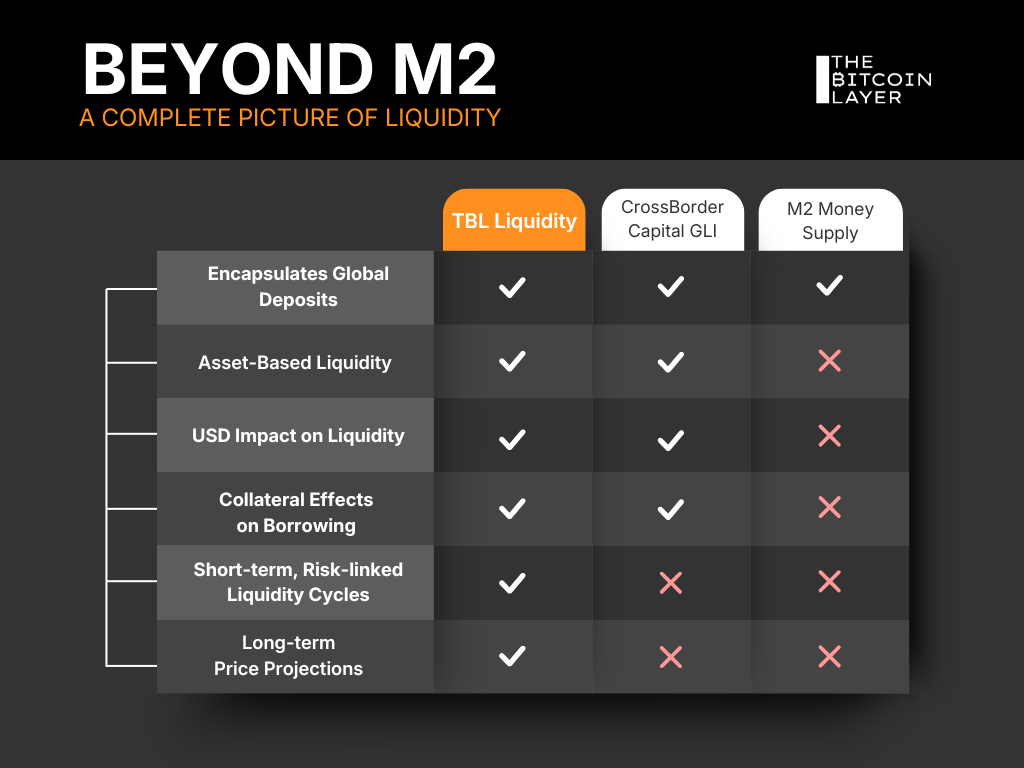

2026 Outlook & Why I Use TBL Research Dashboard EverydayA year-end letter to analyze bitcoin's moving pieces, at least the ones I can see.Dear Readers, I'd like to start by wishing you a Merry Christmas and a happy holiday season surrounded by family, friends, and those you love. This year, we have so much to be thankful for at The Bitcoin Layer, most importantly, our entire team. With Augustine, Demian, Johan, my amazing wife Chandni, and our media expert behind the scenes, this company has left the tiny one-man shop in 2021, and its ‘once-per-week’ cadence miles in the rearview mirror. Your support means everything. Sponsors are a big part of the puzzle, especially companies founded by bitcoiners with crucial products and services bitcoiners need, but the subscriptions of TBL Pros lay the foundation for this research firm. Because of you, we are able to build a quantitative framework using elite data providers and back it up with a squadron of analysts focused on delivering signal. This year, we expanded our framework and added live notifications to the TBL Research Dashboard, giving you instant alerts whenever our TBL Liquidity signal changes. I use it every day, and I’ll explain what we built for true bitcoin & global macro daily signals. For a glance at what TBL Liquidity represents versus other liquidity measurements, we put together a little comparison chart: Our index is proprietary, and we provide depth and transparency that is unmatched. It’s all available on our TBL Research Dashboard, while the detailed analysis will continue to be sent right to your inbox. Today’s letter will contain a condensed summary of what we created with TBL Liquidity, what it is saying today, and how to use it. Many of you have taken advantage of a rare 40% sale, but for those of you on the edge, you have until just after Santa makes his final rounds to snag a discounted TBL Pro subscription. Now, here are my thoughts on bitcoin in 2026 and how I use our own research tool to help me see more clearly. As billions of people compete for a fixed supply of 21 million coins while fiat currency supplies continue to expand, bitcoin’s risk-reward profile stands apart. On January 7 at 10 AM CT, join Unchained and Parker Lewis for an online video premiere exploring the forces shaping bitcoin’s opportunity today and what current market and policy conditions may mean going forward. A talk originally given on December 10th at the Old Parkland debate chamber in Dallas, Parker covers:

If you want a clearer framework for thinking about bitcoin’s opportunity and the risks of overlooking it, this is the talk to share with friends and family. Tuesday, January 7 at 10 AM CT — online, free to attend Secure your Bitcoin this holiday. 21% off all Blockstream Jade devices. Before we keep going with the article, we want to wish everyone some Happy Holidays! We want to show the world everything we’ve built this year for our TBL Pro members, and give you the chance to get full access at a 40% discount on annual subscriptions through Christmas. As a TBL Pro member, you’ll get access to:

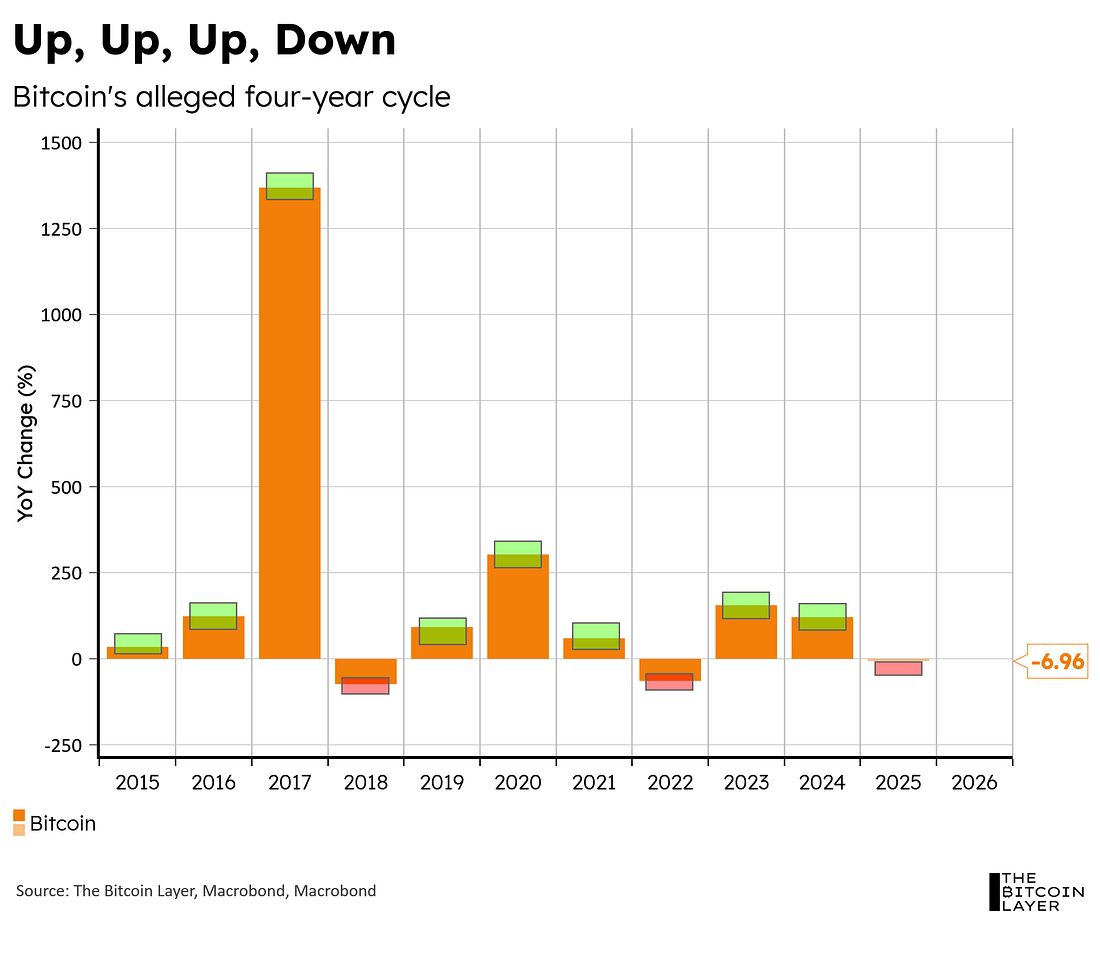

On Behalf of the TBL Team, Happy Holidays! If you are currently a TBL Pro member and want to take advantage of this offer, cancel your current subscription and resubscribe to redeem this discount Bitcoin priceI always remind the team why we are here: we care about long-term ownership of bitcoin. While that means price in many practical ways, it also means we have to think about this young asset class in the context of other asset classes that have been around for centuries (or even millennia). Gold, we all know, has a several-thousand-year history as an asset class, while traded equity and ownership shares in international conglomerates traces its origin to the Dutch and British East India companies in the early 17th century. Government bonds have a similar timeline, as the Bank of England purchased sovereign bonds from the English royal family in the late 17th century as the origins of its balance sheet. But bitcoin, oh sweet bitcoin, is still between driver’s license and legal drinking age. Bitcoin is so young that we are still vigorously debating what moves the price, bringing us to the famed 4-year cycle debate. Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Tuesday, December 23, 2025

2026 Outlook & Why I Use TBL Research Dashboard Everyday

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

From $78B Leverage Wipeout to $250K Upside: Galaxy Digital's Long-Term Bitcoin Outlook ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Financial conditions are easing, ETF outflows are fading, and the odds are shifting toward recovery ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The team behind Aave protocol redirected some money from the DAO to the team wallet. Now, there's a huge debat...

No comments:

Post a Comment