| gm Bankless Nation,

The world's biggest bank is setting up shop on Base. Today's Issue ⬇️ - ☀️ Need to Know: 'Token Taxonomy'

The SEC is nearly ready to define tokens. - 🔬 Analysis: J.P. Morgan Onchain

Why JPM Coin is such a big opportunity. - 🗣️ Opinion: Uniswap Restores the Faith

RSA talks promises kept in DeFi. - 🎧 Latest Pod: Ethereum Beast Mode

Justin Drake on Lean Ethereum.

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI. . . . NEED TO KNOW 'Token Taxonomy' - 🪙 SEC Chair Paul Atkins Wants 'Token Taxonomy' for Crypto Assets. The initiative would classify tokens under the Howey Test.

- 💰 Winklevoss-Backed Cypherpunk Debuts With $50M Bet on Zcash. The new firm is making a bid to become the MicroStrategy of privacy coins, starting with ZEC.

- 🤠 Coinbase Ditches Delaware for Texas Incorporation. Coinbase is joining a growing corporate migration toward states with more business-friendly laws.

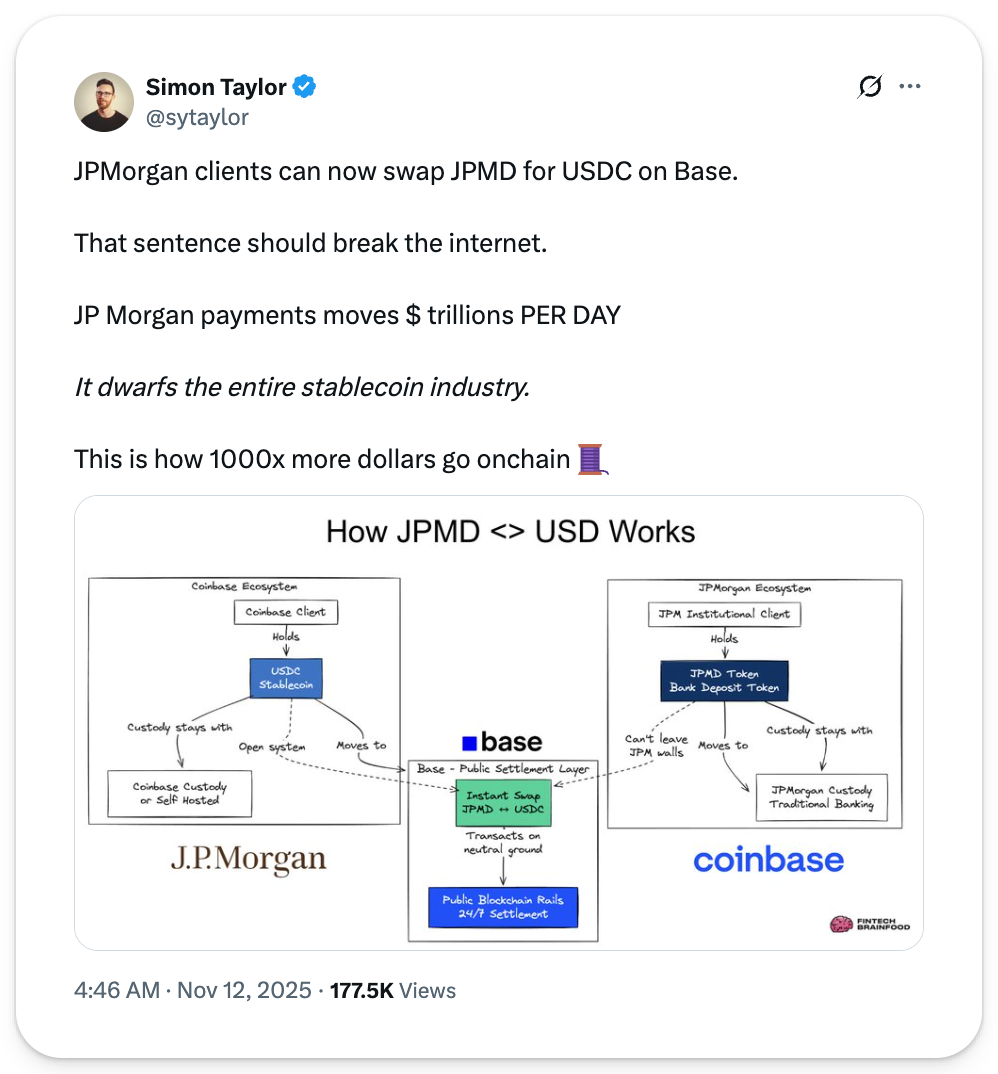

📸 Daily Market Snapshot: The world's biggest institutions are betting on crypto, but major announcements aren't moving the needle during a brutal autumn for token prices. | Prices as of 5pm ET | 24hr | 7d |  | Crypto $3.43T | ↘ 1.7% | ↘ 0.8% |  | BTC $101,660 | ↘ 0.9% | ↘ 1.7% |  | ETH $3,406 | ↗ 0.1% | ↘ 0.6% | . . . ANALYSIS J.P. Morgan Sets Up Shop on Base JPMorgan Chase & Co. – the largest bank in America – will now facilitate balance transfers for any institutional client via Coinbase's Base blockchain. The move coincides with CEO Jamie Dimon's steadily warming stance towards blockchain tech. Dimon, who still seems to maintain reservations about Bitcoin, has come around on the underlying technology, professing throughout 2025 that he is a believer in both stablecoins and blockchains. Today, we're unpacking the JPMD, a tokenized deposit solution now available to J.P. Morgan institutional clients on Base. 👇 🪙 JPMD Now Available on BaseFive months ago, Base – the Ethereum L2 blockchain created by crypto exchange Coinbase – publicized that it had been selected to host J.P. Morgan's "JPMD," a USD deposit token for institutional clients. This announcement came on June 17, the very same day the United States Congress passed the GENIUS Act, a comprehensive federal framework for regulating stablecoins and the first crypto-specific legislative action passed in American history. According to Naveen Mallela, Global Co-head of Kinexys, "JPM Coin delivers the security of bank-backed deposits and settlement, combined with the speed and innovation of 24/7, near real-time blockchain transactions, increasing efficiency and unlocking liquidity." JPMD was previously used in a blockchain pilot program with B2C2, Coinbase, and Mastercard, which provided participants with near-instant 24/7 settlement and real-time liquidity. In public statements about the integration, Mastercard EVP Raj Dhamodharan touted JPM Coin for delivering "secure, streamlined access to onchain payments for our shared customers and the broader industry." Similarly B2C2 CEO Thomas Restout lauded the experiment for delivering "real-time, onchain settlement with the assurance of a regulated USD deposit." Now, the JPM Coin concept is fully live: J.P. Morgan's institutional clients can securely send and receive dollars using JPMD tokens on Base. 🌐 JPMD's Profound ImplicationsTokenized deposits are no more complex than stablecoins, yet their capability to revolutionize the future of digital money appears many times more potent. Both stablecoins and tokenized deposits appear adept candidates for adoption in real-world transactions in the United States. Pending further regulatory clarity, these dollar-pegged instruments may soon gain the ability to be treated as cash for accounting purposes, posted as collateral with financial institutions, and used in inter-bank settlement. However, unlike stablecoins (such as USDC), which are explicitly prohibited from making interest payments to holders under the GENIUS Act, tokenized deposits issued by chartered commercial banks (like JPMD) can pay holders interest. Even though stablecoins and tokenized deposits will have similar functionality in a regulated blockchain future, the ability of the latter (issued by banks) to pay interest will help in making them the default option for digital dollar users in the majority of circumstances. J.P. Morgan processes an average $10T in daily payments volumes. As the banking giant continues to support digital assets, blurring the lines between crypto and finance, it becomes increasingly likely that other financial players will adopt the more efficient blockchain-based payments. While the future of finance is no doubt moving onchain, emerging regulations are helping to preserve the banking sector's stranglehold on the modernized financial system in tandem, as visible through the GENIUS Act-imposed banking monopoly on interest payments.  FRIEND & SPONSOR: FRAX The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower onchain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem. . . . OPINION Uniswap Restores the Faith Bankless founder Ryan Sean Adams on Uniswap's long-awaited fee-switch and the message it sends to a crypto industry bogged down by nihilist talking points. . . . LATEST POD Ethereum Beast Mode Ethereum hasn’t reached full speed yet. Now it might. Justin Drake of the Ethereum Foundation outlines Lean Ethereum, a plan to optimize the stack so validators stop executing and start verifying. With zk proofs in under 12 seconds and on-prem provers around 10 kW, the base layer can reach gigagas capacity and roughly 10,000 TPS while getting more decentralized. Add Fossil, seconds-level finality, and post-quantum signatures, and the changes stick. We unpack the EthProofs race, the four-phase path to mandatory proofs, the three-times-per-year gas target in EIP-7938, and why native rollups could remove gas ceilings for L2s. If you’re wondering whether Ethereum can scale without turning into a data center chain, this is the roadmap. Listen to the full episode 👇 |

No comments:

Post a Comment