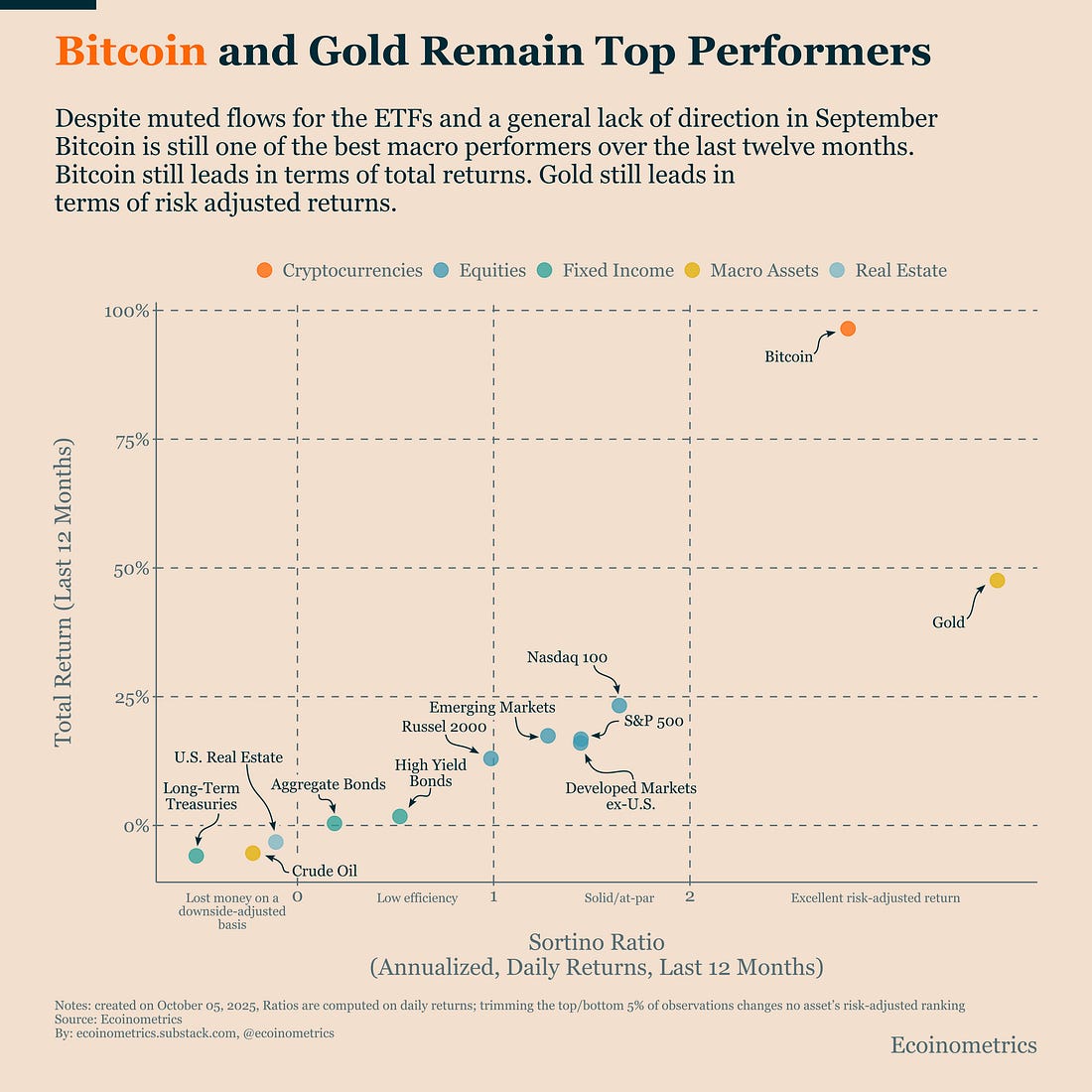

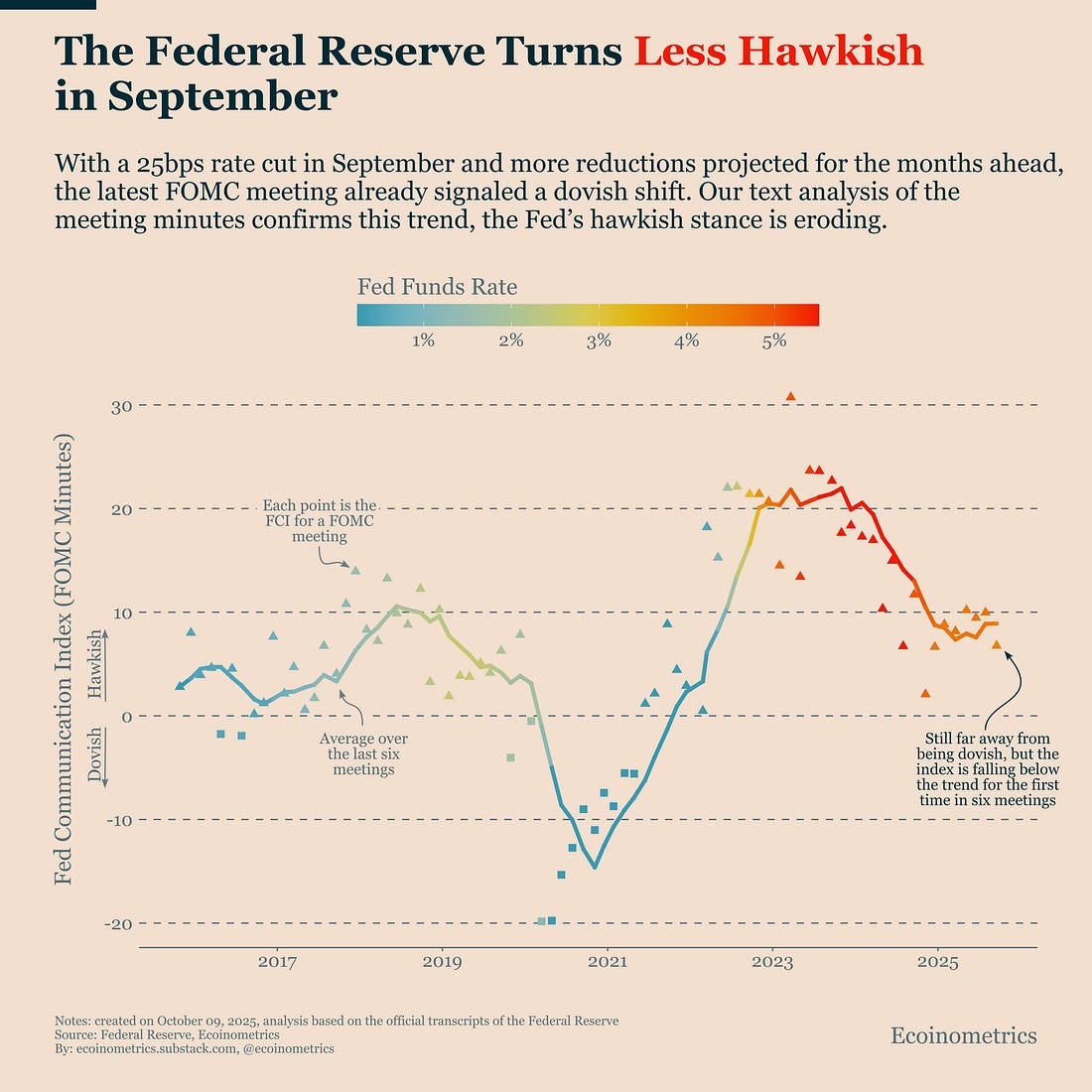

Bitcoin and Gold Remain Top Performers in a Hard-Asset CycleThe streak continues. As of early October, Bitcoin and gold remain the two standout global assets in both total and risk-adjusted returns. This isn’t a fluke, it’s been true for nearly two years. The persistence of that pattern points to a macro trend favouring hard assets. And the thing about macro trends is that they don’t turn on a dime. They tend to grind forward for years, shaping how capital allocates across markets. Think of the long decline in bond yields from the early 1980s to 2021. That 40-year cycle had plenty of ups and downs, but the underlying forces (disinflation, globalization, aging demographics, and central-bank interventionism) kept pushing yields lower for decades. Today, we may be in the early stages of another secular shift. Investors are increasingly worried about unsustainable fiscal paths and the risk of fiscal dominance, where government borrowing pressures limit central banks’ ability to tighten policy. If that dynamic takes hold, the value of major fiat currencies could erode over time. In that environment, Bitcoin and gold play a new structural role. They act as portfolio anchors against policy excess and currency debasement. Their prices will fluctuate with short-term liquidity cycles, but the long-term trajectory remains upward as capital adapts to the new macro reality. The Federal Reserve Turns Less HawkishThe September FOMC meeting brought a 25bps rate cut and clear signals of more to come. So, it’s no surprise that the tone inside the Fed has turned less hawkish. Still, the release of the FOMC minutes gives us a chance to quantify that shift. Running our text analysis on the minutes, the Fed Communication Index (FCI) shows the same story: both in words and in actions, the Fed is tilting dovish. The turn isn’t dramatic, Powell’s tone at the press conference was a bigger change than the minutes themselves, but for the first time in six meetings, the FCI has fallen below its recent trend. That marks a meaningful softening of stance after a year of steady hawkish messaging. Not dovish yet, but taking the direction. This kind of adjustment doesn’t happen overnight. The Fed prefers to move gradually, avoiding surprises to financial markets. But the direction is clear: policy communication is evolving toward less resistance to liquidity expansion, and that increasingly aligns with the U.S. Treasury’s objectives, lower borrowing costs and sustained debt financing. That alignment is the hallmark of fiscal dominance, a macro environment where inflation takes a back seat to debt management. As we discussed in the previous section, that’s a powerful tailwind for hard assets like Bitcoin and gold. In the near term, it also ensures U.S. financial conditions stay loose, a backdrop that remains highly supportive for risk-on assets.

That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. Invite your friends and earn rewardsIf you enjoy Ecoinometrics, share it with your friends and earn rewards when they subscribe. |

Friday, October 10, 2025

Strong Crypto Inflows, Bitcoin Still Leads

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Market Jitters or Strategic Buying? Decoding Bitcoin's Price Retracement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Stripe’s deep embrace of crypto has marked a big moment for the industry, but it’s time to think deeper about alignment. ...

-

Bitcoin On-Chain Activity Report, September 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

DefiLlama delisted Aster volume. Reason? They can't trust it. ͏ ͏ ͏ ͏...

No comments:

Post a Comment