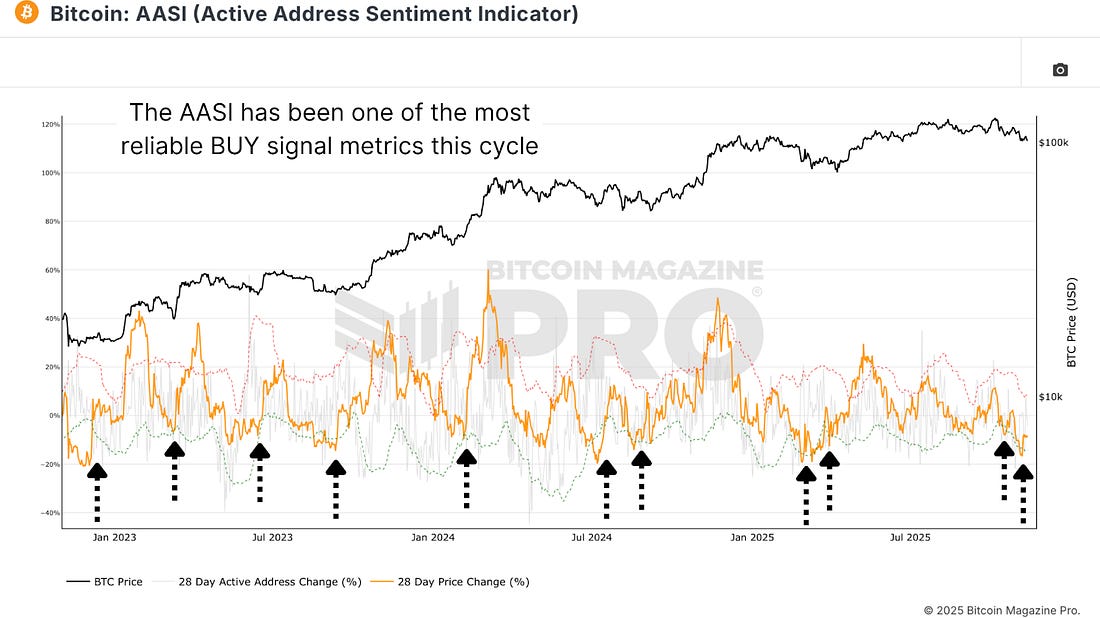

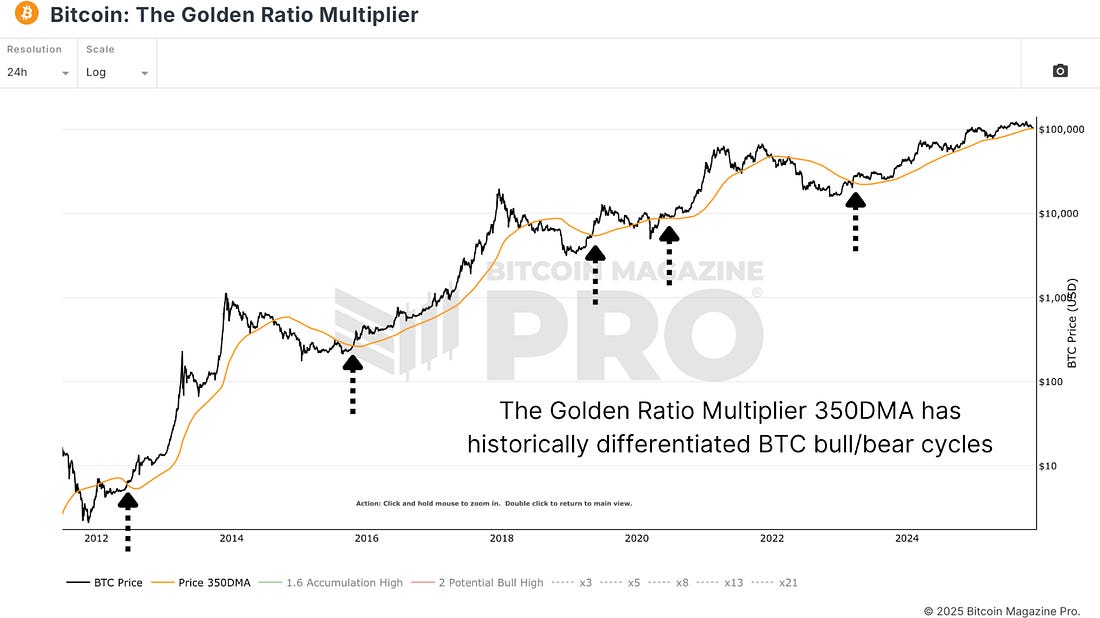

A Simple Strategy That Has Outperformed BitcoinDCA beats HODL (587%), but this 2-metric rule hits 640%. Scale in on AASI exhaustion, take profit on overheat. Zero emotion.Here we look at one of the simplest data-driven strategies that has quietly outperformed Bitcoin over multiple years, using just two metrics available on BitcoinMagazinePro.com: the Active Address Sentiment Indicator and the Golden Ratio Multiplier. Both are easy to apply and demonstrate how disciplined, data-based accumulation can rival long-term buy-and-hold or dollar cost averaging performance. Active Address Sentiment IndicatorThe Active Address Sentiment Indicator (AASI) tracks the 28-day percentage change in both Bitcoin’s price and its active addresses, effectively measuring how closely network activity aligns with or diverges from market price movements. When active addresses rise faster than price, it signals growing network demand relative to valuation. Conversely, when price outpaces usage, it often warns that market momentum may be running ahead of fundamentals. Figure 1: The 28-day price change hitting the lower boundary has been a very reliable buy signal throughout this cycle. For simplicity, we can monitor this using upper and lower deviation bands. Crosses above the upper band (the red dotted line) often occur when the market becomes overheated, while crosses below the lower band (the green dotted line) tend to highlight periods of exhaustion and potential accumulation opportunities. This single metric alone has proven highly effective at identifying points of both overextension and value throughout this cycle. The aim isn’t to time exact tops or bottoms but to systematically accumulate Bitcoin during periods of underutilization and trim exposure when price becomes overextended relative to network activity. The Golden Ratio MultiplierTo refine the strategy further, we can also combine the AASI indicator with The Golden Ratio Multiplier, using its 350-day moving average as the structural baseline. When Bitcoin is trading above this long-term moving average, the system permits profit-taking. When it’s below, accumulation continues uninterrupted, avoiding selling into weakness. Figure 2: For this strategy, we’ll also use The Golden Ratio Multiplier 350DMA to signal when to take profit or continue accumulation. Just 6 days until Bitcoin Black Friday 🎁 Limited time deals drop next week! Building The StrategyThe strategy built around these two indicators is deliberately straightforward. When the AASI 28-day percentage price change moves above the lower deviation band (green dotted line), that event signals an entry point to deploy a small percentage of available capital. For this example strategy, we are scaling in 3% of available capital. When this same line later crosses below the upper deviation band (red dotted line) and it remains above The Golden Ratio Multiplier 350DMA, that’s treated as a profit-taking signal to sell 3% of the accumulated holdings. The aim isn’t to time exact tops or bottoms but to systematically accumulate Bitcoin during periods of underutilization and trim exposure when price becomes overextended relative to network activity. OutperformanceUsing backtested data from 2018 onwards, a simple buy-and-hold Bitcoin position would have generated approximately 489% gains. Whereas a simple blind Dollar Cost Average Strategy (DCA), in this case a $10 daily purchase, would have yielded a superior ~587% realized profit across the same period. Figure 3: Over the past 8 years, a blind DCA strategy has outperformed buy-and-hold. Backtesting the strategic model outlined above, accumulating on lower deviations and trimming near the upper bands, the long-term results are remarkable, increasing realized profit to around 640%. This data-driven framework removes emotions and external noise from the trading process, ultimately limiting drawdowns, minimising losses, and compounding gains. When also accounting for unrealized profit from BTC still held due to aggressive dip-buying throughout the cycle, total performance rises to an outperformance of more than 320% compared to passive buy-and-hold. Figure 4: Considering unrealized profit, the proposed strategy outperforms buy-and-hold by over 320%. Beyond BitcoinWhile developed primarily for BTC, this method has also produced strong results for other crypto assets. When applied to Ethereum using identical parameters, returns increased from roughly 233% under buy-and-hold to an outperformance of almost 360%. This reinforces the value of simple, rule-based, and compounding systems built around fundamental network data rather than speculative sentiment. Figure 5: Switching the model from BTC to ETH also outperforms the buy-and-hold strategy for this asset. ConclusionAround 96% of all historical Bitcoin days have been profitable for long-term holders. That statistic alone validates buy-and-hold as one of the most effective investment strategies ever. However, by strategically adjusting accumulation based on objective on-chain and behavioral data, investors can meaningfully enhance their results while reducing volatility and emotional stress. Structured, data-driven accumulation, especially when supported by confluence across metrics such as Active Address Sentiment and The Golden Ratio Multiplier, continues to offer one of the most effective ways to outperform both the market and the emotions that often derail it. For a more in-depth look into this topic, watch our most recent YouTube video here: How To Use Simple Data To Easily Outperform Bitcoin  Matt Crosby Lead Analyst - Bitcoin Magazine Pro Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, November 14, 2025

A Simple Strategy That Has Outperformed Bitcoin

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

With some coins drawing outsized attention lately, let's break down our takes on the top 5 tokens this month. ...

-

Perp aggregators were a pretty obvious opportunity after the success of dex aggregators. But I hadn't seen one...

-

Sponsorship Opportunities Now Open ...

-

Bitcoin ETF Report, November 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

No comments:

Post a Comment