Dear Readers, This past week was a busy one—not only in markets, given all the announcements and data that came out, but also for The Bitcoin Layer. As the last full month of the summer gets going here, we wanted to finish it off with a bang! We are collaborating with Michael Howell and the Crossborder Capital team this month to bring our TBL Pros a co-written article on liquidity. Michael Howell will also join the panel in this month’s Live Q&A, so you can ask him questions yourself! Go to our Q&A Hub for the registration link: Okay, but enough about us, let’s get to what you really came here for: our weekly analysis. One of the great things about TBL Liquidity is that, with a single metric, we cover a myriad of things happening in the overall macro environment; this is why we like to start our bitcoin analyses with TBL Liquidity—it works as an anchor point. Accordingly, today’s article will go over:

So, without further ado, let’s dive into TBL Weekly #151. Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk. Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys. Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account. We are also happy to announce our newest sponsor this month: Arch Lending! At TBL, we help you decode Bitcoin’s macro trends and give clear market signals—holding Bitcoin is just the beginning. Arch lets you borrow against your Bitcoin—unlock cash without selling:

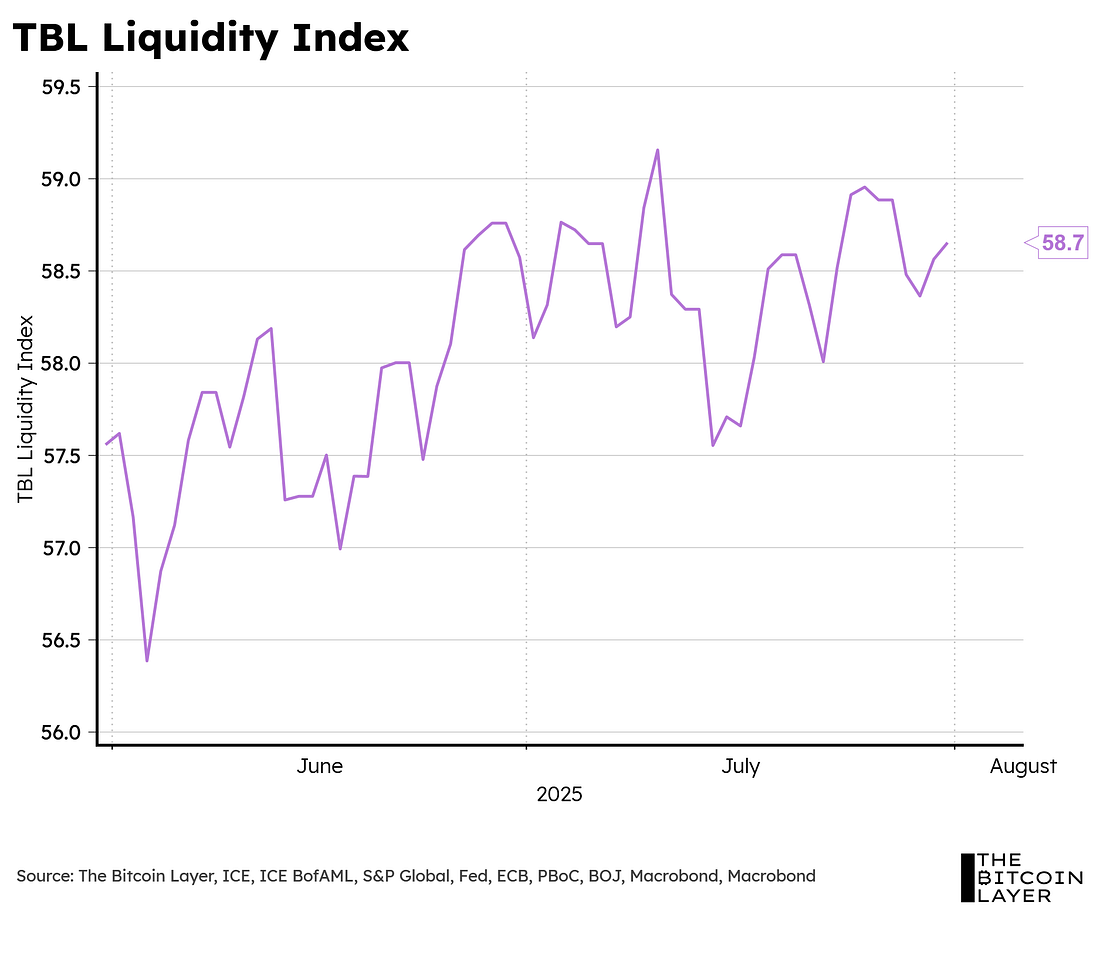

Stay long, stay liquid. Use code “Nik” for 0.5% off interest rate for 2 years. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! Weekly AnalysisTBL LiquidityMany of you have access to this daily-updated chart already through your TBL Dashboard, but to provide a little more context on the chart, our TBL Liquidity Index has been designed to show liquidity conducive environments when it lies above the 50-level: As you can see, 2025 has remained above 50 (even throughout Liberation Day’s turmoil). In short, liquidity in the financial system has remained relatively ample throughout 2025 and has now reached somewhat of a plateau, bouncing between the 57-59 range since mid-June: This has led to our TBL Quarterly Liquidity Cycle printing negative for the first time since late April (again, something you have access to in your TBL Dashboards on a daily basis) - note that we will also review a ‘buying’ strategy at the end of this article using the chart below: Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Friday, August 1, 2025

TBL Liquidity, US Rates, and More TBL Strategies: TBL Weekly #151

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Our bi-weekly quantitative risk report for TBL Pros: December 17th, 2025 Edition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's the time of year that Bankless busts out the crystal ball. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

The future of onchain real-world assets is a winner-takes-most game, but who are the contenders besides Ethereum? ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment