Debate

The Quantum Threat to BTC.

BTC maxis present Bitcoin as the perfect protocol.

But Bitcoin does have two risks. The first one is the security budget issue. It has to do with the economics of BTC mining when the Miner rewards become negligible.

This is a complex topic that we won't cover today. This article explains the economic threat pretty nastily.

Quantum threat is the second big risk. And last week, it was the center of a controversy in the Bitcoin community.

There are two sides to the issue: alarmists and skeptics.

Alarmists see the quantum threat as a near-term issue that requires BTC community to start preparations now. Skeptics argue the threat is decades away and dismiss it as FUD.

First, let me explain the threat.

Nic Carter, the lead alarmist, has written a series on the quantum threat. If you want a detailed argument with references and sources, read that. I'll explain the 80/20 here.

Current blockchains use "public key cryptography". So accounts on blockchains, including Bitcoin, are a key pair of private and public keys. Your private key controls the assets. The public key is the public address that the world sees, and others can send assets.

(Technically, most Bitcoin addresses that the public sees are hashes of public keys plus some metadata. The actual addresses will only be visible when the BTC is spent. But that's a technical nuance I'll skip over for simplicity.)

Getting to private key from the public key is a math problem. Fortunately, nobody can solve that problem. At least for now.

With quantum computers, that won't be true. They aren't just "faster computers". They're really good at specific math problems. And getting to private key from the public key is a math problem.

Aka, really good at getting to the private key from the public keys.

If an attacker can get to the "private key" that controls a Bitcoin account, then they can spend the victim's BTC.

Governments and experts (e.g., NIST, Metaculus) broadly expect cryptographically relevant quantum computers around 2030–2035. So this is a huge problem that needs to be solved before quantum computers become real, aka before 2030.

According to alarmists, this is a huge threat.

- Moving to post-quantum is a huge technical hurdle. The preparations for it should start asap.

- Unlike other chains like Ethereum and Solana, it doesn't have the social muscle to upgrade to quantum-secure addresses. There have only been two protocol updates since 2017.

- Roughly 6.7 million BTC are already in quantum‑vulnerable address types, and another 1.7 million "lost" early coins (including Satoshi-era P2PK outputs) create another unique problem. In the future, attackers will be able to get those and dump them, which will crash the BTC price. Freezing them is the other option. However, it'll create controversy regarding "property rights" on Bitcoin.

So addressing the quantum threat will be a huge undertaking for Bitcoin. The case with lost coins will be heavily contentious. So, alarmists want the Bitcoin community to start working on it immediately.

Skeptics believe that the quantum threat is overhyped. They claim that realistic threats are decades away. They question the motives of alarmists by pointing at their investment bias.

"Solutions to quantum threats" are a bigger threat to Bitcoin than quantum threats. According to them, these new solutions and unproven cryptography have greater risks.

Personally, I lean more towards the alarmist camp. The quantum threat is a low‑probability but existential risk, so preparations for it should start now.

Sponsored by Solstice

Solstice Finance: The Solana Stablecoin

Solana's leading stablecoin project is doing a presale.

At >$328M in Total Value Locked, Solstice Finance is the top Solana-native stablecoin.

- USX is their 100% collateralized USD stablecoin.

- eUSX is the yield-bearing version of USX. You get it by depositing USX into YieldVault.

- SLX is their upcoming protocol token. (You can still join their points program to qualify for a potential airdrop.)

Let's recap the basics first.

#1. $USX

It's a stablecoin 100% backed by stable collateral.

The reserves are independently verified by the Accountable, an independent protocol for financial verification. You don't have to trust anyone blindly — you can monitor the reserves here.

Incentives ensure USX stays pegged to USD. It allows whitelisted users to mint or redeem USX using USDC or USDT. They're incentivized to maintain the stablecoin peg.

#2. eUSX & YieldVault

With eUSX, Solstice is bringing institutional-grade yield to retail.

- You deposit USDC to YieldVault and get eUSX in return.

- Solstice will take that money and earn yield using delta-neutral strategies.

- The yield will be reflected in the value of the eUSX token.

Solstice's delta-neutral strategy has been live since Jan 2023. And it had 100% positive months. They've reliable, proven strategies to earn yield.

eUSX can be used across DeFi. >$60M in $USX & $eUSX is deployed across Solana DeFi ecosystem. So there's not too much opportunity cost for using the YieldVault.

And if you want your stablecoin back, you can always redeem eUSX for the underlying stablecoins anytime you want. But for any withdrawals more than $1,000 USDC, there is a 7-day cooldown period.

(The cooldown period is necessary to safely manage the capital for delta-neutral strategies and the USX liquidity stability.)

#3. $SLX

It'll be the native token of the Solstice ecosystem.

- Holders might get in-app utilities like priority access to new features.

- Governance power to vote on protocol parameters and ecosystem decisions.

- More importantly, $SLX stakers will govern how the revenue generated by Solstice will be used.

Right now, there are two ways to get $SLX: flares & presale.

To earn flares, just use $USX & $eUSX. The Deep DeFi tab in the Solstice app lists many opportunities for them in DeFi. You can track your flares there as well.

Presale is the second way to get $SLX. However, Solstice is only raising $6.5M in this round. And everyone is looking to get a hand on it

Solstice Finance is doing the presale on Legion.

- Applications opened yesterday.

- The presale will close on December 25th.

- Fully Diluted Valuation of $SLX will only be $130M.

- 50% will be unlocked at TGE. The rest will vest daily over 3 months.

Is the $130M the "fair value" of Solstice? Is it undervalued or overvalued?

Let's compare it with other top stablecoin projects. The ratio between Fully Diluted Valuation and Total Value Locked should be enough for now.

- Sky has a ratio of 0.244 (1.583/6.472)

- Ethena has a ratio of 0.478 (3.156/6.591)

- Falcon's ratio is 0.453 (0.956/2.109)

If we take the $130M and $328 as $SLX's FDV and TVL, respectively, the ratio comes to 0.396. This is higher than Sky, but notably less than both Ethena and Falcon.

So $SLX is definitely not overvalued. But considering the ratios and market conditions, it isn't undervalued enough to give you 2x at TGE either.

It seems fairly valued. This is a bet you can take if you want to bet on Solstice.

Their growth metrics do inspire confidence.

- ~27k USX holders and ~17.6k eUSX holders.

- YieldVault has distributed over $1.3m to users since launch.

- During bearish conditions, they increased TVL by 2x in 90 days. It went from $166M to $328M.

- It's been integrated across the Solana ecosystem. Some of them include Kamino, Exponent, Ondo, Orca, Raydium, and more.

The chart below tracks the growth of USX & eUSX.

Solstice is aiming for a very attractive niche: Solana's go-to stablecoin.

- >80% of Solana's stablecoin supply is USDC & USDT.

- The yield USDC & USDT generates is literally going to Solana competitors like Base chain.

- Solana community needs a stablecoin that'll direct the stablecoin yields into the Solana ecosystem.

- $USX & $eUSX are best positioned to become the Solana-native stablecoin.

Additionally, Solstice also has a staking department that has been operating since 2019. Institutional-grade validator infrastructure securing $1b+ across Solana, Ethereum, and Sui. 7,000+ validators. 99.99% uptime. In the last four years, there hasn't been a single slashing event.

Right now, most of the good opportunities are in ICOs and token sales. And Solstice is a presale that you should evaluate.

🚀 DeFi Catalysts

MegaETH has launched the Frontier Mainnet for the developers. However, it's not open to users yet.

Paradex released the Privacy Perps on the mainnet. They're offering CEX-like privacy but with self-custody.

Jupiter is powering the Solana DEX trading on the Coinbase App. This gives more order flow to the Jupiter.

Katana introduced the Katana App v1. It's designed as the home page for DeFi in the Katana ecosystem.

FX100 introduced a "non-liquidatable" perpetual futures platform that embeds options-like protection into perps so positions cannot be forcibly liquidated.

Bonk has partnered with dYdX. The Perps platform will power a new perp dex on Bonk.trade that'll redirect 50% of all fees to the BONK community.

RateX published the tokenomics of its $RTX token. The max supply of token is 100M, and ~36% of the supply is allocated for the team and investors.

Solana Foundation introduced Kora, a fee relayer and signing node. It'll enable fee-free transactions, custom fee tokens, and more

United Stables launched $U on BNB Chain and Ethereum. It's backed 1:1 by USD and audited main stablecoins such as $USDT, $USDC, and $USD1.

Aster, the perp platform, introduced the Shield Mode. It's a new protected trading mode for high-leverage perps.

DEIN is short for Decentralized Insurance Network. It's a marketplace for risk and insurance. And they've launched their mainnet.

Predict.fun went live on BNB Chain. It's presented as the BNB-native prediction market. They've also started a points program.

🐦⬛ X Hits

- 33 Psalms for 2026

- The fat distribution era.

- A new model for token issuance

- 2026 outlook from Coinbase Institutional.

- Raoul Pal's macro presentation at Solana Breakpoint.

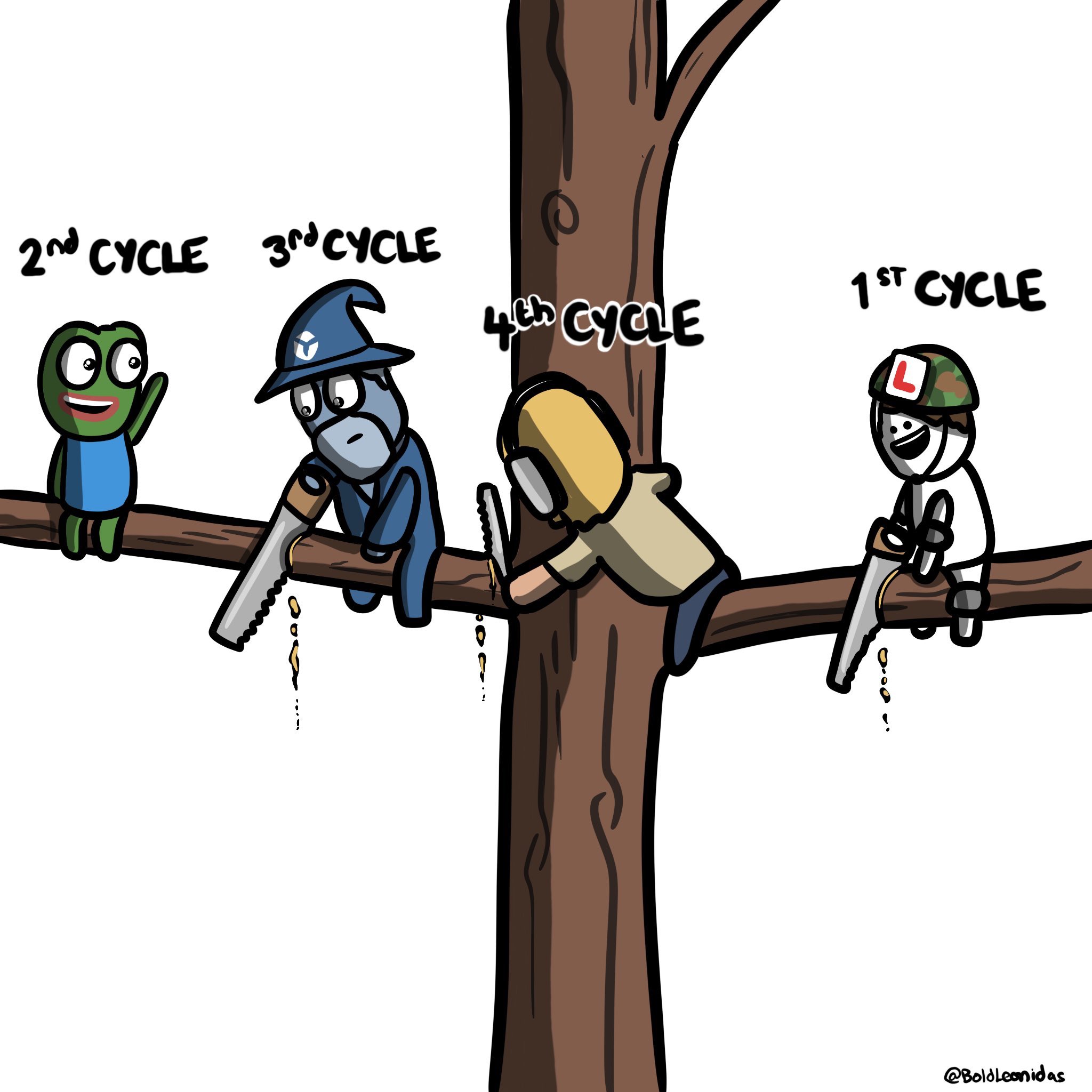

😂 Meme

Until next time,

Edgy

Today's email was written by Edgy and Yayya.

DISCLAIMER: I'm NOT a financial advisor. This content is for education and information purposes only. Crypto and DeFi are risky and speculative. Please do your research before investing.

| | Be Early to the Next Opportunities TDE Pro gives you direct access to our research, our portfolios, and the gems we're betting on.

It's your unfair advantage to move before the crowds.

|

Whenever you're ready, here's how we can help you:

- ⚙️ The DeFi Edge PRO - Designed for busy people who want to stay ahead of the curve. Leverage our research to save you hours each week, and to see what we're personally investing in. Join today.

- 🚀 The DeFi Edge Ventures - We identify, invest, and help amplify DeFi Protocols that positively impact the Crypto space.

You're receiving this email because you signed up for my newsletter. You can update your Preferences or Unsubscribe here.

600 1st Ave, Ste 330 PMB 92768, Seattle, WA 98104-2246

No comments:

Post a Comment