| Dear Readers, Welcome back to another edition of Mean Median Mode—a quantitative risk report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters. So, without further ado, here’s our latest risk report.

Bitcoin: Technical Analysis TBL Liquidity Analysis Bitcoin: Correlation Analysis Bitcoin: On-Chain Analytics US Rates Analysis Fed and Money Market Watch

Is the fiat retirement system sinking? With markets uncertain, layoffs on the rise, and monetary policy shifting, it might be time to rethink how you protect your long-term savings. On October 28 at 12 PM CT, Mark Moss and Unchained’s Jeff Vandrew will cover: Why the “illusion of wealth” hides the true weakness of fiat-based retirement accounts Why bitcoin’s scarcity and growth curve make it the cheat code for retirement planning How rolling an old 401(k) into a bitcoin IRA could offer tax advantages and help build generational wealth Learn how bitcoin can protect your purchasing power, strengthen your retirement plan, and offer a level of sovereignty no other retirement asset can.

Tuesday, Oct 28 at 12:00 PM CT — online, free to attend. Register Now

We are also happy to announce our newest sponsor this month: Arch Lending! At TBL, we help you decode Bitcoin’s macro trends and give clear market signals—holding Bitcoin is just the beginning. Arch lets you borrow against your Bitcoin—unlock cash without selling: Instantly access a Bitcoin-backed line of credit Borrow from just $5k for up to 2 years No rehypothecation. Ever. Insured custody at Anchorage Digital

Stay long, stay liquid. Use code “Nik” for 0.5% off interest rate for 2 years. Start Today

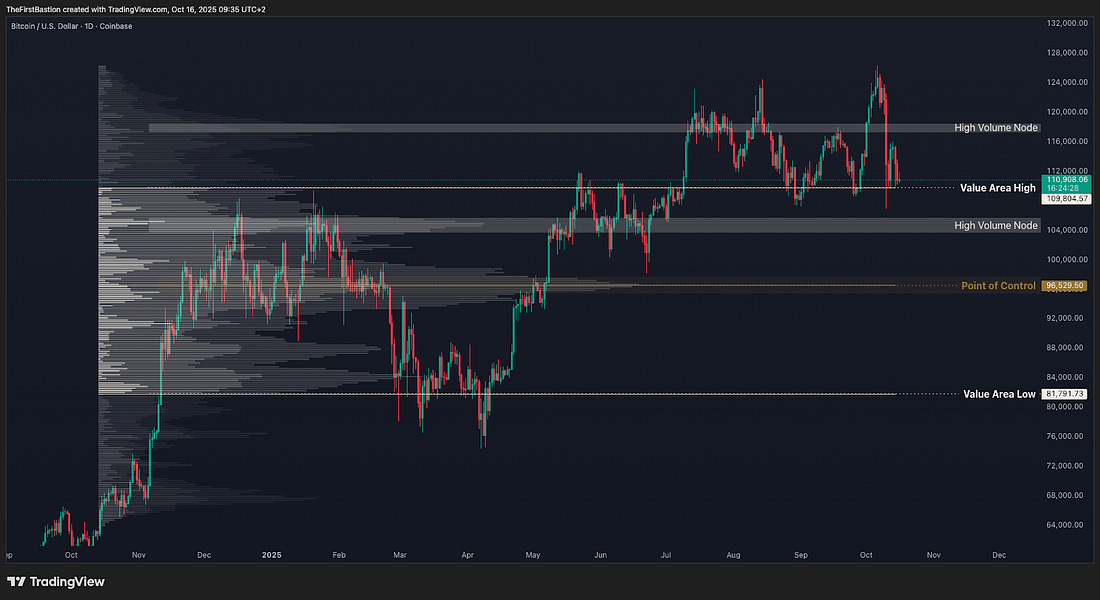

Since our last risk report two weeks ago, much has happened — yet at the same time, nothing has. Back then, we had just seen a bullish engulfing candle that we identified as a probable trend reversal, which indeed pushed the price to new all-time highs. While price moved slightly higher, it got rejected, and we didn’t see a convincing rally or sustained breakout. The price of bitcoin gained almost $16,000 in seven days — quite a lot — so some short-term consolidation was expected. But this “consolidation” turned into a massive sell-off. Nik and James covered this in the most recent collaboration, which we encourage you to check out if you haven’t already. While they broke things down in a very detailed and well-written manner, we would like to highlight one additional point, which we’ll cover in the Low Timeframe section. For now, on the High Timeframe, the key to remaining bullish is not to lose all the ground gained during the most recent rally. You can mark the starting point of that rally around $110,000, and ideally, we don’t want to lose that level. The first sign of strength after that would be the price regaining the STH Cost Basis around $113,500. As we often mention, you also need to be prepared for what could happen if price loses that $110,000 area. Being prepared doesn’t mean you need to act on it — it means being mentally ready so you don’t react emotionally if it happens. The first key level below is the 200-Day Simple Moving Average, currently around $107,000. Especially for TradFi participants, this is an important threshold where investors and algorithms often make decisions when price breaks below it. The real line in the sand lies between $98,000 and $94,000. The chart might look crowded, but that’s because there’s significant confluence around that zone: Point of Control: the area where the most trading volume has occurred over the past 12 months. MVRV Ratio Mean: what we call the Market Divider — historically separating bull from bear markets. When bitcoin trades above it, we’re in a bull market, and vice versa. Minimum STH Value: we’ll revisit this in the on-chain section, but historically, price hasn’t closed below this level (aside from brief wicks) during bull markets. STH MVRV -1σ: the lower band of our framework for expected future price action. The bitcoin price has traded within these bands for the last three years, and if the bull market continues, we should remain within or above them.

Let’s not get too far ahead of ourselves — we’ll revisit these levels if we even get there.

Let’s first take a look at the daily timeframe with the Fixed Volume Profile of the past 12 months. Even though the market experienced one of the largest crypto liquidation events — in absolute terms — in its entire history, the price of bitcoin still managed to hold above the VAH (Value Area High). This area is somewhat subjective, as it depends on the settings of the Fixed Volume Profile. The idea behind it, however, is that it represents the zone where roughly 68% of trading activity (within one standard deviation of a normal distribution) has occurred. If the trend — meaning price continues to trade within this large range — holds, the gravitational pull is toward the Point of Control (POC), which represents the 50% area. Still, it shows strength when price manages to stay above the VAH.

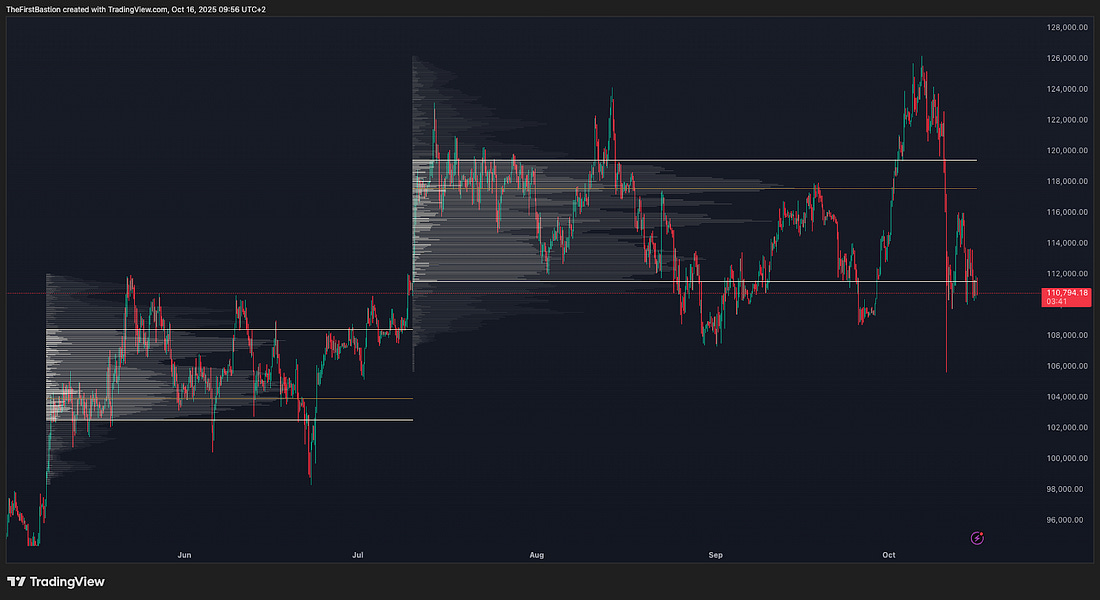

Down to the 4-hour chart — the data we use here comes from the bitcoin index, which aggregates prices from multiple exchanges. This gives a more accurate view of where price is trading, rather than relying on a single exchange that can show discrepancies, especially during volatile periods like we saw over the weekend. The wick down toward $105,000 is becoming more visible. But as we saw in the previous chart, the bitcoin price has recovered back into the range between $110,000 and $126,000. Again, if we lose this range, price will likely move lower into the previous one — between $98,000 and $110,000 — which brings us very close to our line in the sand.

The liquidation cascade last weekend was absolutely brutal — especially for “crypto” traders. The point we want to add is that it was more nuanced than most people think. Yes, the broad takeaway is that some traders misuse leverage and get liquidated. But this was a crypto-wide liquidation that dragged bitcoin down with it. Nik and I covered, in a recent video, the signs we watch for when the bitcoin market itself gets too over-levered. This time, there weren’t real signs that bitcoin was due for a flush. Sure, open interest had been rising, but with a larger market cap, it’s normal for OI to rise in dollar terms. We could write an entire report on what happened, but getting overly technical won’t add much for readers who are investors focused on macro rather than the crypto micro. But we do think it’s essential for TBL Pros to get an understanding of the crypto market dynamics. What’s essential for understanding this move is the term cross-asset margin. Many crypto traders are trying to increase their bitcoin stack. They park a portion of their bitcoin on exchanges as collateral to open crypto swap (perpetual futures) positions — say on ATOM or SUI. Their bitcoin functions as cross-asset collateral to meet margin on those non-bitcoin perps. When Trump floated potential China tariffs, risk assets took a hit. Algorithms, trained on the April 2025 “tariff tantrum” pattern, started decreasing exposure — partly risk management, partly opportunistic. Bitcoin, used as collateral, dipped from $122,000 to $117,000, which is a sharp but not unusual move. Then came contagion. Some altcoins fell 50–75% in minutes during illiquid weekend trading as market makers stepped aside to avoid taking a big haircut. Illiquidity plus forced selling cratered prices. Even modest leverage could wipe traders out in that tape. Back to cross-asset margin: longs on those alt perps got liquidated as prices plunged. Liquidation means their bitcoin collateral is auto-sold at market — right in the worst liquidity — adding sell pressure to bitcoin. That, in turn, can trip stops and liquidations on bitcoin perps (with or without leverage) as key levels break. It got worse with reports of exploiters attempting to momentarily depeg a stablecoin (e.g., USDe) on Binance. Because Binance uses its own spot market to value some collateral (rather than an external index), a local depeg makes that collateral worth less and can trigger automated selling by Binance. Traders who posted USDe as collateral could be liquidated not because their P&L blew out, but because their collateral’s value was halved in ~30 minutes. You get the picture. The addition we wanted to make is: this wasn’t just “OI was up so the market needed a flush.” The dynamics were cross-collateral, venue mechanics, and weekend liquidity — a crypto liquidation that pulled on bitcoin, not the other way around.

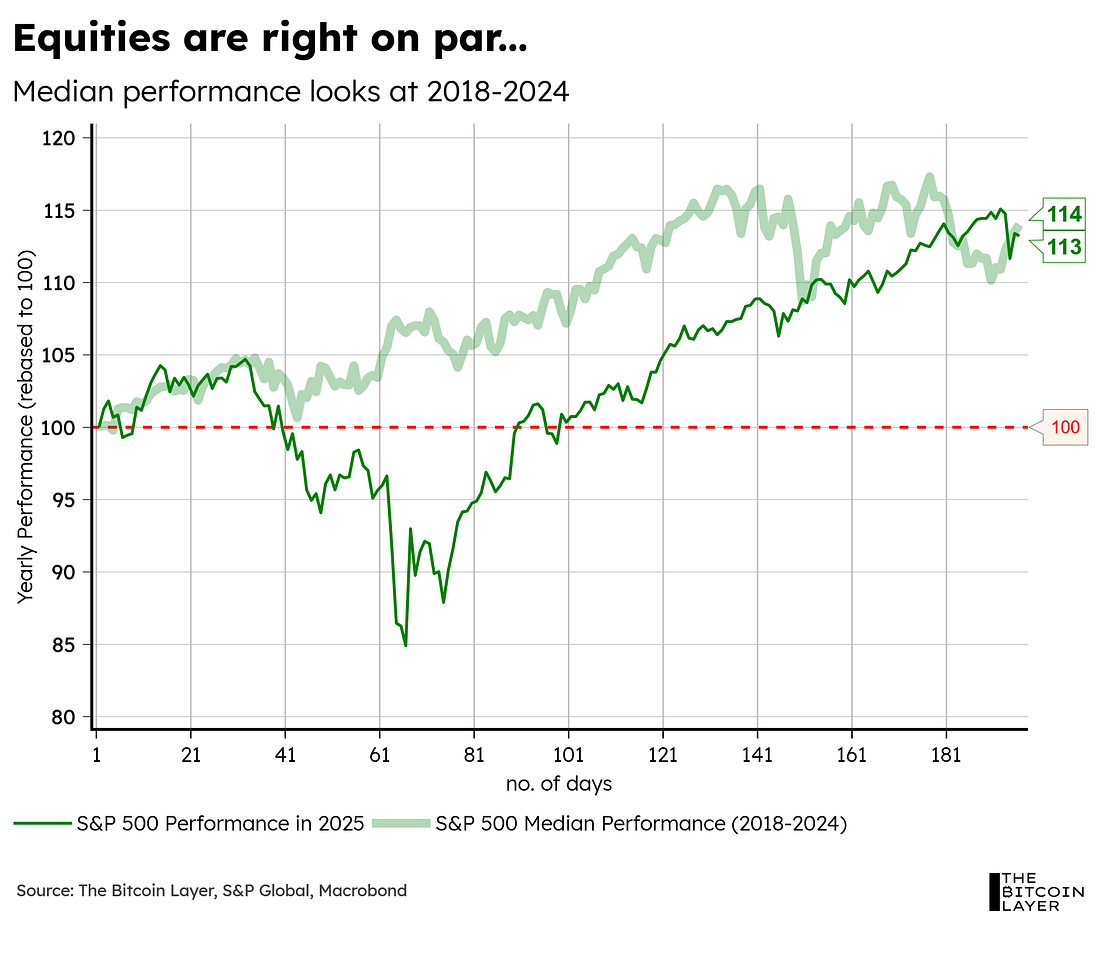

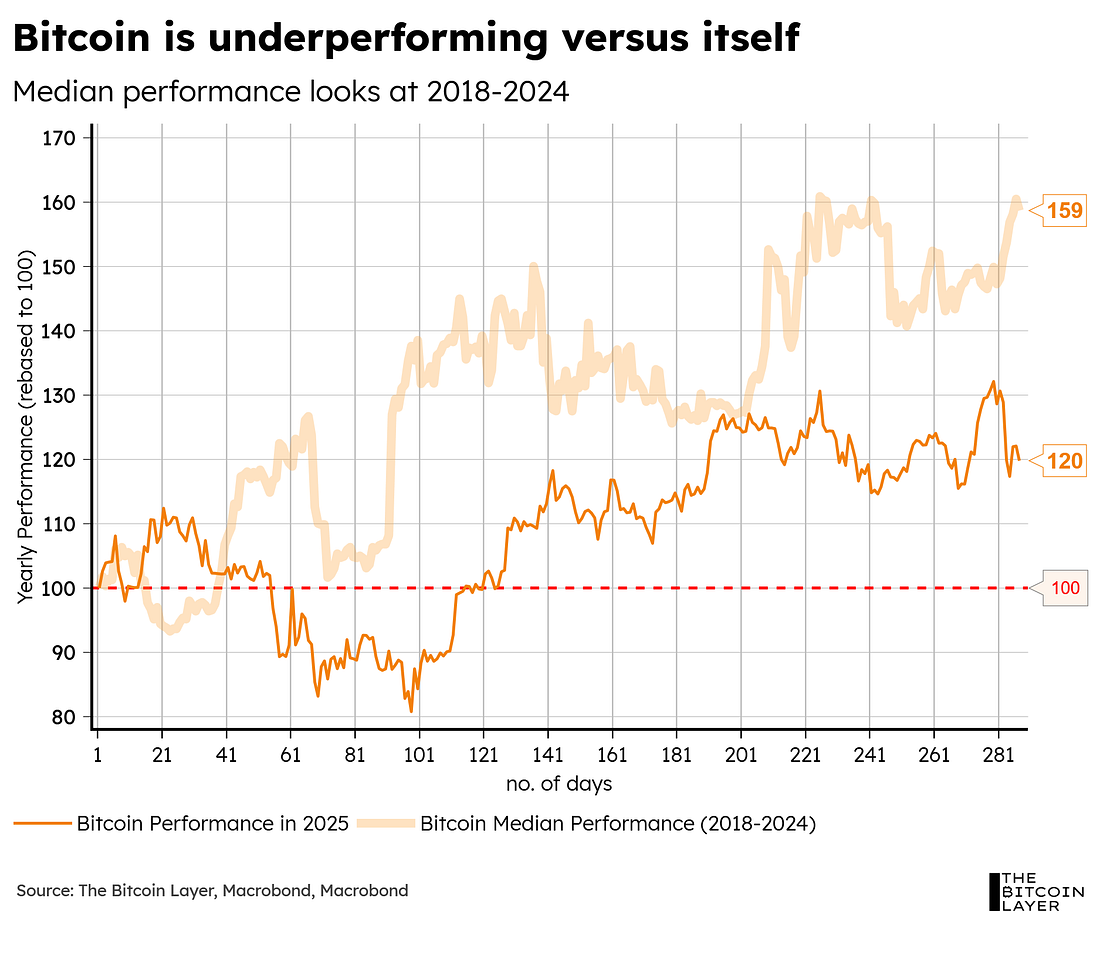

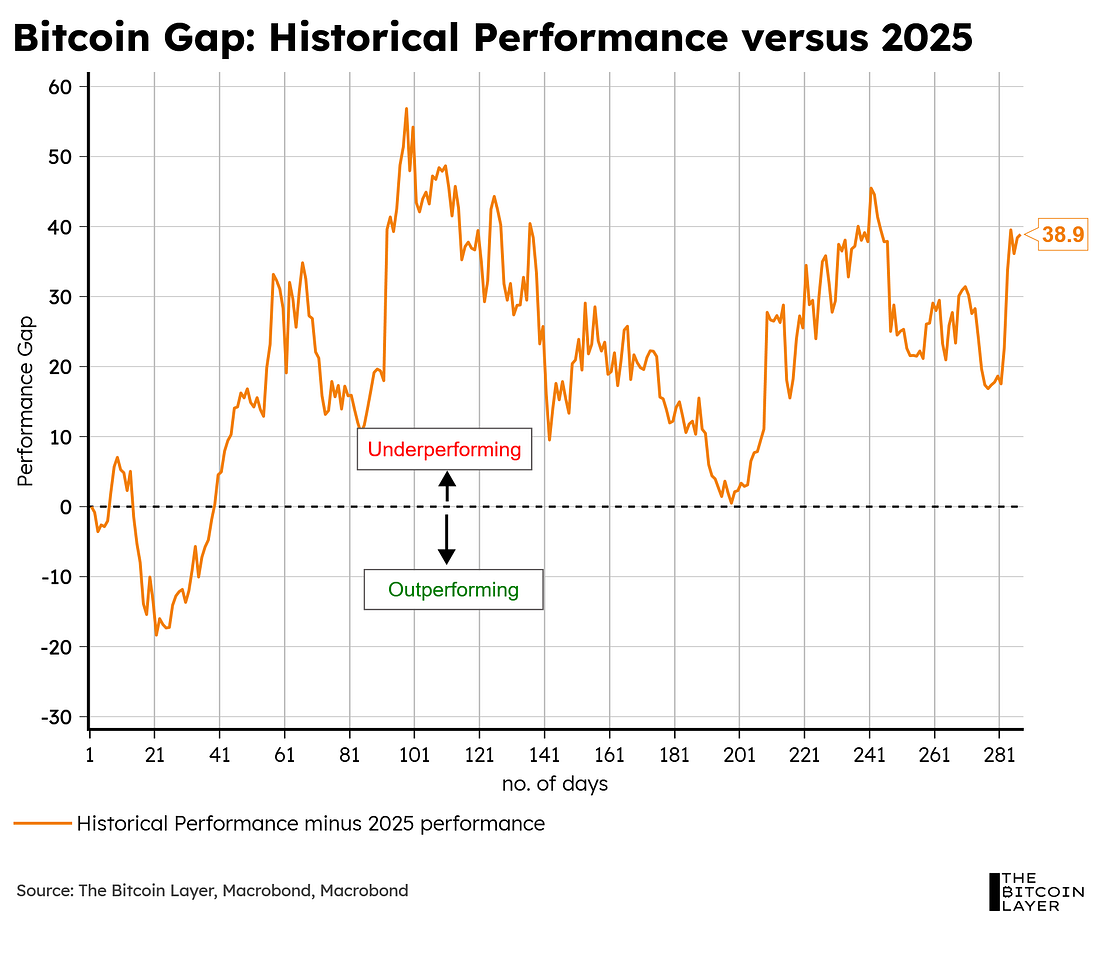

So far this year, equities have made a Cinderella story-like comeback since the ‘detox’ days back in Q1. If you bought equities in New Year’s and held through Liberation Day’s turmoil all the way to today, you are currently standing exactly where the stock market has stood at this point in the year over the past 7 years: The same cannot be said about bitcoin, unfortunately: For a second there, during July’s runup—and even at the start of this month—bitcoin began closing the gap with its previous self, but with last week’s turmoil, the gap widened again (line from chart below goes up)…2025’s bitcoin is clearly struggling to match its previous self: We wanted to see how our TBL Liquidity Indicator Strategy has performed in comparison to bitcoin’s 2025 run so far:... Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you: | TBL Pros receive a bi-weekly 'Mean, Median, Mode' report |  | TBL Pros attend monthly live Q+A sessions |  | TBL Pros can personally request analysis & community discussions |

| |

No comments:

Post a Comment