Bitcoin’s Drawdown Is Being Compounded by the Nasdaq’s PullbackAlso No Clear ETF Support for Bitcoin Around $100K & Market Doubt About December Rate Cuts Is Raising Downside RiskWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

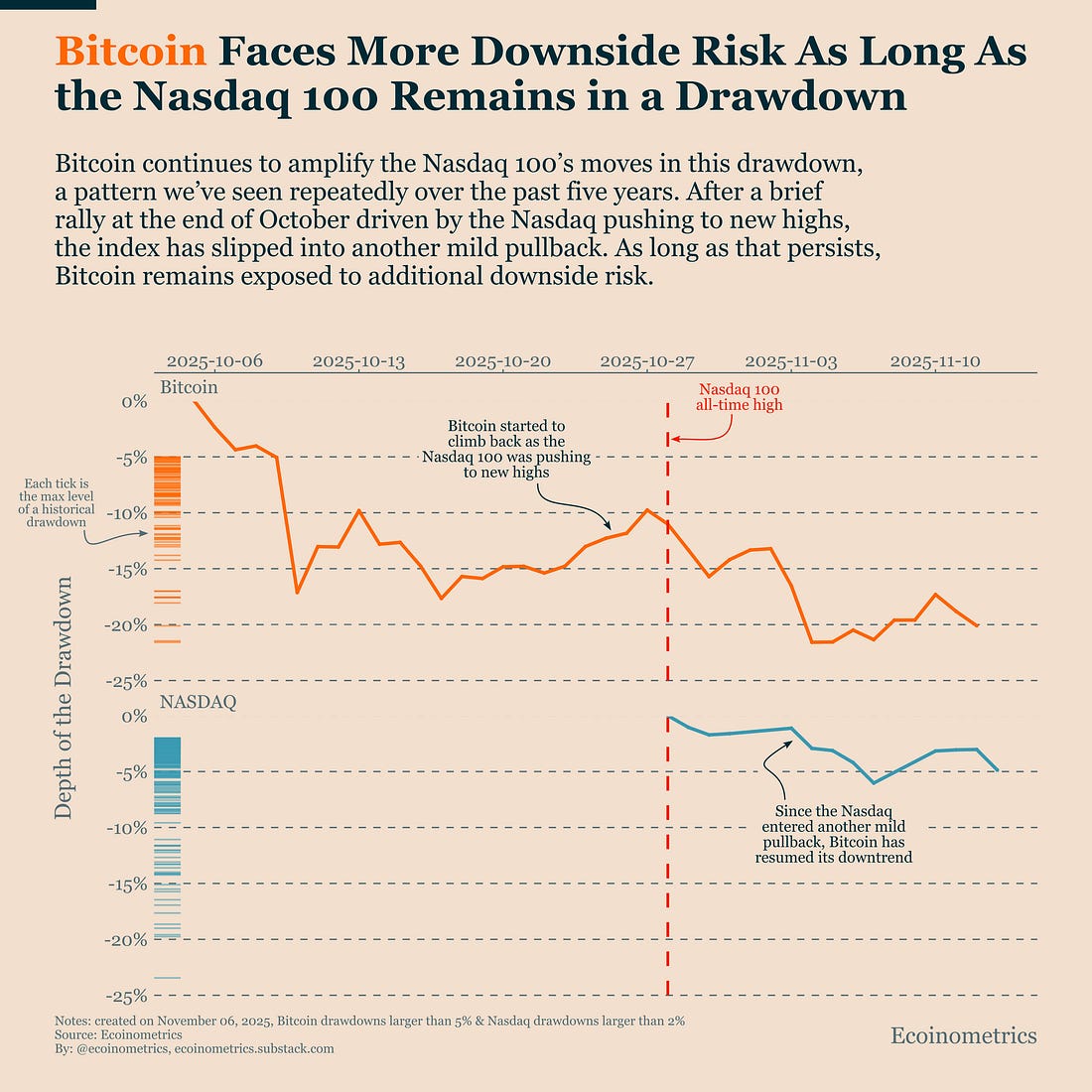

What links all three is a shift in the market’s risk appetite. Equity momentum has cooled, ETF demand is hesitant, and the Fed outlook has become uncertain again. When these forces align, Bitcoin tends to lose its bid and drift lower until clarity returns. In case you missed it, here are the other topics we covered this week: Bitcoin Market Monitor - Key Drivers in Ten Charts: Get these professional-grade insights delivered to your inbox: Bitcoin’s Drawdown Is Being Compounded by the Nasdaq’s PullbackBitcoin is getting pushed back below $100K as the Nasdaq 100 loses momentum. These are difficult conditions for Bitcoin. Historically, BTC’s returns tend to be positively correlated with the Nasdaq 100, and that correlation strengthens when the Nasdaq posts sharp negative daily moves. The chart below shows both drawdowns. Bitcoin began a timid recovery in late October when the Nasdaq was pushing to new highs. But once the Nasdaq slipped into another mild pullback, Bitcoin’s bounce stalled and the downtrend resumed. That weakness is now colliding with other challenges:

Bitcoin is now 25% below its all-time high. That’s not as deep as the February-March drawdown, when BTC fell 30% under similar conditions:

Back then, conditions eventually improved and both U.S. equities and Bitcoin resumed their bull market. Today, we are in another period of high uncertainty. That is not the kind of environment where Bitcoin typically begins a recovery. We expect more downside risk in the current conditions. No Clear ETF Support for Bitcoin Around $100KAs we discussed earlier this week, the market is still working through a deleveraging phase, and that makes it harder for capital to rotate into Bitcoin. The deleveraging started weeks ago, but the impact is only now showing up in the data. That shift alone is enough to cancel our hope that Q4 would bring a strong wave of fresh institutional buying. In this environment, Bitcoin sits too high on the risk curve for most institutions. With money managers turning cautious, risk-on exposure is being trimmed rather than increased. We’ll only know the deleveraging phase is ending once lagging indicators like the National Financial Conditions Index start to roll back down. But for now, we can judge the outcome directly: ETF flows show very little demand for Bitcoin even at the $100K level. After the six-day outflow streak that pushed BTC down to this area, we’ve seen a mix of small inflows and outflows, nothing close to a sustained run of buying. Until we see at least a solid week of inflows, it’s hard to argue that Bitcoin has found durable support here. Market Doubt About December Rate Cuts Is Raising Downside RiskOne of the main reasons risk-on assets are struggling again is that the market no longer knows what the Fed is going to do. With very limited U.S. economic data after the month-long government shutdown, investors have been forced to rely mostly on public comments from Fed officials to guess whether rate cuts are still on the table. Now, the Fed keeps saying its decisions are data-driven. If you take that at face value, then acting without reliable data means doing nothing in December. But that’s a sharp contrast with where expectations stood just a few weeks ago, when the market was pricing a near-certain 25bps cut and even anticipating more easing in 2026 than the Fed had signalled. We’ve already warned that a Fed surprise in the opposite direction of market expectations could have sharp negative consequences. And that’s exactly the setup forming now: a crisis of confidence. The probability of a December rate cut has collapsed from 90% to roughly 50%, and that reversal is already weighing on risk-on assets, including Bitcoin. The bigger risk is what happens if the Fed leans hawkish in December. Nothing in the data so far points to an end-of-cycle bear market, but a hawkish pivot against market expectations could easily push us closer to that scenario. It’s something worth monitoring closely. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, November 14, 2025

Bitcoin’s Drawdown Is Being Compounded by the Nasdaq’s Pullback

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

With some coins drawing outsized attention lately, let's break down our takes on the top 5 tokens this month. ...

-

Perp aggregators were a pretty obvious opportunity after the success of dex aggregators. But I hadn't seen one...

-

Sponsorship Opportunities Now Open ...

-

Bitcoin ETF Report, November 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

No comments:

Post a Comment