Bitcoin and Gold Dominate Risk-Adjusted ReturnsAlso Bitcoin ETFs Have Caught Up to Gold & Bitcoin’s Volatility Is at a 10-Year LowWelcome to Ecoinometrics' Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we'll cover:

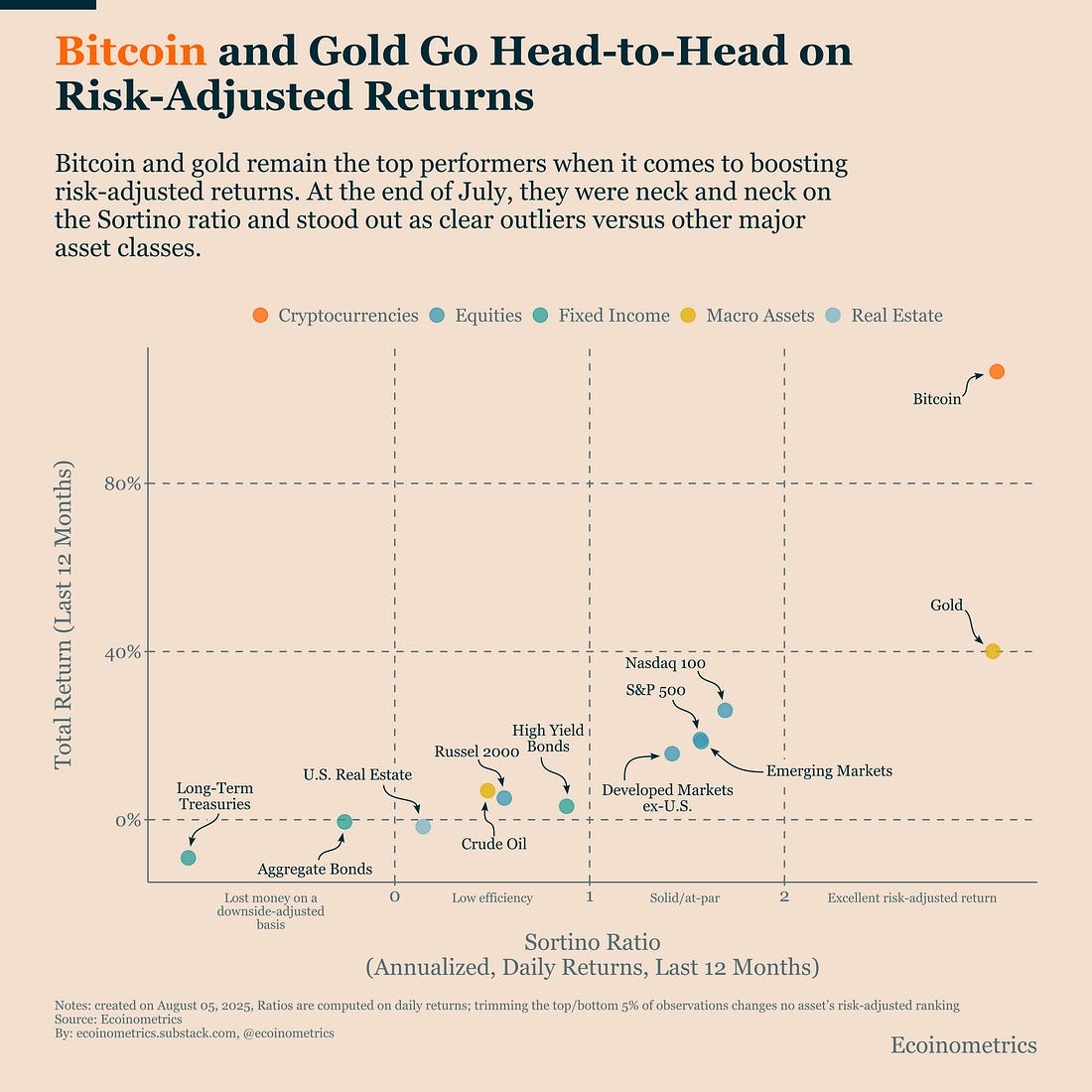

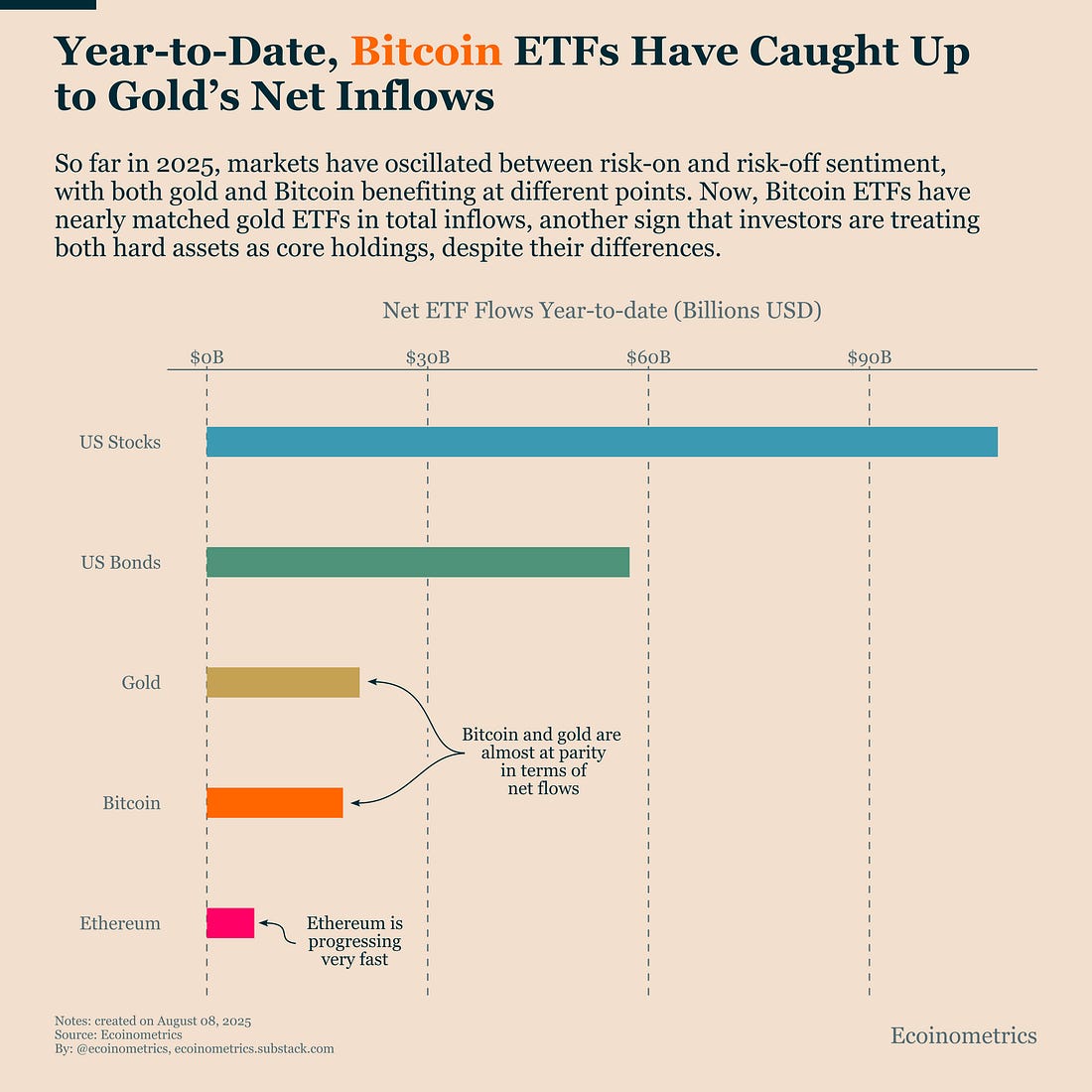

Together, these three signals tell a clear story: Bitcoin is maturing into a core asset. It competes with gold on both risk-adjusted performance and capital flows, and it’s doing so with a historically low volatility profile. That’s not the profile of a fringe speculative trade, it’s the footprint of a mainstream asset. In case you missed it, here are the other topics we covered this week: Essential Decision-Making Tools Bitcoin Market Monitor - Key Drivers in Five Charts: Bitcoin Market Forecast - Probability Scenarios & Risk Metrics: Get these professional-grade insights delivered to your inbox: Bitcoin and Gold Dominate Risk-Adjusted ReturnsBitcoin has struggled a bit since last Friday due to a shift in risk sentiment. But as we discussed on Monday, that dip is well within the range of what you’d expect when U.S. stock indices take a hit. What matters more for investors with a multi-month time horizon is that, as of the end of July, Bitcoin continued to deliver excellent risk-adjusted returns over the past 12 months. As the chart below shows, Bitcoin’s Sortino ratio is well ahead of the Nasdaq 100, even though the Nasdaq already offers solid risk-adjusted performance. That puts Bitcoin and gold head-to-head again when it comes to downside-adjusted returns. Both stand out as outliers and make a strong case for holding hard assets to improve a portfolio’s risk-return profile. This isn’t just about chasing upside. Matching or beating gold on a risk-adjusted basis is no small feat, especially in an environment with ongoing macro uncertainty. It shows that Bitcoin can be an efficient part of a portfolio, not just a speculative one. Bitcoin ETFs Have Caught Up to GoldSo far, 2025 hasn’t delivered one clear market regime. Instead, risk sentiment has swung back and forth, risk-on for a few weeks, risk-off for a few weeks. As expected both Bitcoin and gold have benefited at different points. And now, Bitcoin ETFs have nearly caught up with gold ETFs in total inflows for the year: $18.5 billion for Bitcoin, $20 billion for gold. That’s a notable shift because these two hard assets serve different purposes:

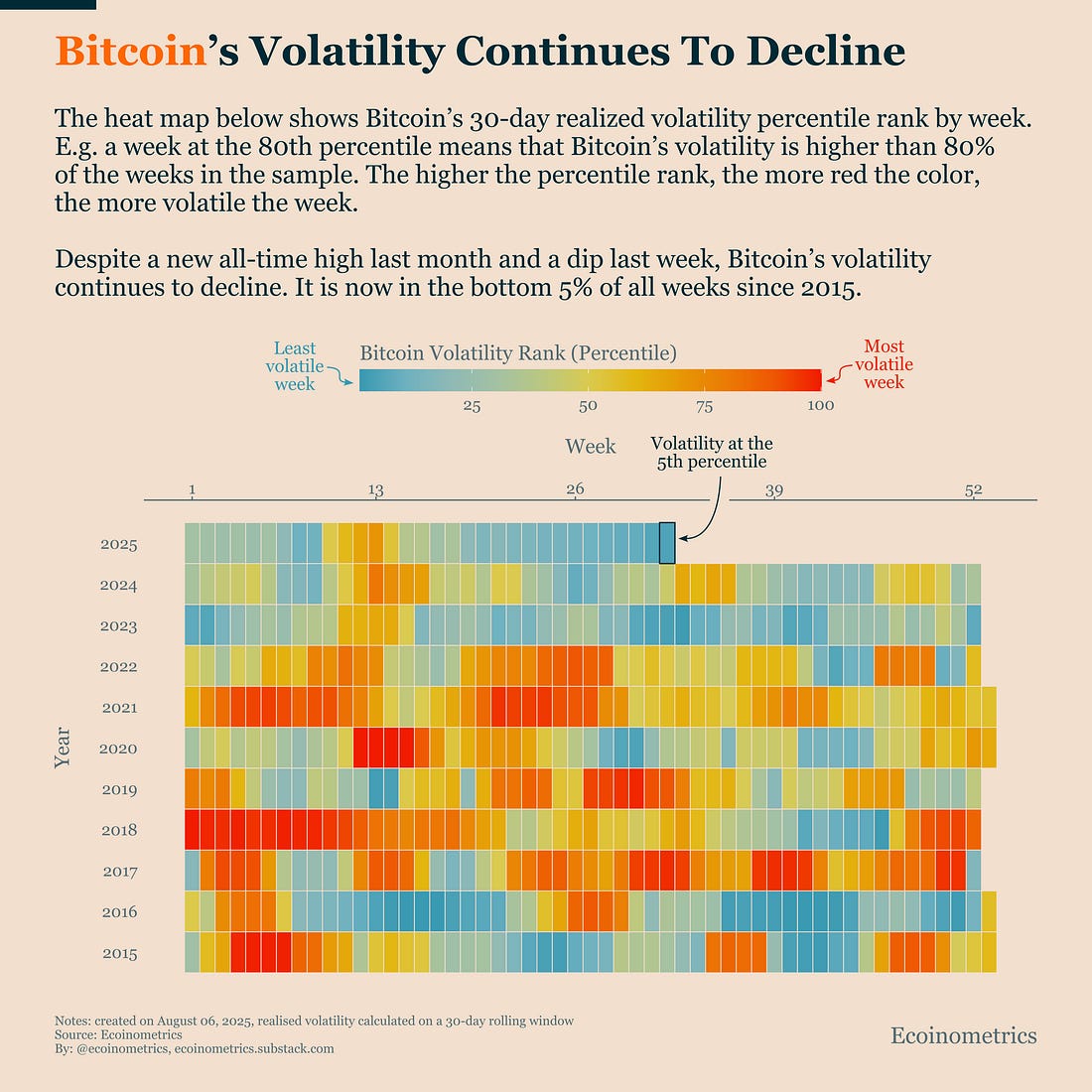

Despite those differences, investors are treating both as strategic holdings. That’s quite different from the earlier narrative where Bitcoin was expected to replace gold entirely. Instead, investors appear to be using Bitcoin and gold as complementary tools. Same objective, hedging macro uncertainty, but different angles. But the bottom line is: the growing allocation to hard assets is a structural tailwind for Bitcoin. Bitcoin’s Volatility Is at a 10-Year LowBitcoin has changed. If you look back over the last decade, every bull market came with volatility spikes, especially during the sharpest upward phases when new highs were made. Big price swings were part of the game. But this cycle is different. Since 2023, Bitcoin has barely registered any significant volatility spike. Even as it recovered from a bear market and entered a multi-phase bull run, the overall volatility profile has remained unusually calm. And it’s still getting quieter. In July, Bitcoin broke out to a new all-time high, then dipped last week. But instead of spiking, its volatility kept falling. It’s now in the bottom 5% of all weekly readings since 2015. That’s what happens when Bitcoin becomes part of institutional portfolios. With a moderate correlation to major U.S. stock indices and tighter trading behavior, its profile is starting to resemble a maturing macro asset. And the more stable it gets, the more institutional capital can move in, closing the feedback loop. That's it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. Invite your friends and earn rewardsIf you enjoy Ecoinometrics, share it with your friends and earn rewards when they subscribe. |

Friday, August 8, 2025

Bitcoin and Gold Dominate Risk-Adjusted Returns

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Paul S. Atkins, Chair of the U.S. SEC, Will Deliver Keynote on Day 1 of DAS NYC ...

No comments:

Post a Comment