Dear Readers, As you all know from Nik’s two books and from our TBL Liquidity Index, the specialty here at The Bitcoin Layer is money creation via credit creation. The entire premise behind our TBL Liquidity Index is that credit creation leads to more liquidity in the system, which in turn leads to risk-on scenarios. In this article, we decided to take a closer look at the banking sector, from its market performance to its operations—lest we forget that banking assets are a part of our TBL Liquidity index. Over 10,000 investors downloaded the original report calling for $120k when bitcoin was just $27k. With that price level now achieved, Tuur is back with the 2025 edition refreshed for the bull run with new data and insights—including Adamant Research’s latest price outlook. The bull run is heating up—now is the time to take it seriously. You’ll also get exclusive access to an HD recording of Tuur Demeester’s new 30-minute video presentation, Charting Our Way Through Chaos, breaking down why this boom might be only just beginning—and what forces could push it to the next level. Read the first-ever mid-cycle report from Adamant Research: We are also happy to announce our newest sponsor this month: Arch Lending! At TBL, we help you decode Bitcoin’s macro trends and give clear market signals—holding Bitcoin is just the beginning. Arch lets you borrow against your Bitcoin—unlock cash without selling:

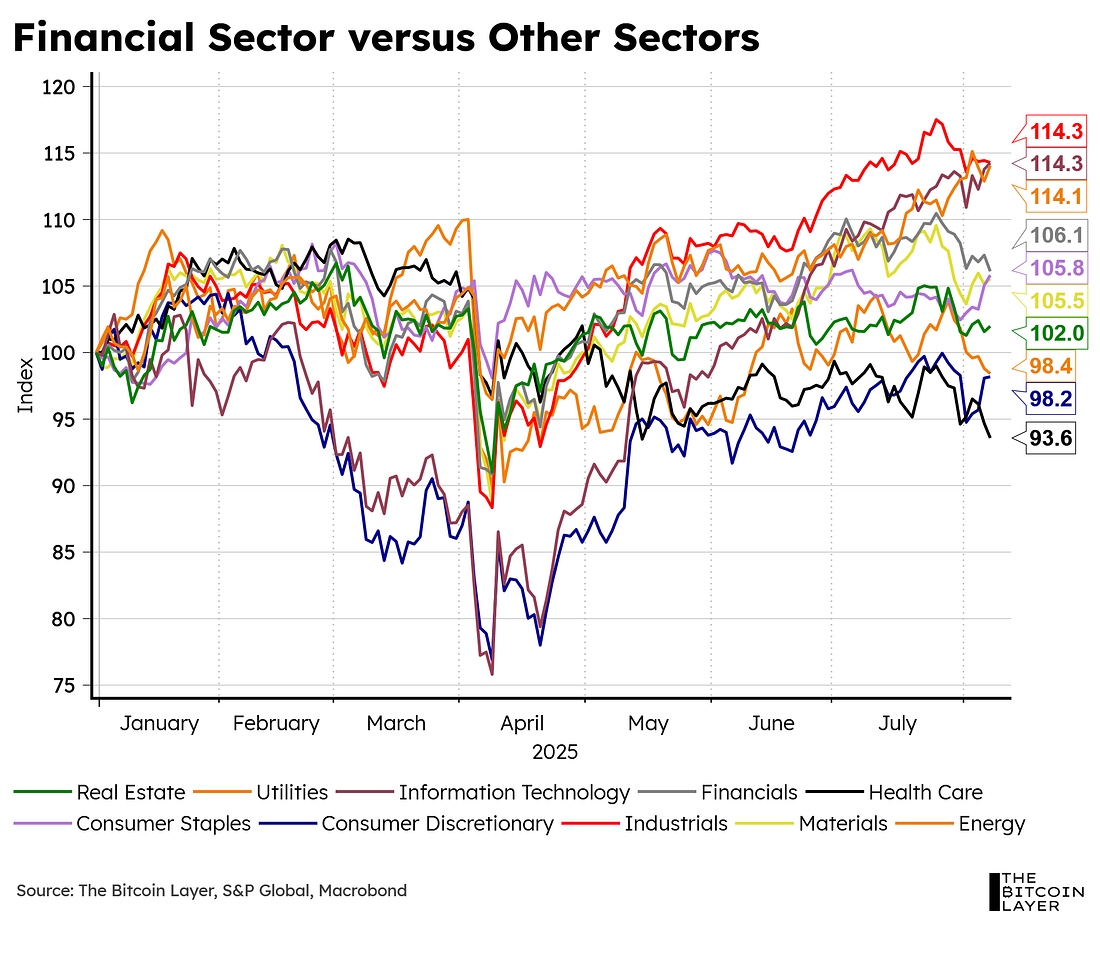

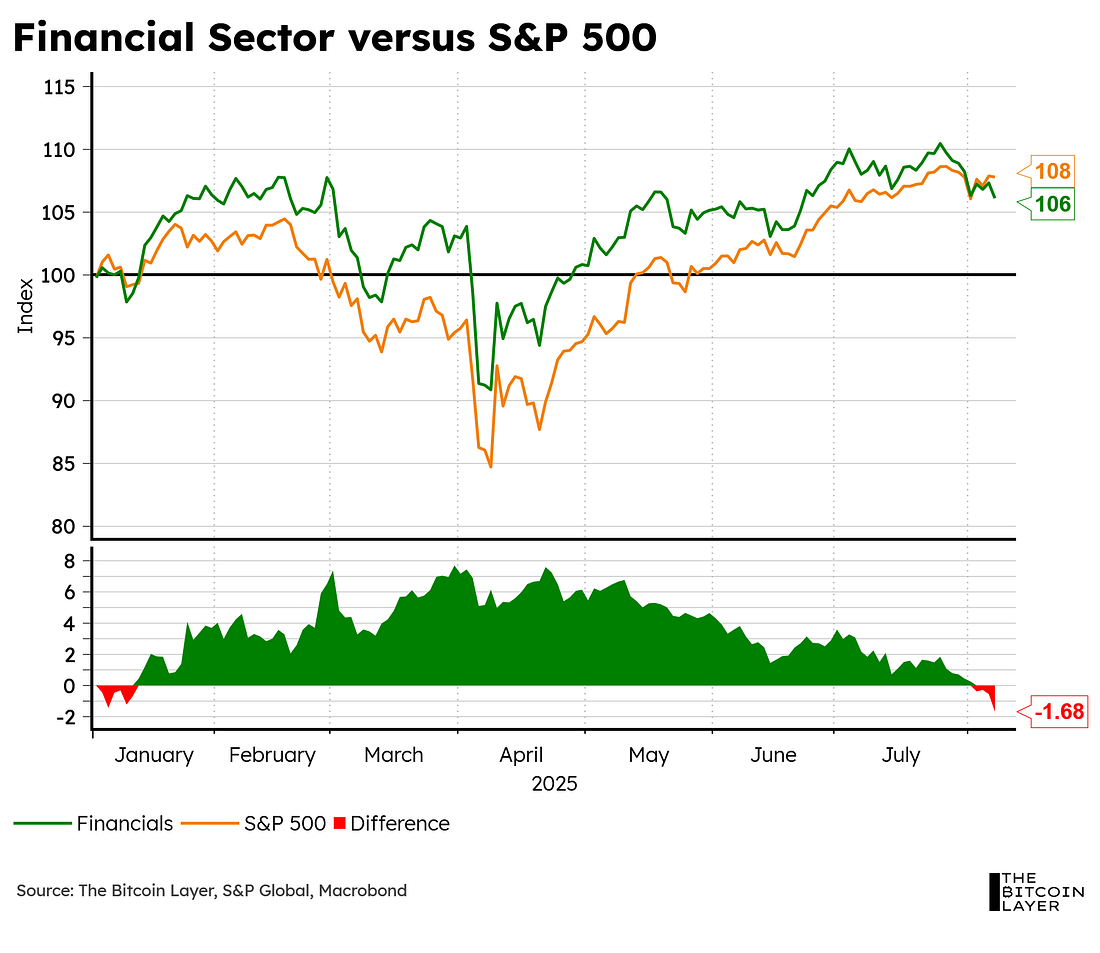

Stay long, stay liquid. Use code “Nik” for 0.5% off interest rate for 2 years. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! Weekly AnalysisFinancial sector performanceWhen compared against other stock market sectors, the financial portion of the S&P 500 is almost smack-dab in the middle, with a 6.1% return so far this year: When compared with information technology, industrials, and utilities, financials lag behind by a decent margin. Comparing the financial sector to the overall market’s performance, we see the effects of the information technology sector finally catching up to the financial sector, leading the overall market to outperform finance for the first time since January of this year: However, when we isolate the financial sector and compare this year’s performance to its own performance over the past 10 years, we see a completely different story, and a huge reason why TBL Liquidity has been so strong this year:... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Friday, August 8, 2025

Liquidity Is Booming: TBL Weekly #152

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Paul S. Atkins, Chair of the U.S. SEC, Will Deliver Keynote on Day 1 of DAS NYC ...

No comments:

Post a Comment