The New ICO Wave Gets Tested gm Bankless Nation,

ICOs are back in the picture. How are the latest token drops performing? It's... complicated. Today's Issue ⬇️ - ☀️ Need to Know: Ledger Going Public

The hardware wallet giant is eyeing an IPO. - 🗣️ Analysis: How Are ICOs Going?

The new wave of ICOs faces a tough market.

Sponsor: Consensus — Consensus Miami | May 5-7 | Save 20% with the code BANKLESS

. . . NEED TO KNOW Ledger IPO Incoming? - 💸 Crypto Hardware Wallet Maker Ledger Targets 2026 IPO. The prospective $4B initial public offering would mark one of the biggest "going public" moments in crypto this year.

- 📱 Coinbase App Integrates Solana's Jupiter into Trading Stack. Users in Brazil and the U.S. (excl. NY) can now easily trade millions of Solana tokens using their Coinbase balances.

- 📈 Binance Reportedly Exploring Reintroducing Stock Tokens. The crypto exchange previously shuttered stock trading in 2021.

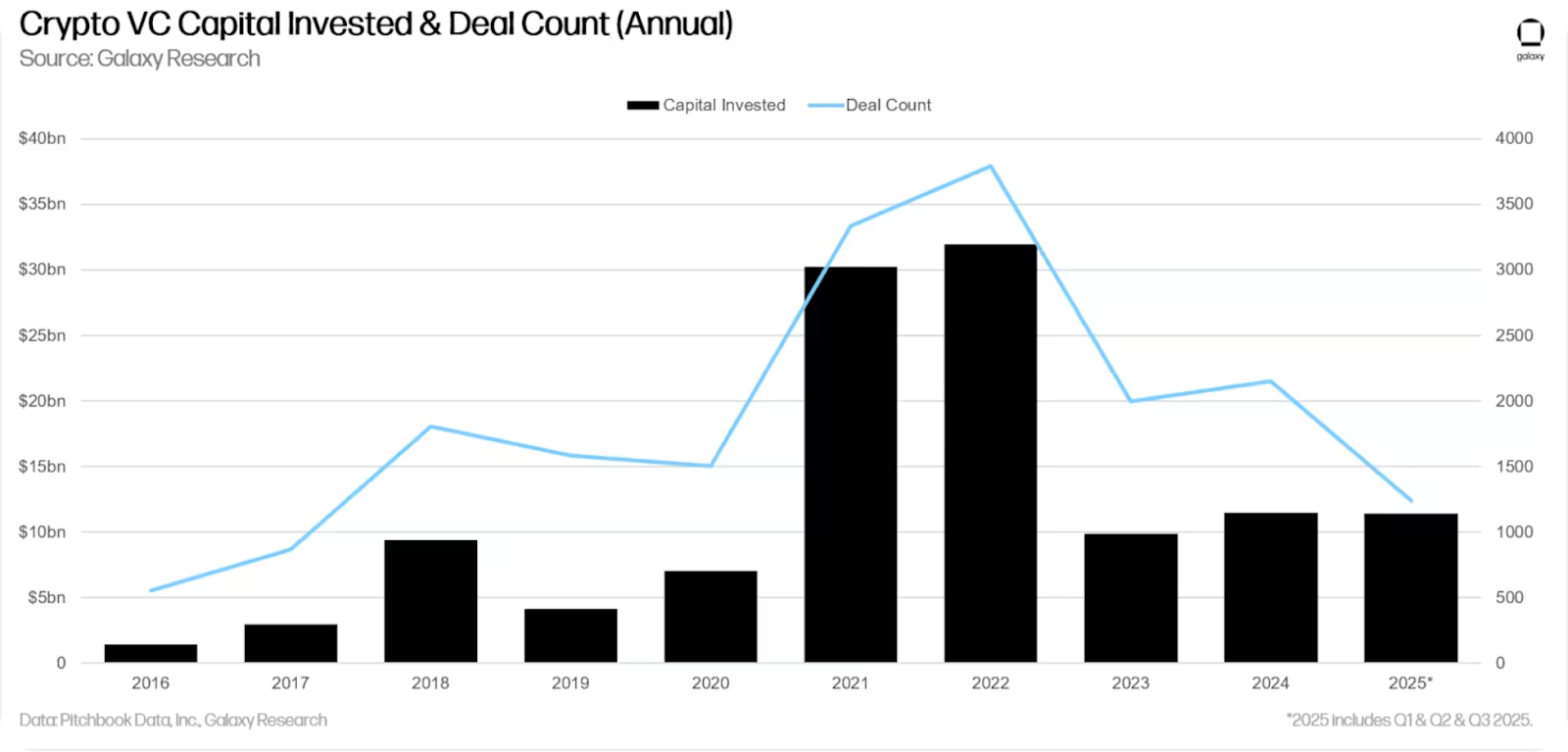

📸 Daily Market Snapshot: Though still in the red after a wild week, BTC and ETH have been flat over the past 24 hours alongside most other top 100 coins, as crypto holds steady. | Prices as of 3pm ET | 24hr | 7d |  | Crypto $3.01T | ↘ 0.1% | ↘ 6.3% |  | BTC $89,677 | ↘ 0.1% | ↘ 5.6% |  | ETH $2,948 | ↘ 0.1% | ↘ 10.2% | . . . ANALYSIS The ICO Wave Returns with Early Mixed Results Monad kicked off the winter wave of ICOs back in November. Since, we've seen a steady stream of projects following suit – so far, four tokens have gone live and given us an early set of data to deduce how ICOs are actually performing in this challenging market. So far, the takeaways are... complicated. And the nuances matter, because they reveal a lot about why projects are choosing to launch tokens into what continues to be a pretty tough market. If you've been around for a few cycles, you know that ICOs carry baggage. The 2017 boom produced thousands of tokens that raised massive sums; it also established there were some pretty ever-present incentives for young teams to extract rather than build off of said huge raises. Without frameworks to prevent this, extraction became the default. And while there were a few exceptions, most projects from that era bled out. So when ICOs started returning in late 2025 — aided by a more lenient regulatory environment and an increasingly competitive venture market — the natural question was whether anything had changed. Looking at the tokens currently trading, the short answer appears to be that some things have, and some things haven't. The ScoreboardAt the time of writing, here's how the tokens that have launched since November are performing against their raise prices (in USD): - Football.Fun: +11.6%

- Ranger: -9.3%

- Monad: -27.6%

- Trove: -98.9%

Notably, only Football.Fun is outperforming Bitcoin, which remains the benchmark. Ranger and Monad are down but within ranges that could recover. Trove collapsed dramatically within minutes of its launch. The spread from +11.6% to -98.9% tells you that market conditions alone aren't explaining these early outcomes. Project-specific factors, particularly raise structure and reputation, matter a great deal. But first, let's talk about market conditions and why anyone would launch into this. Why TGE Into This Market?Put simply, the VC landscape has gotten significantly more competitive, and that's creating headwinds for startups that might have once had easier access to institutional funding sources. Galaxy Research's Q3 2025 report paints a clear picture – an estimated 57% of crypto-centric venture capital now flows to established, later-stage companies, leaving less for younger projects. Pre-seed deal count continues to trend down, and Galaxy's researchers explicitly stated that "the golden era of pre-seed crypto venture investing has passed," a sentiment that aligns with the anecdotal appearance of fewer raise announcements on Twitter these days. New fund count for the last year also sits at a five-year low. ETFs and digital asset treasury companies are competing for allocator attention. And the historical correlation between Bitcoin price and VC activity has broken: prices are up compared to previous cycles, yet funding activity is flat. This pressure hits different projects differently. For Early-Stage Projects: Access to CapitalFor early stage projects like Ranger, Trove, Football.Fun, and Solstice Finance, the competitive VC environment means fighting for a shrinking slice of capital from fewer funds with increasingly institutional appetites. ICOs offer a path that might not otherwise exist — access to retail liquidity directly, without gatekeeping, and with potentially less dilution. Yet this can still come at the expense of users when vetting is thin. So far, most ICOs have been legitimate, though Trove's collapse signals that caution remains warranted. And raising via ICO doesn't guarantee results: Solstice Finance struggled to attract capital, showing that investors are still selective even amid the return of ICO activity. For Established Projects: Strategic ConsiderationsMonad, Aztec, MegaETH, Zama, Rainbow — these have already raised significant venture capital. So, why turn to ICOs? Several reasons quickly overlap. Aztec and MegaETH are launching entire chains, which requires capital for grants, incentives, and ecosystem development that VC alone may not cover. Even well-funded projects like Monad may want additional runway to weather uncertain conditions, or to curry favor with users amid souring sentiment from delayed timelines. MegaETH Sale 27.8x Oversubscribed, Secures $1.39B | Bankless

ICOs can also jump-start decentralization, a process which can only get more cumbersome and time-consuming if attended to later down the road. This rationale sits at the heart of Aztec’s choice to ICO, giving token holders control over network parameters from the get-go. There's also a strategic argument for TGE-ing into a difficult market: launching low leaves room for upside. If your token price drops initially, that's recovery potential. Compare that to launching at a peak and watching it bleed for years. The Perception ProblemNot all raises land the same way. Monad faced plenty of skepticism despite its pedigree. If institutions already invested at earlier rounds, why is retail being offered tokens now? The "VCs dumping on retail" perception can hurt demand even for quality projects. Contrast this with MetaDAO launches, where the framing aligns more naturally with community distribution. Perception shapes participation, and participation shapes price — which brings us to the structural question underlying all of this. Building Accountability Into ICOs?Despite a friendlier regulatory climate, there's no equally evolved framework for token rights or investor protections. The 2017 failure mode — raise, extract, disappear — remains available to any team willing to use it. When there's nothing preventing you from walking away with the treasury, some will. The MetaDAO launchpad has built its own answer to this problem, and it's been a standout in this wave of ICOs. Ranger launched via their platform and uses their "ownership coins" structure, which sits at the opposite end of the extraction spectrum. Here's how it works: at launch, market cap equals the Net Asset Value in the treasury, creating a floor. All funds and token minting rights transfer to market-governed contracts that founders cannot directly access. Teams can only spend up to a pre-defined monthly budget — $250K in Ranger's case — and anything above requires passing a market proposal. Governance runs on futarchy, where proposals pass or fail based on market speculation rather than voting. The vesting structure reinforces this. Ranger's team receives 0% of their allocation at TGE. Their tokens only unlock through performance milestones tied to price multiples (2x, 4x, 8x, 16x, 32x of ICO price), each requiring a 3-month TWAP and subject to an 18-month minimum cliff. Even pre-ICO investors get 0% at TGE with 24-month linear vesting — meaning VCs can't dump on retail either. The tradeoff is agility. If a founder needs to move fast and the market rejects a proposal, execution slows. Most teams won't accept this structure. But for investors, it offers something rare: structural protection against the extraction playbook. Final ThoughtsThe ICO wave reflects two converging forces: a more lenient regulatory climate and a VC market that's become structurally harder for early-stage projects to access. For younger teams, ICOs offer funding that might not otherwise exist. For established projects, they offer additional runway, a way to curry favor with users, and a mechanism to decentralize ownership from day one. But the variance in outcomes shows that structure matters. Friendlier regulations haven't produced equally evolved token protections. Projects without accountability mechanisms remain exposed to the same extraction incentives that killed the last ICO wave. As crypto matures into a more institutionally-driven industry, with later-stage companies IPO-ing and VC capital concentrating in proven winners, we can expect early-stage venture deployment to remain limited. That makes ICOs increasingly important as a funding path for smaller projects. But for that path to be sustainable, token rights need to evolve. Whether more projects adopt and build on these structures will determine whether this ICO revival lasts longer than the last one. FRIEND & SPONSOR: CONSENSUS Consensus Miami • May 5-7 — Crypto’s most influential event arrives in Miami’s electric epicenter of finance, tech and culture. Join 20K+ decision-makers representing trillions in capital for market-moving intel, dealmaking rocket fuel, and epic parties to match. Save 20% with the code BANKLESS. |

No comments:

Post a Comment