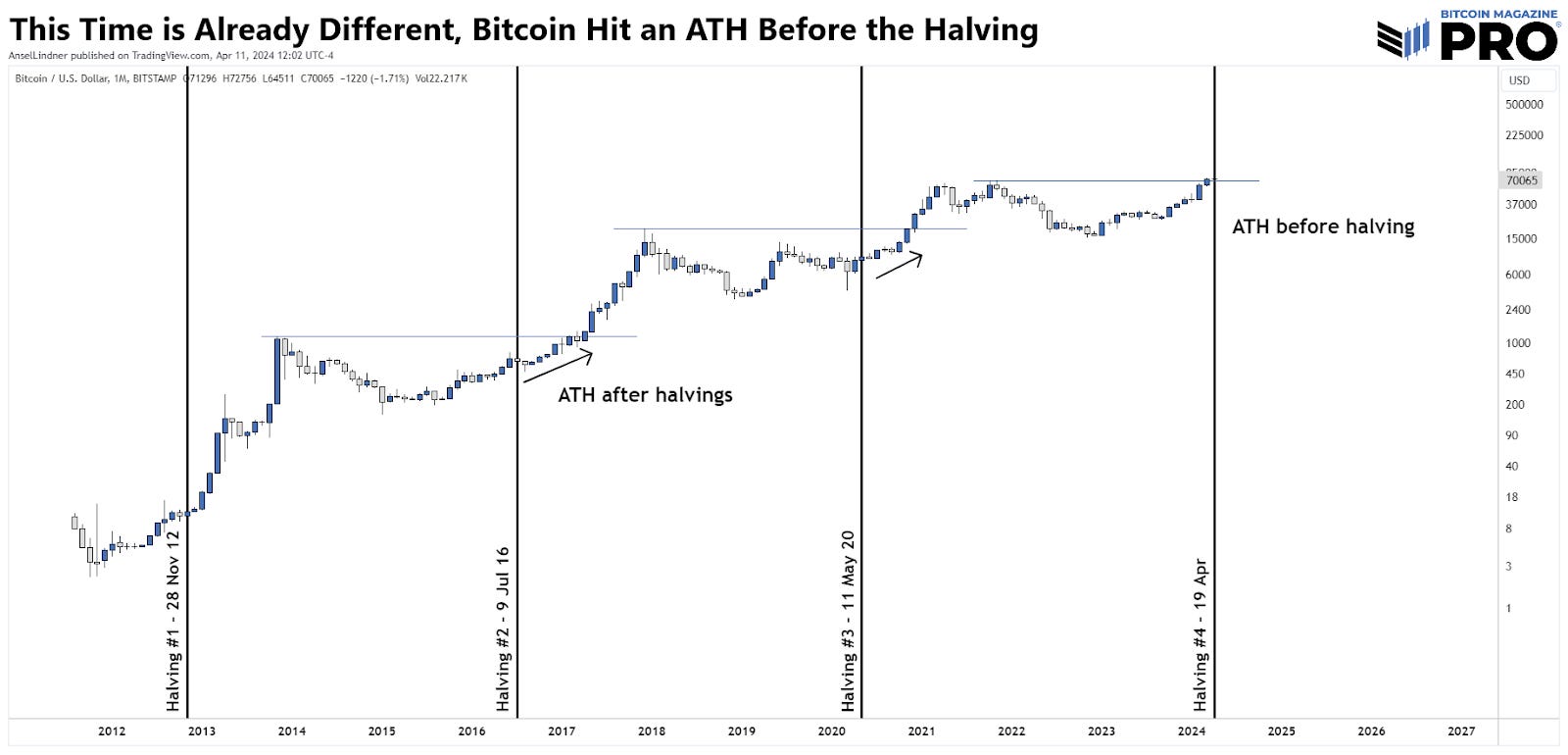

This Time is Different: Unprecedented Halving ForcesExploring the 2024 Bitcoin Halving: A Deep Dive into Institutional Adoption, ETFs, and a Shifting Global Economic Landscape.The Unprecedented Convergence Shaping Bitcoin's 2024 HalvingEach Bitcoin halving event marks a pivotal moment, influencing market dynamics and investor sentiment. As seasoned observers of Bitcoin, we've witnessed the dramatic impact of previous halving’s on Bitcoin's price. However, the impending halving next week promises to be unlike any other. Not only are the internal fundamentals of Bitcoin drastically different this time, but the wider macro environment and monetary landscape is ripe for disruption. At the heart of this shift lies the remarkable surge in institutional adoption and the advent of Bitcoin exchange-traded funds (ETFs). These institutional players, including major companies like MicroStrategy and Tether, are injecting substantial capital into the Bitcoin market, fundamentally altering its dynamics. Coupled with this influx of institutional investment is the emergence of a unique macroeconomic and geopolitical environment, characterized by deglobalization, demographic decline, and a search for alternative monetary systems. Against this backdrop, Bitcoin stands as a beacon of financial sovereignty and independence, offering a hedge against inflation, deflation, and geopolitical uncertainty. What Characterized the Previous Halvings?Let’s review what characterized the previous halvings, and briefly summarize why this one is different. First Halving - Obscurity: During the first halving in 2012, Bitcoin was relatively obscure, known only to a niche group of enthusiasts. The market was unstructured, and institutional investment was virtually non-existent. The impact of the halving was strong because of the size of the reduction from 50 to 25 bitcoins per block. Second Halving - Speculation on Altcoins: By the time of the second halving in 2016, Bitcoin had gained more visibility, and the broader Bitcoin market was being infiltrated by altcoins. Degenerate speculation dominated and institutional investors were still mostly absent. Third Halving - Venture Capital, COVID-19 and Maturation: The third halving in 2020 coincided with the global COVID-19 pandemic, which led to unprecedented economic stimulus measures. Bitcoin’s resistance to inflation became more widely recognized. Venture capital moved into scams and token sales in a big way. This was the heyday for unregistered securities. We saw the beginnings of institutional interest and respect, however, the institutional framework was not fully developed. Fourth Halving - Institutional Adoption and ETFs: The landscape for the 2024 halving is fundamentally different. Institutional investors are now actively participating in the Bitcoin market, not just as speculators but as major stakeholders. The advent of Bitcoin ETFs has provided a regulated pathway for institutional money, reducing barriers to entry and adding a layer of legitimacy and stability to the market. Altcoins are stagnant and the new alternatives are becoming publicly listed companies either stacking or mining bitcoin...  Continue reading this post for free, courtesy of Bitcoin Magazine Pro.A subscription gets you:

|

Thursday, April 11, 2024

This Time is Different: Unprecedented Halving Forces

Subscribe to:

Post Comments (Atom)

Popular Posts

-

ETH prices spent the afternoon in an epic battle against 2021 highs, with the asset less than $50 shy of a new record. ...

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Today, we're wishing you a Merry Christmas with a curated collection of our best podcasts and newsletters of 2025. ...

-

Michael Saylor Defiant as MSCI Considers Kicking Bitcoin Treasury Giants Out of Global Benchmarks ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment