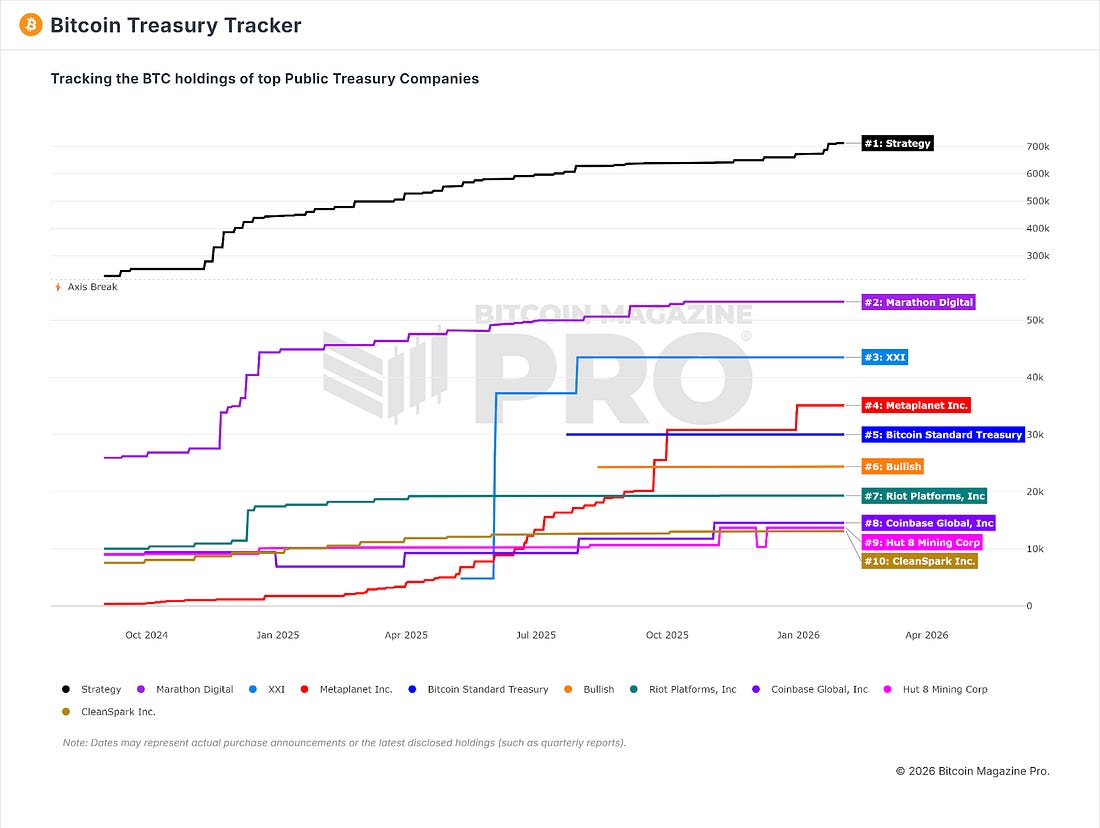

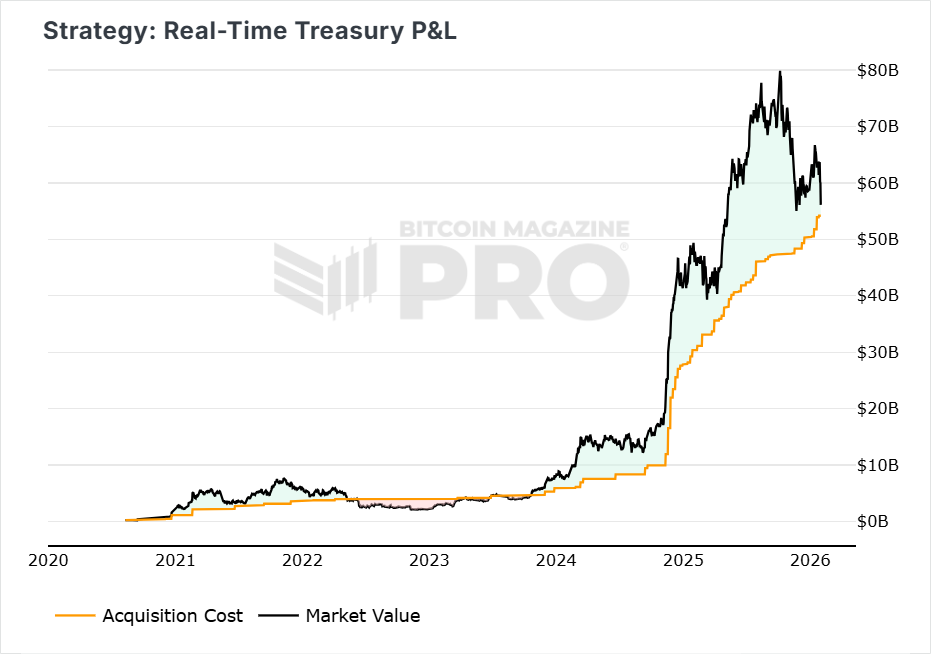

Strategy ($MSTR) Hits a 52-Week Low Where’s the Bottom?From Treasury Titan to Distress Sale? MSTR Down 53% in a Year Amid Extreme FearWhat’s Happening Price ActionBitcoin has tumbled hard this week, particularly over the past few days, dropping more than 12%. BTC has now dropped below $80,000 and is trying to stabilize at $76,988. Figure 1: BTC has tumbled this past week. The result of this drop means that BTC is now down 19.7% over the past year, having experienced a real rollercoaster of volatility in both directions. Figure 2: BTC past 12 months’ performance. This volatility, combined with the latest downward price pressure, has many market participants fearing that BTC may need to head lower. As a result, the Fear & Greed Index continues to sit deep into the Extreme Fear Territory. Currently, it has a score of just 14. Figure 3: Fear & Greed Index stuck in Extreme Fear. The Big Story: Strategy ($MSTR) Hits a 52-Week Low Where’s the Bottom?Shares of Strategy Inc have fallen to a new 52-week low of $149, capping off a severe drawdown for the market’s largest Bitcoin treasury company. Over the past 12 months, $MSTR is down 53%. Volatility remains extreme, reflected in a five-year beta of 3.43, well above the broader equity market. Despite the sell-off, some analysts argue the stock is now trading at distressed levels. Current price targets range widely, from $213 at the low end to as high as $705, highlighting just how polarized sentiment remains. With earnings due shortly and a headline P/E ratio around 5.4, investors are watching closely for any signal that downside pressure may be easing. Key Technical LevelsWe highlighted last year that Strategy stock began to struggle after losing its 200-day moving average, a level that had previously acted as reliable support during bull market pullbacks. A failed retest of the 200 DMA in October 2025 marked a turning point. From there, $MSTR rolled over decisively and broke below its 1-year moving average, also known as the 52-week MA. Since losing that longer-term trend level, the stock has fallen by a further 50% as market sentiment turned sharply against Bitcoin treasury companies, with Strategy firmly in the crosshairs as the category leader. Figure 4: Strategy key technical levels Looking ahead, many bears are now eyeing the 200-week moving average, which sits just below current prices at approximately $112. Historically, this level has acted as a final line of defense during deep cyclical drawdowns. Bitcoin Treasury Position Still the Market LeaderDespite the equity drawdown, Strategy remains the largest Bitcoin holder among publicly listed companies, with its treasury position still unmatched in scale. Figure 5: Treasury Tracker. From a Bitcoin profitability perspective, the company is now hovering close to break-even. Strategy’s aggregate Bitcoin cost basis sits around $54.1 billion, while its real-time treasury valuation is approximately $56.1 billion. This leaves the company with a modest unrealized profit of roughly $2 billion. Figure 6: Strategy Real-Time Treasury P&L This proximity to break-even helps explain the current tension in the stock. Bulls see limited downside if Bitcoin stabilizes or rebounds, while bears argue that any further weakness in BTC could quickly push Strategy back into unrealized losses, intensifying pressure on the equity. The Setup From HereIf Bitcoin can find a durable bottom and broader risk sentiment improves, $MSTR is positioned for a sharp reflexive bounce, given how far it has already fallen relative to its long-term trend levels. However, until momentum decisively shifts, Strategy remains a high beta proxy for Bitcoin itself, amplified on both the upside and the downside. For now, attention remains focused on key long-term moving averages and whether the market is willing to reprice Bitcoin treasury exposure back into favor. To view all of these charts and receive more in-depth analysis, subscribe to the Bitcoin Magazine Pro platform here. The Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, February 2, 2026

Strategy ($MSTR) Hits a 52-Week Low Where’s the Bottom?

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto Twitter feels broken – can X fix it? And where does onchain social fit in? ͏ ͏ ͏ ͏ ͏...

-

Token design level-ups helping solve the 'good coins problem.' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The Bitcoin Market Monitor by Ecoinometrics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Allocators get into DAS NYC for FREE ...

-

Why Bitcoin’s Greatest Risk Isn’t Regulation or Price — but Mathematics Itself ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment