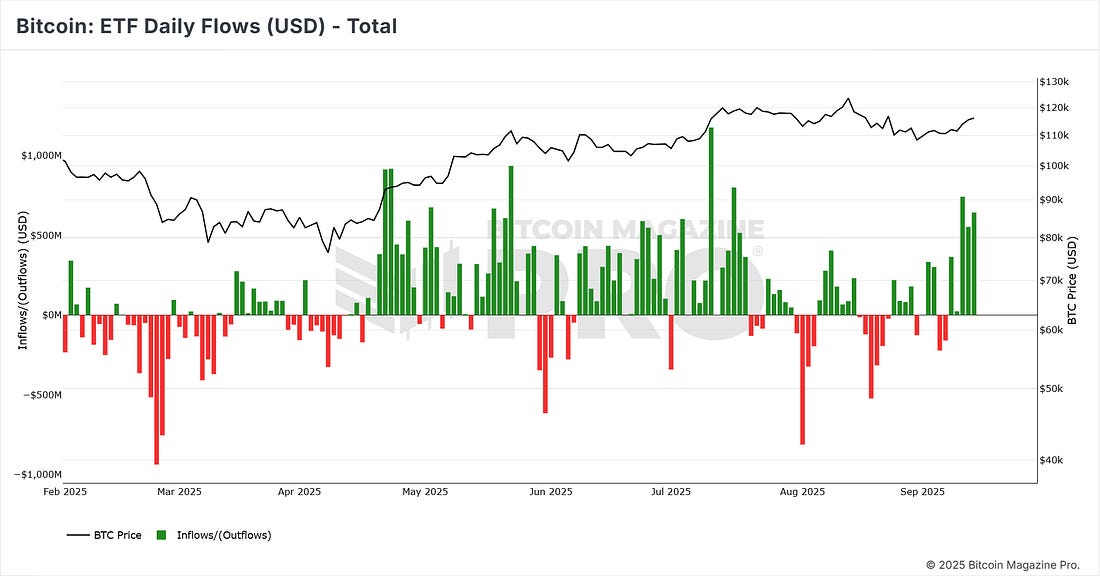

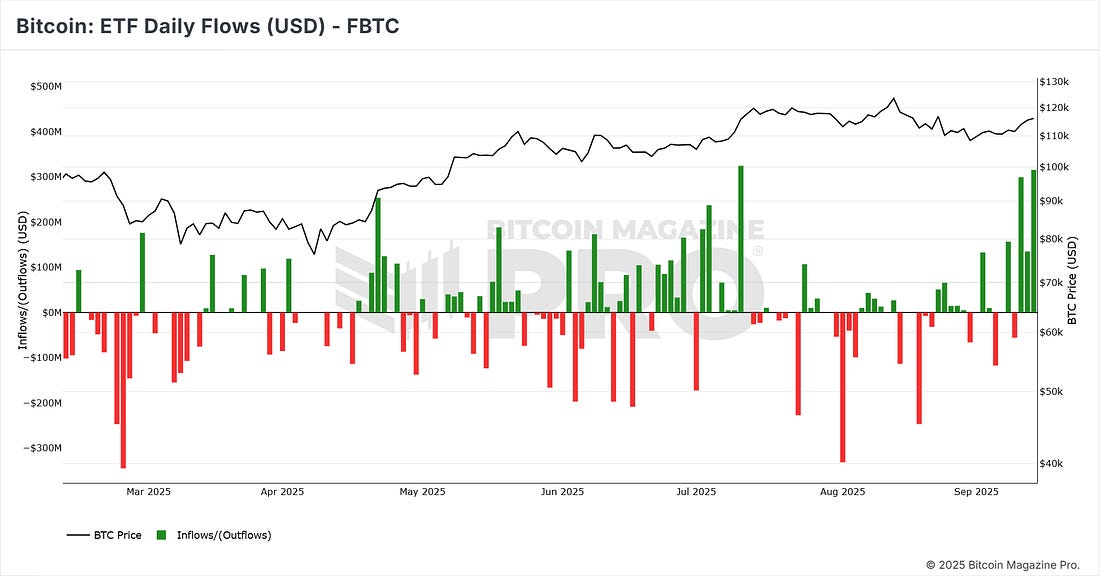

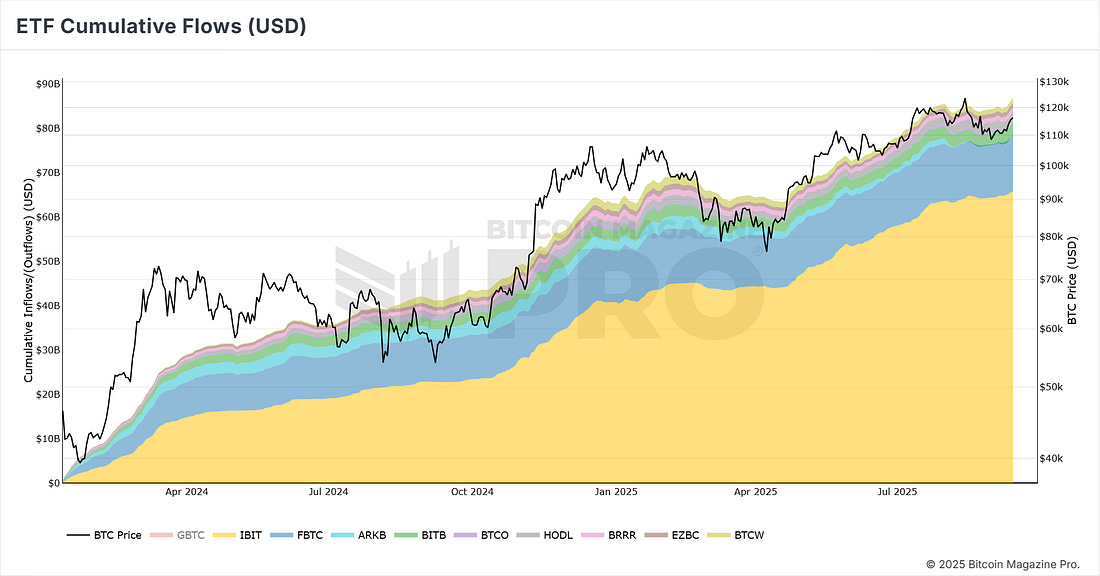

Bitcoin ETF Inflows Surge Ahead of FedWinklevoss twins predict Bitcoin could surge 10x as ETF inflows climb.What’s Happening Price Action In last weeks update we stated we were bullish BTC and that we expected it to rally off the 128-day moving average. That is exactly what has happened over the past week with BTC up +4.83%. Figure 1: BTC steadily climbing up this past week. BTC price has continued to push away from the 128 day moving average, a critical moving average in Bitcoin bull markets and is making its way back up towards $120,000. Figure 2: BTC pulling away from its key moving averages. In addition, price has also bounced off the Short Term Holder Realized price, another key area of support in Bitcoin bull markets. Figure 3: Short Term Holder Realized Price. The STH Realized Price acts as a broad area of support for BTC price in bull markets. It appears to be doing the same again right now. You can learn more about this important onchain metric here. We expect initial resistance for BTC to appear ahead of the previous all-time-highs at around $120,000. Figure 4: Potential upcoming area of resistance. The Big Story: Big Week For Bitcoin ETFs U.S. spot Bitcoin ETFs are seeing their strongest inflows in months as traders position ahead of the Federal Reserve’s September 17 meeting. The major Bitcoin ETF funds pulled in more than $2.3 billion over the past week, marking five straight days of positive flows. Figure 5: Bitcoin ETF inflows building up steam late last week. Daily inflows have been striking: $741 million on September 10, $552 million on September 11, and $642 million on September 12. Fidelity’s FBTC and BlackRock’s IBIT remain the top magnets for capital, with Fidelity alone drawing $315 million on Friday last week. Figure 6: Fidelity saw major inflows last week. Bitcoin’s price has rebounded above $115,000, boosted by expectations that the Fed will ease policy. A Reuters survey showed nearly all economists expect a 25 basis point rate cut, with more reductions likely before year-end. Recent soft inflation data, including an unexpected drop in producer prices, has strengthened the case for looser monetary conditions. Lower rates typically benefit risk assets, and ETFs are increasingly seen as the easiest on-ramp for pensions, hedge funds, and asset managers to gain exposure to Bitcoin. The strong inflows suggest Bitcoin is becoming a mainstream portfolio allocation, not just a speculative trade. This can be seen in the cumulative inflows into the Bitcoin ETFs since their inception with BlackRock’s IBIT (yellow section of the chart) dominating the cumulative inflows. Figure 7: Up only cumulative inflows into the Bitcoin ETFs. With liquidity set to improve and institutions stepping up allocations, we see this latest wave as a foundation for potential new highs in Bitcoin later this year. Buckle up, and we’ll be back with more insights as the Fed decision unfolds. Bitcoin Magazine Pro Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else. We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Tuesday, September 16, 2025

Bitcoin ETF Inflows Surge Ahead of Fed

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Bitcoin's Hidden Strength: Why 2025's Pain Signals a 2026 Bottom ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

From $78B Leverage Wipeout to $250K Upside: Galaxy Digital's Long-Term Bitcoin Outlook ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Financial conditions are easing, ETF outflows are fading, and the odds are shifting toward recovery ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Saylor's Stark Warning: MSCI Exclusion Could Trigger Massive Bitcoin Market Shockwaves ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment