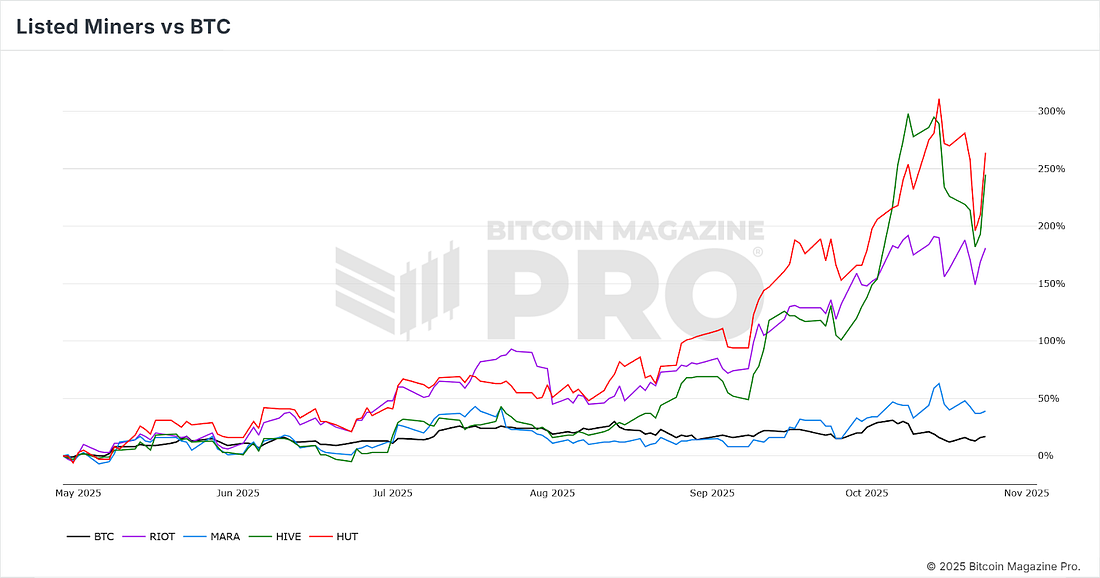

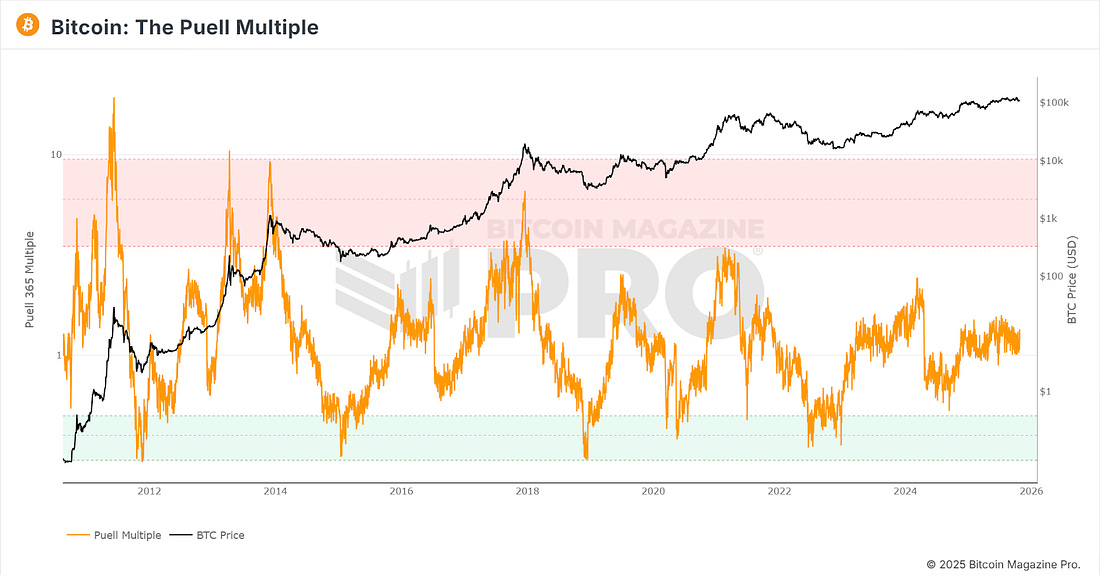

Bitcoin miners surge ahead of BTCBitcoin Miners Eclipse BTC: RIOT Soars 181% as Jane Street Bets Big!What’s HappeningPrice ActionBTC price action continues its roller-coaster ride as price rebounds from the recent lows. Over the past week price is now up +5.53%, with much of those gains coming in the past 24hrs. Figure 1: BTC price is trending up in recent days. These gains now mean that BTC is reclaiming the 128-day moving average. Figure 2: BTC reclaiming the 128-day moving average. In recent Weekly Alphas, we discussed the 200-day moving average holding as support, which played out as BTC has rebounded from that area. Currently, conditions look bullish with BTC back above all three key moving averages. The Big Story: Bitcoin Miners Outpacing BTCOver the past six months, Bitcoin has climbed a modest 17%, yet several major mining stocks have skyrocketed. Data from BM Pro’s Bitcoin Miners Performance Chart shows RIOT +181%, HIVE +245%, and HUT 8 +264% over the same period. This is a dramatic divergence that underscores how miner equities often act as leveraged plays on Bitcoin’s price. Figure 3: Hut 8, Hive, and Riot significantly outperforming BTC. Part of this recent rally was sparked by disclosures that trading giant Jane Street accumulated multi-percent stakes in leading miners like Bitfarms, Cipher Mining, and Hut 8. Investors have also rotated toward miners as a way to gain “upside beta” on Bitcoin without directly holding BTC. However, these gains come with significant risk. Unlike Bitcoin itself, a fixed-supply asset immune to operating costs, mining companies face volatile electricity prices, regulatory uncertainty, capital-intensive expansion cycles, and heavy dilution when raising funds. Their margins can evaporate quickly if BTC consolidates or energy costs spike. A useful lens for understanding miner behaviour is the Puell Multiple, which tracks miner revenue relative to historical norms. Figure 4: Puell Multiple. When the Puell Multiple (orange line on the chart) rises sharply, it indicates miners are generating outsized revenues. This makes them “wealthy” relative to their historical norms. In previous cycles, these periods have coincided with market exuberance and BTC topping out for the cycle. So while miners can be a profitable way to ride Bitcoin bull markets, their outsized performance can also serve as a warning: when miners get too flush, the market may be nearing frothy territory. The Bitcoin Magazine Team. Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Monday, October 27, 2025

Bitcoin miners surge ahead of BTC

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Synthetix and Lighter are melding fast perpetuals trading with Ethereum finality! ...

-

Also Bitcoin’s Drawdown Looks Sentiment-Driven, Not Structural & The Bond Market Is Signalling Easier Conditions Ahead ͏ ͏ ͏ ...

-

Corporate BTC Hoard Tops 1M – But Miners Are Outpacing the Surge ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Taking the pulse of Mantle, one of the hottest Ethereum L2s in recent months. ...

-

From Panic to Power: Bitcoin's Swift Rebound After the $19B Wipeout ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment