| gm Bankless Nation,

A tough 2025 for Ethereum L2s didn’t slow Coinbase’s homegrown chain. Here's how it stayed ahead. Today's Issue ⬇️ - ☀️ Need to Know: ETH's Next Moves

Ethereum's upgrade calendar fills out. - 🗣️ Analysis: Base's Big Year

Base shipped a lot in 2025.

p.s. Token sales are coming in hot, and we built a tool for tracking all of the details you need to know. Take a peek at Bankless ICO Watch: our newest investor dashboard. Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI. . . . NEED TO KNOW ETH's Next Moves - ♦️ Ethereum Core Devs Pin 'Hegota' Upgrade on 2026 Roadmap. Hegota is scheduled to follow the impending Glamsterdam upgrade.

- 🪐 Terraform Labs Liquidator Blames Jump Trading for Terra-Luna Collapse. The bankruptcy administrator is suing Jump and its team for $4 billion.

- 🇺🇸 Michael Selig Confirmed as CFTC Chair. The Trump-nominated Selig is being celebrated as a pro-crypto pick.

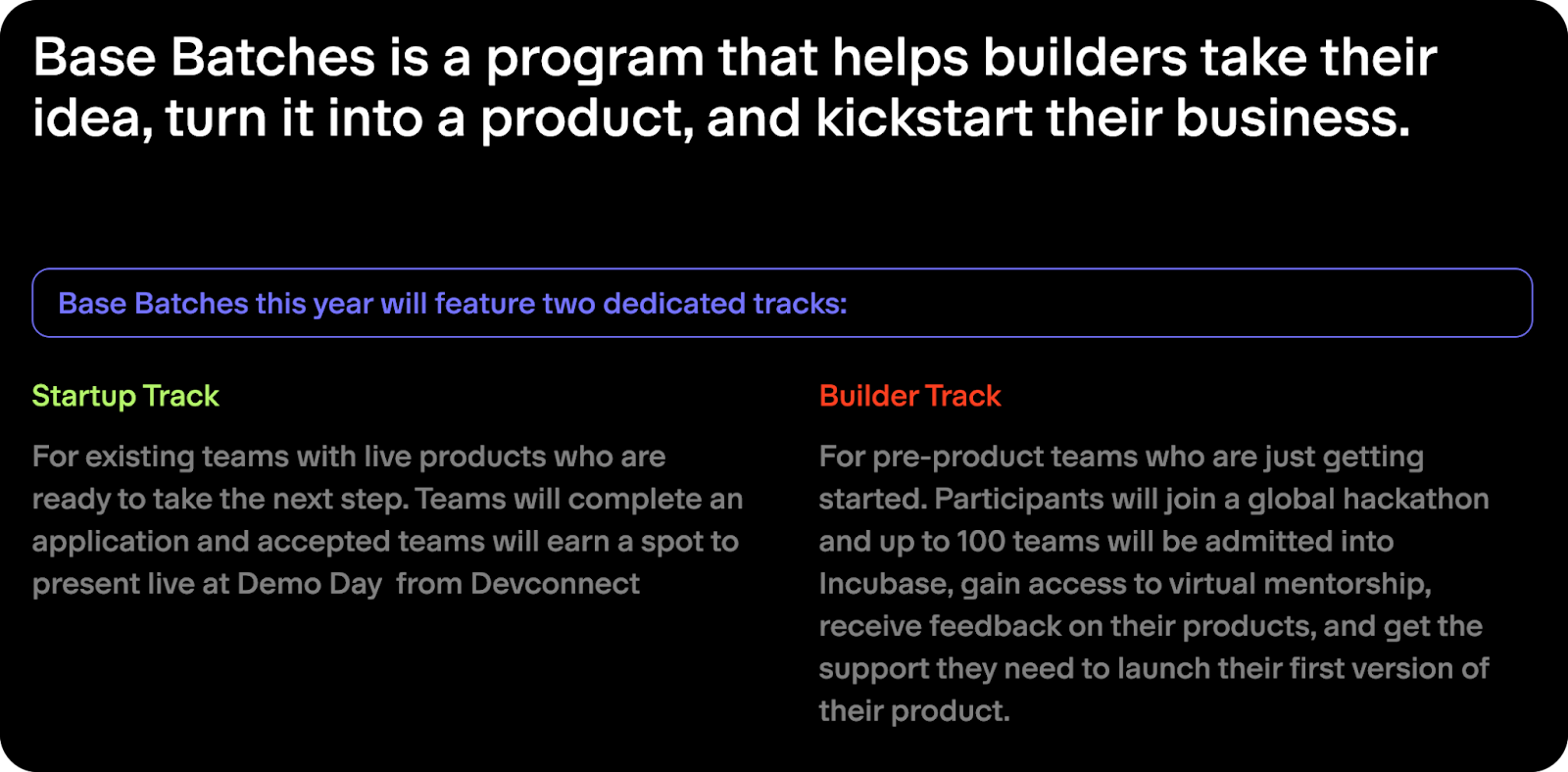

📸 Daily Market Snapshot: ETH is fighting to stay above $3,000 after two rough months of price action. The asset popped 6% on the day, but is still red on the week. | Prices as of 5pm ET | 24hr | 7d |  | Crypto $2.99T | ↗ 4.0% | ↘ 2.8% |  | BTC $88,329 | ↗ 3.2% | ↘ 2.2% |  | ETH $2,990 | ↗ 5.9% | ↘ 3.3% | . . . ANALYSIS Base's Relentless 2025 In a volatile year for DeFi, Base kept experimenting and compounding builder momentum, even as other L2s stalled. The Coinbase-incubated chain finished 2025 ranked first among L2s in revenue, earning $82.6M on the year while hosting $4.3B in DeFi TVL and $4.8B in stablecoin value. This came during a choppy market backdrop, with ETH, BTC, and COIN now ending a year of all-time highs firmly in the red, underscoring how much of Base’s growth was driven by onchain activity rather than just broader price tailwinds. That momentum wasn’t the result of a single breakout product or a token-fueled incentives cycle. Instead, Base leaned into a continuous buildout across DeFi products, developer tools, and infrastructure upgrades, each reinforcing the chain's flywheel. Today, we're taking a closer look at the products, programs, and upgrades that defined Base’s front-line campaign in 2025 👇 1. Growing the DeFi MulletWhile Base has grown alongside Coinbase, Coinbase has also leaned on Base — using it to offer a unique suite of hybrid onchain/offchain products (commonly referred to as the DeFi mullet) that apply centralized finance convenience to DeFi flexibility. Here are some of the top efforts (which we covered prolifically in the Bankless newsletter this year!): Onchain Loans: Through Coinbase, U.S. users can borrow up to $5M in USDC against BTC or up to $1M against ETH, enabled by the exchange’s direct integration with the Morpho lending protocol on Base. Your BTC auto-converts to cbBTC, deposits into Morpho, and your USDC arrives in under a minute. Take this against the week-long (if you're lucky) process of applying for a loan from a bank and it becomes clear how superior crypto’s systems here are. So far, this feature has seen $1.5B borrowed and $1.6B in collateralized BTC, with nearly 19K borrowers to date. Yield Opportunities: Beyond borrowing, Coinbase users have access to a series of yield options. For example, they can deposit USDC directly into Morpho vaults to earn yields higher than typical 4% savings rates — timed nicely as rate cuts reduce traditional yields. For those seeking maximally compliant liquidity venues, Verified Pools offer specialized Uniswap v4 pools open only to Coinbase-KYC'd users, optimized by risk-management firm Gauntlet. DEX Integration: Coinbase also integrated DEX trading directly into its exchange, allowing U.S. users (minus New York...) to trade Base tokens without leaving the app. When you make your first trade, the app creates a self-custody wallet — you hold the keys, but the UX looks just like buying tokens normally on the exchange, with all swap fees sponsored. For traders, it's onchain access without the usual friction. For Base projects, it's expanded distribution to millions more users. Taken together, the combo of accessible loans, competitive yields, and DEX integration positions Coinbase to function as much as a neobank as it is an exchange — a bold vision enabled by Base. Base stands out for its builder-first growth ethos. Instead of elaborate governance structures, the chain has developed tools and programs that reward and support existing builders and lower the barrier for new ones. Builder Programs: To reinforce this culture, Base organizes a global builder program called Base Batches for pre-accelerator talent, with dedicated tracks for AI, stablecoins, and consumer apps. Structured around a series of hackathons, the program aims to provide early-stage support and possible pathways to incubators and venture funding. Meanwhile, Base Build offers a development dashboard with real-time user analytics from launch, along with a monetization option through builder rewards. For plug-and-play infrastructure, Base provides a set of tools, including Embedded Wallets for account abstraction, Base Pay for USDC checkout within applications, and Sign on with Base, which streamlines account creation and onboarding. These tools represent a subset of a broader and growing suite of APIs and SDKs aimed at simplifying onchain development on Base. x402: Perhaps the most forward-looking addition here has been x402, an open payments standard that allows payments to be attached to web requests. The protocol solves the hassle of traditional API access by letting you pay automatically based on usage — per-call or per-inference — with payment happening instantly as part of the request. This enables AI agents to act as true, autonomous service providers, managing all the expenses and access they need to run operations independently. The through line here is accessibility. By equipping builders to ship faster, Base stimulates its onchain economy, makes it easy for people to experiment onchain, and positions their L2 as a positive-sum environment, an ever-critical factor when dealing with fickle market sentiment. 3. Shipping New Technical UpgradesBeyond brand power and product launches, Base kept making under-the-hood improvements — strengthening security, slashing latency, and expanding connectivity. Decentralization: In April, Base hit Stage 1 decentralization with the launch of permissionless fault proofs and the implementation of a security council. This strengthened the chain's security and reduced its trust assumptions — particularly important given the chain’s close relationship with a shareholder-owned public entity. Scaling: July brought the debut of Flashblocks, which slashed block times from 2 seconds to 200 milliseconds — moving transactions into "instant" territory. In December, Base (somewhat controversially) launched a native Solana bridge using Chainlink CCIP, enabling SPL token support within Base applications and cross-chain actions where transactions on one chain can trigger transactions on the other. It's the first non-Ethereum chain connected to Base, positioning it as a hub where every asset can exist across every network. These upgrades lay the groundwork for Base to compete on performance, not just distribution, while reducing the trust assumptions that come with being tied to a centralized exchange. 4. Laying Out the Next Phase of BaseBeyond infrastructure and product releases, two big developments stood out: the first showcasing a new method for traversing the chain, and the second (soft) confirming something many had hoped for from the beginning. Base App: Coinbase launched the Base App in July and has expanded it to 140+ countries, replacing Coinbase Wallet as the ecosystem’s primary interface and signaling a shift toward social-first crypto. The app integrates chat, trading, social features, and mini-app discovery all wrapped up in one familiar feed. It currently has 169k registered users, and while many are there to farm the chain’s upcoming token, there is certainly a core group of users who are embracing its call to "just coin it," and tokenize their media onchain. BASE Token: At Base Camp in September, the team publicly confirmed they're "exploring" a native token. Given the soft framing, it's likely it will be some time before a BASE token goes live. In the meantime, airdrop hunters are getting active as it's almost certain that onchain activity will be rewarded – if they pursue an airdrop as part of a possible token launch. Together, these moves sketch a vision of Base as a living ecosystem with its own culture and incentives — one where participation, especially as a builder, can pay off handsomely. Looking AheadBase's 2025 was defined by stacking advantages. The symbiosis with Coinbase has proven mutually beneficial: Base gets a built-in distribution engine and trusted brand for onboarding newcomers, while Coinbase gets the infrastructure to offer hybrid products that meaningfully distinguish it from competitors. At the same time, the chain's builder-first ethos — toolkits, retroactive grants, and programs like Base Batches — has cultivated a positive-sum environment that stood out during a year that was all over the place. And with Stage 1 decentralization achieved, Base has made meaningful progress in reducing the trust assumptions that naturally accompany an exchange-backed L2. The result is the most successful exchange-backed L2 to date, built on a foundation that positions it well for the next phase of growth. Its most credible near-term challenger may be Robinhood’s L2, which, if launched, could prove to be an ultimate test for the chain's staying power. It may still be day one for the chain, but the momentum suggests it is building toward something much, much larger. FRIEND & SPONSOR: FRAX The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem. |

No comments:

Post a Comment