BlackRock Files for a Bitcoin Covered Call ETF: TBL Weekly #169How these ETFs work, and what they mean for bitcoin’s marketDear Readers, Only hours after last week’s letter was published, BlackRock filed for a new bitcoin “premium income” ETF built around IBIT. The product will hold bitcoin while systematically selling covered call options on IBIT shares, generating option premiums that may be distributed to investors as income. In today’s piece, we’ll walk through how bitcoin income ETFs actually work, the trade-offs embedded in these strategies, and how large-scale volatility selling can shape both returns and the broader bitcoin market. As always, this piece is for educational purposes only and does not constitute financial advice. The foundations of money are shifting in ways that are easy to feel but harder to name. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk. In The Debasement Trade, James Lavish explains why currency debasement is structural, why traditional portfolio assumptions are being tested, and why gold tends to move first while bitcoin often moves further as the implications compound. The report covers:

❌ DON’T WRITE YOUR SEED ON PAPER 📝 Why? Because securing your generational wealth on paper is risky. It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

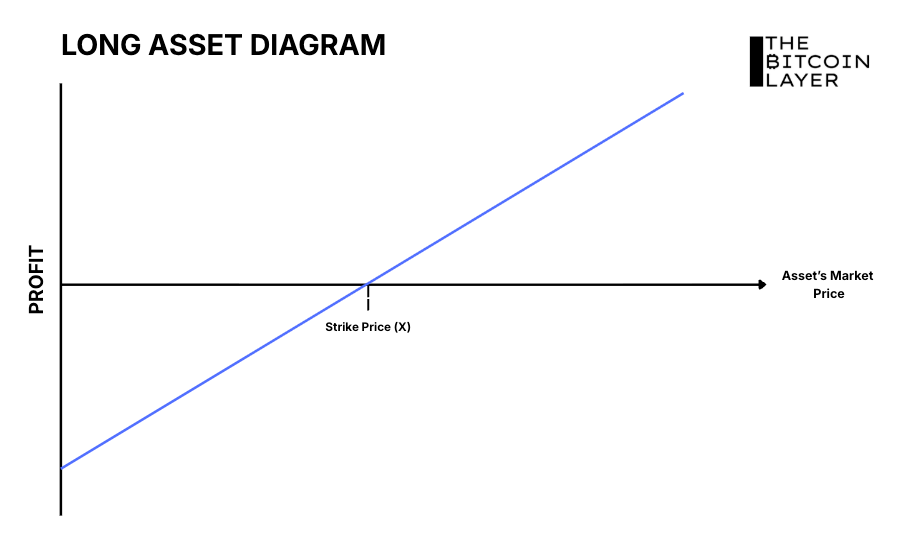

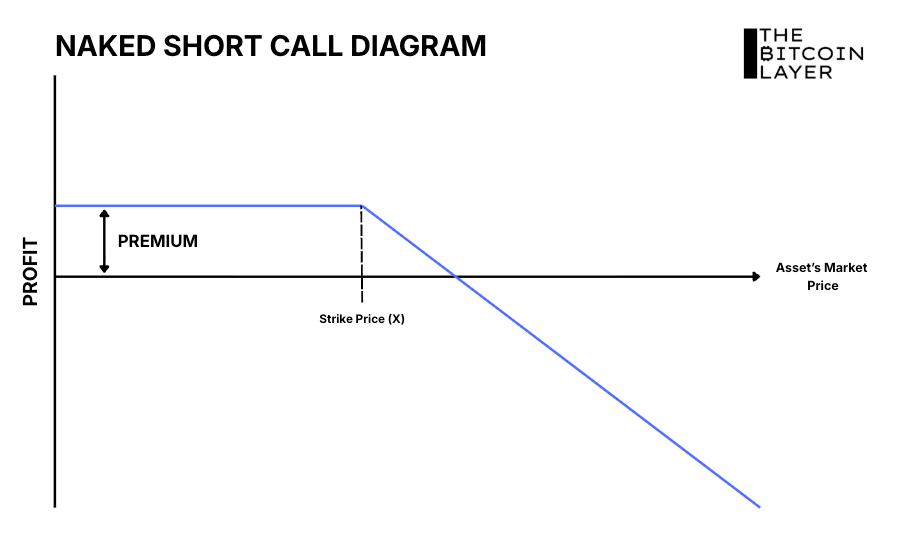

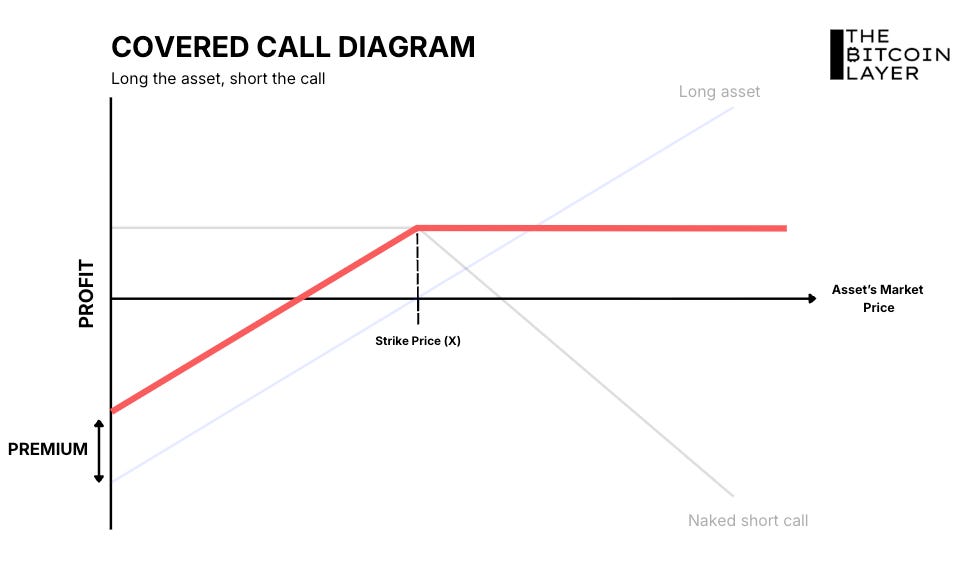

Use code TBL to take 15% off your purchase. A Quick Refresher on Covered CallsBuying a call option means you and another party have come to an agreement that in X-number of days, you may buy an asset from the other party at a specified price. Theoretically, you can create such agreements (options) for anything. If you think 1995 Honda Civics will become the next superstar collectors’ items—to be worth millions in six months—you could sign an agreement with anybody, wherein you have the option to buy a Honda Civic from them in 6 months from now for, say, $5,000. In this example, you are buying a call option on the car, while the other side of the agreement is selling you the call option. Herein lie the terms ‘covered’ and ‘naked.’ If you sign the agreement with the owner of a 1995 Honda Civic, then they sold you a covered call, as they own the asset already. If you sign the agreement with a counterparty that does not own the car, then they are selling you a naked call. Lastly, the counterparties will obviously not sell you these options for free; they’ll want a premium for taking on the risk. Here’s what selling a covered call visually looks like:

Going back to today’s topic, as we explained last week, in bitcoin terms, selling a covered call means selling someone the right to purchase your bitcoin at a future date should bitcoin reach (or surpass) the predetermined price, known as the strike price (e.g., the $5,000 from the Honda Civic example above). In exchange for offering this option, you receive an upfront premium. If bitcoin reaches the strike price, your offering is exercised, and bitcoin is effectively sold at that level. If it does not, the option expires worthless, and you keep both your bitcoin and the premium. This is why investors treat covered calls as a way to generate income on bitcoin they already own, with the trade-off only appearing when bitcoin rallies beyond the chosen strike. How Covered Call ETFs WorkFor those who want exposure to this strategy without directly trading options, a growing number of actively managed bitcoin income ETFs now package covered call writing into a single investment product. While some of these ETFs implement exposure synthetically using combinations of options rather than physically holding bitcoin or IBIT shares, the economic payoff is designed to mirror a traditional covered call strategy. For clarity, we’ll focus on the covered call structure itself, which is what ultimately drives returns and market impact. In practice, these ETFs maintain bitcoin exposure, either directly or synthetically, and systematically sell call options against that exposure on a recurring basis. Each option sale generates upfront premium income, which the fund may distribute to investors, while charging an annual management fee for providing the strategy. Most bitcoin income ETFs use short-dated options, typically expiring within one to two months, with strikes set out-of-the-money. Selling shorter-term options allows the strategy to benefit from faster time decay, the primary source of option premium. Setting strikes out-of-the-money helps balance two objectives: generating meaningful premium while increasing the likelihood that the options expire worthless. When this occurs, the fund retains its bitcoin exposure while keeping the premium collected, while still allowing for some upside participation before the strike is reached... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Friday, January 30, 2026

BlackRock Files for a Bitcoin Covered Call ETF: TBL Weekly #169

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto Twitter feels broken – can X fix it? And where does onchain social fit in? ͏ ͏ ͏ ͏ ͏...

-

Token design level-ups helping solve the 'good coins problem.' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The Bitcoin Market Monitor by Ecoinometrics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Allocators get into DAS NYC for FREE ...

-

Why Bitcoin’s Greatest Risk Isn’t Regulation or Price — but Mathematics Itself ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment