Bitcoin Is Showing Bear-Market-Level Weakness as Equity Risk Only CoolsAlso Bitcoin Is Entering Its Fourth Month Of Drawdown & Jerome Powell Signals Policy Stability, Not a PivotWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

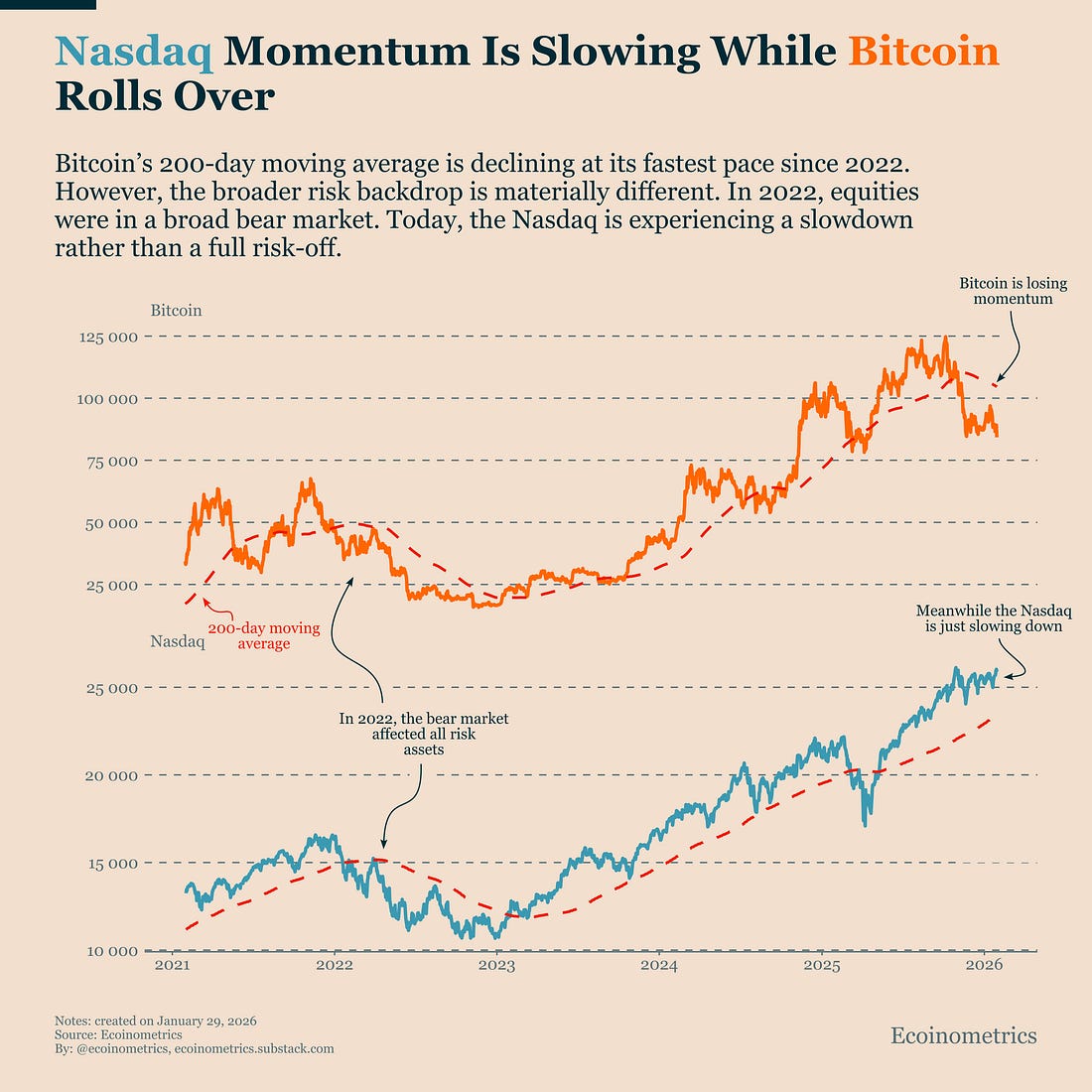

Taken together, today’s three charts describe a market under real strain, but not one experiencing a broad risk-off shock. Bitcoin is showing bear-market-level weakness and an increasingly prolonged drawdown, even as broader risk sentiment cools rather than collapses. At the same time, the Federal Reserve is maintaining a neutral, predictable policy stance, removing the risk of near-term policy surprises. The result is a fragile setup in which downside risks persist and recoveries will take time to form. In case you missed it, here are the other topics we covered this week: Get these professional-grade insights delivered to your inbox: Bitcoin Is Showing Bear-Market-Level Weakness as Equity Risk Only CoolsBitcoin is losing momentum in a way that usually doesn’t end well. The chart below shows the evolution of the 200-day moving average for Bitcoin and the Nasdaq 100. For Bitcoin, the message is clear. Long-term momentum is rolling over at its fastest pace since the 2022 bear market. Historically, this kind of deterioration doesn’t show up during healthy consolidations. It tends to appear when the market is under genuine stress. On that signal alone, Bitcoin looks weak, like bear-market weak. But what makes the current setup unusual is the backdrop in which this weakness is happening. In 2022, Bitcoin’s momentum collapsed alongside everything else. Equities sold off hard, liquidity dried up, and risk appetite vanished across the board. It was a macro driven collapse. Bitcoin wasn’t just weak, it was trapped in a broad, synchronized risk-off regime that left very little room to breathe. That is not the environment we are in today. The Nasdaq 100 is slowing, but it is not breaking down. Its long-term trend is not even flattening yet. Yes, volatility has picked up, returns have compressed, and upside momentum has cooled, but equities are still behaving like a cautious market, not one entering a full-scale liquidation. This is an important distinction. Bitcoin is showing bear-market-level weakness even though broader risk sentiment is only cooling. That combination tells us two things at once:

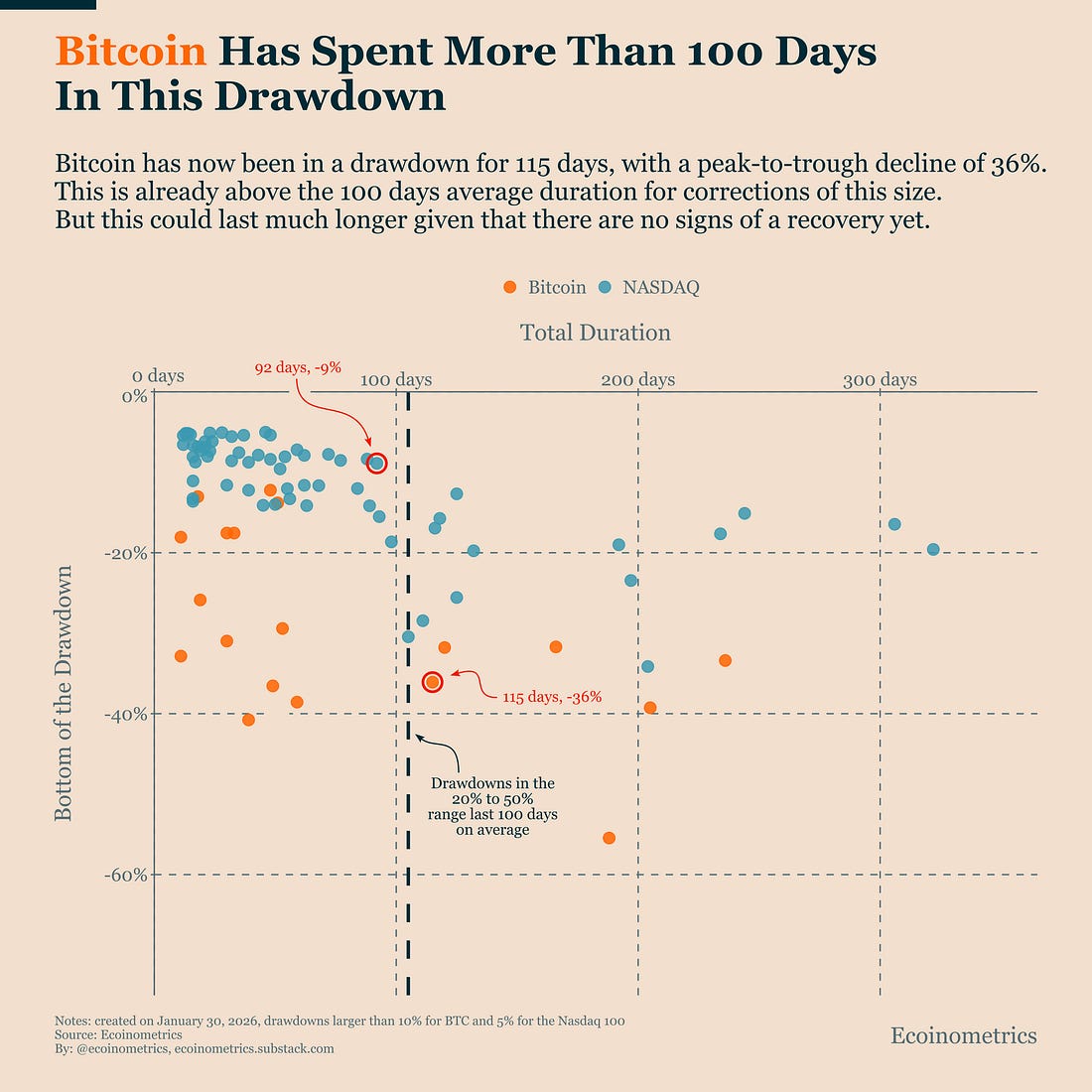

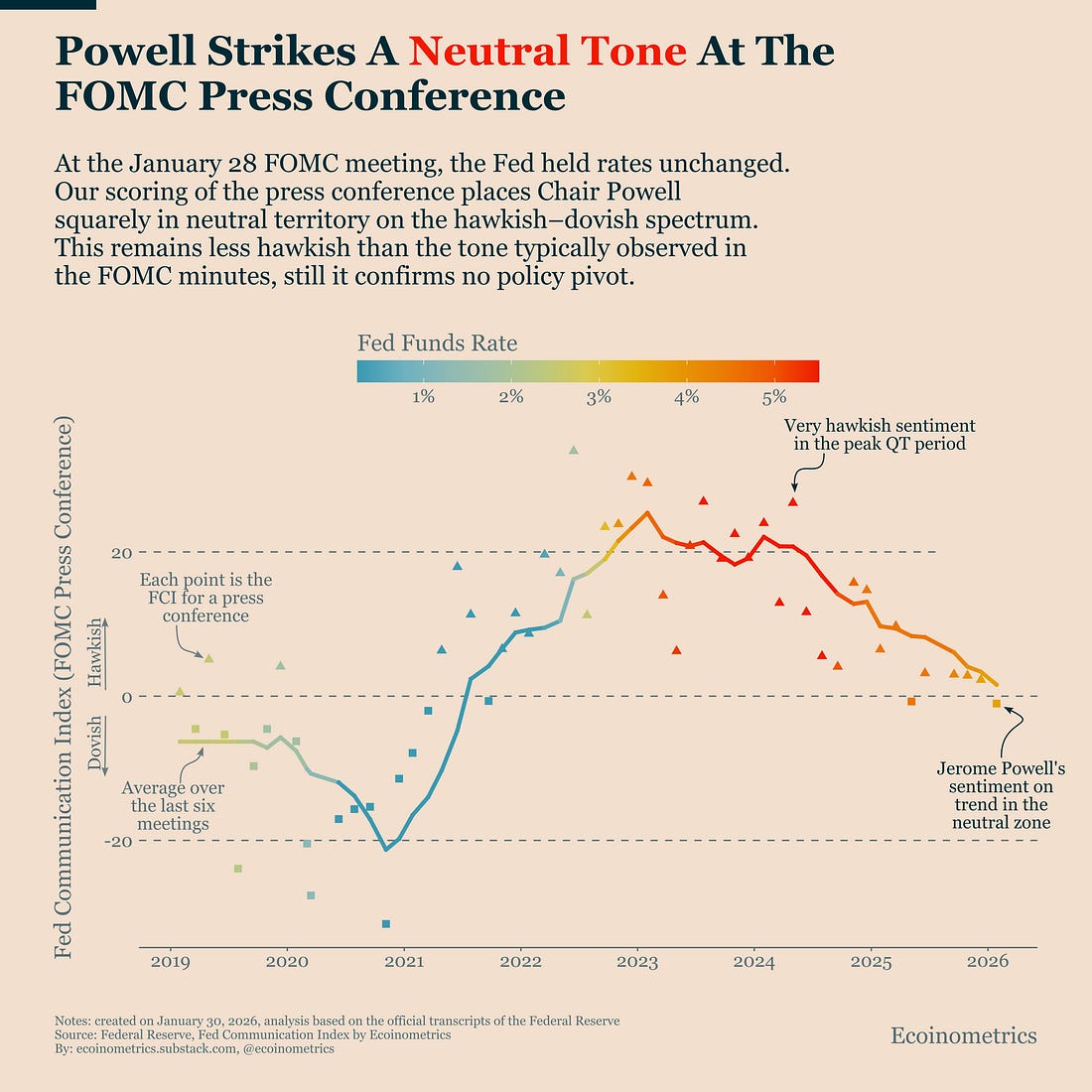

The result is an uncomfortable middle ground. Not all hope is lost, but the market is poorly positioned to absorb shocks. With momentum fading and participation thin, Bitcoin becomes more reactive and more prone to sharp moves in both directions. In practical terms, this is not an environment that rewards complacency but it’s also not one that calls for capitulation. The odds favour a rough ride in the short term, even as the broader risk environment leaves the door open for stabilization if conditions improve. Bitcoin Is Entering Its Fourth Month Of DrawdownBitcoin and the Nasdaq 100 are both in drawdowns that have lasted longer than what most investors would consider “comfortable.” The chart above maps historical drawdowns by depth and duration for both assets. On that basis alone, the current episode doesn’t look extreme yet. A drawdown of this size typically lasts around three months, and both Bitcoin and the Nasdaq are now hovering around that historical average. Where Bitcoin starts to stand out is not the size of the decline (not exceptional so far), but the lack of recovery attempts. In past corrections, Bitcoin often showed at least tentative signs of recovery before this point. Even weak bounces mattered, because they signaled that buyers were stepping back in and that the market was beginning to rebuild momentum. This time, those signals are missing. Bitcoin has now spent more than 100 days in drawdown, and price remains pinned near the lows. Historically, when drawdowns of this magnitude extend beyond their average duration without early signs of stabilization, they tend to resolve slowly. The market doesn’t snap back, it grinds. And that lines up with what we discussed earlier this week. On Wednesday, we showed that Bitcoin is losing momentum across several dimensions: the long-term price trend, on-chain activity, and ETF flows are all pointing in the same direction. With participation fading simultaneously across these channels, recoveries are bound to take longer to materialize. Put differently, this drawdown is no longer just about how far Bitcoin has fallen. It’s about how long investors are going to stay disengaged. Jerome Powell Signals Policy Stability, Not a PivotThis week’s FOMC meeting did not introduce any new surprises and in the current environment, that’s a blessing. Using our Fed Communication Index, which quantitatively scores FOMC press conference transcripts from hawkish to dovish, Chair Powell’s January 28 remarks come in slightly negative, placing them squarely in neutral territory. There is no sign of a rhetorical shift, no acceleration toward easing, and no renewed push toward tightening. It is basically on trend. In plain terms, the Fed is staying the course. That doesn’t mean policy is about to turn accommodative. A neutral tone is not a pivot. But it does mean the Fed is not actively injecting additional uncertainty into markets at a time when risk appetite is already fragile. And as we discussed previously, this is especially relevant right now. Bitcoin is on edge, momentum has weakened across several dimensions, and investors are clearly more cautious. In that context, the last thing the market needs is a surprise from the Fed. This meeting delivered the opposite: a familiar message, delivered in a familiar way. So the takeaway is simple. The Fed didn’t rock the boat. That won’t solve Bitcoin’s issues, but it does remove one potential source of pressure. When markets are already fragile, the absence of new shocks is a form of support.

Tactical TakeawayBitcoin is in a weak, slow grind phase, and history suggests these conditions rarely resolve quickly without a clear return of demand. With momentum still deteriorating and participation thinning, adding exposure on the expectation of a near-term rebound carries poor risk-reward. The absence of macro or policy shocks limits tail risk, but it does not shorten the recovery process. Until trend and demand indicators stabilize, the risk isn’t to miss the upside, it is to get caught in another wave of liquidation. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors, financial advisors and serious retail investors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, January 30, 2026

Bitcoin Is Showing Bear-Market-Level Weakness as Equity Risk Only Cools

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto Twitter feels broken – can X fix it? And where does onchain social fit in? ͏ ͏ ͏ ͏ ͏...

-

Token design level-ups helping solve the 'good coins problem.' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The Bitcoin Market Monitor by Ecoinometrics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Allocators get into DAS NYC for FREE ...

-

Why Bitcoin’s Greatest Risk Isn’t Regulation or Price — but Mathematics Itself ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment