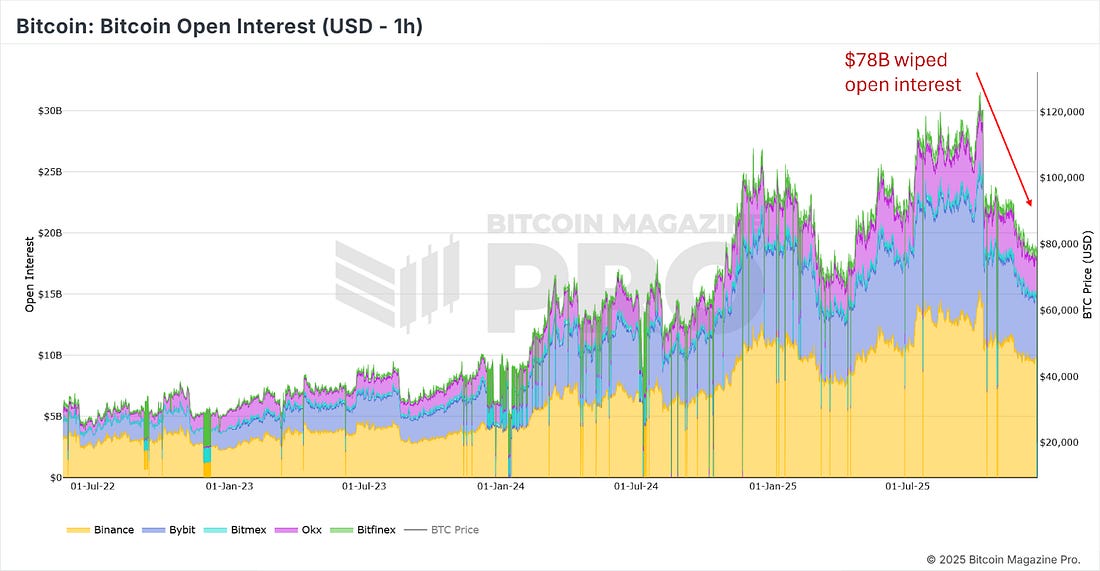

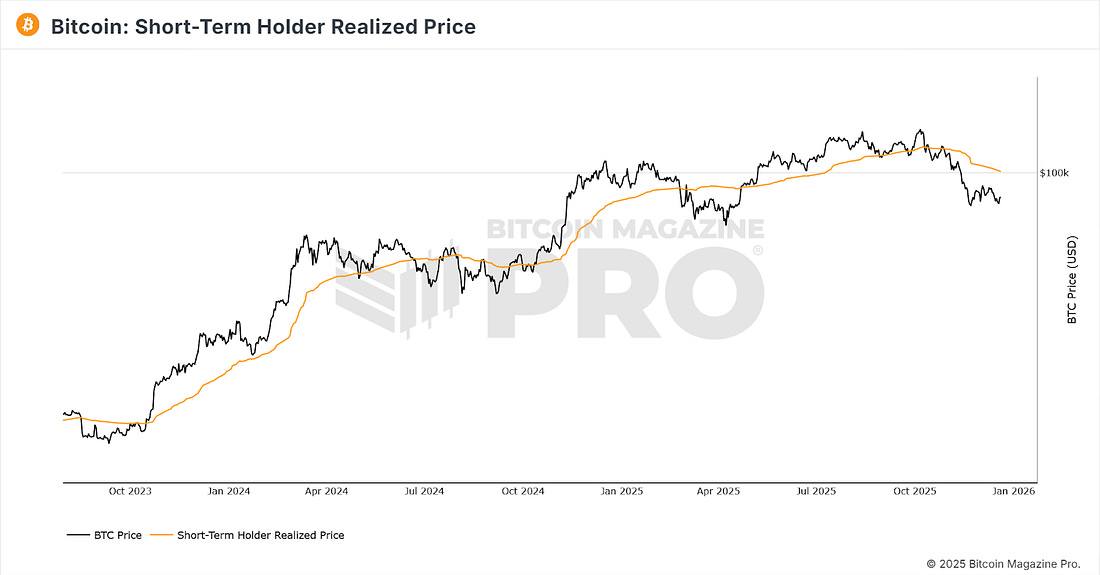

Galaxy Digital Sees Bitcoin at $250k by 2027From $78B Leverage Wipeout to $250K Upside: Galaxy Digital's Long-Term Bitcoin OutlookWhat’s HappeningPrice ActionWhile some expected heavy end-of-year selling, that has not materialised, and Bitcoin continues to range. Over the past month, BTC has risen by 5.61%. Figure 1: BTC price is actually up over the past month. As we move towards the end of the year, it is clear to see the volatility over the past 12 months that has brought us back to where the year started. BTC is currently down just -6.93% despite extreme volatility in both directions after the climb up to $125k and then the drop back down to current prices in Q4. Figure 2: BTC past 12 months. There have now been three tests of the support level we have highlighted on the chart since BTC lost the 1-year moving average over a month ago. Figure 3: Support continues to be tested. With each test, that support level becomes weaker, so bulls are hoping that BTC can now pull up towards the major 1-year moving average resistance at $100,000. The Big Story: Galaxy Digital Sees Bitcoin at $250k by 2027Galaxy Digital has outlined a bullish long-term outlook for Bitcoin, suggesting the asset could reach $250,000 by the end of 2027. However, the firm is far less confident about the road ahead, flagging 2026 as a year of heightened macro and market risk. Bitcoin’s recent volatility underscores the need for caution. After reaching a peak above $126,000 in October 2025, prices retraced sharply to the high-$80,000 range following a major leverage unwind that wiped out roughly $78 billion in crypto futures open interest. Figure 4: $78B in open interest has been unwound. Galaxy notes that until Bitcoin can sustainably reclaim the $100,000–$105,000 range, downside risks remain elevated in the near term. This echoes the outlook we have stated since BTC lost the 1-year moving average. It also aligns with the short-term holder realized price, which is the cost basis of shorter-term holders that can act as resistance in bear markets. Figure 5: Short-term holder realized price. That level is now at $100,000, but is dropping sharply. Looking further out, Galaxy’s long-term thesis rests on Bitcoin’s growing role as a scarce, global store of value. That view contrasts sharply with the firm’s expectations for 2026, which it describes as unusually uncertain. Heavy capital allocation toward AI infrastructure, potential shifts in global monetary policy, and the U.S. midterm elections could all drive significant swings in risk assets, including crypto. Meanwhile, large movements of long-held coins in 2025 suggest early investors may be reassessing exposure after the recent cycle. In short, Galaxy sees substantial upside for Bitcoin over the next few years, but expects investors to navigate a volatile and macro-driven period before getting there. This will require some patience and HODL’ing until BTC can reclaim the $100,000 level. The Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, December 22, 2025

Galaxy Digital Sees Bitcoin at $250k by 2027

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

From $78B Leverage Wipeout to $250K Upside: Galaxy Digital's Long-Term Bitcoin Outlook ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Financial conditions are easing, ETF outflows are fading, and the odds are shifting toward recovery ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Saylor's Stark Warning: MSCI Exclusion Could Trigger Massive Bitcoin Market Shockwaves ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment