Why Q4 Matters for BitcoinAlso Waiting for the Next Bitcoin ETF Flow Streak & Sticky Inflation, Risky Fed PivotWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

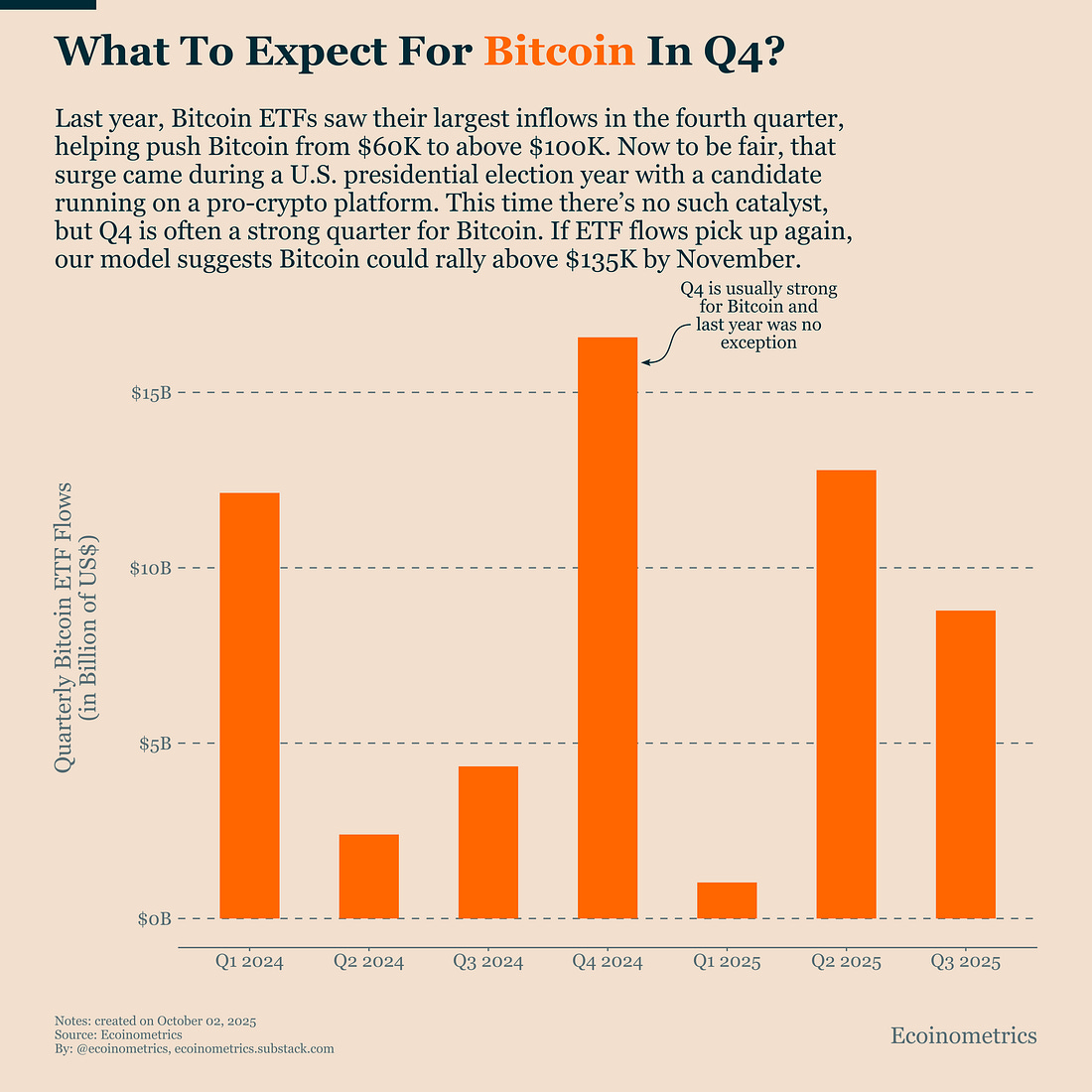

Even though these signals don’t line up neatly, together they tell the story of a market at a crossroads. Bitcoin is waiting for institutional flows to restart, Q4 seasonality points to a potential tailwind, and the Fed is taking a gamble by cutting rates into sticky inflation. For investors, the common thread is that positioning now means balancing upside potential with policy-driven risks. In case you missed it, here are the other topics we covered this week: Bitcoin Market Monitor - Key Drivers in Ten Charts: Get these professional-grade insights delivered to your inbox: Why Q4 Matters for BitcoinIn our October forecast, we leaned toward the bullish scenario in our simulations. One reason is that Q4 has historically been a strong quarter for Bitcoin, especially during bull markets. The record speaks for itself:

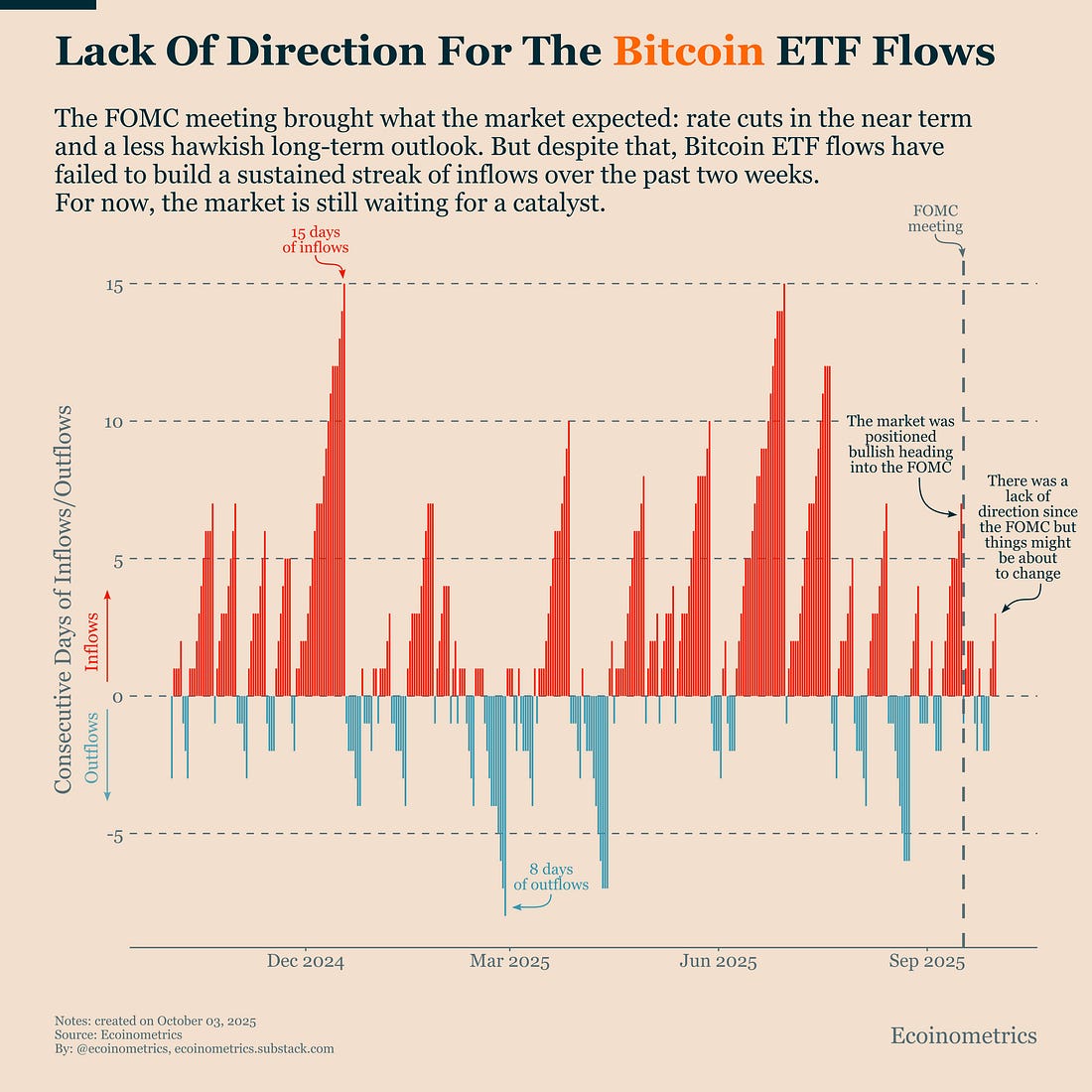

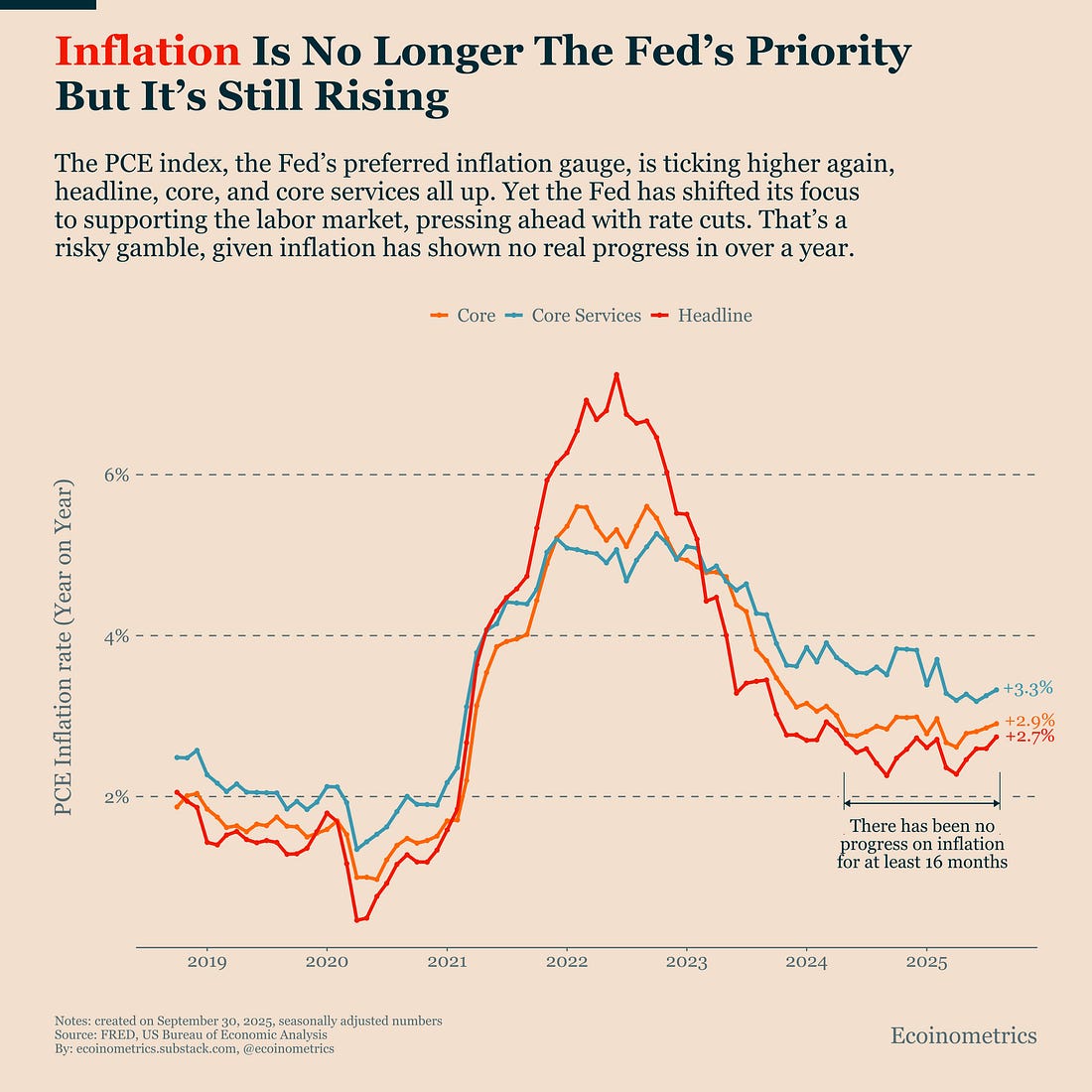

Last year’s Q4 stands out even more because we now have ETF flow data. It was the strongest quarter of inflows to date and by far the biggest institutional push into Bitcoin. Of course, Q4 2024 was also an election year in the U.S., with one candidate openly running on a pro-crypto platform. That was a catalyst we don’t have this time. But history suggests Q4 tends to be good for risk assets, and Bitcoin often benefits the most. The reason is partly seasonal: at year-end, institutions rebalance portfolios, rotate capital into higher-beta assets, and deploy fresh allocations ahead of the new year. So combined with generally favourable liquidity conditions, this often creates a window where Bitcoin outperforms. This year, the setup is different but still favourable. Liquidity conditions remain supportive, and the Federal Reserve has softened its hawkish stance. It might not be as explosive as last year, but the bias is clearly tilted bullish heading into the final stretch of the year. Waiting for the Next Bitcoin ETF Flow StreakThere is no sustained Bitcoin rally without long streaks of ETF inflows. The size of rolling net flows matters most, it has the strongest correlation with returns. But streaks reveal something else: how committed institutional investors are at any given moment, it’s a sentiment gauge. ETFs are now the dominant structural force in Bitcoin. When they receive inflows, they must buy coins. That pushes the price higher, which in turn attracts more inflows. This reflexive loop explains why streaks are so powerful. The last strong streak of inflows came just before the September FOMC meeting. The market was positioned bullish, and the Fed delivered. Since then, flows have stalled. The absence of inflows right after a dovish Fed is revealing. It suggests institutions are not rushing back in just because of rate cuts, they may be waiting for a stronger catalyst in Q4. That makes the timing of the next streak even more critical. But it already looks like something started. Watch this closely: rising prices supported by inflows are the recipe for a breakout. If a new streak takes off, our bullish forecast shows Bitcoin could climb above $135K by November. Sticky Inflation, Risky Fed PivotThe one factor that could derail the liquidity train is inflation. The Fed’s justification for cutting rates is that, between sticky inflation and weakness in the labor market, the labor market should come first. That’s debatable, but as long as inflation doesn’t spike, the Fed can maintain that stance. The problem is that inflation isn’t going away. It has shown no real progress in over a year, and more recently, it’s been ticking up again. And the real driver is not tariffs or imported goods, it’s core services inflation. That covers housing rents, healthcare, education, insurance, and a wide range of domestic services that together account for more than two-thirds of U.S. GDP. Of course lower rates do nothing to ease this kind of inflation. In fact, if easier policy strengthens the labor market, it could make things worse, since wages are a major input cost for services. So the Fed is taking a gamble. If it is forced to walk back its dovish pivot, the market will not like it, and the result could be asymmetric downside risk. The best-case scenario is that inflation stays high but contained, allowing the Fed to keep pretending it isn’t a pressing issue. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, October 3, 2025

Why Q4 Matters for Bitcoin

Subscribe to:

Post Comments (Atom)

Popular Posts

-

From Panic to Power: Bitcoin's Swift Rebound After the $19B Wipeout ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Crypto isn’t just speed-running finance’s past – it’s rewriting it with math instead of lawyers. ...

-

London's Can't-Miss Event ...

-

Taking the pulse of Mantle, one of the hottest Ethereum L2s in recent months. ...

-

Our third collaboration with the Checkonchain team, which includes a live Q&A tomorrow! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment