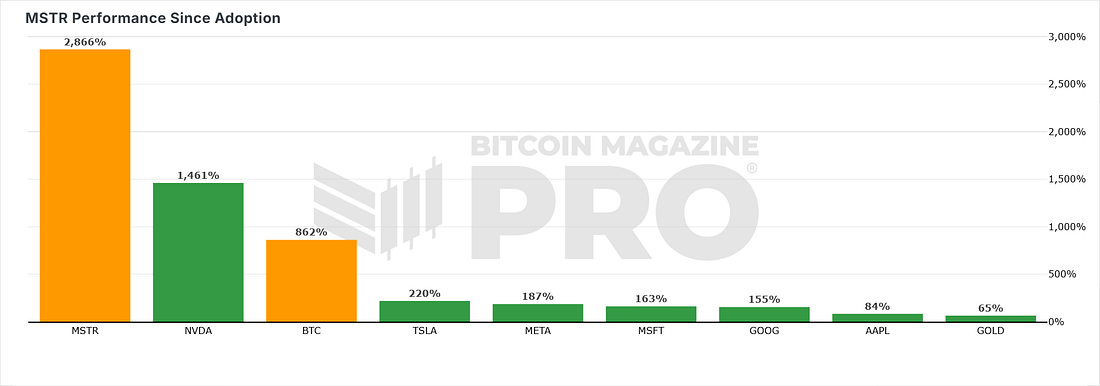

Bitcoin Dips, Institutions Stack: What Comes Next for BTC?Is this just a shakeout? BTC pullback hits key support, Strategy dominates earnings, miners flash bullish signals—and Satoshi’s statue swims.News HeadlinesBitcoin Price ActionBTC has dropped in recent days, and many people are panicking. It is our view at Bitcoin Magazine Pro that this panic is overblown. Many metrics still point to the fact that we are in the middle stages of a bull market. These types of pullbacks are very typical to wipe out any excess leverage among derivatives traders before the price moves back up higher. We also note that BTC price has simply pulled back to the previous high and has retested it. This provides a good area of support for now. Figure 1: Retest of the previous high on the recent pullback. The near-term task for BTC now is to climb back ABOVE the recent range at $120,000 and achieve daily closes above it. That will bring significant confidence back to the market. Confidence has waned somewhat on this recent pullback because over the past month, BTC is now up just +5.69%. Despite this still being a good return, in BTC bull markets, many participants often expect / hope for a lot more. Figure 2: Past month performance of BTC. The Big Story: Strategy earned a cool $10B in Q2 because of BitcoinSurprising even the most bullish observers, the leading Bitcoin-treasury firm Strategy posted roughly $10 billion in net income on just $114 million of revenue, translating to $32.60 in earnings per share in Q2 2025. The windfall flowed almost entirely from Strategy’s 628,791 BTC hoard, now measured under the Financial Accounting Standards Board’s new fair-value crypto rules that took effect this year. Those guidelines let companies run unrealised gains and losses through the income statement, turning Bitcoin’s roller-coaster into an income-statement swing factor overnight. With Bitcoin averaging about $73k during the quarter and sprinting to $118k by late July, Strategy’s pile, roughly 3% of the total global supply, ballooned to an estimated $72 billion. They hold a profit on all the BTC they have acquired of +$25B. Figure 3: Strategy Real-time treasury P&L At Bitcoin Magazine Pro we are able to track in real-time the KPI’s that internal management at Strategy monitor. Satoshis per share in Q2 leapt up to 227,379 per share. This is also a key metric that shareholders want to track so that they can understand if they are getting more bitcoin per share over time. Figure 4: Satoshis per share. To keep buying coins while cushioning volatility, the company is pioneering a series of Bitcoin-backed capital-market instruments. The headline act, STRC, a perpetual preferred stock paying a 9% coupon, pulled in $2.5 billion on launch and could add another $4.2 billion in coming months. Executive chairman Michael Saylor touts the product as a corporate-finance analogue to the iPhone: simple, high-yield, and hard-to-copy. This will likely continue to have a bullish impact on $MSTR stock price, which is currently up +2,866% since the company adopted a bitcoin strategy. Figure 5: $MSTR stock performance since adopting a bitcoin strategy. This gain towers over even the likes of Nvidia during that same time period, and certainly over the big tech names like Meta, Google and Apple. You can track all these metrics for FREE on our Strategy Treasury dashboard here. Platform members are now also receiving alerts when these metrics hit key levels. So if you want to know the latest with (Micro)Strategy, subscribe here. Speak again soon! Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, August 4, 2025

Bitcoin Dips, Institutions Stack: What Comes Next for BTC?

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment