Volatility in Bitcoin ETF FlowsAlso The Crypto Market Is Re-Composing & Mixed Signals From the Federal ReserveWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

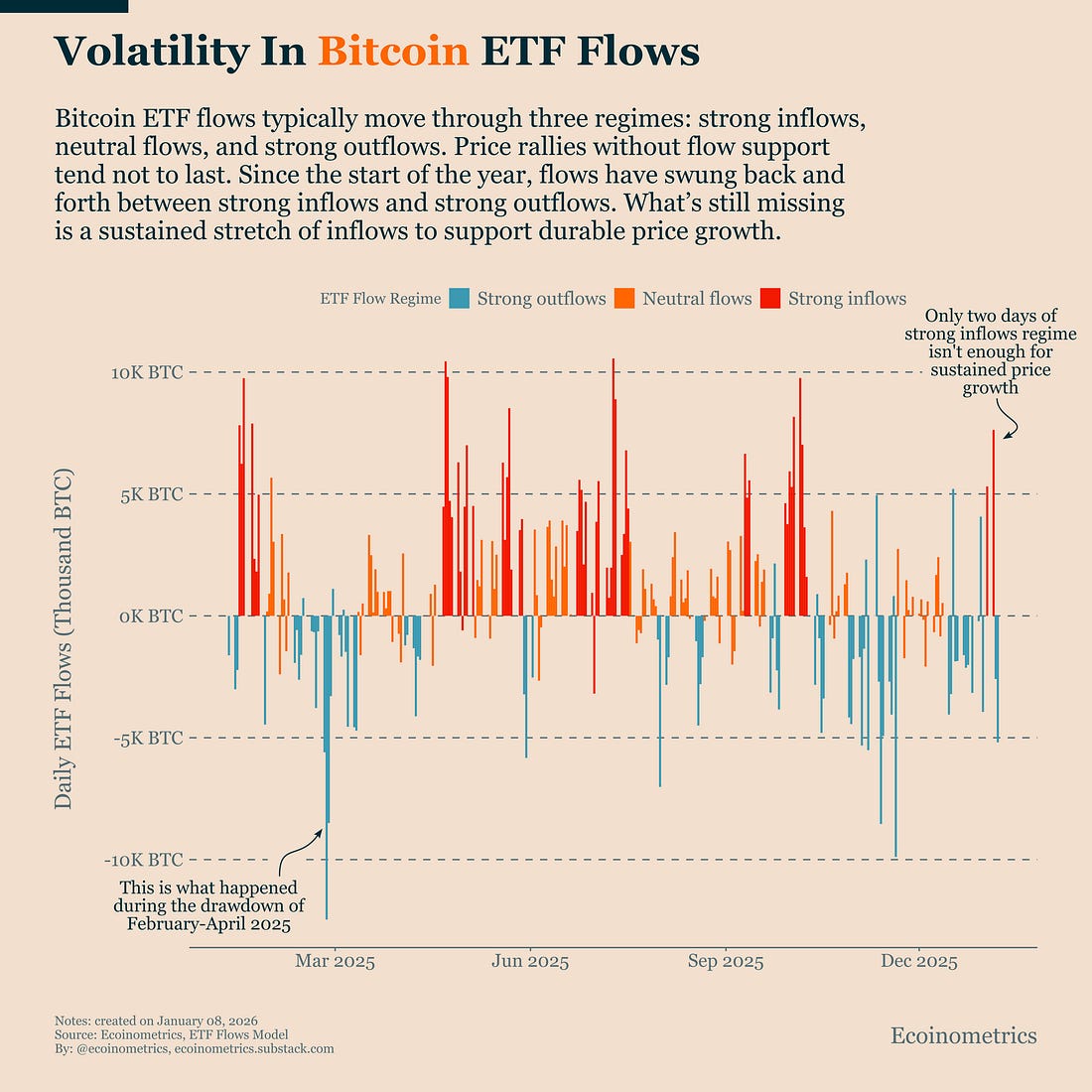

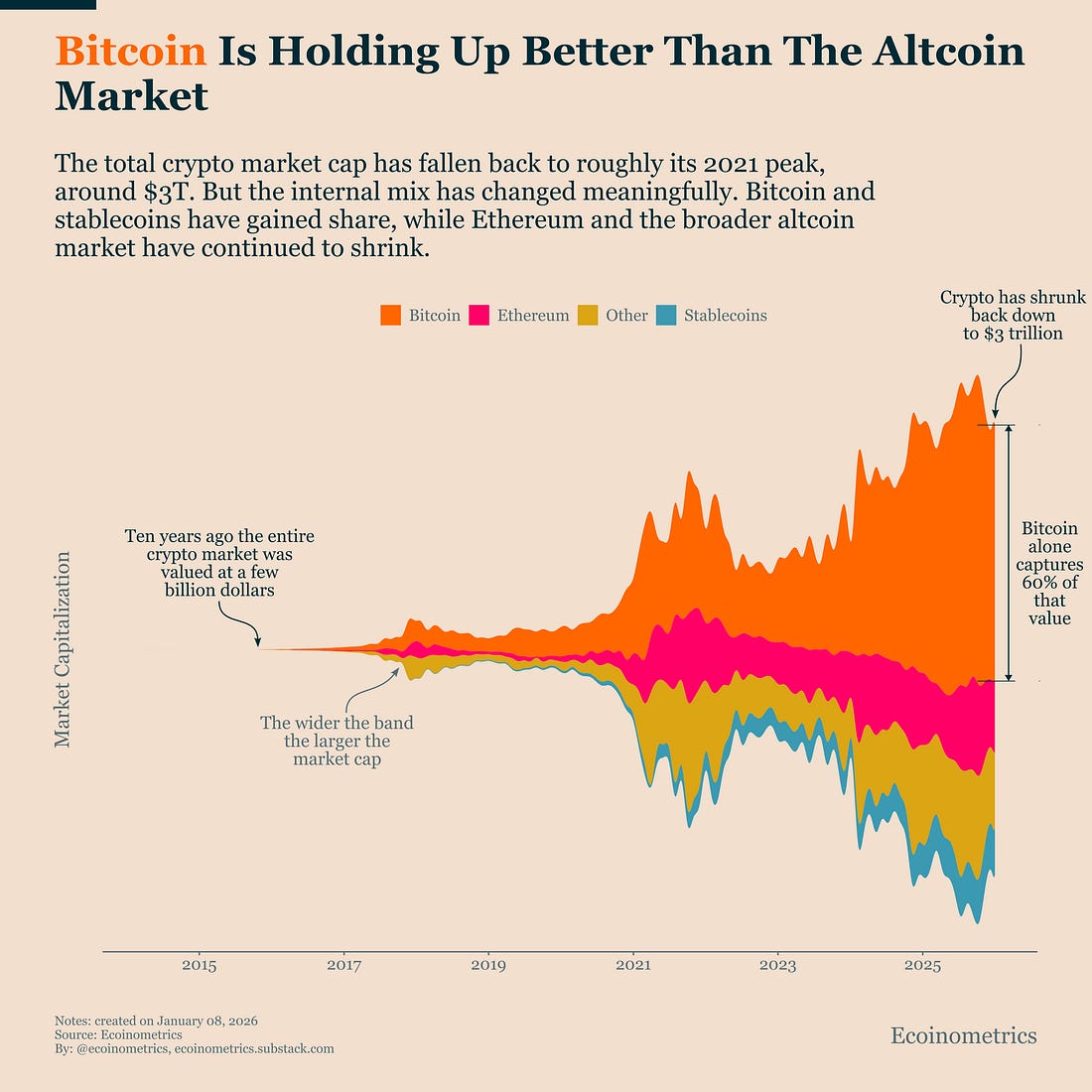

Viewed together, today’s charts describe a market where the building blocks for a sustained move are not yet aligned. Liquidity is available, Bitcoin continues to dominate crypto capital, but demand remains episodic and policy signals remain mixed. The result is a market biased toward stabilization rather than acceleration. In case you missed it, here are the other topics we covered this week: Get these professional-grade insights delivered to your inbox: Volatility in Bitcoin ETF FlowsWe have been cautious for weeks about the likelihood of a clean upside breakout in Bitcoin. Again this week, our ETF flows forecast showed that under current conditions, there is still no solid support for Bitcoin to push and hold above $95K. Price action has since reinforced that view. Bitcoin’s momentum has stalled several times around the same level, suggesting that buying pressure is not strong enough to carry prices higher. It is understandable to feel more optimistic after a few days of strong daily inflows. But for price growth to be durable, inflows need to be sustained. Focusing on isolated days is the wrong timescale if the goal is to separate signal from noise. When we look at ETF flows through our daily regime framework, a clearer picture emerges. The market has spent most of its time in a strong outflows regime, with only a handful of brief transitions into strong inflows before quickly reverting back. That level of regime volatility makes sustained price advances difficult. What we are still missing is a meaningful cluster of strong inflow days, followed by a period of neutral flows rather than an immediate reversal into outflows. That type of sequence would signal more stable demand. So far, we are not seeing it. Demand remains inconsistent. The Crypto Market Is Re-ComposingThe total crypto market has fallen roughly 25% from its all-time high. That puts overall market capitalization back near the peak levels of the 2021 bull market. But looking only at the headline number misses what has changed the most: the internal composition of the market. And that shift says a lot about which crypto use cases are actually gaining traction over the long run. What stands out clearly is that Bitcoin and stablecoins have grown, while Ethereum and the broader altcoin ecosystem have continued to shrink. The numbers tell the story:

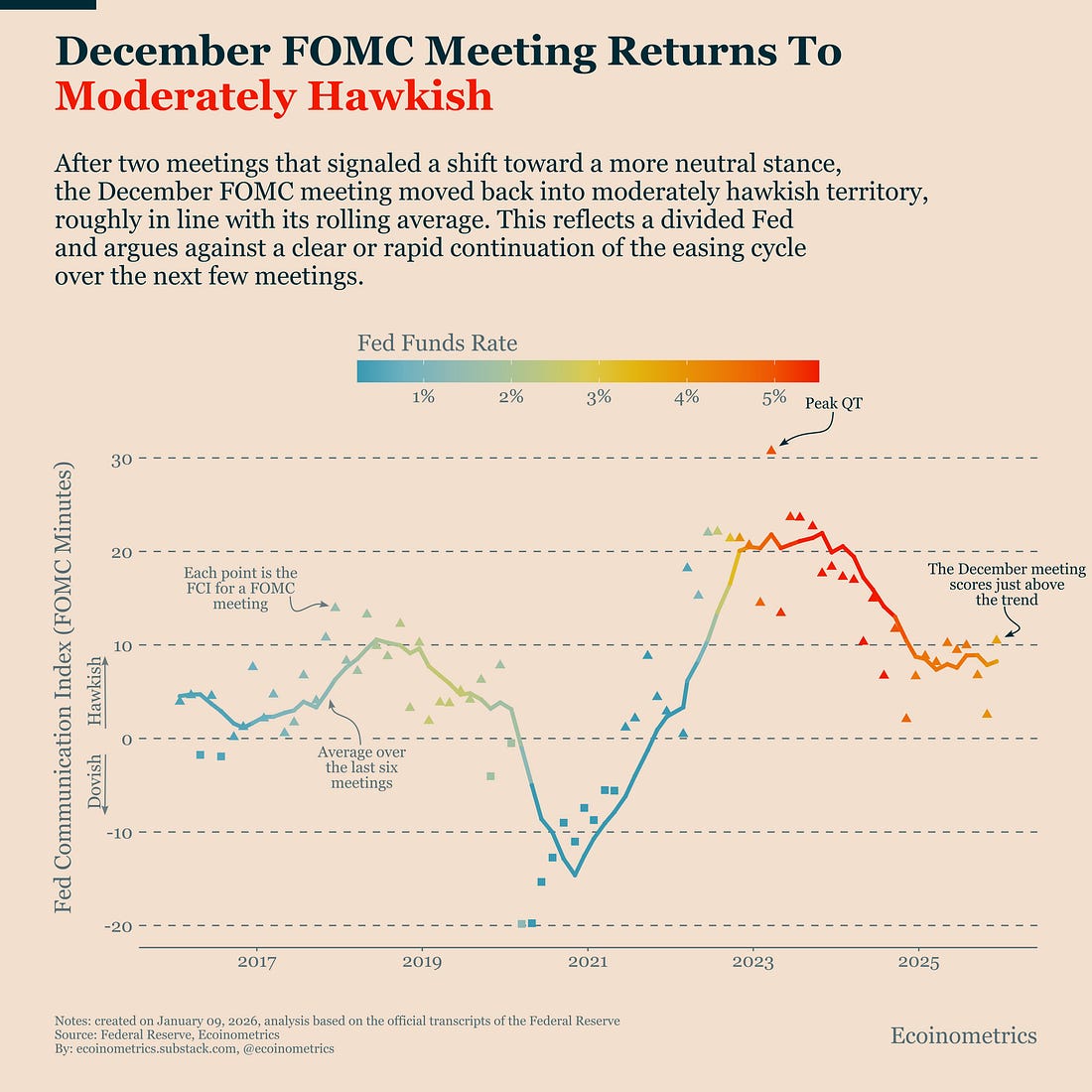

Bitcoin is clearly winning on its core investment thesis: digital gold and hard asset exposure. The introduction of spot Bitcoin ETFs has reinforced this trend by making Bitcoin easier to access within traditional portfolios. Stablecoins are also proving their value as cross-border settlement and capital flow tools. Their digital-native design makes them attractive to financial institutions and to investors operating across global markets. By contrast, most speculative Web3 applications have yet to demonstrate sustained adoption. For now, they remain high-risk bets with uncertain timelines and outcomes. This reinforces a simple conclusion: gaining exposure to crypto through Bitcoin captures most of the durable value in the space, unless one is explicitly seeking asymmetric outcomes in thin and volatile markets. Mixed Signals From the Federal ReserveThe minutes from the December FOMC meeting are now out, and they tell a slightly different story from Chairman Powell’s press conference held immediately after the meeting. As a reminder, Powell struck a relatively neutral tone. In our Fed Communication Index, the sentiment of recent press conferences has continued to drift lower, moving closer to neutral territory. The Fed Communication Index measures Federal Reserve sentiment on a dovish-to-hawkish scale and is built using a systematic quantitative analysis of official Fed communications. When we apply that same analysis to the December FOMC minutes, the picture shifts. The index moves back into moderately hawkish territory, roughly in line with its rolling average. After two consecutive meetings that leaned more neutral, uncertainty has resurfaced. Incomplete and delayed data following the U.S. government shutdown added to an already divided Federal Reserve, reinforcing a cautious and indecisive stance rather than a clear policy direction. The takeaway is that investors should not expect a fast or well-defined easing path from the Fed in early 2026. Policy remains slow, data-dependent, and lacking strong conviction. For Bitcoin, this backdrop is not automatically negative. What matters more than policy clarity is liquidity. As long as financial conditions remain loose, the absence of firm Fed conviction does not translate into immediate downside risk. And so far, conditions have improved. The National Financial Conditions Index has trended lower again in recent weeks, indicating that markets are not experiencing tightening stress. This means financial conditions are not currently a headwind for Bitcoin. They allow capital to move into risk-on assets, even if they are not yet acting as a strong tailwind. Tactical TakeawayThe setup still argues for patience rather than anticipation. Bitcoin is supported by improving financial conditions and a market structure that increasingly favours durable use cases, but demand remains episodic rather than persistent. Without sustained ETF inflows, upside moves remain vulnerable to quick reversals. At the same time, macro policy is no longer the dominant risk. Liquidity is available, the Fed is cautious rather but not restrictive, and financial conditions are not tightening. That removes a major downside pressure, but it does not create a catalyst on its own. For now, the balance of risks favours range behaviour over trend continuation. Strength should be treated as stabilization, not confirmation, until flows and participation begin to cluster rather than flicker. Early 2026 is shaping up as a period for monitoring demand and positioning, not front-running a breakout. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, January 9, 2026

Volatility in Bitcoin ETF Flows

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Let's see how they shake out... ...

-

DAOs have many problems like token <> equity alignment, illusion of governance, and more. "Asset futarc...

-

gm Bankless Nation, it's been a politically contentious election for Crypto, and builders are looking for some reassurance fro...

-

Don't miss the action in 2026 ...

-

As Polymarket and Kalshi go mainstream, headline-grabbing insider trading episodes can create risks for early adoption. ...

No comments:

Post a Comment