BitMine's Two Million ETH gm Bankless Nation,

The digital asset treasury buzz is alive, with top players stacking and new recruits joining the fray. Today's Issue ⬇️ - ☀️ Need to Know: Two Million ETH

BitMine keeps making ether buys. - 🗣️ Tactic: Get Started with Jupiter Lend

How to check out the DEX's major expansion.

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI. . . . NEED TO KNOW BitMine's 2M ETH - ⛏️ BitMine Treasury Holdings Surpass 2 Million ETH. The public DAT company bought over 319K ETH last week!

- 🪶 Robinhood Joins S&P 500, Strategy Gets Snubbed. HOOD jumped 15% on inclusion news, while MSTR dipped as its BTC-driven profits failed to sway the index committee.

- 🚤 OpenSea Launches $1M NFT Reserve. The marketplace’s new Flagship Collection will collect notable NFTs as a long-term cultural treasury.

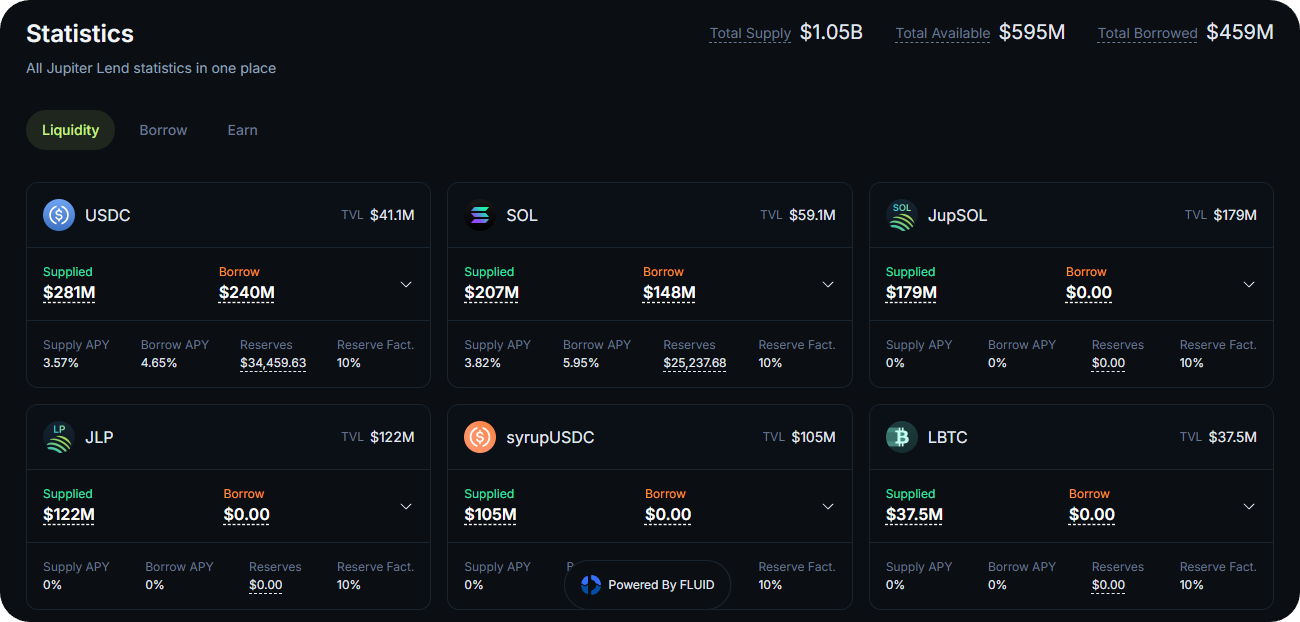

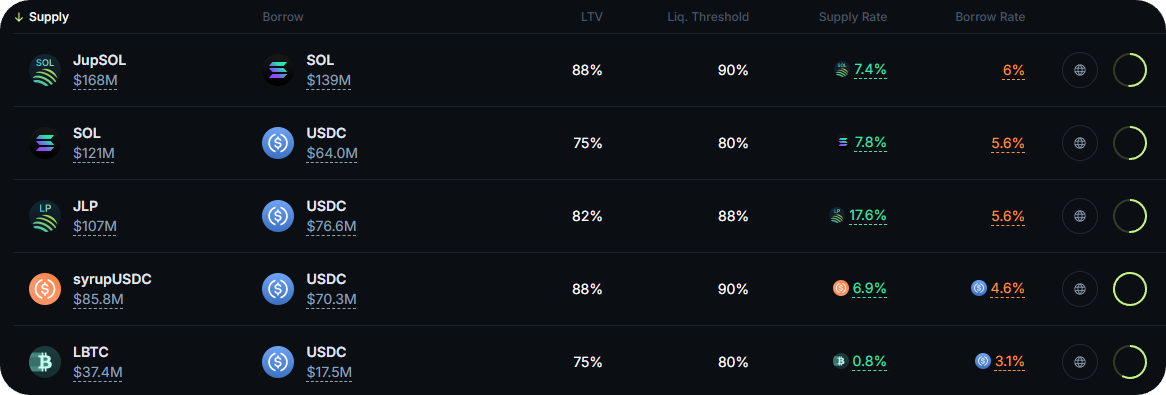

📸 Daily Market Snapshot: Crypto markets saw minor gains after a quiet weekend, but all eyes remain firmly fixed on next week's Fed rate cut decision. One of the biggest movers today was Worldcoin, which is up 82% this week following the launch of a DAT backing the asset. | Prices as of 6pm ET | 24hr | 7d |  | Crypto $3.88T | ↗ 1.4% | ↗ 3.7% |  | BTC $112,369 | ↗ 1.0% | ↗ 3.9% |  | ETH $4,315 | ↗ 0.3% | ↗ 1.2% | . . . TACTIC Getting Started with Jupiter Lend Jupiter recently opened the Jupiter Lend public beta, marking the DEX giant's expansion into money markets on Solana. Built alongside the Fluid team, whose own protocol has become a dominant force in Ethereum’s lending scene, Jupiter Lend brings a streamlined UX for Solana lenders and borrowers. Less than two weeks after launch, the new protocol has already crossed $1B in TVL, making it one of the fastest-growing DeFi rollouts ever. It's one to watch, so let’s walk through how you can explore it yourself. Starting with StatisticsIf you're like me, you like to get a bird's-eye view of a DeFi project before diving in. Accordingly, consider first heading to the Statistics hub at jup.ag/lend/statistics. This page provides a one-stop overview of all Jupiter Lend's current activity, like TVL levels, supply APYs, borrow APYs, etc. You can flick through the "Liquidity," "Borrow," and "Earn" tabs to analyze and find opportunities that suit you. Lending with EarnAfter scoping things out, you can start locking in some passive yields by heading to the Earn hub at jup.ag/lend/earn. Here, you can deposit SOL or stablecoins, after which Jupiter Lend automatically routes your funds for the optimal available returns. Just choose your asset, deposit, and the protocol handles the rest. If you decide to take the leap in, click on your Vault of choice to bring up the deposit UI. Just keep in mind that Jupiter Lend enforces dynamic withdrawal limits, so how much you can withdraw may vary depending on the protocol's flows at the time. Onto BorrowingIf you want to supply crypto and borrow against your funds, then head to the Borrow hub at jup.ag/lend/borrow. This is where Jupiter Lend uses isolated vaults and its new liquidation engine to facilitate onchain borrow positions. Here, you'll find pairs of supply assets and borrow assets, like SOL + USDC, LBTC + USDC, etc. First, review the vaults' available metrics, like loan-to-value ratios (how much you can borrow against your collateral), liquidation thresholds (the limit at which some of your collateral may be liquidated), and supply and borrow APYs. Once you've found a pair you like, click into it. Next you'll be prompted to deposit some of the required supply asset, after which the UI will let you draw your loan in the borrow asset up to the designated LTV amount. Also, on the individual pair pages, you'll find "Bundled Actions" like Deposit & Borrow, Repay & Withdraw, Deleverage, etc. for easier management. Just remember to keep an eye on your loan's liquidation threshold and repay or add more collateral as needed. Leveraging with MultiplyFor the degens among us who like dabbling with leverage, you can also check out the Multiply hub at jup.ag/lend/multiply. Here, you can readily loop your collateral with borrows to lever up exposure. In other words, you borrow against your collateral, then the borrowed asset is swapped back into your collateral asset, and you can do this up until a certain max leverage limit. The hope is to amplify your returns. But with bigger potential rewards also comes bigger potential liquidation risks, so use caution if you decide to explore here! FRIEND & SPONSOR: FRAX The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem. |

No comments:

Post a Comment