Dear readers, The media has become unreadable, and if you’re flying without navigation, you might as well be staring into thick clouds with no idea what comes next, or even where you’ve visited. I say this because many of you might be trying to read “news articles” on Venezuela and the capture of Maduro, but are instead stumbling through AI slop, Trump Derangement Syndrome, and overall uninformed views. Not that I have some grand understanding of Venezuelan politics, but I also carefully read the National Security Strategy published by the White House, recorded an extended analysis, and believe I, on the surface, understand the stated goal of a Trump Corollary to the Monroe Doctrine. While it’s easy to connect the dots between Hussein, Gaddafi, and Maduro on the oil front, hidden from most of the media’s coverage is discussion of China, Russia, James Monroe, and Theodore Roosevelt. As billions of people compete for a fixed supply of 21 million coins while fiat currency supplies continue to expand, bitcoin’s risk-reward profile stands apart. On January 7 at 10 AM CT, join Unchained and Parker Lewis for an online video premiere exploring the forces shaping bitcoin’s opportunity today and what current market and policy conditions may mean going forward. A talk originally given on December 10th at the Old Parkland debate chamber in Dallas, Parker covers:

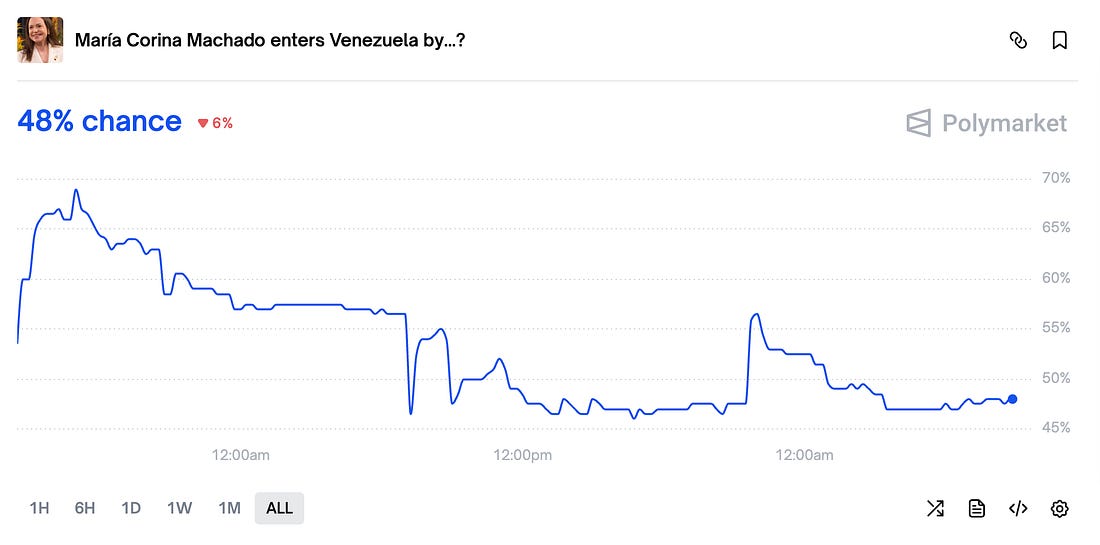

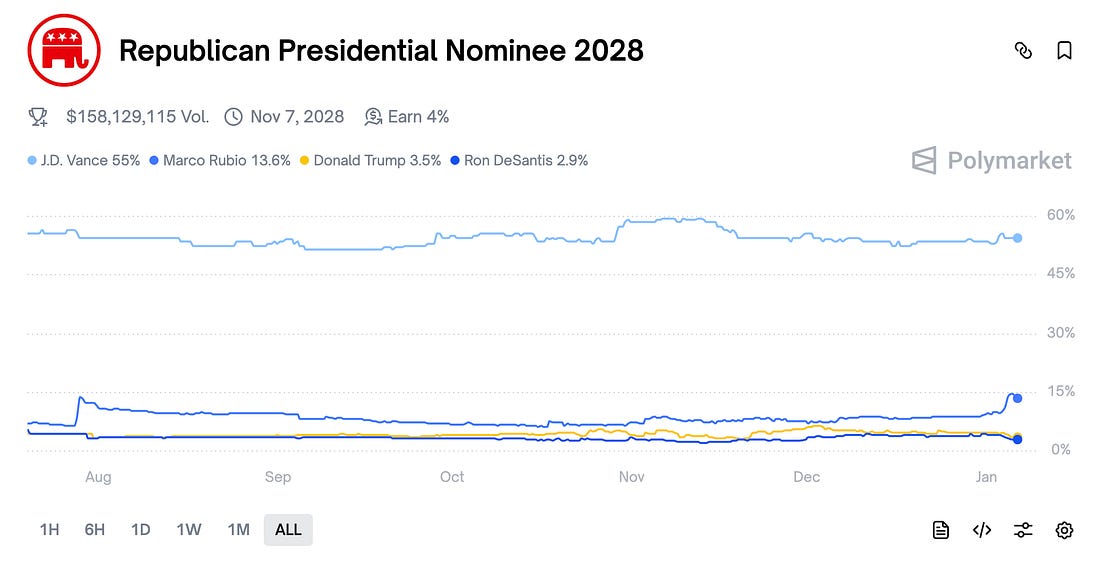

If you want a clearer framework for thinking about bitcoin’s opportunity and the risks of overlooking it, this is the talk to share with friends and family. Tuesday, January 7 at 10 AM CT — online, free to attend For a worthwhile analysis on Venezuela, I relied on this analysis from Niall Ferguson, who helps put the move in context. My first reaction upon hearing the news was that the National Security Strategy document covered extensively by TBL spelled this move out in advance, so I was looking for some analysis that was able to relate the NSS and Maduro extraction. Ferguson did so nicely, so I’ll leave you with it. Interestingly, Polymarket was all over this. There looked to be some advanced bets placed, reminding us to stop and reflect on the Securities and Exchange Commission’s framework over insider trading of securities and how this might bubble up, eventually, to prediction markets. Either way, we will watch whether Machado will return to the country or not, currently trading at 48% odds by the end of March: While this might have some impact to the Latin American bitcoin ecosystem given her avid support of the technology, it is more important for the idea that the U.S. will be physically running (or not running) foreign governments post-dictator. It also makes us wonder about what the threats to Mexico, Cuba, and notably Colombia mean for Marco Rubio and the State Department. We are reminded of this meme, which seems to capture the mood: Speaking of Rubio, we noticed a pop in his odds to become the GOP Presidential nominee in 2028, perhaps a nod to the shift toward Latin American foreign policy: His State Department activity already sets him apart as a distinct carrier of Trump policy. There is also a robust prediction market developing around the departure of Iran’s Supreme Leader before each quarter-end, which we have an eye on. In the spirit of delivering signal to you, we share this interview with Niall Ferguson on Venezuela and the Trump Corollary to the Monroe Doctrine, which informs our view. We caution against news articles as a source of your analysis — they are pitiful at providing context and spin facts and half-truths like a Great Plains tornado. For genuine analysis on large topics such as the extraction of a dictator in Venezuela, rely on historians, even if they present arguments you don’t agree with. With history, you can make your own assessments. One of the things I personally try to do is present sound analysis from experts when I find them to you, the Reader. Ferguson’s Venezuela take was healthy, strong, historical, and relevant, and I took it as a positive sign that he opened his analysis with the NSS document from weeks past. Our NSS video is here. Now, we arrive at the core of today’s analysis, which surrounds bitcoin price action. Over the Christmas break, I admit I was doing some long-term charting, namely bitcoin monthly candles. I’m excited to share with you what I observed. Bitcoin monthly candles...Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Tuesday, January 6, 2026

Starting 2026 with Bitcoin Monthly Candles

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Calibrating Momentum Risk and Continuation Odds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

Unlocking Bitcoin's Hidden Value: Insights from Funding Rates, Sentiment, and HODLer Trends ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Let's see how they shake out... ...

-

Unlocking Multi-Timeframe Magic: Elevate Your Bitcoin Trades with Precision Confluence ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

DAOs have many problems like token <> equity alignment, illusion of governance, and more. "Asset futarc...

No comments:

Post a Comment