Bitcoin's Recovery Supported By A Turn In ETF FlowsAlso No Volatility For Bitcoin Despite A Turbulent Year & The U.S. Debt Isn't Slowing DownWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

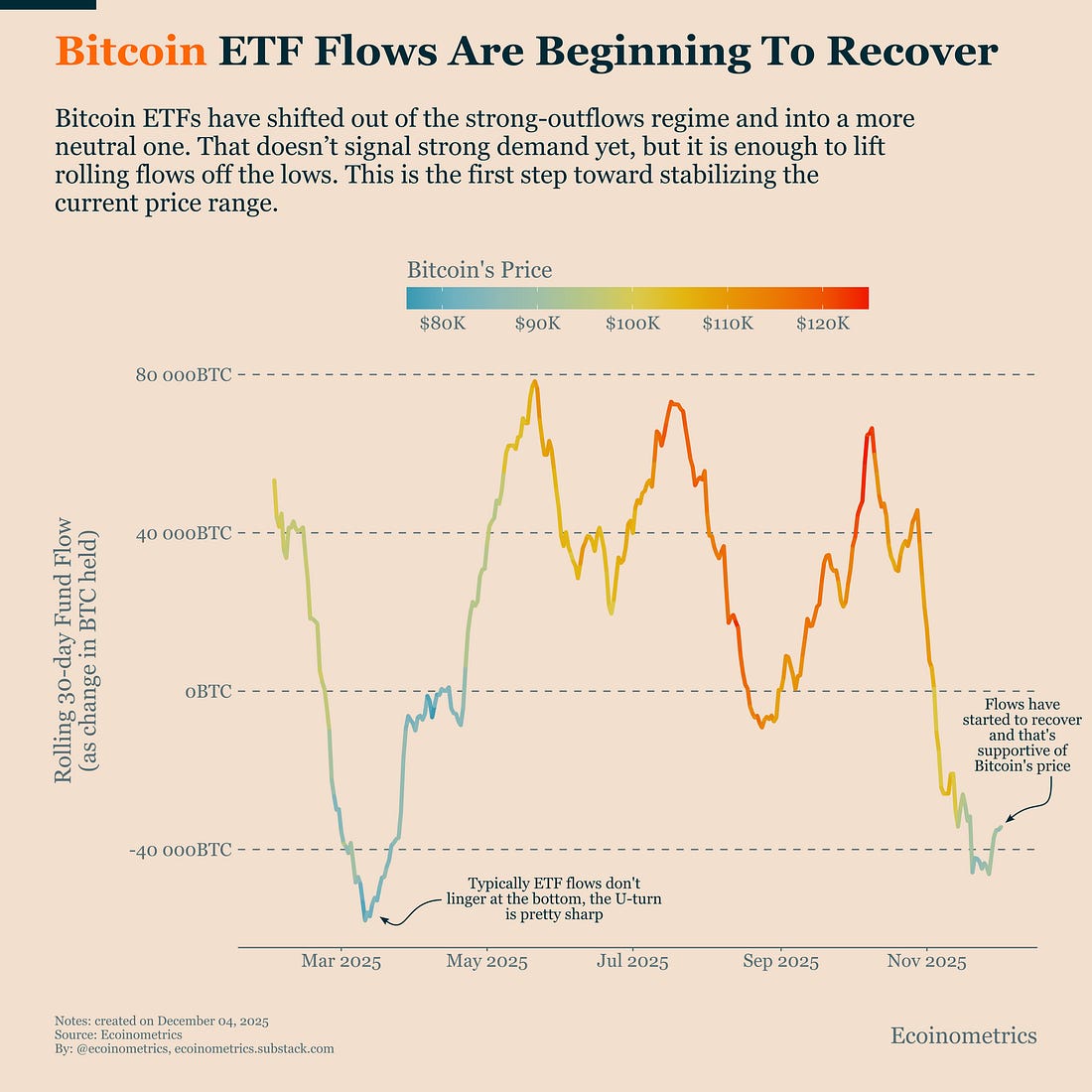

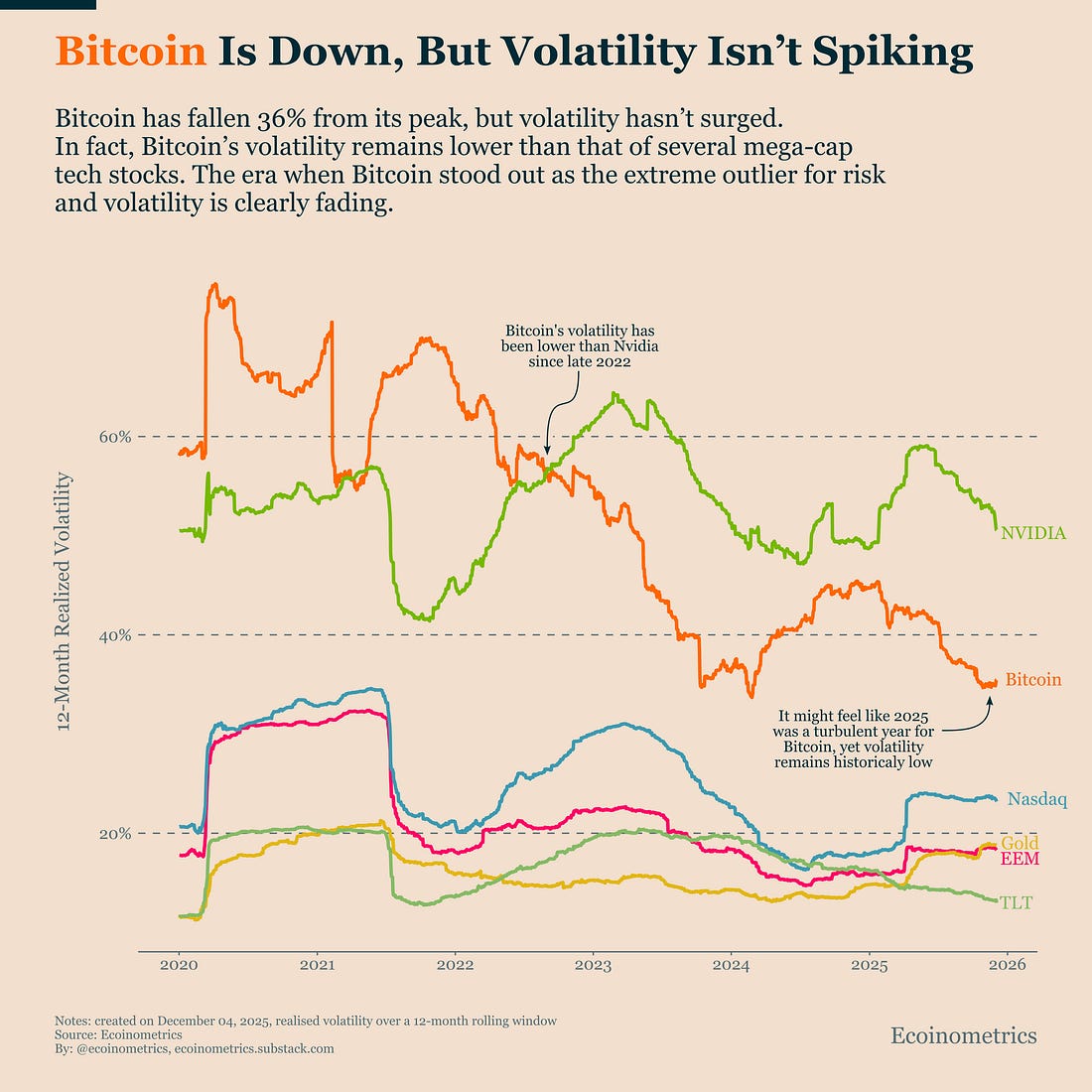

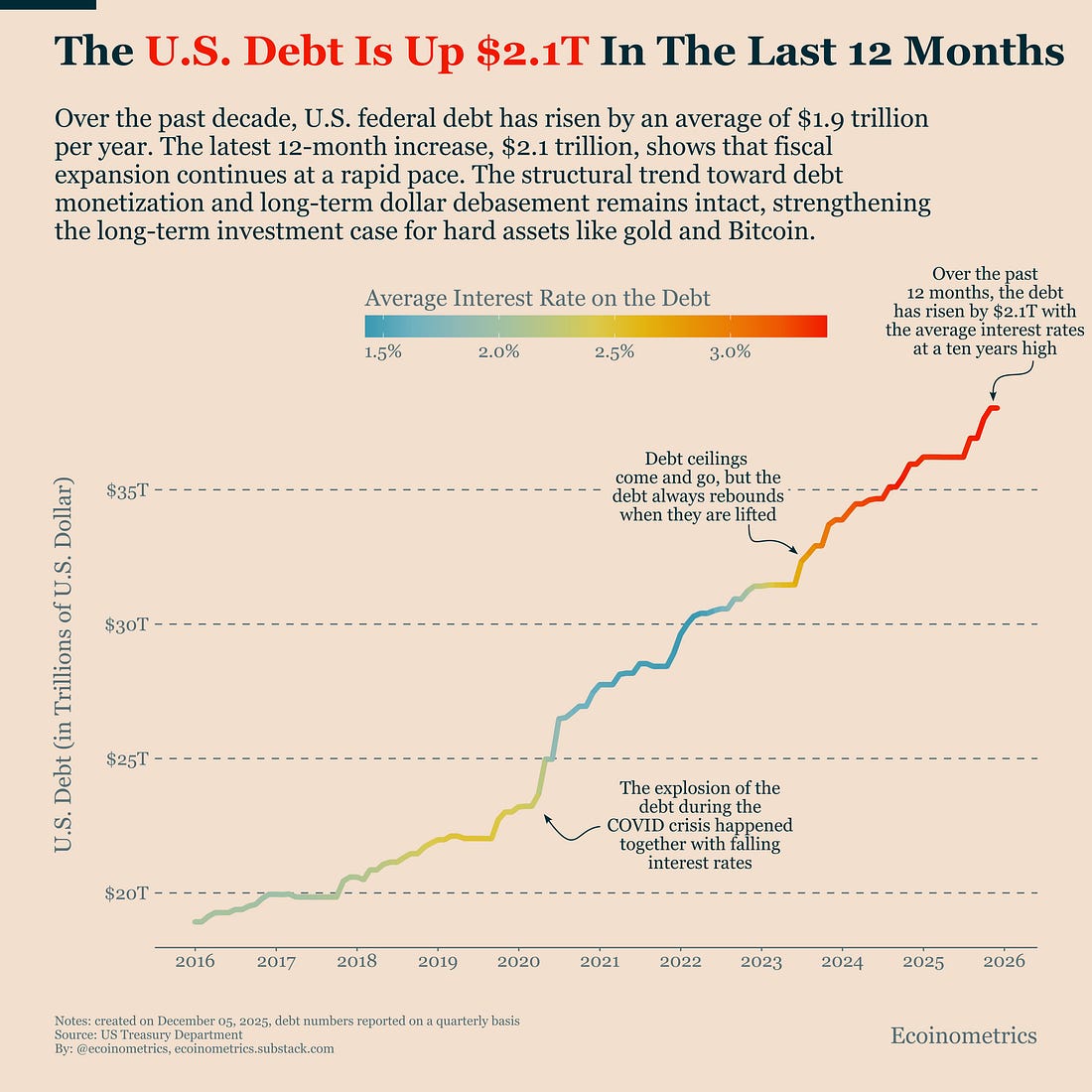

These charts sit in different corners of the market, but together they highlight what investors should really pay attention to right now: flows, stability, and structural risk. Bitcoin’s flows are turning, its volatility remains muted despite drawdowns, and the U.S. debt is growing rapidly at a time when funding costs are elevated. Together, they define the macro setting investors must account for today. In case you missed it, here are the other topics we covered this week: Bitcoin Market Monitor - Key Drivers in Ten Charts: Get these professional-grade insights delivered to your inbox: Bitcoin’s Recovery Supported By A Turn In ETF FlowsThis is something we’ve repeated many times: don’t look at Bitcoin’s price action without checking whether it is consistent with the trend in ETF flows. On monthly time scales, the relationship between Bitcoin’s returns and net ETF flows is extremely strong. It remains one of the most reliable models we’ve developed. And the model makes one point very clear: before Bitcoin can establish a solid support level, we need to see a U-turn in the 30-day rolling ETF flows. Outflows don’t need to flip positive right away, but they do need to stop accelerating to the downside. Luckily, that’s what is happening now. With the end of the latest sequence of heavy outflows, rolling flows are forming a bottom. The pattern looks similar to what we observed in March earlier this year. While that doesn’t guarantee an immediate rebound, if that trend continues, it meaningfully reduces the odds of another leg lower. It is worth observing that, over the last two years, ETF flow bottoms tend to be sharp. Once the U-turn begins, the improvement usually doesn’t drag on for weeks, flows climb back up fast. That’s why monitoring the slope of the rolling flows often gives a more timely signal than looking at Bitcoin’s price directly. On Wednesday we ran simulations based on our ETF flows model to map out possible scenarios. Those scenarios point to an encouraging setup: rising flows, Bitcoin’s price to form a strong base. No Volatility For Bitcoin Despite A Turbulent YearWe’re almost at the end of the year, and looking back, it’s hard to argue that 2025 was smooth sailing for Bitcoin. We saw multiple new highs, but also two sizeable drawdowns. Market sentiment kept oscillating between risk-on and risk-off, which made the whole year feel unsettled. So in the big picture, it’s fair to call 2025 a turbulent year. Yet Bitcoin’s volatility has been moving in the opposite direction. It has been declining all year, and even during the most recent pullback, realized volatility hasn’t spiked. Since late 2022, Bitcoin has actually been less volatile than several mega-cap stocks with similar market caps, including Nvidia. A few years ago, that would have sounded unrealistic, but it’s now the norm. This shift confirms that Bitcoin’s price behaviour is being shaped more by structural forces than by short-term trader sentiment. Institutional adoption and Bitcoin’s integration into the broader macro landscape are key reasons why its volatility is normalizing. Now importantly, lower volatility doesn’t mean downside risk disappears. It simply means that the pace of repricing is much slower than it used to be and that deeper forces such as flows and correlations are doing more of the work. That’s why it has become harder to rely on older Bitcoin market patterns to interpret today’s behaviour. The market’s state is now better understood through the lens of capital flows, macro correlations, and positioning rather than the cyclical playbooks of the past. The U.S. Debt Isn’t Slowing DownHere’s a topic that isn’t front and centre in U.S. politics these days: the U.S. debt. While most people have stopped paying attention, the federal debt has increased by $2.1 trillion over the last 12 months. That’s not an outlier. It’s almost exactly in line with the average pace of the last decade, which comes in at $1.9 trillion per year. And as the chart shows, this latest increase is happening at a time when the average interest rate on the debt is at a ten-year high. In other words, borrowing is accelerating even though it’s more expensive. If you were looking for one political reason behind the Federal Reserve’s considering to cut interest rates, you don’t need to look much further than this. At the same time, the Fed has reached the end of its balance sheet reduction program. From here, they will begin buying Treasuries again, slowly at first and only to replace bonds that mature. But that shift leaves the door open for more active support if funding conditions tighten. This is a slow-moving train wreck, which is exactly why it’s easy to overlook. But step by step, it pushes the U.S. closer to a regime of fiscal dominance, where the central bank is effectively forced to finance government deficits on a recurring basis. That’s a major long-term risk. It explains why gold has been so strong in recent years and why Bitcoin has such compelling long-term potential as a hard asset. It’s not the headline narrative right now. But it’s something to keep in mind because some investors may prefer to hedge this risk while Bitcoin is still relatively cheap. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, December 5, 2025

Bitcoin's Recovery Supported By A Turn In ETF Flows

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Trump-appointed prosecutors are waging a war on crypto privacy and using Biden era tactics to score convictions, David Christopher...

-

And a hot PropAMM that does 50% of Solana spot volume is doing token sale. Here's everything you need to know....

-

Aave just released a savings mobile app. And it looks like the perfect app the onboard regular people to DeFi. ...

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Welcome to The Bitcoin Vector Lite 009! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment