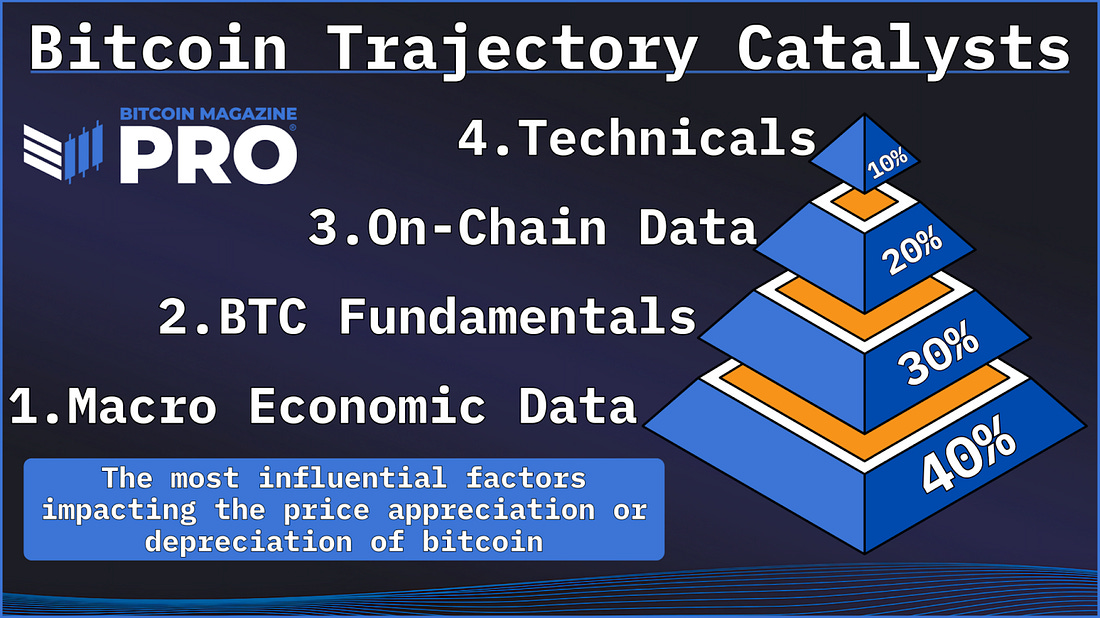

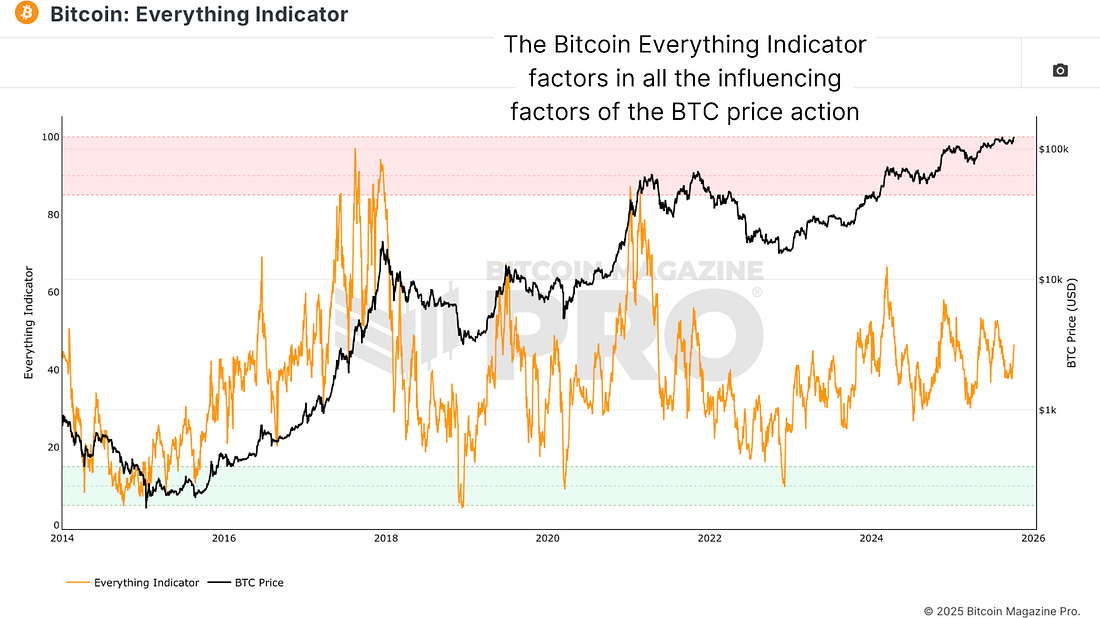

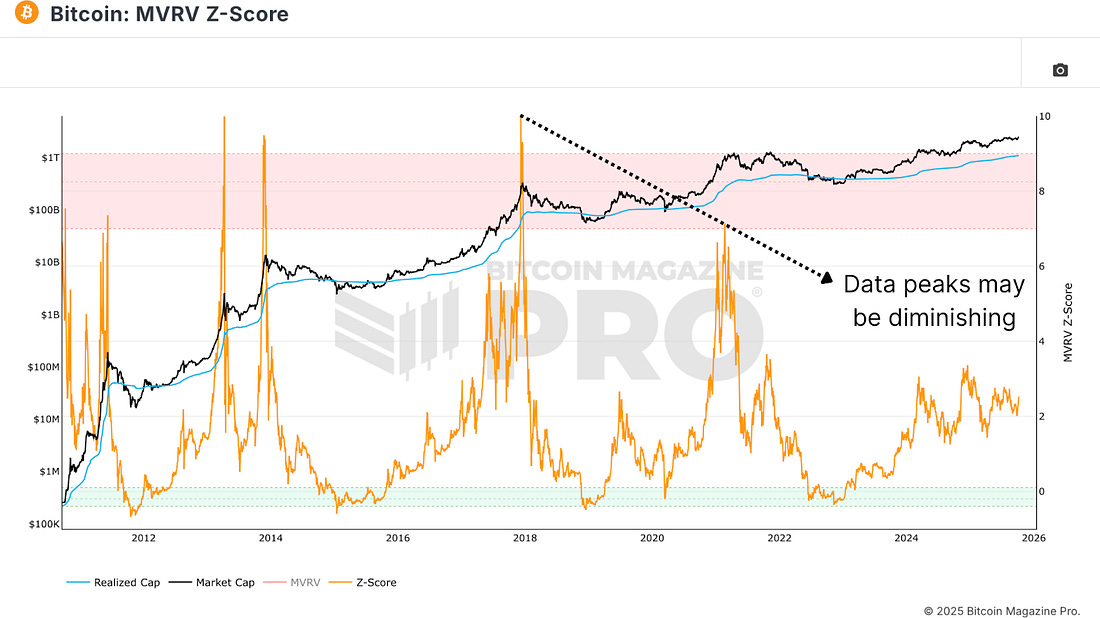

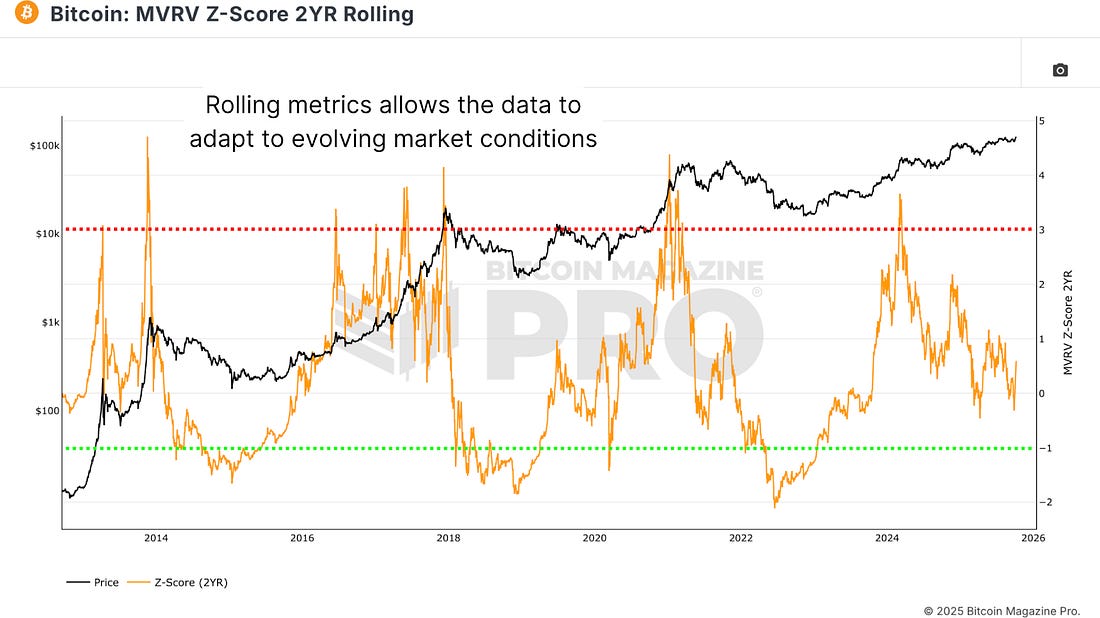

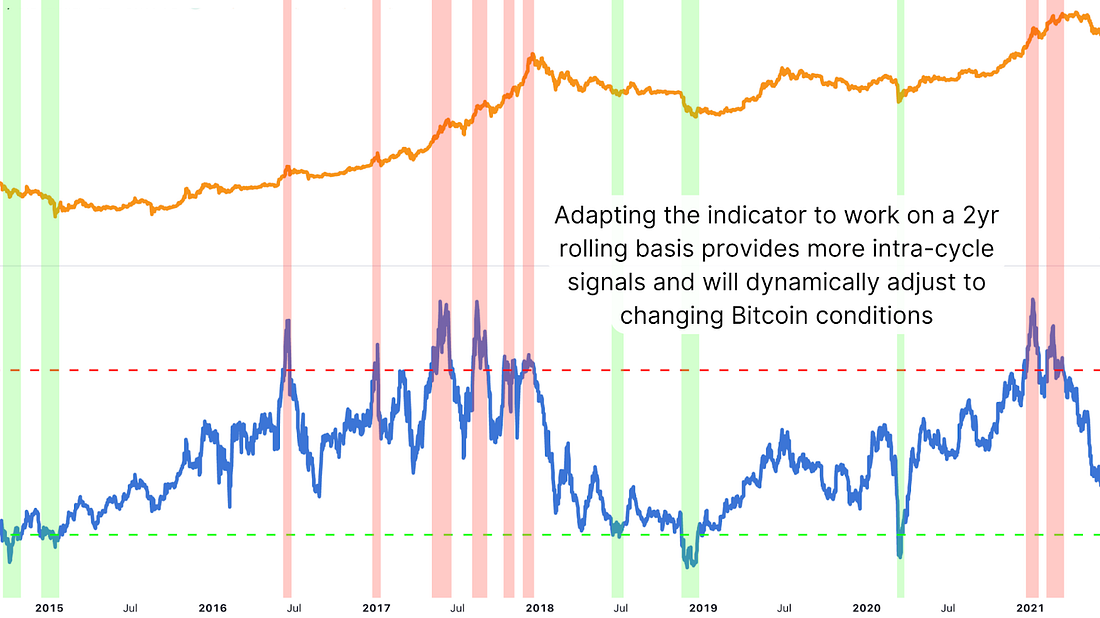

Improving The Bitcoin Everything IndicatorFrom Chaos to Clarity Merging Macro and On-Chain for BitcoinIn this week’s analysis, we explore what happens when every significant Bitcoin data point, from on-chain activity to macroeconomic liquidity, is merged into one unified model. This is the Bitcoin Everything Indicator, designed to capture every key driver of BTC price action in a single, dynamic framework. But as Bitcoin evolves, and as institutions and global markets reshape its behavior, we’ll also look at how adapting this model to changing conditions can make it even more powerful. A Comprehensive Bitcoin ModelOver the years, analysts have created countless “all-in-one” indicators to measure Bitcoin’s valuation across its cycles. However, most of them rely too heavily on a single data type, such as on-chain activity, miner profitability, or technical charting patterns, often ignoring the macroeconomic shifts that now play a critical role. Our goal was to take a broader approach by combining all major drivers of Bitcoin’s value, including Global Liquidity and macroeconomic expansion, Bitcoin network fundamentals such as Miner expectations, on-chain metrics such as the MVRV Z-Score, Spent Output Profit Ratio (SOPR), network utilisation data, and Active Address Sentiment, and technical data including the Crosby Ratio. Figure 1: Core inputs into the Bitcoin Everything Indicator combining macro, network fundamentals, on-chain, and technical data. This confluence of data forms the backbone of the Bitcoin Everything Indicator, giving a multi-dimensional view of when BTC is historically overheated or undervalued. And as you can see from the chart, historically this confluence of data has worked pretty well! Figure 2: Bitcoin Everything Indicator with top and bottom zones identifying cyclical turning points. Dynamically EvolvingWe do need to acknowledge, however, that Bitcoin as an asset is changing and evolving, and we may need to adapt our metrics to account for these shifts. For example, while Bitcoin’s MVRV Z-Score has historically signaled major tops and bottoms, its peaks have become less extreme as volatility and speculative activity decline, a natural result of increasing institutional participation. Figure 3: Historically, the pronounced peaks and troughs of the MVRV Z-Score aligned with cycle tops and bottoms, but recent market stabilization may constrict these. To account for this, we added the 2YR Rolling MVRV Z-Score, a derivative of the MVRV Z that uses a rolling data window and adjusts to the most recent market dynamics. This evolutionary framework reduces lag, normalizes for long-term shifts in volatility, and aligns more closely with Bitcoin’s changing behavior across cycles while increasing its long-term viability and accuracy. As you can see below, historically, this rolling version of the data has also provided reliable results. Figure 4: The MVRV Z-Score 2-Year Rolling metric smooths cyclical extremes and improves accuracy. The 2-Year Rolling Everything IndicatorBy applying a 2-year, rolling methodology, the Everything Indicator effectively removes backward bias and captures real-time momentum in on-chain and macro data. In practical terms, this means the indicator adapts to changes in liquidity and investor composition, it reflects Bitcoin’s maturing volatility and lower speculative turnover, and maintains sensitivity to inflection points without overreacting to noise. Figure 5: The adapted 2-year rolling Everything Indicator has provided accurate trading signals. What we find is striking consistency. The bottom 5% zones (green bars) have coincided almost perfectly with long-term accumulation periods, historically some of the best entry points across every Bitcoin cycle. The top 5% zones (red bars) have consistently marked the end of major upward runs and preceded multi-month consolidation or retracement phases. In the current cycle, Bitcoin remains comfortably below that overextended threshold, suggesting considerable upside still remains. ConclusionBitcoin is no longer the purely retail-driven, high-volatility asset it once was. With institutional accumulation, ETF inflows, and even sovereign-level holdings now shaping supply dynamics, the historical amplitude of Bitcoin’s cycles has compressed. This means traditional models, built for the era of retail dominance, may be becoming less accurate. The Bitcoin Everything Indicator provides one of the most complete pictures of Bitcoin’s valuation and cyclical positioning by combining macro, on-chain, and technical factors into a single composite model. By dynamically adapting to new data and recalibrating across rolling time frames, this enhanced version of the Everything Indicator remains highly accurate in identifying both cyclical tops and bottoms. At present, the model suggests that Bitcoin still has significant room to the upside before approaching overheated conditions. For a more in-depth look into this topic, watch our most recent YouTube video here: This Might Be The Only Bitcoin Chart You Ever Need  Matt Crosby Lead Analyst - Bitcoin Magazine Pro Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, October 10, 2025

Improving The Bitcoin Everything Indicator

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Stripe’s deep embrace of crypto has marked a big moment for the industry, but it’s time to think deeper about alignment. ...

-

Market Jitters or Strategic Buying? Decoding Bitcoin's Price Retracement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

DefiLlama delisted Aster volume. Reason? They can't trust it. ͏ ͏ ͏ ͏...

-

Bitcoin On-Chain Activity Report, September 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment