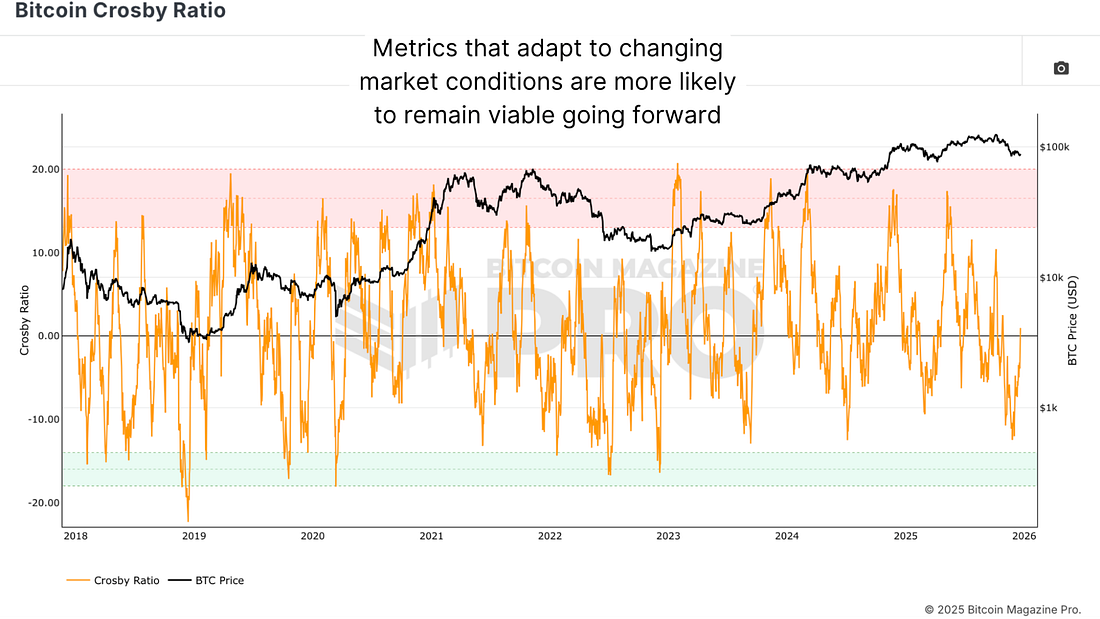

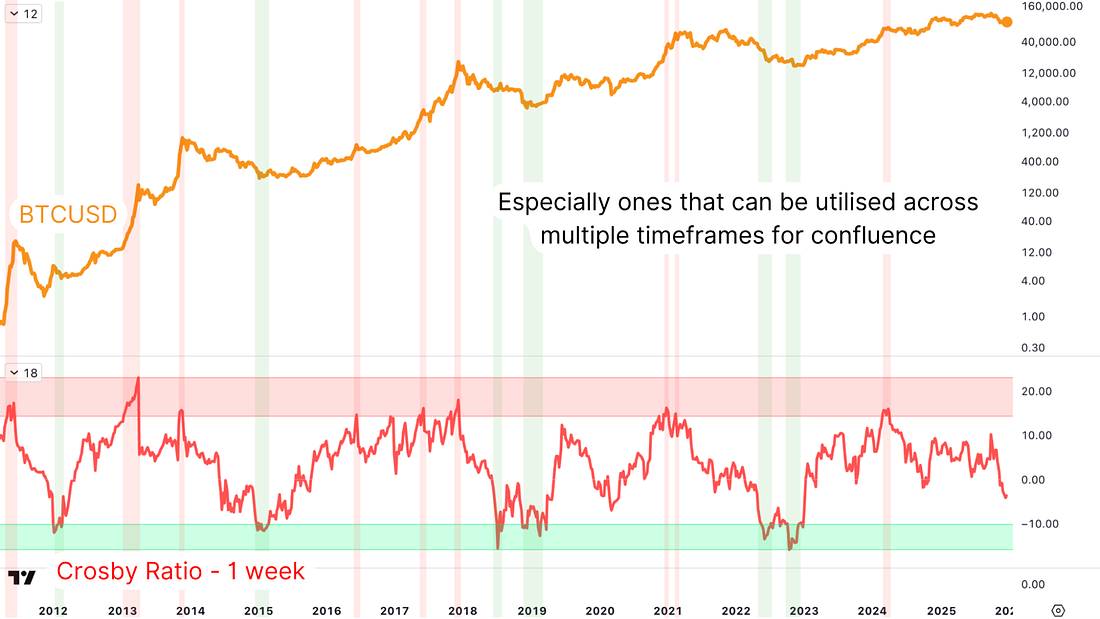

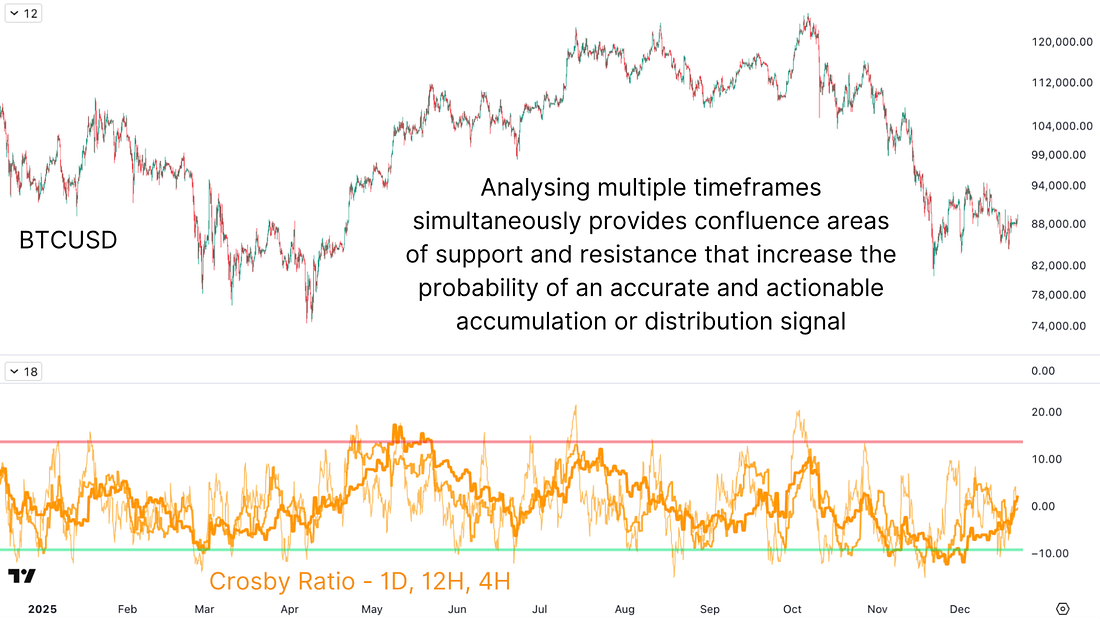

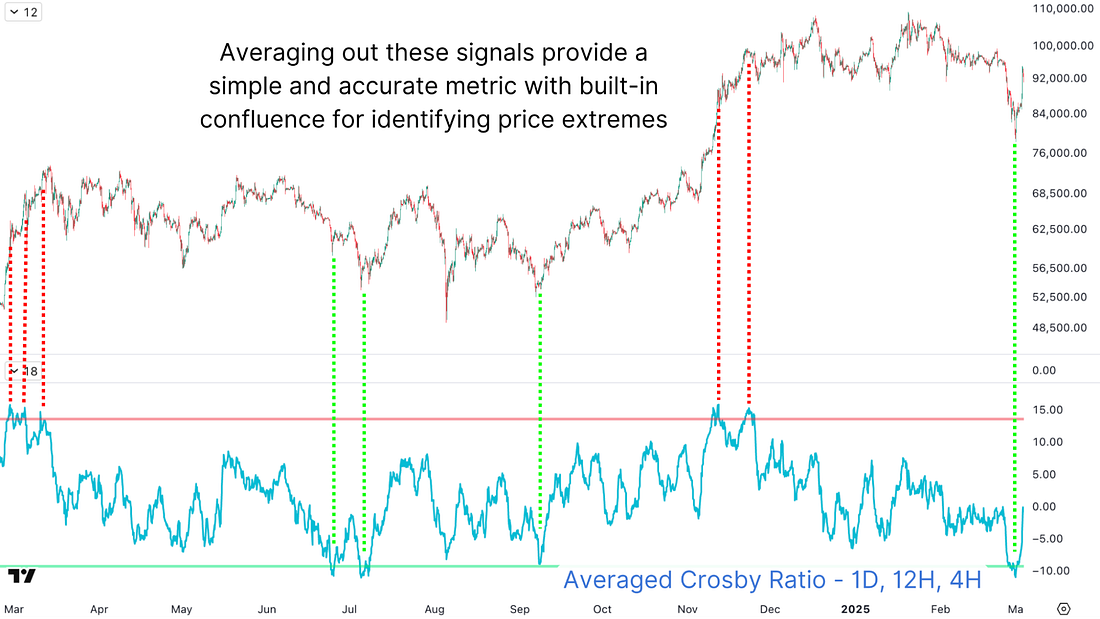

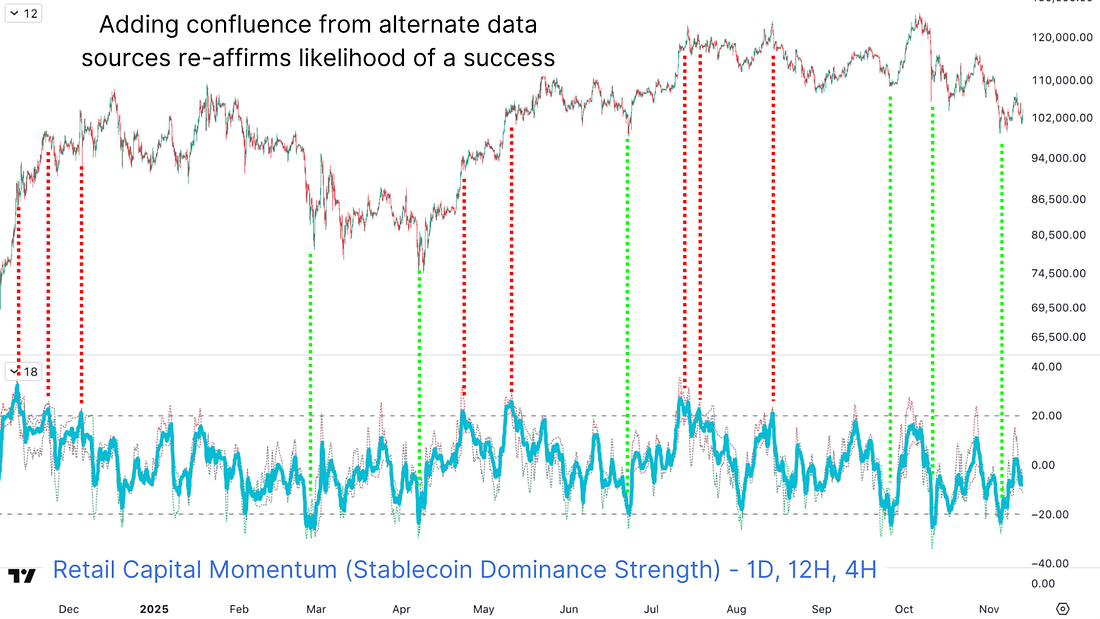

Mastering Confluence For Superior Bitcoin SignalsUnlocking Multi-Timeframe Magic: Elevate Your Bitcoin Trades with Precision ConfluenceBitcoin’s price action rarely presents perfect accumulation and distribution opportunities when viewed through a single indicator or timeframe. Many metrics, while effective for identifying cycle peaks and troughs, frequently fire signals marginally too early or too late, missing optimal exit or entry windows. A more sophisticated approach leverages confluence across multiple timeframes and metrics simultaneously, substantially improving signal accuracy and dramatically enhancing the probability of capturing extreme price movements at precisely the right moments. One Metric ProblemThe daily Bitcoin Crosby Ratio demonstrates the limitations of single-timeframe analysis. Historically, this indicator has signaled accumulated near lows (the green band) and distributed near peaks (the red band) with reasonable consistency. Yet imperfections persist. Occasionally, selling too early, accumulating prematurely on certain dips, or missing signals entirely on volatility that doesn’t meet specific threshold criteria. Figure 1: Despite the overall reliability of the daily Crosby Ratio, it has, on occasion, signaled at the wrong time. The weekly timeframe presents the opposite problem. While the weekly Crosby Ratio excels at identifying macro peaks and lows, it fails to capture intra-cycle opportunities. A timeframe that fires only at cycle extremes is too coarse-grained for active investors seeking intermediate buying or even selling opportunities. Figure 2: The Crosby Ratio, operating on a weekly timeframe. Multi-Timeframe ConfluenceCombining the 4-hour, 12-hour, and daily Crosby Ratio into a single analysis framework dramatically improves signal quality. Rather than relying on any single timeframe’s decision, confluence emerges only when multiple timeframes align in their assessment. Figure 3: Combining three timeframes of the Crosby Ratio provides confluence and increases signal accuracy. The 4-hour timeframe might suggest a local peak forming, but if the 12-hour and daily Crosby ratios haven’t reached their selling thresholds, this represents noise rather than a genuine distribution signal. Conversely, when only the daily shows accumulation potential while shorter timeframes lack confirmation, patience proves rewarded. Historically, this multi-timeframe approach has marked exact cycle lows and peaks with remarkable precision. When all three timeframes align beneath their respective oversold levels simultaneously, subsequent price action has generated strong bounces. The inverse holds true when all three timeframes align above overbought levels, distribution signals prove reliable. Enhanced Signal ClarityFurther refinement comes from averaging the three time frame signals into a single composite metric. Rather than mentally synthesizing three separate lines (difficult to read and prone to interpretation errors), averaging produces a single line representing aggregate multi-timeframe positioning. Figure 4: Combining the multi-timeframe metrics into a single averaged signal further refines this indicator. This averaged metric has functioned nearly flawlessly throughout the current Bitcoin cycle. Where individual timeframes occasionally produce ambiguous signals, the averaged version clearly delineates accumulation and distribution windows. The smoothing effect eliminates noise while preserving the critical inflection points where directional shifts occur. Cross-Metric ConfluenceSophistication increases further by pairing multi-timeframe analysis with additional metrics like the Retail Capital Momentum. This indicator measures changes in stablecoin dominance across cryptocurrency markets, functioning as a monetary fear-and-greed index that complements sentiment-based alternatives. When stablecoin dominance spikes sharply downward, it indicates capital rotating out of safe-haven assets into riskier cryptocurrency plays, a contrarian signal of potential market tops. Conversely, massive spikes in stablecoin dominance indicate flight to safety, suggesting panic selling and attractive accumulation zones. Figure 5: Pairing the multi-timeframe Crosby Ratio with an additional on-chain capital flow indicator provides further confluence. The critical insight is that this Retail Capital Momentum indicator operates on different principles than purely price action metrics. While the Crosby Ratio analyzes angular price movement, Retail Capital Momentum monitors actual capital flows. Confluence between these independent analytical frameworks produces extraordinarily high-probability signals. ConclusionAfter years of emphasizing confluence as a critical investment principle, the practical implementation can seem tedious. Yet the specific application of multi-timeframe analysis represents a quantifiable methodology that has historically produced near-perfect entry and exit signals for Bitcoin. For traders and investors navigating Bitcoin’s volatility, the difference between single-timeframe and metric systems and multi-timeframe, multi-metric frameworks separates marginal performance from exceptional results. For a more in-depth look into this topic, watch our most recent YouTube video here: Bitcoin Multi-Timeframe Confluence: The Real Edge  Matt Crosby Director of Research & Analytics - Bitcoin Magazine Pro Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, January 2, 2026

Mastering Confluence For Superior Bitcoin Signals

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Unlocking Multi-Timeframe Magic: Elevate Your Bitcoin Trades with Precision Confluence ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The crypto industry is entering a new era in 2026, and builders are chasing a new cohort of users. ...

-

Also 2025 Is Bitcoin’s Least Volatile Year of the Past Decade & The Federal Reserve Is Done Shrinking Its Balance Sheet ͏ ͏ ͏ ...

-

Second order effects of YT Extra from Pendle. Also, a guide for doing annual crypto review. ...

-

Let's see how they shake out... ...

No comments:

Post a Comment