TBL Liquidity versus Japanese YieldsIs the latest JGB selloff a headwind or a tailwind for liquidity (and thus risk)?Dear Readers, One of the benefits of having a working framework is that we can assess all macro situations from a specific perspective, and whether a specific event is constructive or not constructive from that lens. Accordingly, here’s the question we aim to answer today: Question to answer:Is the latest JGB selloff a headwind or a tailwind for liquidity (and thus risk)? The cracks in the foundations of money are becoming harder to ignore. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk. On January 28 at 1PM CST, James Lavish joins Unchained for a live conversation on currency debasement, why traditional portfolio assumptions are being tested, and how gold and bitcoin fit into a changing monetary landscape. The discussion will cover:

Wednesday, January 28 at 1PM CST — online, free to attend. Register now and get early access to the report: ❌ DON’T WRITE YOUR SEED ON PAPER 📝 Why? Because securing your generational wealth on paper is risky. It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

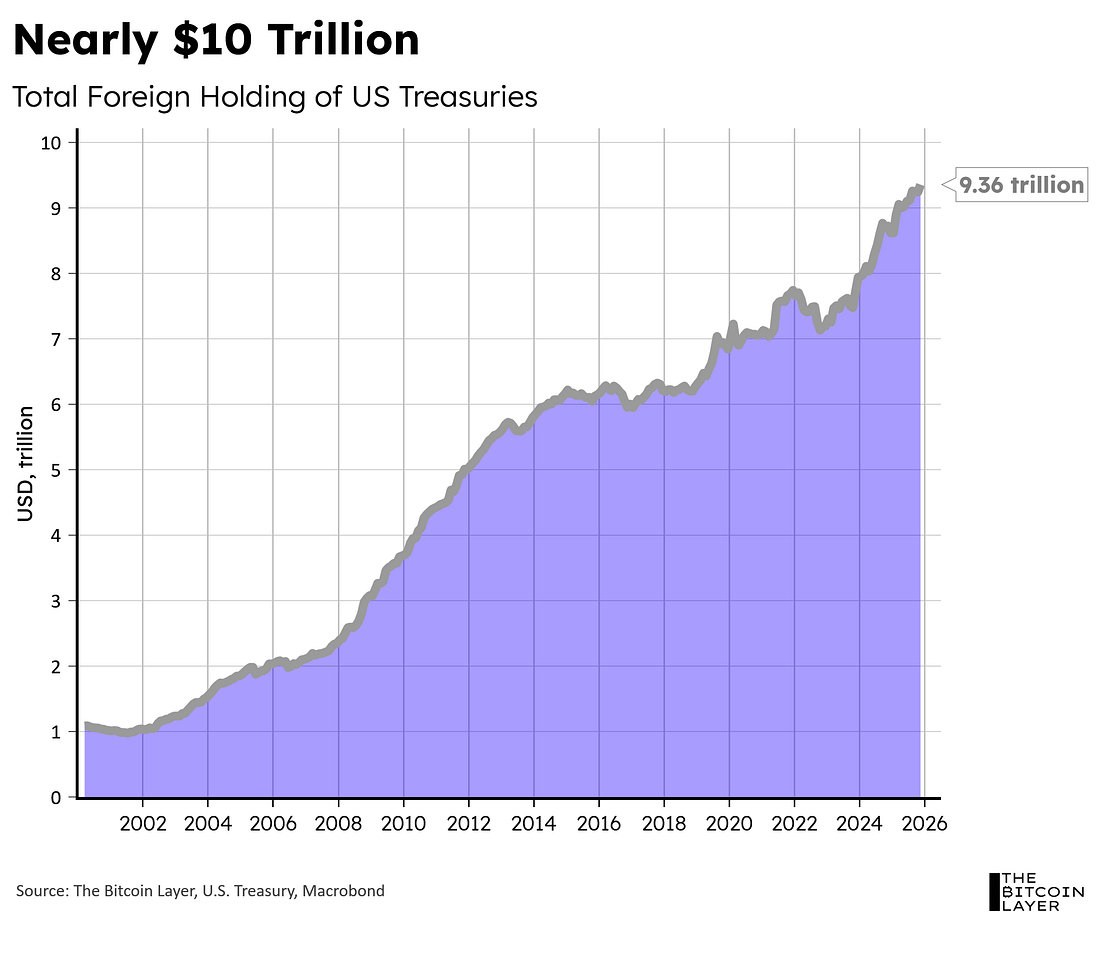

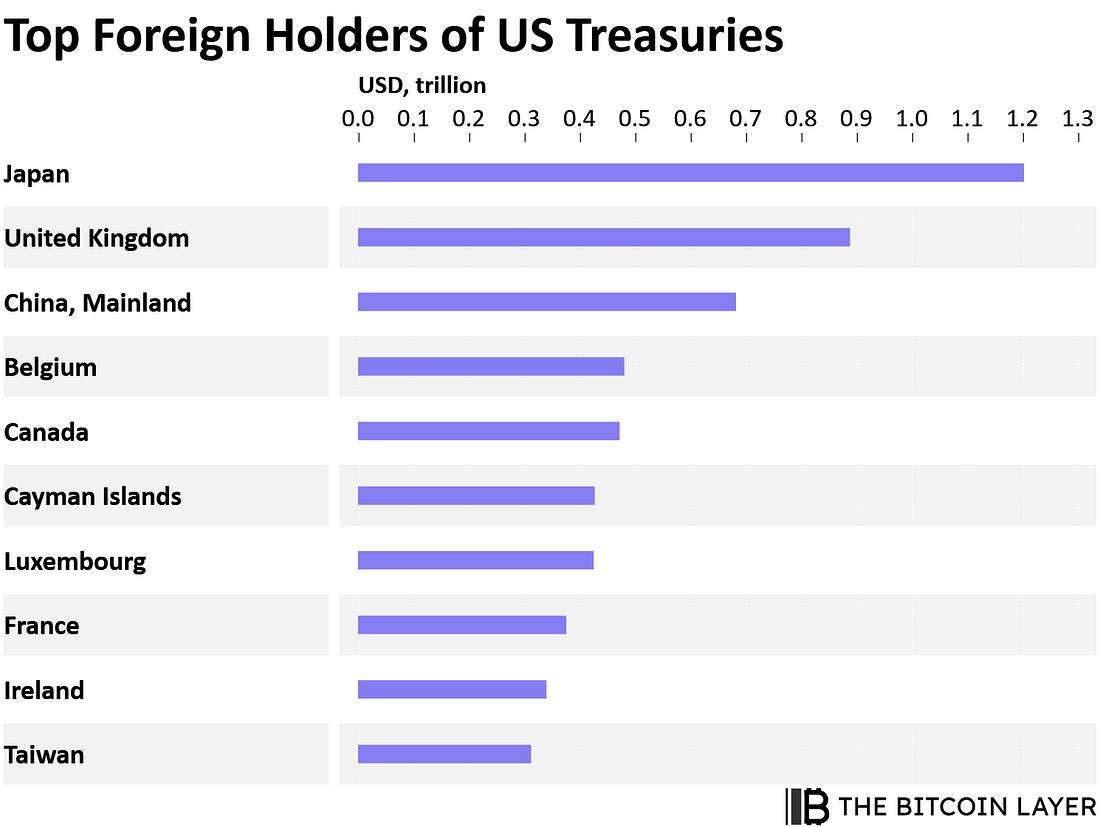

Use code TBL to take 15% off your purchase. USTs and JGBs: A Push and Pull RelationshipOf the total foreign ownership of US Treasuries (which amounts to $9.36T - chart below)... …Japan is the United States’ biggest lender, at $1.2T (or 13% of total foreign ownership) as of November 2025: So, when Japan’s PM Takaichi calls a snap election in which all parties run on an increased spending agenda—causing Japanese bond vigilantes to act by selling JGBs (chart below)—the place to hide should arguably be US Treasuries, right? What with Japan being the biggest foreign lender and all... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Thursday, January 22, 2026

TBL Liquidity versus Japanese Yields

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Is the latest JGB selloff a headwind or a tailwind for liquidity (and thus risk)? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The New York Stock Exchange is ready to embrace blockchains in a massive way. ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Lock in early access before standard tickets go live ...

-

The crypto privacy renaissance continues as tools for shielding your transactions grow more frictionless than ever. ...

-

ETF flows have turned supportive, but confirmation is still missing ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment