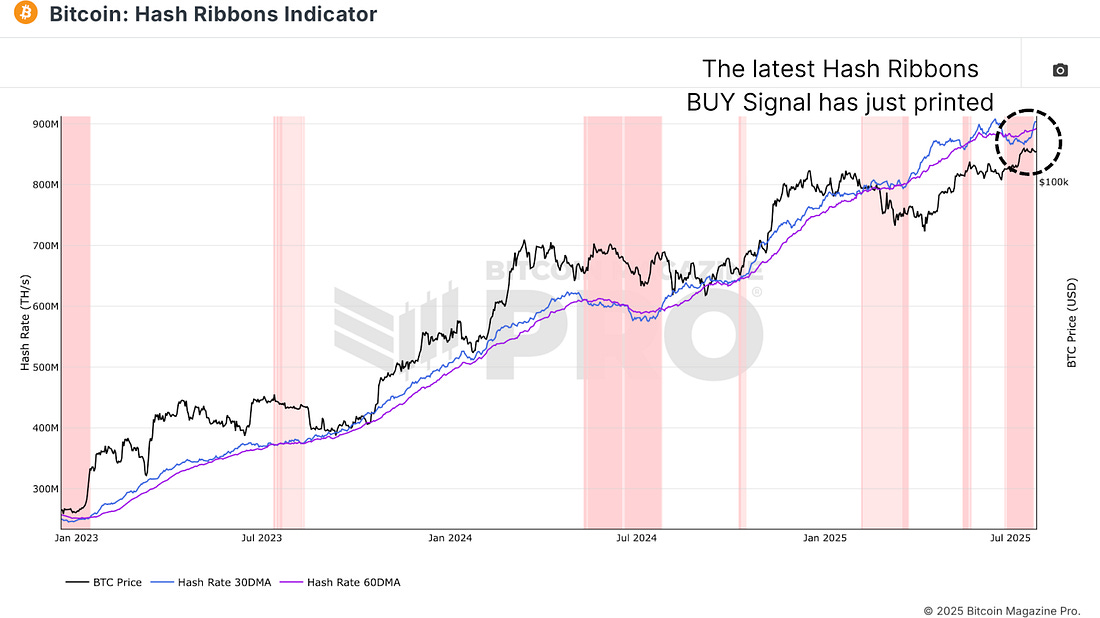

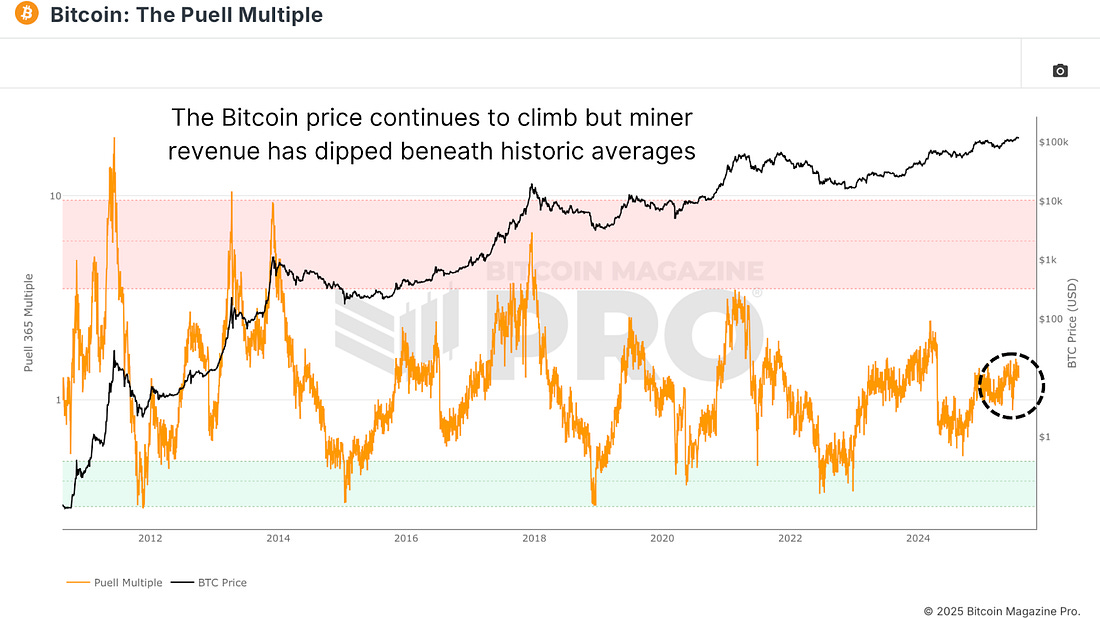

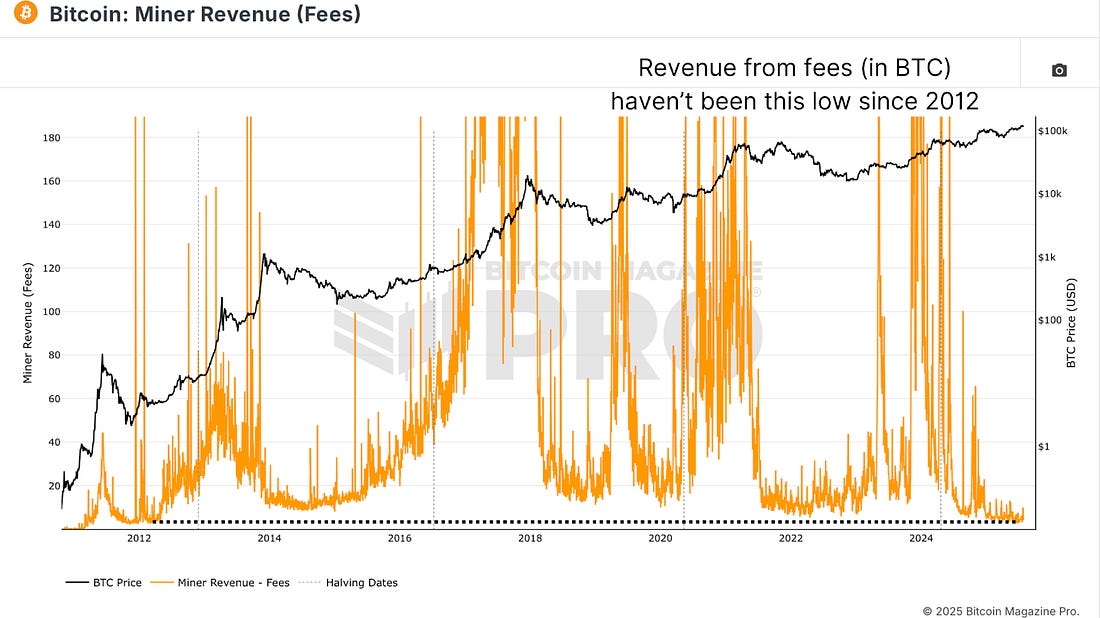

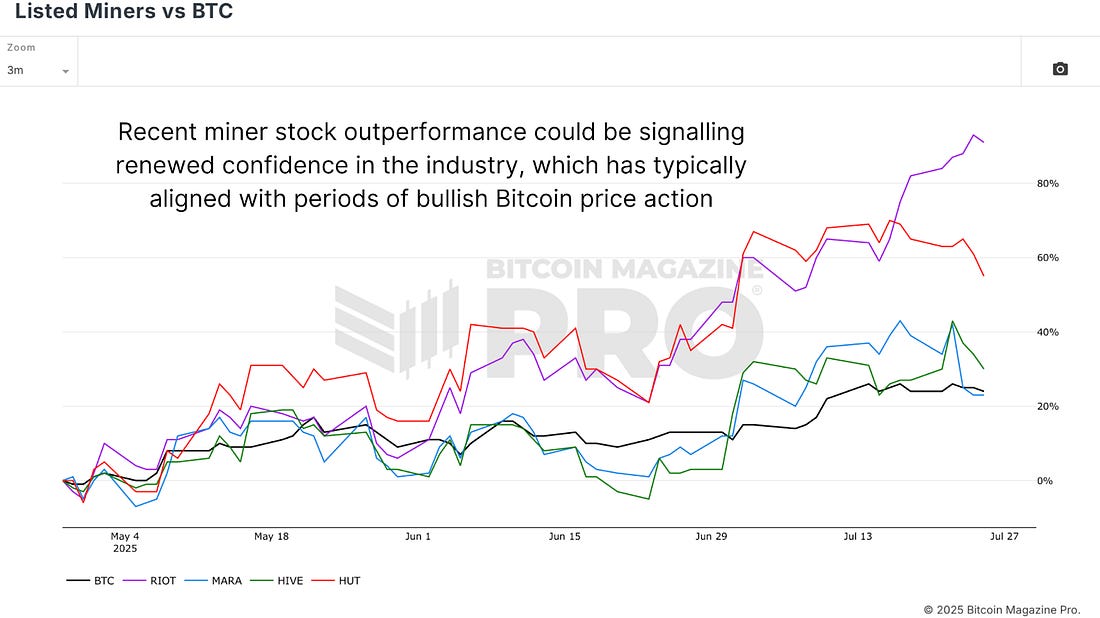

Bitcoin Miners And Market MomentumA rare ‘buy’ signal flashes from the mining sector as stocks surge and margins recover — miners may be front-running Bitcoin’s next rally.With Bitcoin recently consolidating near all-time highs, many are looking to miners for clues about what might come next. Mining data offers some of the most nuanced and real-time signals of market sentiment and profitability, so understanding how miners are reacting can provide deep insights into upcoming price trends. Miner Capitulation We begin by examining the recent pullback in Bitcoin’s hash rate, which triggered one of the most significant drops in Bitcoin Miner Difficulty we’ve seen in recent history. A confluence of factors likely contributed to this decline, notably a seasonal spike in electricity costs, particularly in places like Texas, along with a sustained period of flat Bitcoin price action and thinning profit margins for mining firms. Figure 1: The drop in Bitcoin Miner Difficulty at the end of June was one of the most significant adjustments recorded. The exponential rise in hash rate throughout the cycle has led to growing competition, tightening margins even further. During times of low volatility and stagnant price action, miners sometimes temporarily scale down operations to preserve profitability. Hash Ribbons Signal This drop and recovery in hash rate created a rare signal from the Bitcoin Hash Ribbons Indicator, which tracks the 30-day and 60-day moving averages of the hash rate. When the shorter average crosses below the longer, it signals miner capitulation. But when it crosses back above, like it just has, it generates a “buy” signal. Historically, these buy signals have been among the most reliable indicators for upcoming bullish price action in Bitcoin. Figure 2: The recent occurrence of the 30-DMA crossing over the 60-DMA has triggered a previously reliable “buy” signal. Discover how Meanwhile can help you plan for the future—offering life insurance designed to preserve and grow your wealth in Bitcoin. Miner Profitability Looking at miner revenue in USD terms via The Puelll Multiple, a comparison of current daily earnings to the 365-day average, we saw this metric fall below 1 during the hash rate pullback. This confirms that miners were earning less than their historical average, reinforcing why many scaled back operations. At the lowest, miners were only earning about 89% of their average from the past year. But this quickly rebounded to a recent Puell Multiple of around 1.5, which is a strong sign of profitability returning to the sector. This pattern of capitulation, recovery, and breakout is strikingly similar to behavior seen after the 2016 halving, which led to the massive 2017 bull run. Figure 3: The Puell Multiple rebound after the recent hash rate cut indicates a boost to miner profitability. Long-Term Parallels Despite institutional involvement and the changing structure of Bitcoin ownership, miner behavior continues to follow historic patterns. For example, even though miners now earn significantly less from transaction fees (especially in BTC terms) than they did in past cycles, the hash rate continues to rise. This shows miners remain deeply bullish, positioning themselves ahead of anticipated future price appreciation. It also speaks to the resilience and long-term outlook of the mining sector. Fees may be declining due to efficient scaling solutions like the Lightning Network and shifts in Bitcoin’s narrative, but miners are still investing heavily. Figure 4: Current Miner Revenues from transaction fees are the lowest since 2012. Mining Stocks Bitcoin mining stocks are usually a leveraged play on the price of BTC, and they tend to lead price action. Recently, Listed Miners stocks have outperformed Bitcoin itself. For instance, Marathon Digital and other listed miners began rallying significantly before Bitcoin’s move to new highs. Historical analysis confirms that in past bull markets, mining stocks would peak before Bitcoin’s major tops, giving a potential early warning for cycle euphoria. Right now, those stocks are accelerating again, a potential signal that traders are pricing in further upside. Figure 5: Over the past three months, Listed Miners stocks have outperformed Bitcoin. Conclusion Recent miner behavior is pointing toward renewed confidence and bullish expectations in the Bitcoin market. The hash ribbons buy signal, recovering Puell Multiple, and continued hash rate growth all suggest that the worst of miner capitulation is behind us. Meanwhile, mining stock outperformance hints at further upside. Although these signals should be used in conjunction with broader market analysis, they provide strong evidence that miners expect Bitcoin’s next leg up could be just around the corner. For a more in-depth look into this topic, check out a recent YouTube video here: Where Do Bitcoin Miners Expect Price To Go Next  Matt Crosby Lead Analyst - Bitcoin Magazine Pro Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, August 1, 2025

Bitcoin Miners And Market Momentum

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment