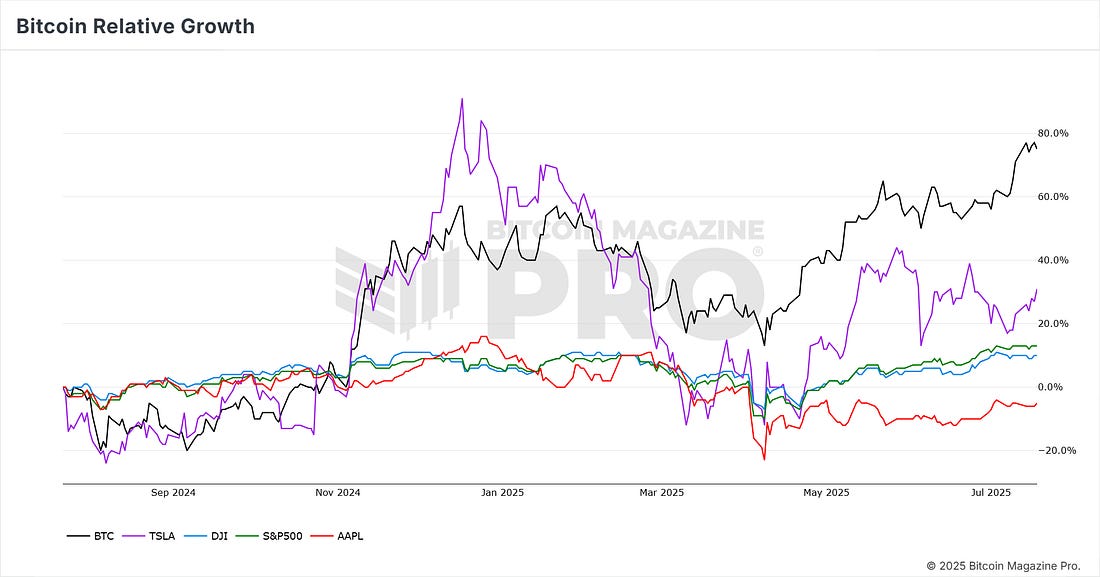

BTC ranging...but what's next?BTC ranges between 0.5 & 0.618 fib at $117K, healthy consolidation after run-up. Patience key for investors.News Headlines Price Action Since reaching our recent target of the 0.618 fib extension that we discussed in last week’s newsletter, BTC has retraced slightly to the 0.5 fib extension at $117,000. It is currently ranging between those two levels. In our view at Bitcoin Magazine Pro, this is a perfectly healthy consolidation following the strong run-up that occurred two weeks ago. Times like this simply require some patience for the strategic investor. Figure 1: BTC ranging between the 0.5 and 0.618 fib extensions. Zooming out and looking at BTC performance over the past year, it is now up +73.2%. An impressive performance. Figure 2: Past 12 months performance. Comparing that performance versus other major assets shows how impressive it has been, as other leading global assets have significantly lagged behind Bitcoin. Figure 3: BTC relative growth vs other assets. Past 12 months' performance of BTC versus other leading global assets:

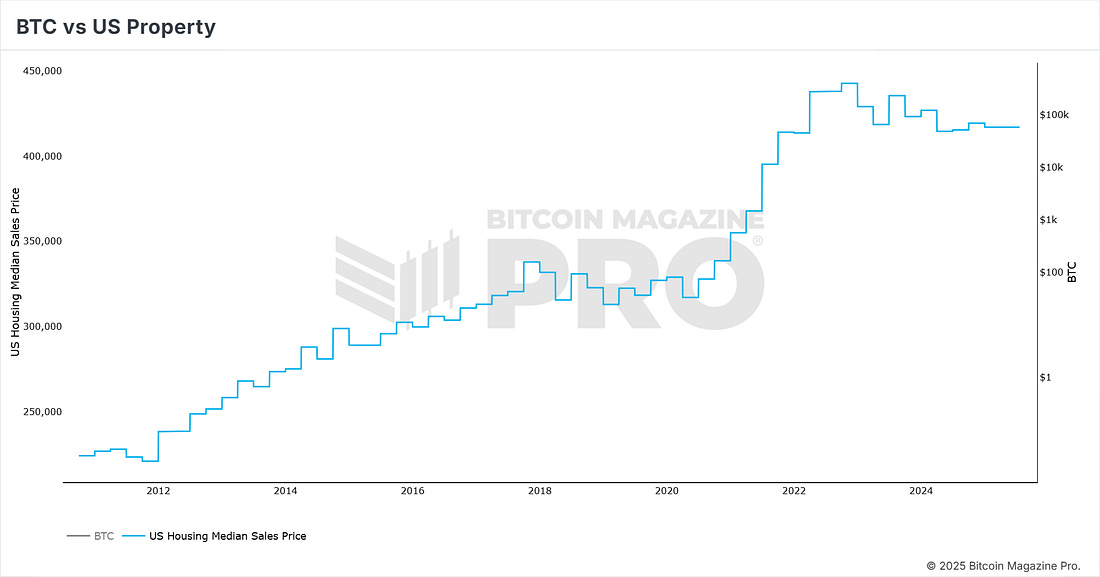

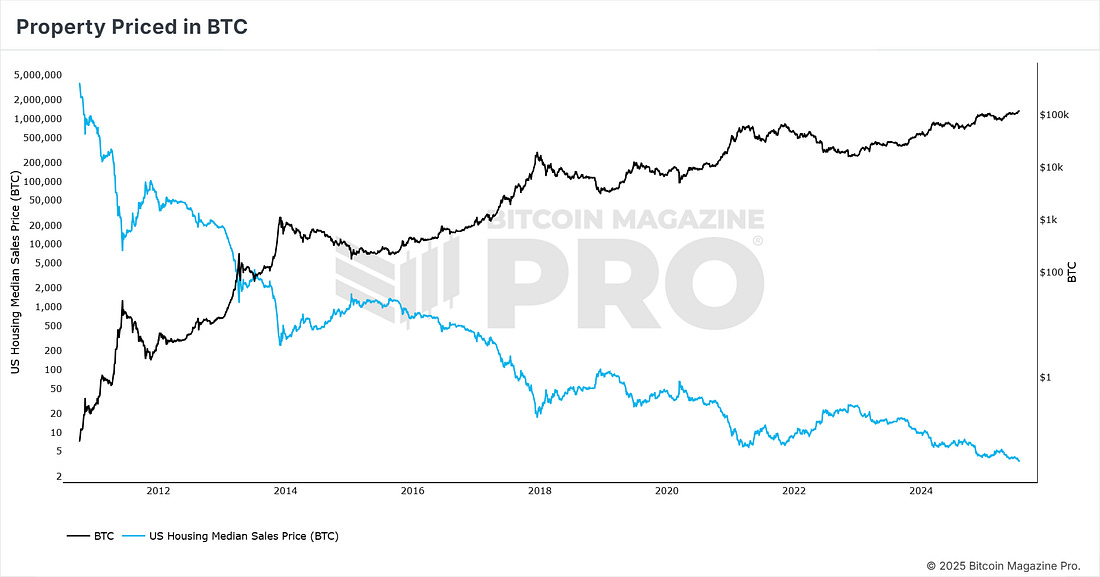

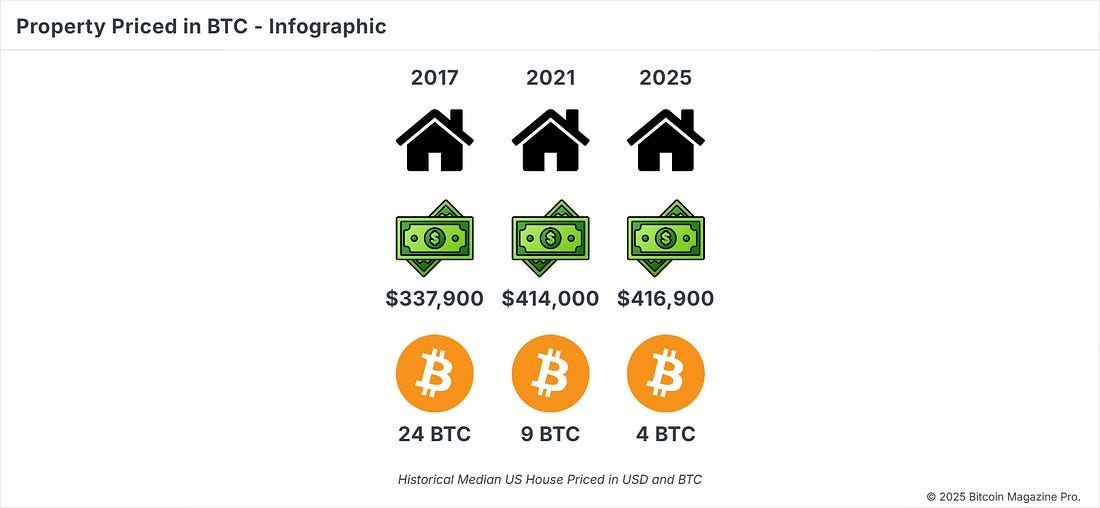

The Big Story: Bitcoin Draining The Value Out Of Real Estate The latest Bitcoin Magazine article by Martin Matejka lays out a radical thesis on why Bitcoin could eat into real estate as the world’s favourite store-of-value. Give the full article a read here. Below, we provide our take on the article and showcase, through data, how Bitcoin is already starting to overtake real estate as a better store of value for millions of people. Real estate’s status‑quo store‑of‑value is fraying. The impact of that over time can be seen on the chart below, which shows US Median House prices steadily increasing (blue line). They are shown alongside BTC (black line). Figure 4: US Median House Prices. However, as an investor, you want to be holding onto hard assets that can outperform. When we look at US Median House priced in BTC terms rather than in USD, we see a very different picture. US Median House prices have significantly LOST value over time relative to BTC. Figure 5: US Median House Prices in BTC terms. A demographic hand‑off is accelerating the shift. Young investors already hold more cryptocurrency than stocks, bonds, or property, and surveys show that two-thirds of millennials eyed crypto ETFs last year, versus a small fraction of boomers. It’s a generation that values portability and internet‑native wealth over the traditional “forever home.” The impact of this and BTC’s relentless growth over time as it becomes adopted can be seen in this infographic. A median-priced house in the US would have cost 24 BTC back in 2017. Today it costs just 4 BTC! Figure 6: US Median House Prices in BTC terms infographic. If Bitcoin captures even a slice of real estate’s monetary premium, tens of trillions of dollars could rotate rapidly into digital custody. Is this a global repricing event most investors are still underestimating? Speak again soon. Bitcoin Magazine Pro Team. ⏳ Limited Time OfferIf you would like to access Bitcoin charts and chart alerts to understand where we are in the bull market cycle, use this code at checkout to get 30% off: NOW30 The code will expire in 48 hours, so get your 30% off while you can. We hope you enjoy becoming a platform member, so that you can get an edge in the market. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, July 21, 2025

BTC ranging...but what's next?

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

From $78B Leverage Wipeout to $250K Upside: Galaxy Digital's Long-Term Bitcoin Outlook ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Financial conditions are easing, ETF outflows are fading, and the odds are shifting toward recovery ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The team behind Aave protocol redirected some money from the DAO to the team wallet. Now, there's a huge debat...

No comments:

Post a Comment