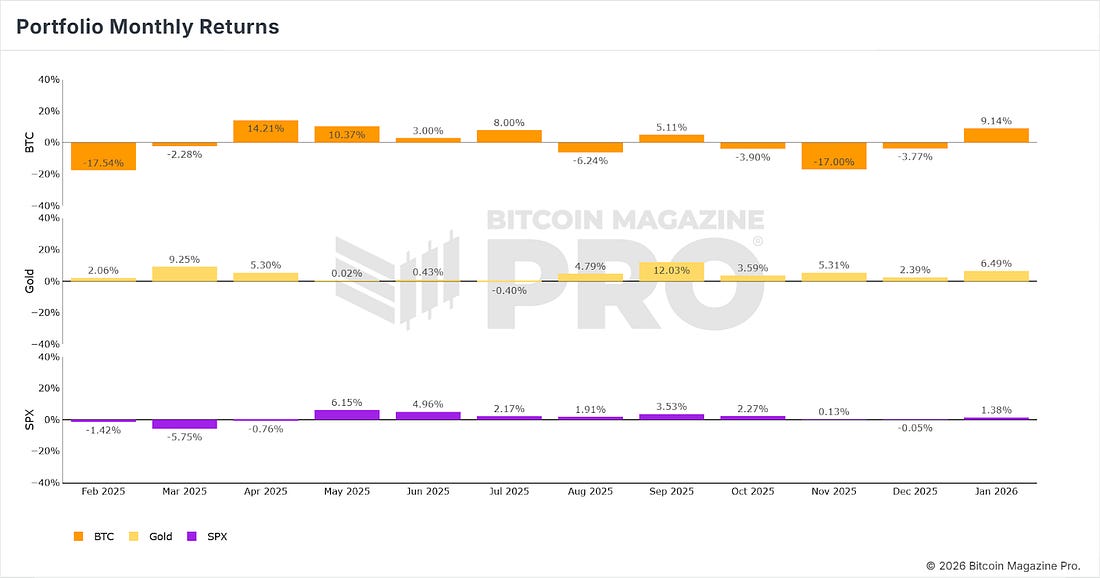

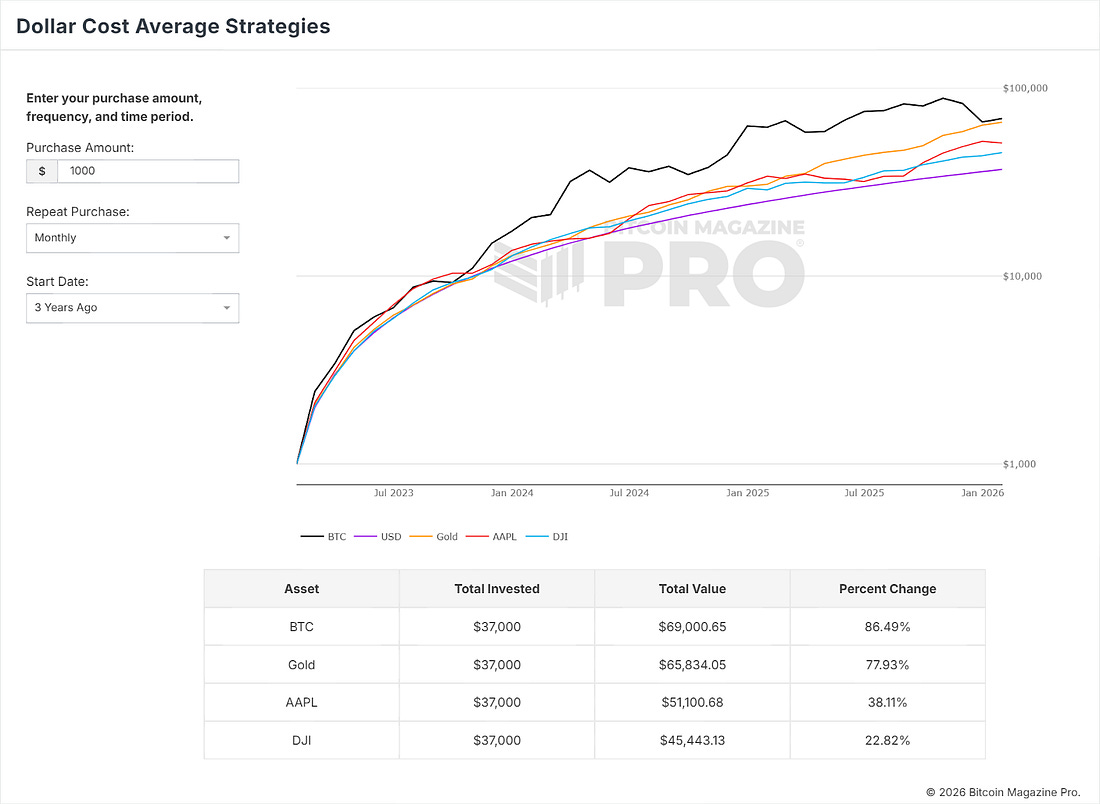

Has Gold Outperformed Bitcoin?Gold's steady gains steal the spotlight in the past year, but Bitcoin's 86% 3-year DCA return still outpaces gold, equities, and property.What’s Happening Price Action Bitcoin experienced a sharp drop over the past 24 hours, wiping out much of the gains of the past week. After its push up to $98,000, it stabilised around $95,000 but had a sudden move down earlier today, bringing the price back to the $92,500 area. Figure 1: BTC experienced a sharp move down today. As a result, BTC is relatively flat over the past week, with a gain of just 0.4%. Despite this low time-frame volatility, BTC continues to attempt a recovery from recent lows and is up +5% over the past month. Figure 2: BTC grinding up from last month’s lows. From a technical perspective, BTC remains some distance away from the major targets of the 1yr moving average, which has historically acted as a bull/bear market pivot point and the 200-day moving average. After a brief fakeout above the key reversal level of $95,000 (red zone on the chart below), BTC is now back in its range. Figure 3: BTC back under resistance. Fear and uncertainty will remain in the market as long as price action continues to grind through this zone. Patience will be required for the longer-term investor. The Big Story: Has Gold Outperformed Bitcoin? In recent months, gold has reclaimed the headlines. Once again, it is being positioned as the hard asset of choice amid persistent government deficit spending, fiat currency expansion, and rising global instability. Not long ago, that role belonged to Bitcoin. Often described as digital gold, Bitcoin was widely viewed as a hedge against monetary debasement in an increasingly uncertain macro environment. This shift in narrative raises a key question. Has gold actually outperformed Bitcoin, and how does it compare to other hard assets such as equities and property? Let’s take a closer look. Monthly Performance: Bitcoin vs Gold vs EquitiesFigure 4: Past 12 month performance of BTC, Gold, SPX. Over the past 12 months, Bitcoin’s performance has been notably volatile. February 2025 and November 2025 were particularly challenging for holders, with monthly drawdowns of more than 17 percent in both periods. Gold, by contrast, delivered remarkable consistency. It posted positive returns in every month except July 2025, when it declined by just 0.4 percent. The S&P 500 sat somewhere between the two. While its performance was more muted than both Bitcoin and gold, it nevertheless delivered a solidly positive year in 2025. A Longer-Term View: Dollar-Cost AveragingWhile gold may have dominated recent headlines, short-term performance can be misleading. A longer-term perspective often provides a clearer picture, particularly for investors who deploy capital systematically rather than all at once. Figure 5: DCA Performance. In this example, we assume an investor dollar-cost averaged 1,000 dollars per month into each of the following assets over the past three years:

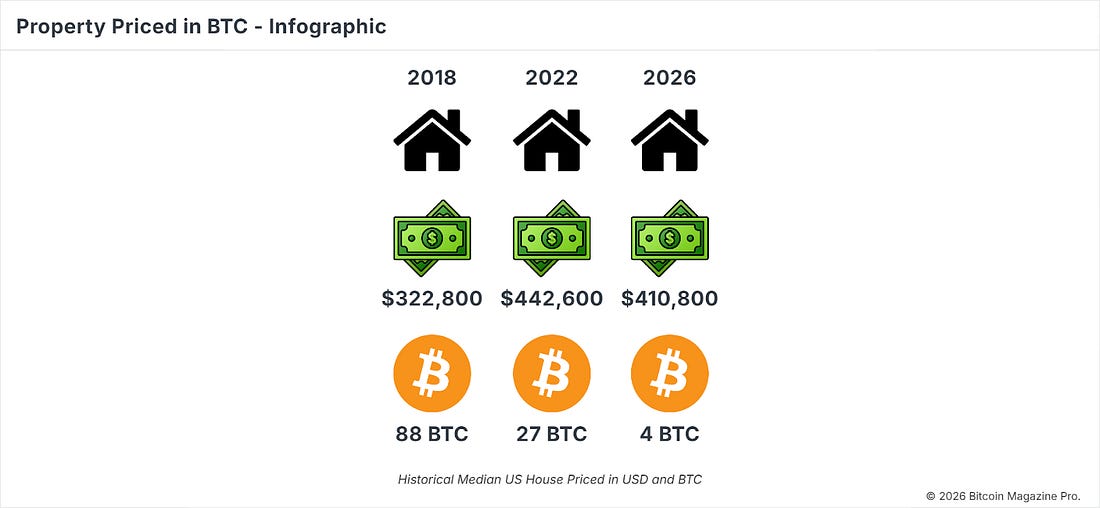

The results are striking. Bitcoin and gold clearly emerge as the top performers. Bitcoin slightly outpaces gold, delivering an 86 percent total return compared with 76 percent for gold. Apple follows with a 38 percent return, while the Dow Jones trails at 22 percent. While gold has outperformed Bitcoin over the most recent 12-month period, Bitcoin continues to lead over longer time horizons. Bitcoin vs Property: A Purchasing Power ShockThe comparison becomes even more dramatic when Bitcoin is measured against property. The median US home today costs roughly 4 BTC. In 2018, that same home would have required 88 BTC. Even as recently as a few years ago, buyers needed around 27 BTC to purchase the median US house. Figure 6: Property priced in BTC. This represents one of the clearest examples of Bitcoin’s long-term purchasing power appreciation. ConclusionGold’s recent strength is undeniable, particularly over the past year. However, zooming out reveals a more nuanced picture. Over longer timeframes, Bitcoin continues to outperform gold, equities, and property, despite higher volatility along the way. For investors focused on long-term purchasing power rather than short-term narratives, Bitcoin remains difficult to ignore. To view all of these charts and receive more in-depth analysis, subscribe to the Bitcoin Magazine Pro platform here. The Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, January 19, 2026

Has Gold Outperformed Bitcoin?

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Hear why at DAS NYC ...

-

Crypto is closer than ever to mass adoption, but its founding values aren’t embedded in every blockchain... ...

-

Hyperliquid's HIP-3 framework is putting gold and Tesla stock into the mix for perps traders. ...

-

Also Strategy Has Become A Key Source Of Bitcoin Price Support & Inflation Is Likely Understated By Data Distortions ͏ ͏ ͏ ...

-

People building freedom technology across the globe are watching freedoms disappear at home. ͏ ...

No comments:

Post a Comment