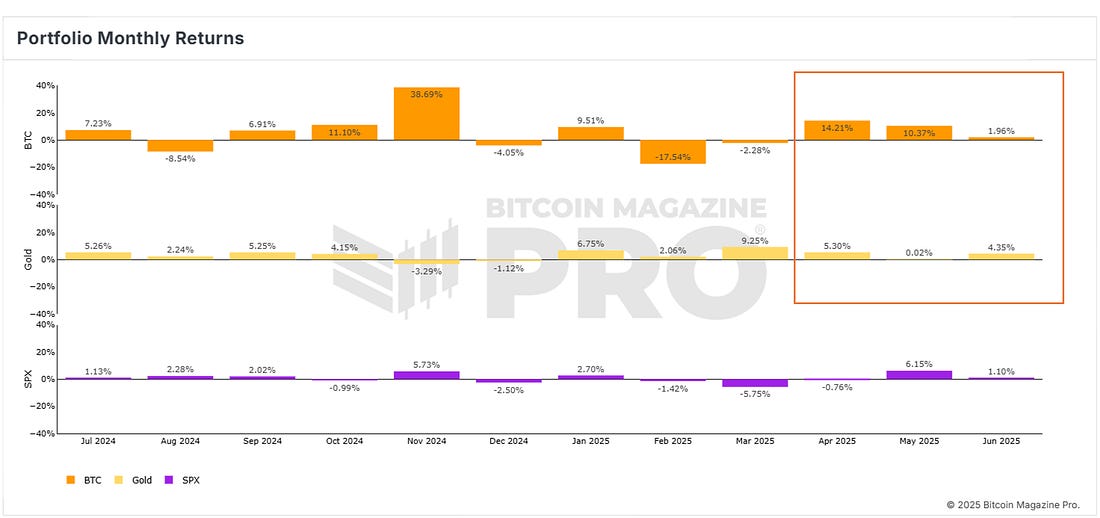

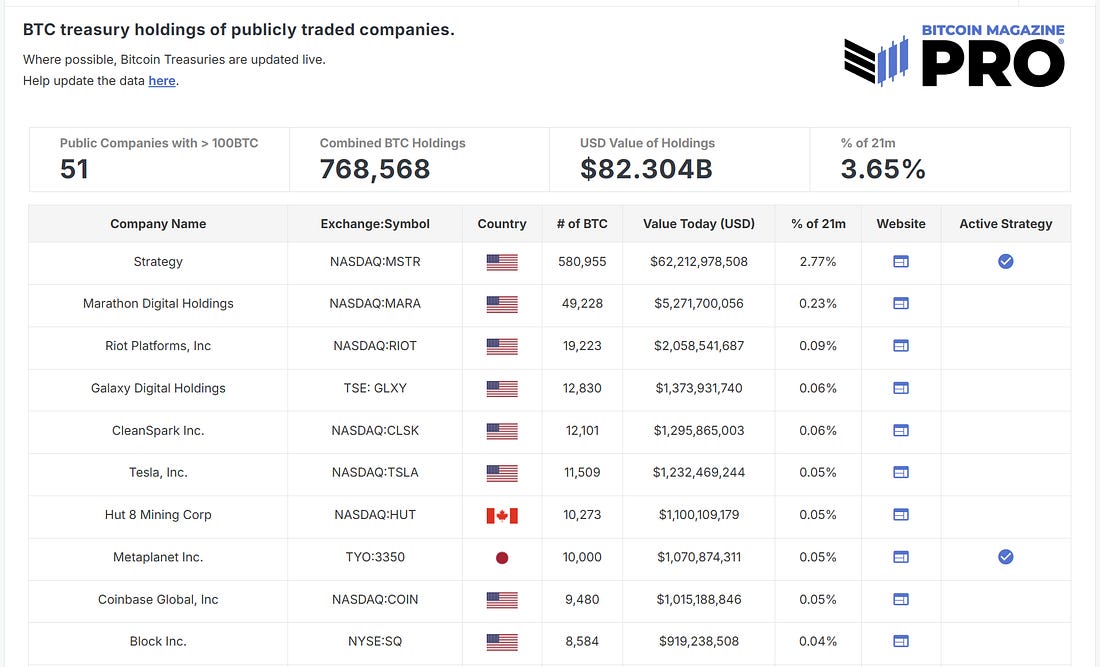

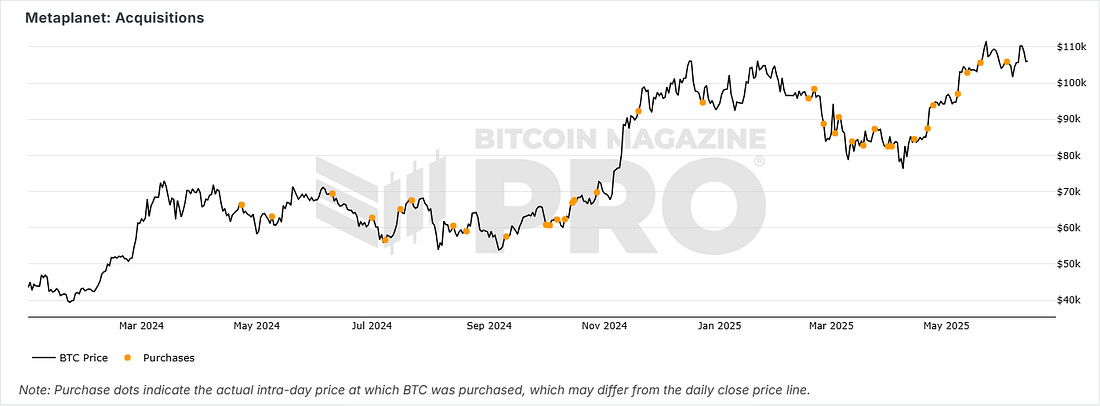

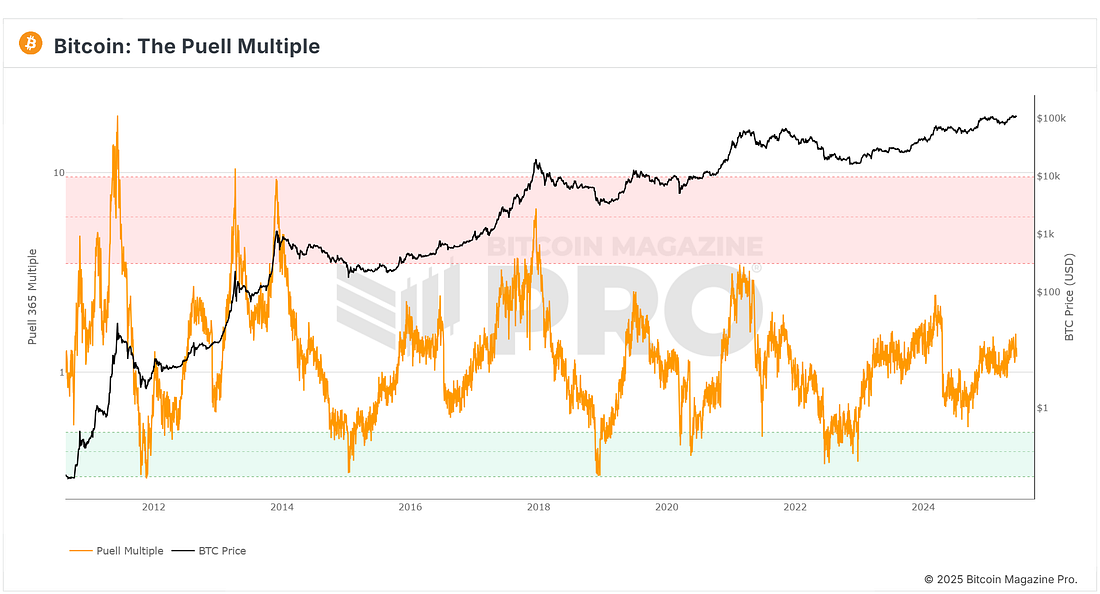

News HeadlinesPrice ActionBTC is once again attempting to break out above the range resistance line that has been acting like a magnet to price in recent weeks. As geo-political risks continue to rise, notably in the Middle East, perhaps after initial panic sell-offs investors will realise that Bitcoin can act as a safe-haven asset in such circumstances. Figure 1: BTC breaking back above range resistance. While much has been made of Gold’s performance in recent months against the geo-political backdrop, when we compare monthly gains, BTC has continued to outperform it. Figure 2: BTC Monthly Performance Versus Gold. If BTC can confidently start trending above $110,000 then it is likely that we will see another month of outperformance versus Gold for June 2025. The Big Story: Metaplanet Now Holds 10,000BTCJapanese Bitcoin Treasury firm Metaplanet has scooped up another 1,112 bitcoin for roughly ¥16.9 billion (about US$117 million), pushing its treasury to the symbolic 10,000-BTC mark. They have reached that number half a year ahead of the target they set for the end of 2025. Crossing that threshold propels the company past Coinbase Global’s 9,480 coin stack and makes it the eighth-largest public holder of bitcoin. Figure 3: Bitcoin Treasury rankings among publicly listed companies. The milestone lit a fire under Metaplanet’s shares, which spiked more than 20 percent on the day and are now up around 430% since January. Metaplanet financed the latest purchase with cash on hand, but it has even bigger funding in the pipeline. The board has green-lighted a US$210 million zero-coupon bond issue earmarked for further bitcoin buys, and earlier this month the firm unveiled a ¥770.9 billion (US$5.4 billion) equity-warrant deal devoted entirely to its accumulation strategy. Expect to see more orange dots on the chart as they continue to acquire more bitcoin over the coming months. Figure 4: Metaplanet acquisitions since April 2024. All told, the company has spent about US$947 million to assemble its 10,000-coin hoard, leaving it in the green with an average entry price near US$94,700 and a year-to-date bitcoin yield in the region of 266 percent. Executives insist Metaplanet is still aiming for 210,000 BTC, roughly one percent of eventual supply, by the end of 2027, underscoring a wider shift among corporates that are treating bitcoin as a strategic reserve necessity rather than a speculative side bet. Chart of the week - Puell MultipleFigure 5: Puell Multiple The Puell Multiple plots the U.S. dollar value of bitcoin newly issued each day (block reward × price) divided by its 365-day moving average, capturing how “rich” or “poor” miners’ revenue is relative to the past year. Readings above ~3.5 historically coincide with bull-market peaks, signalling miner windfalls and overheated conditions. That is shown on the chart above by the orange line (Puell Multiple) moving up into the red zone on the chart. Dips below 0.5 mark periods when miner income is severely compressed and bitcoin prices are near cycle lows. Shown by the orange line dipping down into the green band, highlighting that BTC is likely undervalued. Traders use these extremes as a contrarian timing gauge: high multiples warn of potential tops when the market is over-excited, and low multiples suggest accumulation zones. Currently, the Puell Multiple is trending upwards as we are in a bull market, but has a score of just 1.33, suggesting there may be significantly more upside still to come this cycle. Speak again soon, The Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, June 16, 2025

BTC Breaks Out

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Crypto is closer than ever to mass adoption, but its founding values aren’t embedded in every blockchain... ...

-

Hear why at DAS NYC ...

-

People building freedom technology across the globe are watching freedoms disappear at home. ͏ ...

-

Also Strategy Has Become A Key Source Of Bitcoin Price Support & Inflation Is Likely Understated By Data Distortions ͏ ͏ ͏ ...

-

Is global macro currently a headwind or tailwind for risk? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment