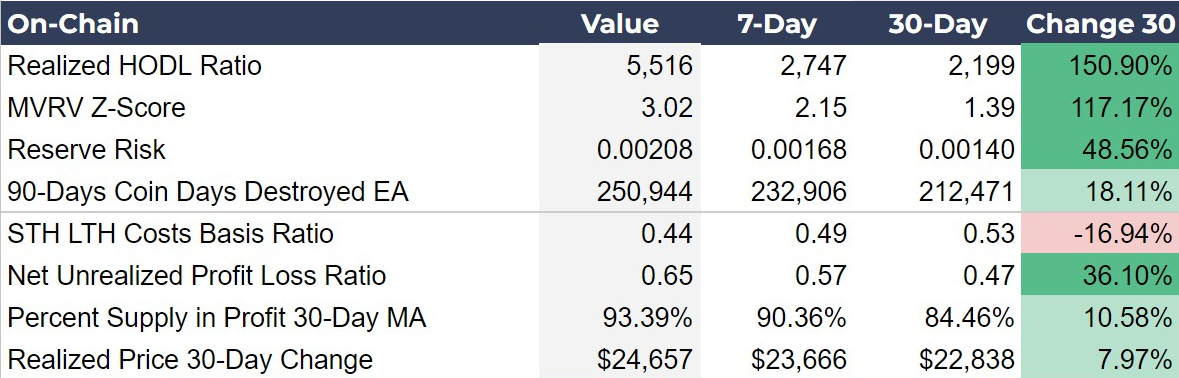

Bitcoin Market Weekly Analysis - Mar 5 2024Deciphering Bitcoin's Bull Run: A Deep Dive into On-Chain and Derivative MarketsCongrats everyone on the new ATH! Let’s see what we can learn from our Market Metrics Dashboard about this move and near term price trajectory. The analysis of Bitcoin's on-chain metrics, price metrics, macroeconomic environment, and derivatives market reveals a comprehensive view of bitcoin’s current landscape. On-chain data shows strong holding by long-term investors, suggesting confidence in Bitcoin's value. However, there are several metrics that indicate volatility might be near. Macroeconomic indicators highlight a generally favorable environment for Bitcoin. Derivatives markets present bullish sentiment with increased hedging for downside risk. On-Chain Metrics: A Strategic AnalysisLong-term holders' strong retention rates, signaled by the high Realized HODL Ratio, reflect a bullish sentiment towards Bitcoin's future. Conversely, the elevated MVRV Z-Score hints at potential overvaluation risks, urging investor caution. Minor increases in selling pressure are noted through Coin Days Destroyed, yet this does not overshadow the long-term holder's confidence, as shown by the low Reserve Risk. Furthermore, the dip in the STH LTH Costs Basis Ratio suggests reduced selling motivation among short-term holders, contributing to potential market stability. Key Insights

Navigating Bitcoin Price MetricsCurrently, the Mayer Multiple stands at 1.82, illustrating a robust bullish trend without veering into speculative bubble territory, as it remains below the 2.4 mark. This indicates a market exuding confidence and growth, yet not overly speculative based on historical standards. The daily moving averages—50DMA, 100DMA, and 200DMA—show a consistent uptrend, reinforcing the bullish sentiment across short to long-term horizons. Similarly, the 200-week moving average (200WMA) reflects long-term stability and growth, aligning with the general market optimism... Keep reading with a 7-day free trialSubscribe to Bitcoin Magazine Pro™ to keep reading this post and get 7 days of free access to the full post archives. A subscription gets you:

|

Tuesday, March 5, 2024

Bitcoin Market Weekly Analysis - Mar 5 2024

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Today, we're wishing you a Merry Christmas with a curated collection of our best podcasts and newsletters of 2025. ...

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Get full research access, live liquidity signals, and institutional grade insights that keep you positioned before the market moves, with 4 ...

-

Last week, Quantum threat for Bitcoin was the topic of debate in BTC community. Aave civil war also escalated. Rea...

-

ETH prices spent the afternoon in an epic battle against 2021 highs, with the asset less than $50 shy of a new record. ...

No comments:

Post a Comment