| gm Bankless Nation,

ICOs are everywhere, all of a sudden, right before the holidays. Today, we're scoping out a few noteworthy ones dropping over the next several days. Today's Issue ⬇️ - ☀️ Need to Know: Firedancer Finally Arrives

Jump Crypto's Solana validator software has shipped. - 🗣️ Analysis: Public Token Sales Are Back

Three interesting ICOs going live next week.

Sponsor: Coinbase — Borrow against your BTC or ETH on Coinbase, powered by Morpho. . . . NEED TO KNOW Solana's Firedancer Debut - 🔥 Solana’s Firedancer Client Finally Goes Live. Jump Crypto’s new validator software aims to reduce centralization risk and boost performance.

- 👻 Aave Labs Catches Flak for Undisclosed Fee Diversion. Some token holders view the situation as 'extremely concerning,' while Aave Labs leadership sees itself in the right.

- 🏦 U.S. National Banking Regulator Grants Trust Charters to Five Crypto Banks. BitGo, Circle, Fidelity, Paxos, and Ripple have all received national trust bank charters.

📸 Daily Market Snapshot: Wall Street is embracing crypto, but it's unclear whether all of the firms are true believers, with a Vanguard executive calling Bitcoin "a digital Labubu," at a conference Friday. With a 3% dive Friday, BTC turned red on the year once again. | Prices as of 4pm ET | 24hr | 7d |  | Crypto $3.04T | ↘ 3.3% | ↗ 1.9% |  | BTC $90,252 | ↘ 3.2% | ↗ 0.9% |  | ETH $3,088 | ↘ 5.3% | ↗ 1.9% | FRIEND & SPONSOR: COINBASE You can now borrow against your ETH on Coinbase, powered by Morpho. Eligible customers can borrow up to $5M in USDC against their BTC and up to $1M in USDC against their ETH. Interest rates are variable, typically between 4% and 8%, and respond to market conditions. Repayment schedules are variable, so you can pay on your time. Plus, Coinbase will not treat borrow transactions as taxable events. Now there's a more accessible, cheaper way to cover life's unexpected expenses. . . . ANALYSIS Public Token Sales Are Back: Here Are 3 We're Watching Slowly, then all of a sudden... ICOs are back. After months of sparse rumblings, crypto protocols are now seeming to flock to coin offering platforms to sell fresh tokens. With Coinbase's acquisition of Echo and the launch of its own token sale platform, a couple of blockbuster raises, and a regulatory apparatus that is letting crypto experiment again, we're seeing the ICOs start to pour in. Bankless has been watching this phenomenon unfold in 2025, and we think now is the time for you to take a closer look. We covered the momentum on our podcast this week, David wrote up his thoughts in Ethereum Weekly last week, and today we're highlighting three noteworthy token sales to watch next week. 👇 OctraWebsite | Twitter Octra is an upcoming, general-purpose confidential computing network that allows computations on data while keeping it fully private, using fully homomorphic encryption (FHE). Unlike other privacy methods that require tradeoffs — trusted setups, limited computation types, or data moving offchain — FHE allows computations on encrypted data without ever decrypting it, making it the “holy grail” of encryption. Octra can operate as: - A standalone blockchain with native privacy.

- A privacy layer or coprocessor on top of existing blockchains like Ethereum, enabling confidential computations on data already living onchain.

- Encrypted storage for onchain and offchain applications.

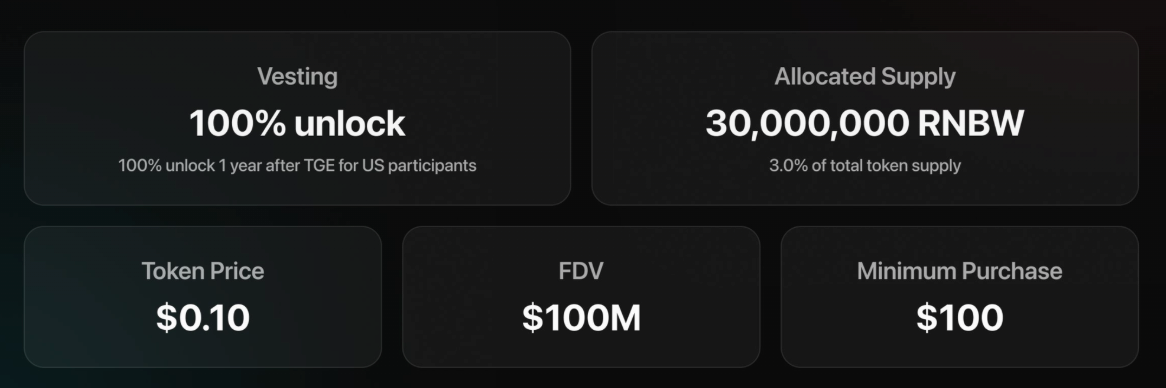

Octra's testnet has been live since June 2025, supporting wallets, encrypted balances, and token transfers, with a mainnet upgrade in preparation ahead of their public sale. From December 18–25, the Octra team will conduct a public sale of OCT tokens via Echo’s Sonar platform, offering 10% of total supply at a fixed price of $0.20 per token, targeting ~$20M raised at a $200M fully diluted valuation. This raise doubles Octra’s valuation from its last Echo raises, where it took in $4M across both. Before that, it also raised another $4M pre-seed from investors like Big Brain Holdings, Finality Capital Partners, and Karatage. The tokens sold will be fully unlocked after the sale concludes, with any unsold being permanently burned. Why Octra Is CompellingAs has become readily apparent in recent months, privacy infrastructure remains not only one of the clearest unsolved problems in crypto, but also one of the most “investable” (at least right now) — and FHE represents the most powerful approach to solving it. Performing computations on data that stays encrypted the entire time is the end goal of this pursuit, and Octra's testnet has already processed millions of transactions without downtime, though it will need to be seen if this translates smoothly to mainnet performance. Beyond FHE though, what makes Octra particularly interesting is its flexibility. Rather than requiring users to migrate to an entirely new environment, Octra can plug into existing blockchains as a privacy layer or coprocessor, meeting developers and users where they already are. That's a meaningfully different value proposition than simply "another L1." For those betting that private computation becomes table stakes for serious blockchain adoption, Octra could offer direct exposure to one of the more technically ambitious implementations in the space, though it faces competition as another, more widely known FHE project, Zama, goes up for sale soon after. RainbowWebsite | Twitter For five years, Rainbow Wallet has been on a mission: making crypto effortless, accessible, and intuitive for everyone. Rainbow is a popular self-custodial wallet for EVM networks that offers user-friendly mobile and desktop experiences. The wallet offers support for in-app crypto buys and token swaps, and has long teased the prospect of an airdrop with a prominent parachute embossed “rewards” button. The RNBW presale is live now, available exclusively to accredited U.S. investors through long-running crypto ICO platform CoinList. The RNBW token will have a total supply of 1B, with 3% allocated toward this ICO, and it will be offered until December 18, 2025, at 17:00 UTC. Tokens will be sold at $0.1, implying an FDV of $100M, or a 33% discount to Rainbow’s last private round, which included tokens and equity. All ICO pre-sale investors will be subject to a mandatory one-year lock period, with 100% stake vesting on the day their lock expires. Investors must make a minimum contribution of $100 using either USDC or USDT, and allocations will be “filled up from the bottom,” filling every buy order with uniform amounts of tokens regardless of its size until the order is completely filled. Why Rainbow Is CompellingThe bull case for wallet tokens is visible, anchored by their service revenues and underpinned by platform utility capabilities. Wallets can rank among some of crypto’s highest-earning applications when speculative fervor runs hot, with Phantom making over $100M of fees in one month when memecoin mania on Solana was flaming brightest in January 2025. For perspective, Rainbow Wallet has earned $2.7M in fee income year-to-date in 2025. Although unclear if Rainbow will retain all fees for its corporate entities (similar to how Uniswap Labs applies front-end fees while UNI token holders continue to wage a years-long battle for fees), it is possible that could be returned to RNBW token holders, potentially through token buybacks, staking programs, or a combination of both. Regardless, even in the event that revenues are not returned to holders, there remains a glaringly obvious use case for RNBW: the elimination of wallet service fees for holders could itself serve as a powerful demand driver. GensynWebsite | Twitter Backed by reputable investors like a16z and Coinfund, Gensyn is a decentralized compute network purpose-built for machine learning, allowing independent computers to jointly train and run AI models without centralized cloud providers. To achieve this, the protocol operates across four layers: - Execution Layer for ensuring consistent outputs regardless of what hardware is running the task

- Verification Layer, which verifies work has been done correctly without needing trusted intermediaries

- Communication Layer, which shares training data between peers

- Coordination Layer for aligning incentives and settling payments via Gensyn’s L2

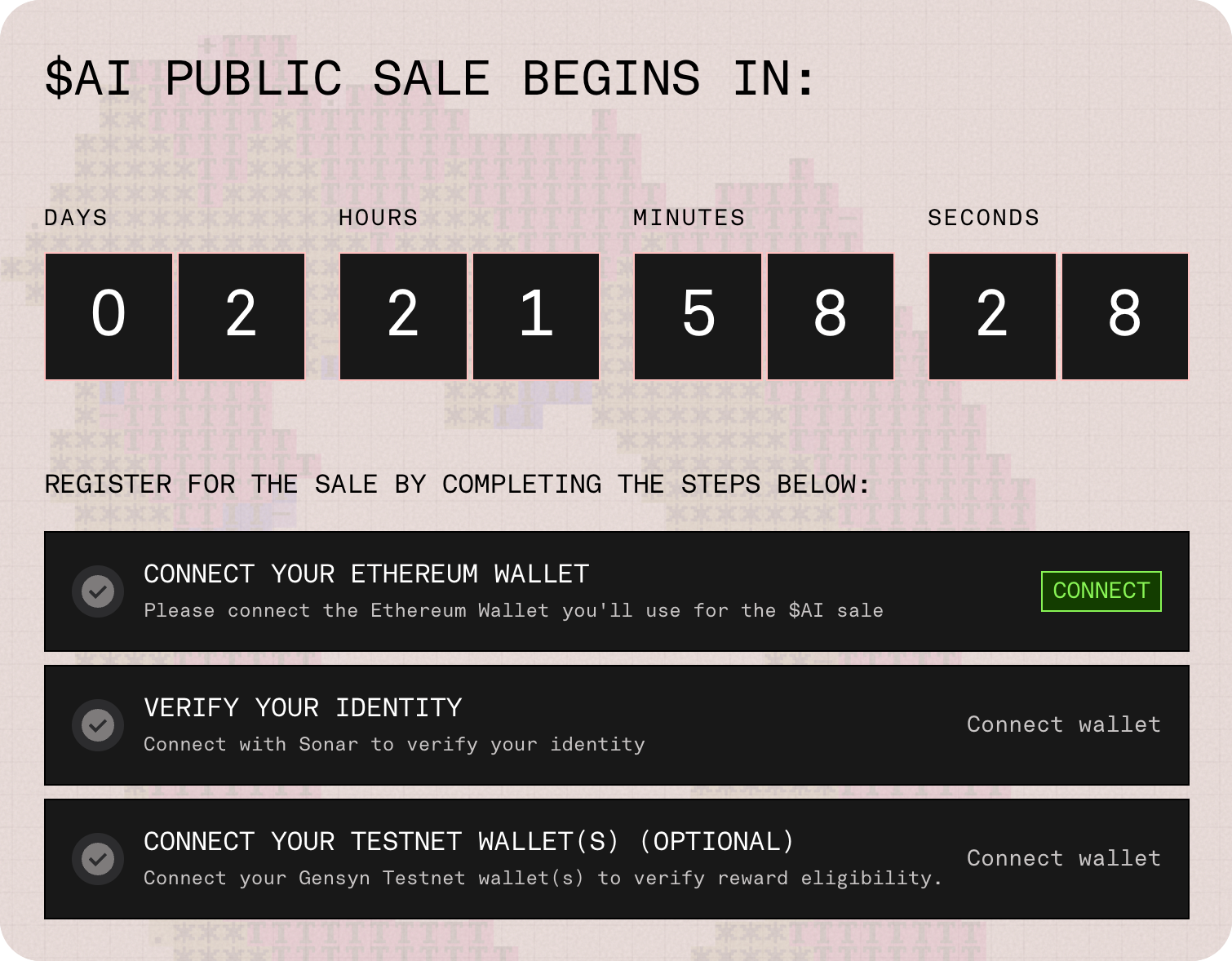

Gensyn has been running a public testnet for some time now, with live application demos including RL Swarm (decentralized reinforcement learning), CodeAssist (an AI assistant that learns from your coding behavior), and BlockAssist (a Minecraft-like environment showcasing verification primitives). Between December 15–20, Gensyn will conduct a public token sale via an English auction, offering 300M tokens (3% of 10B total supply) plus an additional 2% pool reserved for testnet participants. The price floor sits at $0.0001 per token ($1M FDV) and caps at $0.1 per token ($1B FDV) — matching the valuation of their October 2025 a16z-led token/equity round. Sale tokens are unlocked at TGE, except for U.S. investors whose allocations remain locked. Active testnet users who contributed before December 5 receive bonus multiplier tokens and priority allocation if the sale is oversubscribed. Why Gensyn Is CompellingGensyn arrives at a moment when the AI froth of mid-cycle has dissipated, giving way to maturation as institutional appetite for decentralized AI infrastructure grows. Compared to this time last year, we have legitimate examples of technology at the intersection of crypto and AI which solve clear cut issues, most notably x402. At the same time, Bittensor, which can double as a barometer for decentralized AI appetite, is now attracting steady institutional capital, both from crypto-native funds and traditional allocators looking for alternative AI exposure, as its products begin to find market fit. Gensyn, which solves the same goal of specialized training as Bittensor, could be viewed as a similar, yet fresher opportunity. Further, Gensyn boasts an academic rigor not seen by many projects. The team has published real research tackling the questions that must be answered to effectively train AI in a distributed fashion, following up their research by building out tools for deterministic execution, low-communication distributed training, and fault tolerance. For investors looking to gain exposure to decentralized AI infrastructure, Gensyn represents one of the more technically serious entries in the space, built by a team that appears to understand the actual difficulty of what they're attempting. |

No comments:

Post a Comment