| gm Bankless Nation,

It's certainly been the year of the perps exchange, but Ostium is presenting a different flavor of perpetuals opp. Here's what it has to offer. Today's Issue ⬇️ - ☀️ Need to Know: BlackRock ETH Staking

The ETH ETF kingpin is ready for staking. - 🗣️ Tactic: Trading RWA Perps with Ostium

This platform brings perps to real-world assets.

p.s. Thanks to Reya: Trade with zero fees, <1ms speed & 100% ETH security. The first based-rollup DEX (& already top-6 platform) with $1.5B daily vol. Fast, free, secure. Sponsor: Mantle — The Mantle Global Hackathon, running 10/22 to 12/31, invites devs & founders to design, build, and deploy scalable RWA and DeFi products on Mantle. . . . NEED TO KNOW BlackRock ETH Staking - 🥩 BlackRock Officially Files for iShares Staked ETH ETF. iShares will be listed and traded on NASDAQ under the ticker symbol "ETHB."

- 🟢 StableChain Mainnet Launches with STABLE Token. Bitfinex-backed StableChain goes live as a USDT-native Layer 1 for payments.

- 💰 Strategy Announces New BTC Buys as MSTR Shares Stabilize. Strategy's billion-dollar bitcoin buy comes with MSTR up 17% off its December lows.

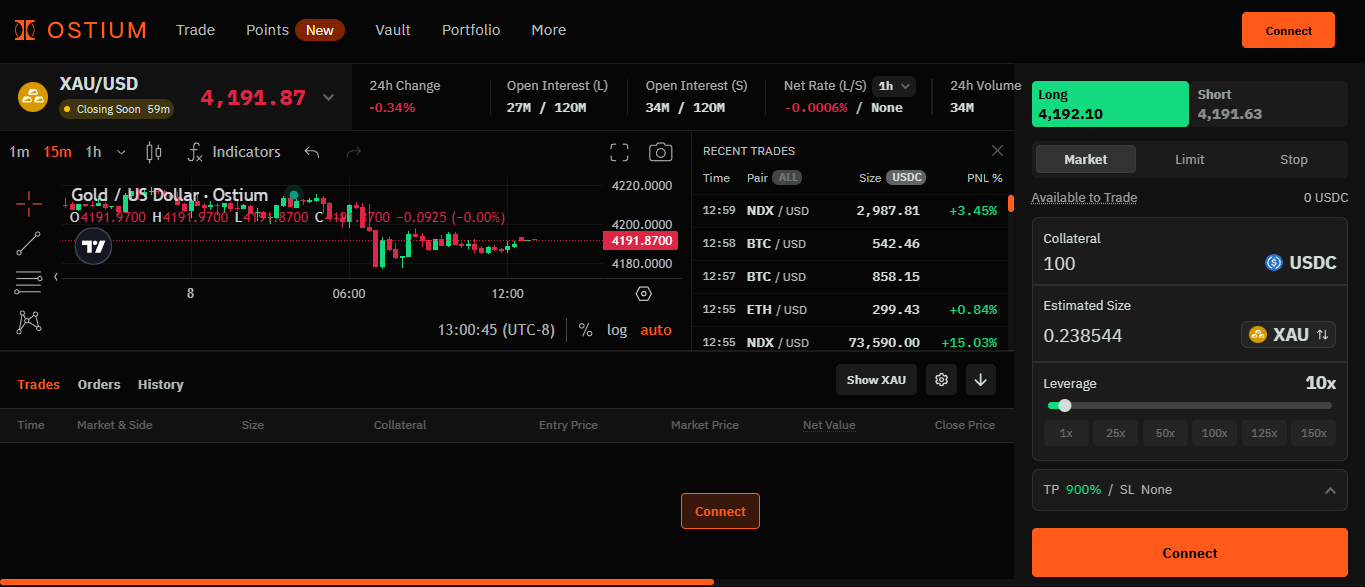

📸 Daily Market Snapshot: Bitcoin struggled to stay above the $90K barrier Monday, even as Strategy announced a $1B BTC purchase. Meanwhile, ZEC is fighting to maintain its pump, up 22% today, though still down 32% over the past month. | Prices as of 5pm ET | 24hr | 7d |  | Crypto $3.10T | ↗ 1.2% | ↗ 5.8% |  | BTC $90,787 | ↗ 1.7% | ↗ 6.4% |  | ETH $3,123 | ↗ 2.3% | ↗ 11.6% | . . . TACTIC Trading RWA Perps with Ostium It's been the Year of the Perp Exchanges. Think Hyperliquid, Lighter, Aster. These venues saw popularity surges in 2025 as people flocked to long and short crypto with leverage and without position expiries. This is perpetuals trading, and it's a streamlined way to (potentially) amplify profits, so long as you maintain your margin requirements! So far the early perps heavyweights in crypto have naturally focused on, you guessed it, crypto assets. This has opened the door for up-and-coming challengers to double down on real world assets in contrast. One project picking up the mantle (and some fresh VC cash) in this opening — and whose name literally means "opening" in Latin — is Ostium. Ostium is a perps platform on Arbitrum that offers crypto perpetuals, but it also offers onchain perps for RWAs like commodities (e.g. gold, silver, copper), forex pairs (e.g. EUR/USD, USD/JPY), and stocks (e.g. NVDA, TSLA, MSFT). The idea here is that instead of needing multiple brokerage accounts to trade these sorts of assets, and instead of waiting for tokenized versions of everything, you can trade synthetic perps, settled on Arbitrum, right from your existing crypto wallet. In other words, one venue for everything, with Chainlink oracles handling the crypto price feeds and Stork powering the RWA price feeds. Over this structure, you can access up to 200x leverage on some markets and maintain self-custody with your wallet all along the way. And while leveraged RWA trading certainly isn't for the faint of heart, it is straightforward to dive into Ostium if you do decide you want to explore the platform further. To finish your first trade here: - Head to app.ostium.com/trade. Then press "Connect." Doing this will bring up an interface where you can sign in with an existing Ethereum wallet, e.g. one you already use on Arbitrum, or you can use an email to spin up a gasless smart wallet on the spot.

- Now prepare your funds. USDC is the medium of exchange here. If you've already signed in with a wallet loaded on Arbitrum, you're good to go. Alternatively, you can use Ostium's "Add" button to deposit from a CEX, buy USDC with a credit card, or transfer and bridge other tokens into USDC.

- Pick your desired market. In Ostium's trade portal, click on the downward arrow tab on the actively listed market to pull up all the available markets. You can surf across categories like "Crypto," "Indices," "Forex," etc. Then click on the trading pair that catches your eye, e.g. XAU/USD if you want gold exposure.

- Choose your parameters. With your target market pulled up, you'll find the trade interface on the right side of the page. Input your desired settings here, like your side (long or short), your order type (market, limit, or stop), your USDC collateral amount, and your leverage level.

- Complete and manage your trade. Once everything looks good, press the "Buy" button to fire off the transaction. Your position will now appear in the "Trades" panel beneath the market's chart, where you can monitor its performance. From here, you can use the pencil icons to add or remove collateral or to update your take-profit and stop-loss levels.

- Close your position. Finally, whenever you’re ready to exit, press the "Close" button in your trade panel to end your trade outright or partially scale out. Ostium lets you define the exact percentage you want to unwind. Anything still open will continue showing in your portfolio, while totally closed positions are archived in your "History" tab.

And that's all it takes to get started here! Before you jump in, though, a few things to keep in mind. First, always approach leverage with caution, and stay on top of your USDC collateral levels to avoid liquidations. Also, note that RWAs have non-market hours (e.g. overnight), so if you place orders during these times, these positions will queue on Ostium for when those markets reopen. Zooming out, with its ongoing points program and over $25B in trade volume so far, Ostium has a chance to rise further into the limelight in 2026. Now, let's see if the platform can make the most of this opening going forward. Mantle Global Hackathon 2025: Mantle has entered a new phase in its roadmap – becoming the distribution layer to connect TradFi and onchain liquidity for RWAs where real-world finance flows. To accelerate this vision, Mantle launched the Mantle Global Hackathon 2025, running from October 22 to December 31, 2025, inviting developers, founders, and innovators to design, build, and deploy scalable RWA and DeFi products on Mantle. |

No comments:

Post a Comment