| gm Bankless Nation,

The privacy coin trade is a cycle standout, but what are the key differences between Monero's XMR and Zcash's ZEC? Today's Issue ⬇️ - ☀️ Need to Know: Crypto Social Reset

Crypto social network Farcaster is sold. - 🗣️ Analysis: Comparing Top Privacy Coins

How Monero and Zcash stack up technically.

Sponsor: Consensus — Consensus Miami | May 5-7 | Save 20% with the code BANKLESS

. . . NEED TO KNOW Decentralized Social Reset - 🪐 Farcaster Decentralized Social Network Bought by Ecosystem Developer Neynar. Neynar acquires Farcaster from Merkle as founders step back. The move follows Lens shifting to Mask Network amid a broader SocialFi reset.

- 🚔 FTX's Caroline Ellison Set for Release After 440 Days Served. Former Alameda CEO Caroline Ellison is set for release from a federal halfway house today after partially serving a two-year sentence for fraud charges.

- 💸 Interactive Brokers Plans to Sell Institutions on Prediction Markets. The publicly traded online brokerage firm is getting ready to onboard institutions to prediction markets to manage their risk.

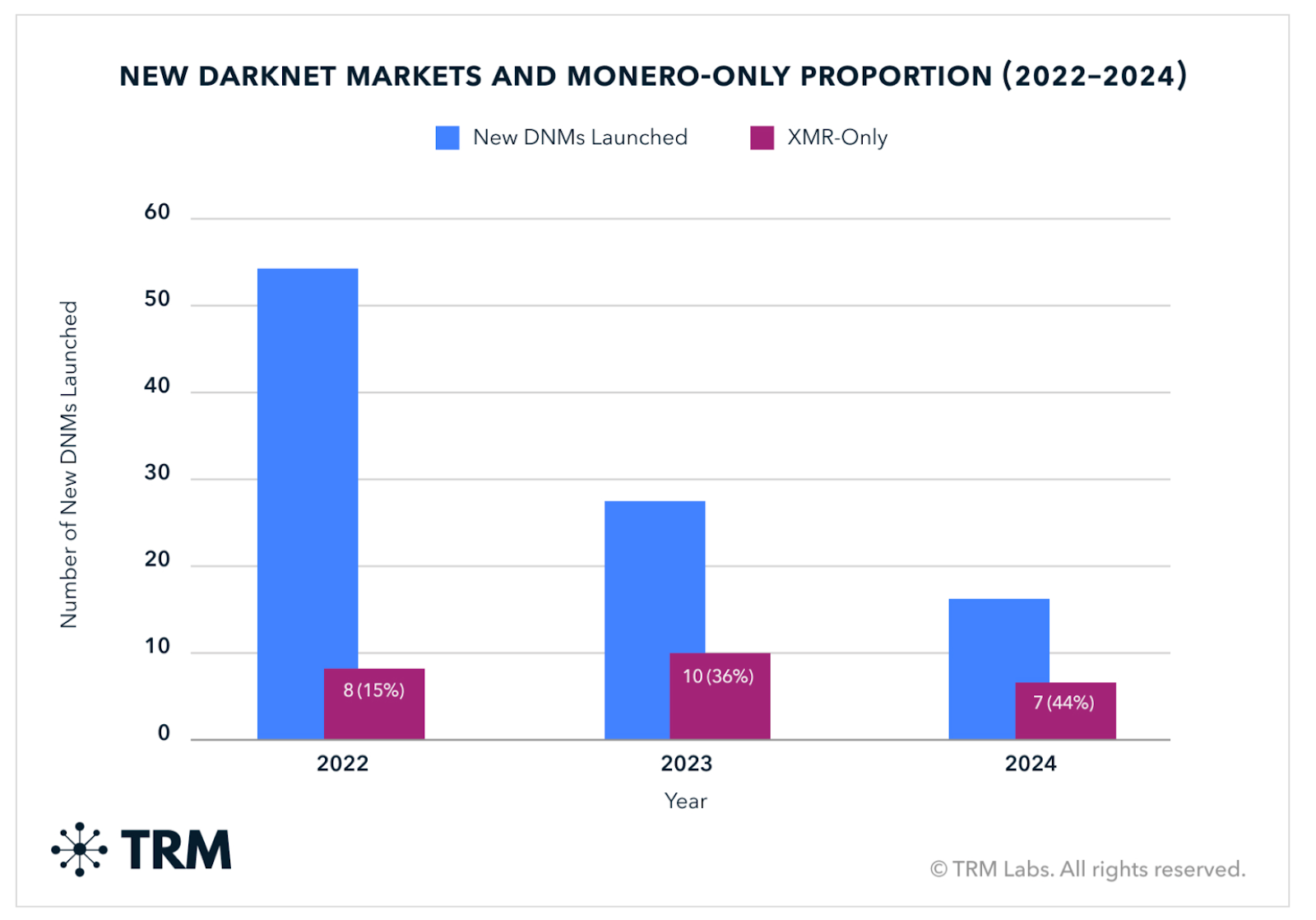

📸 Daily Market Snapshot: Markets retook some of the week's losses on news Trump had backed off his Greenland-centric EU tariff plans after allegedly reaching an agreement with the NATO chief on a plan "framework." | Prices as of 6pm ET | 24hr | 7d |  | Crypto $3.04T | ↗ 2.1% | ↘ 8.2% |  | BTC $89,882 | ↗ 2.1% | ↘ 7.5% |  | ETH $3,015 | ↗ 2.6% | ↘ 10.3% | . . . ANALYSIS Comparing Crypto's Top Privacy Coins The privacy trade has been a rare bright spot over the past several months of crypto market stagnation. The principal focus here has been trading action for the native tokens of Zcash (ZEC) and Monero (XMR). ZEC's epic September run took the privacy coin from the doldrums to Valhalla, reaching a nine-year high in November, 28x above its 1y low. While Zcash stole the headlines, Monero's XMR was grinding higher – albeit from a much higher starting FDV. Two weeks ago, everything was turned on its head when the Zcash core dev team at The Electric Coin Company (ECC) announced they were leaving Zcash over a governance kerfuffle — ZEC tanked, and XMR found new room to retake command of the privacy trade. While Monero has been the larger asset by market cap for most of its life, the ECC governance drama awarded fresh oxygen to the XMR camp's long-standing arguments — that it's the "one true privacy coin," fully private rather than optionally private. That debate is getting renewed attention now – even as both coins endure tough drawdowns alongside the broader altcoin market. Bankless is pumped to welcome Zcash founder Zooko onto the podcast next week to hear from the founder himself on recent action and drama, but to get you ready for the episode dropping soon, let's take a step back and tackle how Zcash and Monero actually differ — not just technically, but organizationally. Both claim to solve the same problem Satoshi identified in 2008, but they've taken fundamentally different paths to get there. Origin StoriesPerhaps the fundamental difference between these two projects lies in how they each got started: Monero was born on forums, while Zcash was born in universities. Monero launched in 2014 as "Bitmonero" by an anonymous user named thankful_for_today, based on the CryptoNote protocol written by pseudonymous developer Nicolas van Saberhagen. The community famously "took over" the project early on to remove controversial decisions by the founder. There's no CEO, no office, and development is funded entirely through voluntary donations via the Community Crowdfunding System (CCS), where contributors submit proposals, the community debates them publicly, and funds are released only after milestones are verified. A small Core Team acts as stewards — managing repositories and holding funds in escrow — but they don't dictate the technical roadmap. Decentralization remains baked into its DNA.  Meanwhile, Zcash traces its roots to 2013 academic research at Johns Hopkins University, where cryptographers developed the Zerocoin protocol. The design evolved into Zerocash and eventually Zcash, launched in 2016 by cypherpunk Zooko Wilcox and the Electric Coin Company. While the project has maintained its cypherpunk origin, unlike Monero, Zcash has worked alongside regulators rather than against them. These different origins shaped fundamentally different organizational structures — and different reputations. Monero's mandatory privacy made it a preferred choice for darknet markets. According to TRM Labs, nearly half of new darknet marketplaces that popped up in 2024 opted to use XMR exclusively. Zcash, by contrast, is rarely cited in ransomware or darknet reports. XMR's reputation has led to regulator pressure on centralized exchanges to delist the asset. Binance dropped XMR in February 2024, OKX did the same in January 2024, and Kraken removed it for European users in October 2024. Zcash faced similar scrutiny but managed to avoid similar major delistings: Binance removed its "Monitoring Tag" for the token in July 2025, and OKX relisted it in November 2025. Core Privacy MechanismsTo understand the technical differences between the two protocols, consider an analogy. Think of any transaction as a message you need to send. With Monero, your message gets mixed into a crowd — you speak at the same time as 15 other people, so an observer knows someone said something but can't prove it was you. With Zcash's shielded transactions, your message goes into a locked box that only the recipient can open. The observer doesn't see the message at all — just the box. Monero uses a three-pronged approach: - Ring Signatures hide the sender by mixing your transaction with other transactions already recorded on the blockchain — currently around 16 of them, called decoys. Any of those 16 could have been the real sender, creating plausible deniability.

- RingCT (Ring Confidential Transactions) hides the amount by encrypting transaction values while still proving no new coins were created.

- Stealth Addresses hide the receiver by creating a one-time address for every single transaction. Even if someone knows your public address, they can't link incoming transactions to it.

Zcash, on the other hand, uses zk-SNARKs to provide privacy, allowing transactions to be proven valid without revealing sender, receiver, or amount. To accomplish this, when you send a shielded transaction, Zcash generates a cryptographic proof that the network verifies — confirming you have the right to spend the coins and that inputs equal outputs — without having to inspect the actual transaction details. Mandatory vs. Optional PrivacyWith Monero, privacy is mandatory. You cannot send a transparent transaction. This creates "herd immunity" — all transactions look identical, so no one stands out. The argument: optional privacy isn't real privacy. If only "suspicious" people use the private option, they become targets — a strong point. Zcash offers privacy by choice. ZEC can be used transparently, or moved to a shielded address, where ZK functionality is then used to obfuscate transaction details and state. Users can move between these freely. While privacy may not be required, the shielded pool continues to grow – around 30% of ZEC supply now sits in shielded pools, up from 8.7% a year ago. Consensus and Supply DifferencesMonero uses the RandomX proof-of-work algorithm, designed to be ASIC-resistant and optimized for general-purpose CPUs friendly to at-home solo miners. Monero also has a tail emission — an infinite supply with a fixed small amount added forever (around 0.6 XMR per block perpetually). This ensures miners always have incentive to secure the network. Zcash currently uses Equihash – an ASIC-optimized proof-of-work consensus mechanism that tends to favor specialized miners. It is transitioning to Crosslink, a hybrid proof-of-work/proof-of-stake system that brings deterministic transaction finality to the network. In pure PoW systems, blocks are never truly "final" — they just quickly become statistically harder to reverse. This isn't an issue you hear about for Bitcoin, but can theoretically leave much smaller networks vulnerable to 51% attacks and create major issues for securely bridging to other chains. Crosslink layers a PoS "finality gadget" on top of PoW: miners continue producing blocks, but stakers provide a second confirmation that makes transactions permanent and irreversible. Like Bitcoin — which it originally forked — Zcash has a fixed supply cap of 21 million ZEC with a halving schedule roughly every four years. What's Next for EachBoth protocols have major upgrades in development that could shift the competitive landscape. - Monero is working on FCMP++ (Full-Chain Membership Proofs), a major upgrade that would replace current ring signatures. Instead of mixing with around 16 decoys, transactions would mix with the entire blockchain history. This dramatically expands the anonymity set from "crowd of 16" to "crowd of everyone" — potentially neutralizing Zcash's shielded pool advantage.

- Zcash has Tachyon in development, a major scaling initiative described as "Zcash's Firedancer," which will dramatically increase the network's speed. Then there’s Crosslink for the hybrid PoS transition and improving user experience thanks to new wallets and functionality like Near Intents integration.

One other salient technical note: Zcash's privacy layer is quantum-resistant, while Monero's ring signatures are not. Monero developers have acknowledged this and plan to address it via FCMP++ and future upgrades. Beyond the technical differences, a project's success ultimately rests on adoption — and adoption depends on two factors these protocols approach very differently: organizational strength and reputation. On organization, Zcash's corporate structure enabled rapid R&D and cutting-edge cryptography, but the ECC departure exposed its concentration risk. The Zcash Foundation and community grants provide backstops, but whether they can maintain development momentum remains an open question. Monero's decentralized contributor model is slower and harder to coordinate, but no single departure creates crisis. On reputation, the tradeoffs are equally stark. Zcash's optional privacy and compliance-friendly features have kept it listed on major exchanges, but at the cost of a smaller shielded pool and weaker network-level privacy guarantees. Monero's mandatory privacy made it a dominant currency for darknet markets — a fact that has driven systematic exchange delistings and regulatory hostility. That said, there's certainly a case to be made that regulatory hostility validates the product better than anything else. In the end, the "one true privacy coin" debate ultimately comes down to what users are optimizing for. Monero offers stronger privacy today but faces steeper adoption headwinds. Zcash offers a path to broader adoption but requires users to actively choose privacy — and most don't. While both tokens have had a return to relevance after many “dormant” years, each now has to demonstrate they can keep the spotlight, and that their technical architecture — as well as their organizational support — can outcompete and outlast the other. FRIEND & SPONSOR: CONSENSUS Consensus Miami • May 5-7 — Crypto’s most influential event arrives in Miami’s electric epicenter of finance, tech and culture. Join 20K+ decision-makers representing trillions in capital for market-moving intel, dealmaking rocket fuel, and epic parties to match. Save 20% with the code BANKLESS. |

No comments:

Post a Comment