| gm Bankless Nation,

Morpho’s new design previews how TradFi can go bankless. Let's catch you up. Today's Issue ⬇️ - ☀️ Need to Know: Kalshi's Big Raise

The prediction market hits a $5B valuation. - 🗣️ Primer: Morpho Vaults V2

A new standard for DeFi asset curation. - 🎧 Early Access: How Crypto Flips Wall St.

In convo with Arthur Hayes + Tom Lee.

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI. . . . NEED TO KNOW Kalshi's Big Raise - 🔮 Prediction Market Kalshi Raises $300M at $5B Valuation. Kalshi's raise occurs as it overtakes Polymarket to become the top prediction market by volume.

- 🏦 Major Banks Eye 1:1 Reserve-Backed Digital Currency. A coalition of global banks is exploring the creation of an onchain, reserve-backed digital currency.

- 🪙 Antalpha Leads $150M Aurelion Financing Round to Establish Tether XAUT Gold Treasury. Aurelion Treasury will become the first Nasdaq-listed corporate backed by Tether Gold (XAUT).

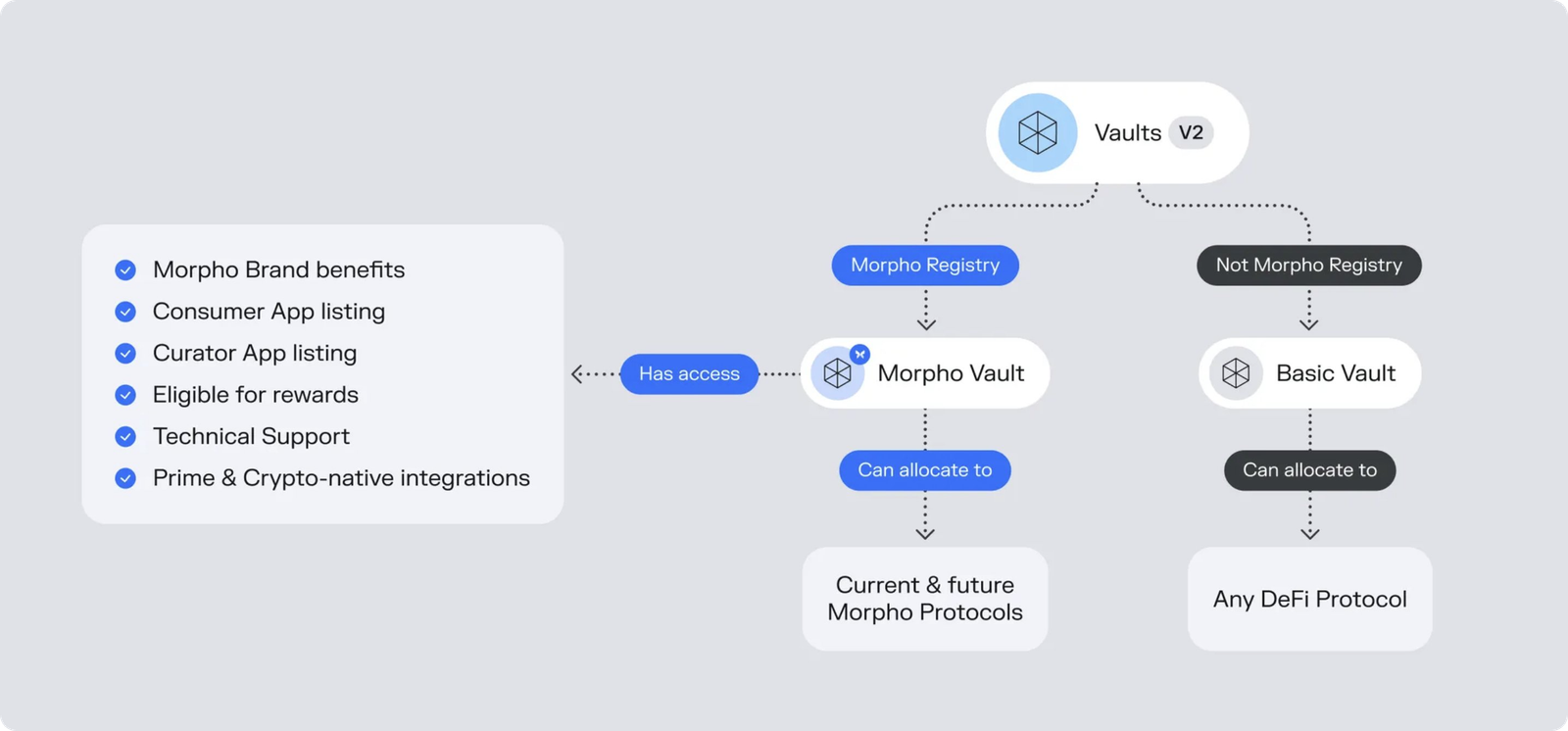

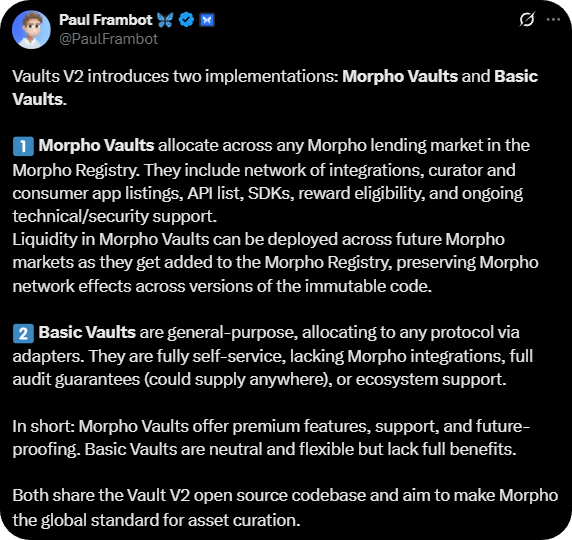

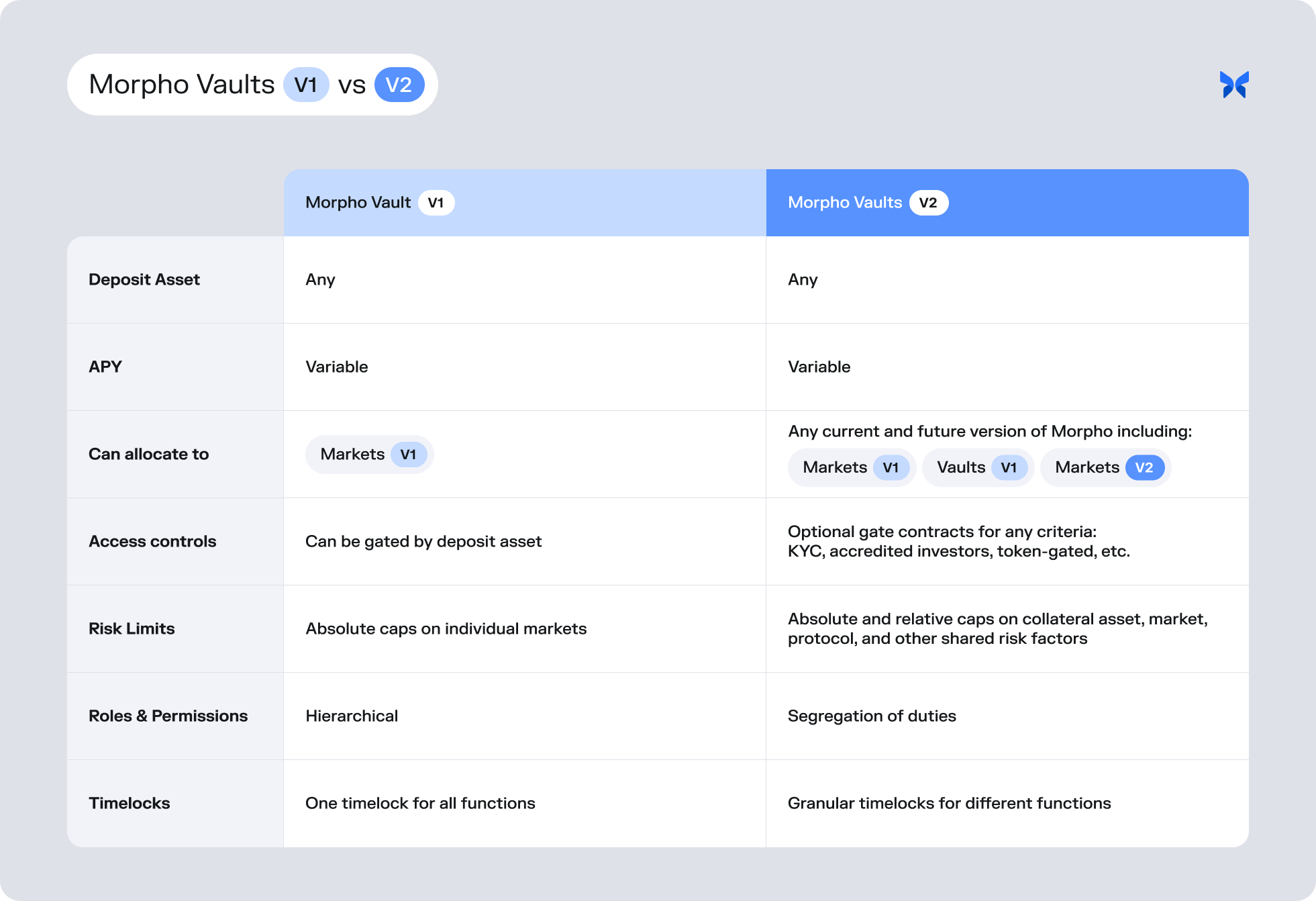

📸 Daily Market Snapshot: Renewed tariff fears deepened the selloff in U.S. stocks, and BTC and ETH followed suit with big dips. Beyond the majors, only ~10 of the cryptoeconomy's top 100 coins were in the green on the day. | Prices as of 3pm ET | 24hr | 7d |  | Crypto $4.08T | ↘ 2.7% | ↘ 3.8% |  | BTC $117,309 | ↘ 3.0% | ↘ 4.2% |  | ETH $4,061 | ↘ 5.9% | ↘ 9.8% | . . . PRIMER Morpho Vaults V2: The Latest DeFi Breakthrough DeFi's promise has always been programmable rules, real-time transparency, 24/7 markets, and user custody. Doubling down on this onchain vision, the new Morpho Vaults V2 architecture turns traditional asset management into verifiable, always-on code. In this system, curators define what's allowed, allocators execute within those limits, and depositors get auditable exposure. Morpho's already powering "TradFi frontend, DeFi backend" experiences like Coinbase's USDC lending product, and now Vaults V2 has opened a path for regulated institutions and DAOs alike to get compliant, practical onchain yield without sacrificing control. All that said, let's break down the basics here. What are Morpho Vaults V2?Morpho Vaults V2 are smart contracts where a curator (think: asset manager) accepts deposits and allocates them across approved lending venues according to a transparent, onchain policy. Within this design, there are two main money legos, which are Morpho Vaults and Basic Vaults. As Morpho co-founder Paul Frambot has explained: Either way, the big idea is that users can deposit once to get exposure to a basket of positions that their curator rebalances within preset rules. Parameter changes are timelocked, so depositors can see what's coming. And deposits mint ERC-4626 shares, so redemptions are pro-rata and noncustodial. Additionally, the Vaults V2 system has a few revamped pillars worth keeping in mind. These pillars include... 1. Roles These are the assignments that outline a particular vault's separation of duties. There are four roles to know: - The Owner — responsible for managing permissions (contract upgrades, role assignments, etc.)

- The Curator — responsible for defining a vault's policy and risk limits

- The Allocator — responsible for executing allocations within predefined limits

- The Sentinel — responsible for stewarding emergency powers for quick de-risking

2. AdaptersMoreover, Vaults V2 add an adapter layer so a single vault can point to multiple underlying venues—e.g. specific Morpho markets today, or other yield protocols over time—without launching a new product. This setup allows curators to maintain their policies while still rotating inventory underneath as markets change. 3. IDs & Caps Vaults V2 also affords better access management. Vault creators can deploy custom deposit or withdrawal requirements, from KYC to token-gating, while curators can cap exposure by asset, oracle, venue, or even relative limits (like "≤20% to any single oracle" or "≤15% per new venue"). Why this fits the "TradFi to Onchain" shiftTraditional managers set a mandate—what to hold, where, and with what risk—then route through brokers, funds, and desks, adding settlement delays, manual reporting, and layers of fees. Onchain vaults flip that model: - The mandate is code, auditable in real time.

- Positions and limits are visible continuously.

- Deposits and withdrawals settle in minutes.

- KYC/AML workflows can be layered in where needed.

For example, let's say an ETH-focused treasury wants diversified lending income to grow its balance over time, but never wants more than 20% of lent assets exposed to any single oracle or venue, requires KYC/AML compliance, and strictly bans high-LTV markets. Toward these ends, a Morpho Vaults V2 curator could encode and deploy these precise limits onchain, thereafter allowing that hypothetical treasury to supply ETH alongside other depositors while staying compliant. How to try for yourselfIf you want to explore Morpho Vaults V2 firsthand, you can start with the very first live deployment here: the Keyrock USDC Vault, which went live on October 8th, 2025. This vault, curated by Keyrock, marks the debut of the V2 architecture. To try it: - Visit the vault's page

- Do your due diligence by reviewing the vault’s onchain policy, caps, and performance metrics.

- If you want to dive in, connect your wallet and then use the page's deposit UI to deposit USDC and start earning yield (currently ~16% APY at time of writing).

Keep in mind this is the first production V2 vault, but expect more curators and more asset options to come online in the months ahead! FRIEND & SPONSOR: FRAX The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem. . . . EARLY ACCESS How Crypto Flips Wall St. In this new episode, Tom Lee + Arthur Hayes come on Bankless to talk how digital assets are rewiring global finance as institutional capital, tokenization, and stablecoin rails move to center stage. They discuss Bitmine’s bold ETH accumulation, Arthur’s case for perpetuals over leveraged ETFs, the rise of crypto equities, and why Tether’s ascent may signal a new era for banking itself. Listen to the full episode! 👇 |

No comments:

Post a Comment