| gm Bankless Nation,

2025 may not have been kind to token prices, but it’s been a banner year for crypto on the regulatory front. Today's Issue ⬇️ - 🗣️ Opinion: Trump's Crypto Impact

Trump delivered big wins to the industry in 2025. - 🎧 Latest Pod: Crypto-Native Era Over?

A Founders Fund investor on crypto's institutional era.

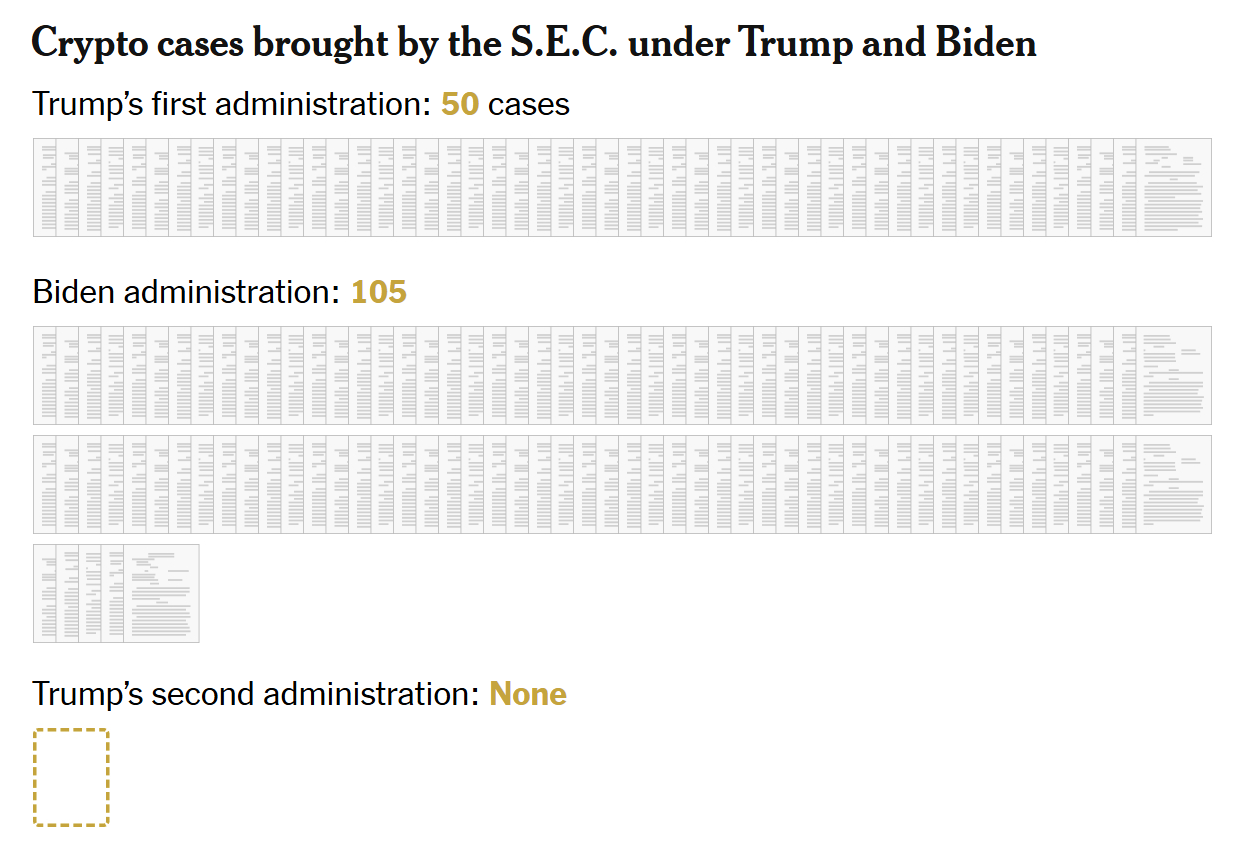

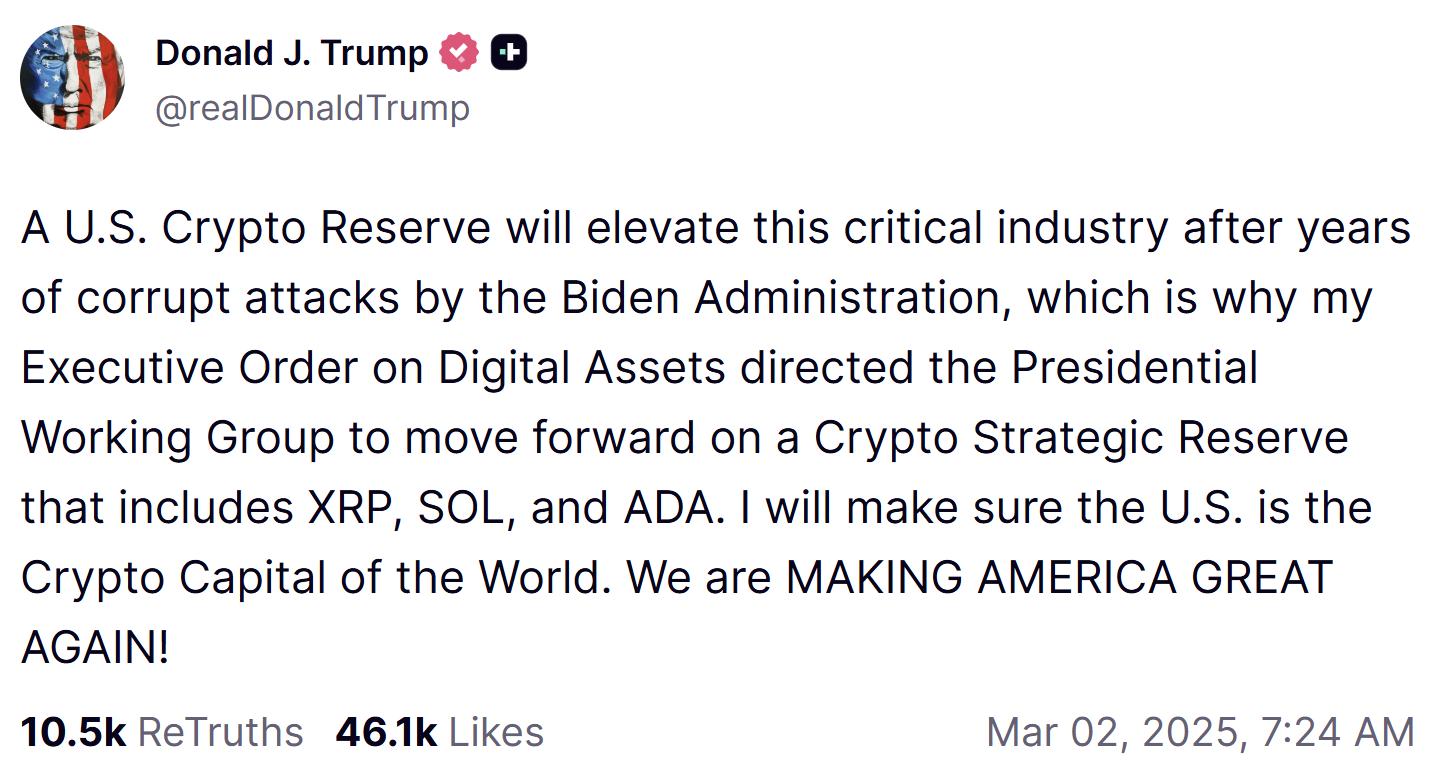

p.s. Token sales are coming in hot, and we built a tool for tracking all of the details you need to know. Take a peek at Bankless ICO Watch: our newest investor dashboard. Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI. . . . OPINION How Trump Reshaped Crypto in 2025 If nothing else, crypto in 2025 was defined by President Donald Trump. Little more than one year ago, the crypto industry was engrossed in never-ending combat with financial regulators, fighting for clear rules and equal access to the financial system. Under the new Trump Administration, legal summons have given way to no-action letters. What was once a volatile relationship between crypto and its regulators is now defined by open engagement, and for the first time in years, crypto builders are free to operate in the open without needing to wage continuous legal warfare with financial regulators. Deregulation reshaped crypto’s trajectory in 2025, and the Trump Administration sat at the center of that shift. Here are five ways Donald Trump changed crypto this year. 👇 1️⃣ Equal Banking AccessCrypto companies have long faced discrimination within the traditional banking system. In 2025, Trump's executive branch took unprecedented steps to open the banking system up for crypto companies, beginning with a January 23 Executive Order that explicitly instructed regulatory agencies to prioritize “protecting and promoting fair and open access to banking services” for the digital asset sector. This EO was followed by a series of agency actions designed to dismantle the restrictive policies of the prior administration, often referred to as “Operation Choke Point 2.0.” In March, the Office of the Comptroller of the Currency (OCC) issued Interpretive Letter 1183, reaffirming that national banks could provide crypto custody services, hold stablecoin reserves, and participate in blockchain networks without prior supervisory approval. The FDIC soon followed, rescinding 2022 notification requirements and clarifying that supervised institutions could engage in permissible crypto activities with proper risk management. By April, many agency guidelines highlighting crypto risks had been withdrawn, and in August, President Trump signed an additional Executive Order "Guaranteeing Fair Banking for All Americans," which empowers regulators to penalize unlawful debanking practices and prohibits the use of "reputational risk" as a pretext for denying services. Progress has only accelerated into the end of the year, with a slew of pro-crypto banking actions announced in rapid succession during December. The OCC authorized banks to broker “riskless” crypto transactions, rebuked America's nine largest federal depository institutions for engaging in politicized or unlawful banking behaviors, and granted national trust bank charters to five digital asset banks. These regulatory actions ended years of de facto exclusion, enabling crypto companies to access essential payment rails, custody services, and capital markets on an equal footing with traditional finance. On the campaign trail, Donald Trump bombastically proclaimed that he would fire former SEC Chair Gary Gensler on day one of his administration. Gensler announced his resignation from the Commission shortly after the election, clearing the way for a sweeping market structure reform. Last December, Trump nominated Paul Atkins – a former SEC regulator who later founded a consulting firm that helps crypto companies comply with financial regulators – as the next SEC Chair to fill Gensler’s void. Atkins was confirmed by the Senate in February 2025, and set about reversing the prior administration’s enforcement-heavy approach. Atkins immediately followed through on a major Trump campaign promise in March by rescinding Staff Accounting Bulletin 121 (SAB 121). This controversial guidance memo strongly recommended financial institutions holding crypto on behalf of customers record an entry for such positions on their corporate balance sheets, potentially triggering increased capital reserve requirements for some types of regulated financial institutions. In August, both the SEC and its commodities counterpart – the CFTC – created dedicated programs to “make America the best place in the world to innovate with blockchain technology and participate in crypto asset markets.” The pair are now intertwined in their efforts to implement President Donald Trump’s crypto agenda, with the SEC working to implement “Project Crypto” and CFTC engaged in operation “Crypto Sprint.” This year ended with no new SEC cases and pullbacks across 60% of active investigations (including the end of high-profile enforcement actions like those against Binance and Ripple), signaling the end of “regulation by enforcement.” 3️⃣ Strategic Crypto ReserveAt Bitcoin 2024 in Nashville, Trump first outlined his plans to make America a leader in blockchain technology by establishing federal BTC strategic reserves (Trump later expressed openness to expanding holdings beyond bitcoin). In March 2025, President Trump would fulfill this key campaign promise by signing an Executive Order that established the “Strategic Bitcoin Reserve” (capitalized initially with an estimated 200k BTC gained from federal seizures) and a separate “Digital Asset Stockpile” to hold all other types of forfeited cryptocurrencies. The order aimed to centralize the government’s previously scattered crypto holdings, prohibited future sales of seized Bitcoin, and directed executive departments to explore budget-neutral strategies for acquiring additional Bitcoin without taxpayer costs. Nothing material has changed since these reserves were created: they’re still backed only by forfeited assets and could be sold off on a whim. But the mere suggestion that the U.S. government might buy crypto was enough to inspire investors, fueling industry-wide optimism and pumping crypto prices for much of the year. 4️⃣ Legislative BreakthroughsThe passage of the GENIUS Act in July 2025 marked the first comprehensive federal legislation action for digital assets, establishing a clear regulatory framework for stablecoins and positioning the U.S. as a global leader in crypto regulation. The Bill regulates payment stablecoins, or digital assets that are pegged to a monetary unit of account (like the U.S. dollar) and whose issuer is obligated to convert, redeem, or repurchase the tokens for a fixed value. President Trump was instrumental in securing enough votes to ensure the GENIUS Act’s passage, rallying bipartisan support, personally lobbying key holdouts for support, and engaging in public pressure campaigns to get the Bill past the finish line. Favorably perceived as pro-crypto legislation, the GENIUS Act established the template for future federal laws on broader digital asset classes. It was a primary reason why the FDIC was able to issue its recent guidance for banks on how to issue compliant payment stablecoins. 5️⃣ Memecoin ClarityWhile Trump's successful campaign centered heavily on courting crypto industry support, his deployment of the TRUMP memecoin just three days before his January 20 inauguration caught plenty of industry supporters off-guard. The move set the stage that Trump wasn't just planning to take an active role in regulating the industry, he planned to set up his family to take an active role in the profits as well. Just one month after the launch of TRUMP and MELANIA, Donald Trump’s SEC issued broad guidance for memecoins, declaring these types of tokens as typically not securities, so long as their “value is driven primarily by market demand and speculation,” similar to a collectible. Although the price of TRUMP tokens was down throughout much of 2025, holders received numerous non-financial benefits during the year, including exclusive access to President Donald Trump at invite-only events. Trump’s personal endorsement paired with favorable SEC guidance cleared the way for renewed experimentation, capital inflows, and sustained activity across the memecoin sector, clearing the way for protocols like pump.fun to dominate the conversation in 2025. It wouldn't be the last time that the President blurred the lines between policy advocacy and wealth creation for him and his family. In July, Bankless published a rundown of his growing personal crypto empire, which in the latter half of the year has largely centered on DeFi opportunities being pursued by his family's World Liberty Financial effort. A Pivotal Year for American CryptoTrump's Crypto Presidency has had a busy first year, and while the market outlook for token prices is less than rosy, the opportunities for tokenizing assets and bringing global financial infrastructure onchain remain big business. While Trump and his sons' efforts to reframe the family business empire through the lens of crypto before leaving office have been an unwelcome distraction for many in the industry – who worry he's setting the industry on a collision course with Democrats should Congressional power shift – the administration's aggressive reversal of Biden era transgressions against the industry has left plenty of crypto power players more than willing to overlook the negative PR it has brought. With a market structure bill next on the agenda following the summer passage of sweeping stablecoin legislation, crypto is prepared for more wins on the horizon under President Trump. FRIEND & SPONSOR: FRAX The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem. . . . LATEST POD Is the Crypto-Native Era Coming to an End? Joey Krug (Founders Fund partner, former Pantera co-CIO, and Augur co-founder) returns to unpack whether the “crypto-native era” is fading as institutions and mainstream apps adopt crypto rails without adopting crypto culture.

We dig into the prediction markets breakout (and why Polymarket finally found product-market fit), the coming regulatory fights around market structure and “insider” edges, and what’s next for founders building in a post-cypherpunk, distribution-first phase of crypto. Listen along to the full episode 👇 |

No comments:

Post a Comment