Bitcoin’s Multi-Year Outperformance Streak Has StalledAlso 2025 Is Bitcoin’s Least Volatile Year of the Past Decade & The Federal Reserve Is Done Shrinking Its Balance SheetWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

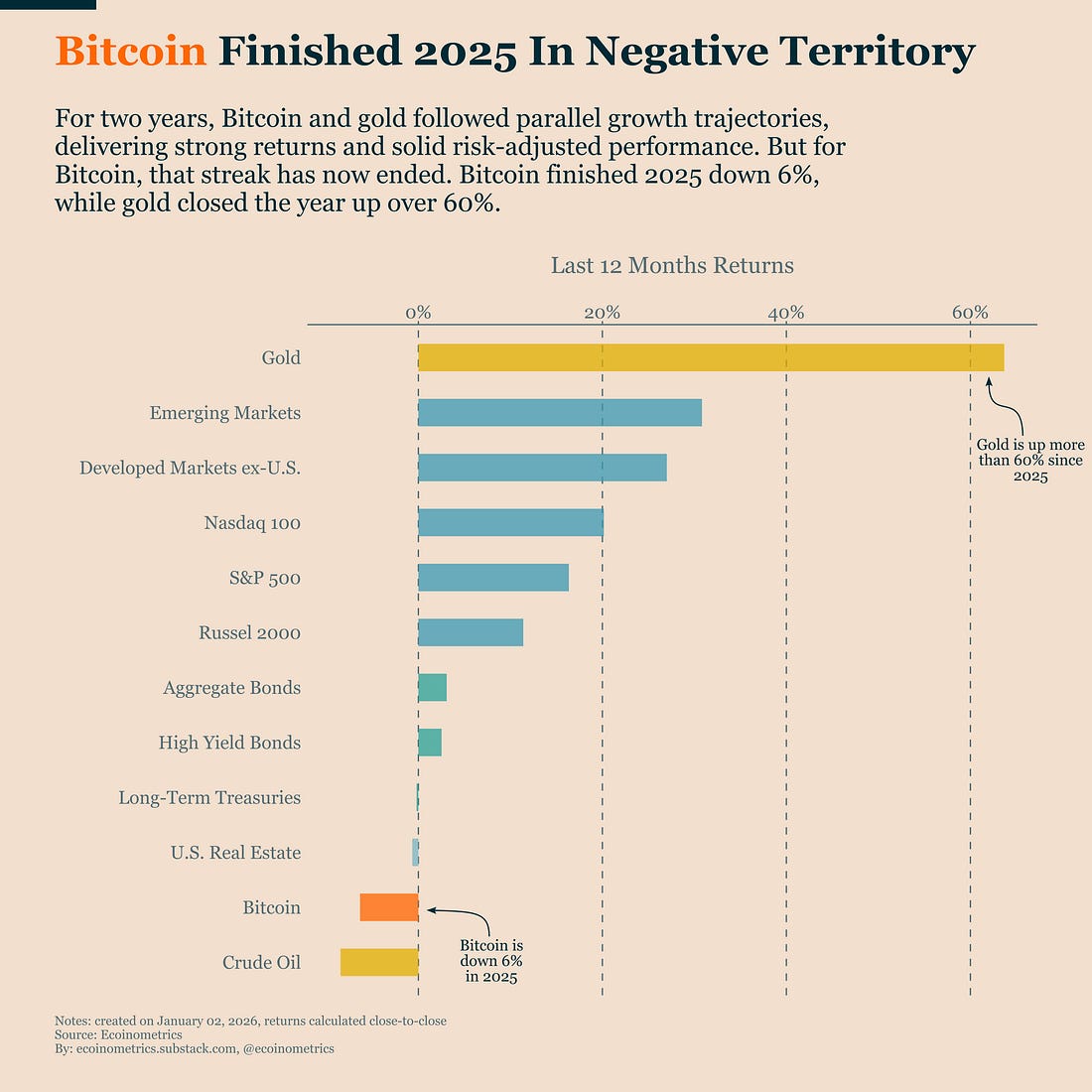

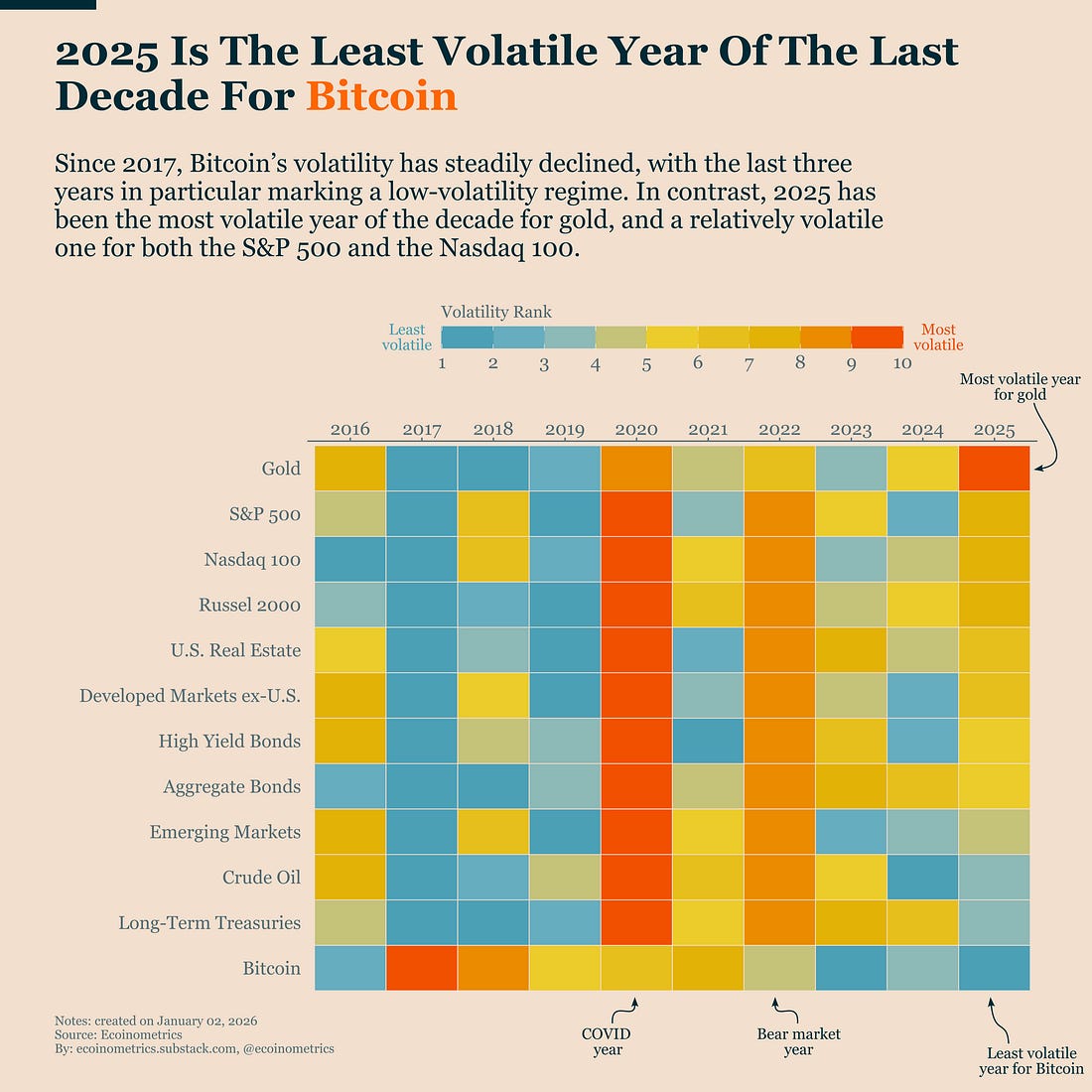

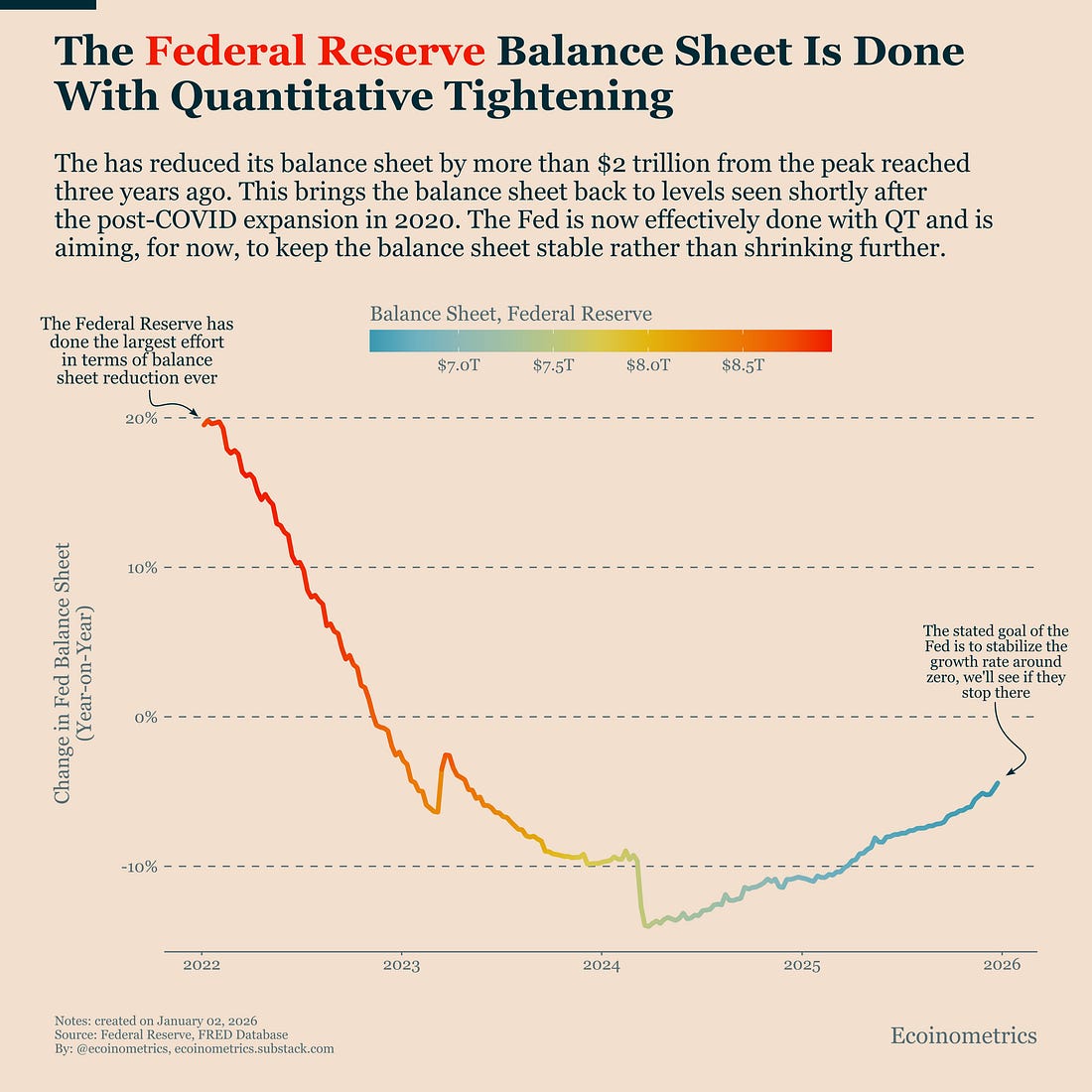

Together, these charts point to a market that is slowing without clearly breaking. Bitcoin has lost momentum, volatility has compressed, and macro conditions remain uncertain but not decisively restrictive. This is not a bullish setup, but it is also not the kind of environment that typically marks the start of a deep macro drawdown. In case you missed it, here are the other topics we covered this week: Get these professional-grade insights delivered to your inbox: Bitcoin’s Multi-Year Outperformance Streak Has StalledFor more than two years, Bitcoin and gold moved in parallel, delivering strong returns and attractive risk-adjusted performance. That relationship has now diverged. Over the past year, Bitcoin is down roughly 6%, while gold is up more than 60%. What stands out is not just Bitcoin’s weakness, but how isolated it is. Most major risk-on assets are still posting positive returns. The Nasdaq 100 and the S&P 500 are both higher, even if their gains are more modest than in recent years. Developed and emerging market equities are also up. When you look across assets, there are very few clear losers. Crude oil is down, largely due to persistent oversupply. U.S. real estate is weaker as elevated mortgage rates continue to weigh on demand. Long-term Treasuries are essentially flat. Outside of those pockets, performance has generally been positive. That matters for Bitcoin. This does not look like a broad risk-off environment where capital is fleeing growth assets across the board. If Bitcoin were declining alongside equities, credit, and commodities, the odds of a near-term recovery would be far lower. Instead, Bitcoin is sitting in a drawdown while the rest of the risk-on complex remains mostly intact. The weakness appears more idiosyncratic than systemic, likely tied to position unwinds late last year and a demand recovery that has yet to materialize. One way to think about this setup is that Bitcoin is lagging a still-functional risk-on backdrop. If broader markets remain stable, Bitcoin doesn’t need a macro tailwind to recover, it only needs marginal demand to return. Structurally, nothing looks broken. This is not a bear-market verdict for Bitcoin. The next key test is whether demand re-emerges as we move into Q1 2026. 2025 Is Bitcoin’s Least Volatile Year of the Past DecadeIn the chart below, each asset’s yearly volatility over the past ten years is ranked from 1 (least volatile) to 10 (most volatile), relative to its own history. This allows us to compare how unusual a given year has been for each asset, rather than comparing absolute volatility levels across markets. The result is striking. In 2025, gold experienced its most volatile year of the decade, while Bitcoin recorded its least volatile year over the same period. This is not a one-off outcome. Since 2017, and especially since 2023, Bitcoin’s volatility has been structurally trending lower. That shift is consistent with the growing role of institutional capital and the integration of Bitcoin into traditional financial markets, which tends to dampen extreme price swings over time. What makes this particularly notable is the broader market backdrop. Volatility has been elevated across many asset classes, including U.S. equities, which are themselves positively correlated with Bitcoin. In that environment, one might have expected Bitcoin to remain relatively volatile. Instead, Bitcoin stands out for the opposite reason. In relative terms, 2025 has been its calmest year of the past decade. Lower volatility doesn’t mean lower risk, but it does change the type of risk investors face. Bitcoin is behaving less like a reflexive momentum trade and more like a maturing macro asset, where demand flows matter more than sudden volatility spikes. The Federal Reserve Is Done Shrinking Its Balance SheetA lot of attention heading into 2026 is focused on whether the Federal Reserve will begin cutting rates. With inflation still above target and the labor market holding up, the odds of an aggressive rate-cutting cycle that materially boosts risk sentiment remain limited for now. That said, the macro backdrop is not uniformly negative. The Fed balance sheet tells a more constructive story. Over the past three years, the Federal Reserve has carried out one of the largest balance sheet reduction efforts in its history. More than $2 trillion has been removed since the peak, an outcome many investors doubted was achievable. Today, the balance sheet has returned to levels last seen shortly after the initial COVID-era expansion. To put that in context, the Fed’s balance sheet still sits around $6.5 trillion, compared with roughly $4.5 trillion before COVID. In level terms, it remains large. But the key point is that the active phase of balance sheet contraction is over. As the chart shows, the year-on-year change in the Fed’s balance sheet remains negative, but the pace of decline has been steadily normalizing since 2024. That process is now approaching zero. The Fed’s stated near-term goal is to keep the balance sheet broadly stable rather than continue shrinking it. Even that matters. By reinvesting maturing securities, the Fed is already supplying liquidity back into the system at the margin. While this is not outright easing, it is materially different from ongoing quantitative tightening and tends to support financial conditions. Put differently, uncertainty remains, but we are not starting the year with all macro forces working against Bitcoin. Conditions may not be outright supportive, but they are not aggressively adversarial either. Historically, that distinction is what separates true macro bear markets from slower, grind-it-out phases. Tactical TakeawayThe setup favours patience over conviction. Bitcoin is no longer in a high-volatility stress regime, and macro conditions are mixed rather than outright hostile, but price action still lacks clear demand confirmation. In this environment, upside moves are fragile and easily reversed if broader risk sentiment wobbles. For now, the key variable is not macro policy or volatility, but whether incremental demand returns after last year’s positioning reset. Until that happens, strength is better treated as stabilization rather than trend resumption. Early 2026 will be about watching flows and participation, not front-running a breakout. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, January 2, 2026

Bitcoin’s Multi-Year Outperformance Streak Has Stalled

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Calibrating Momentum Risk and Continuation Odds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

Unlocking Bitcoin's Hidden Value: Insights from Funding Rates, Sentiment, and HODLer Trends ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Let's see how they shake out... ...

-

Unlocking Multi-Timeframe Magic: Elevate Your Bitcoin Trades with Precision Confluence ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

DAOs have many problems like token <> equity alignment, illusion of governance, and more. "Asset futarc...

No comments:

Post a Comment