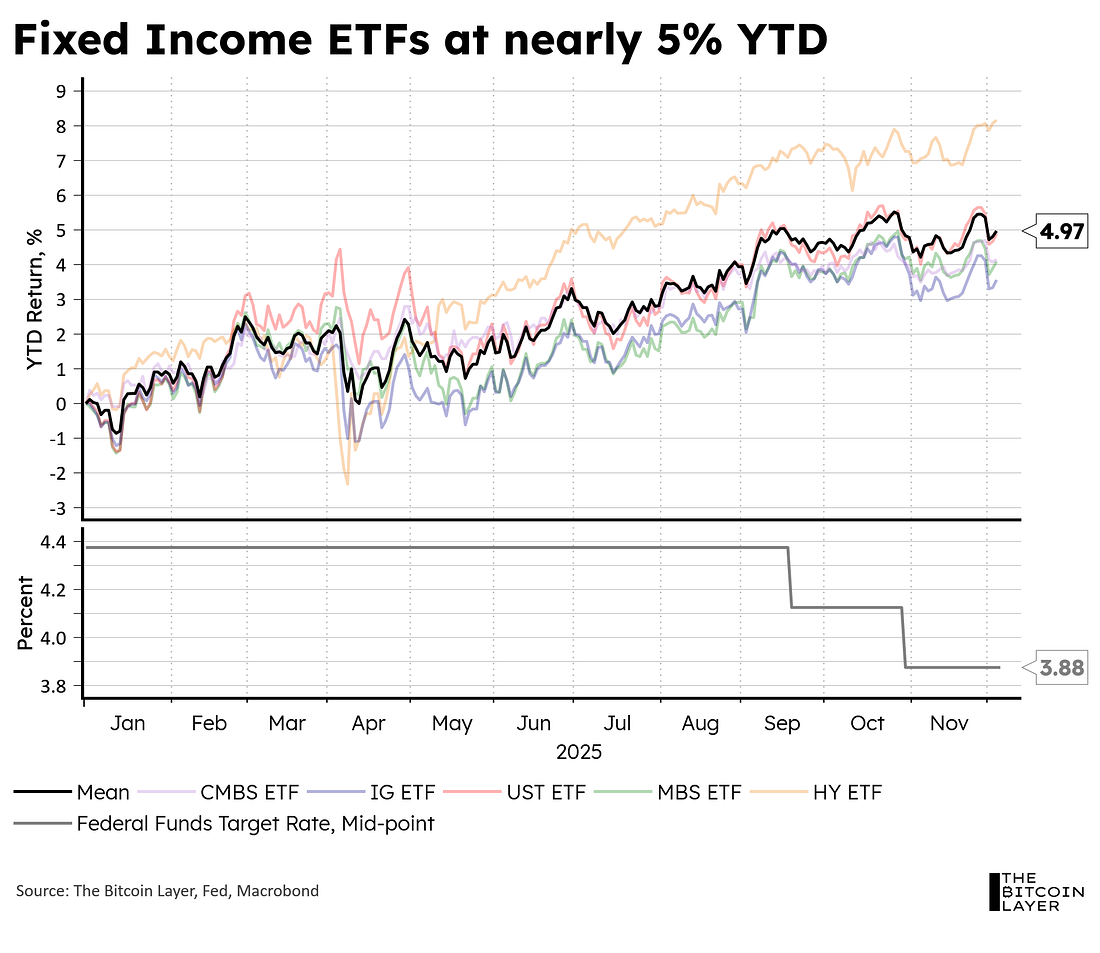

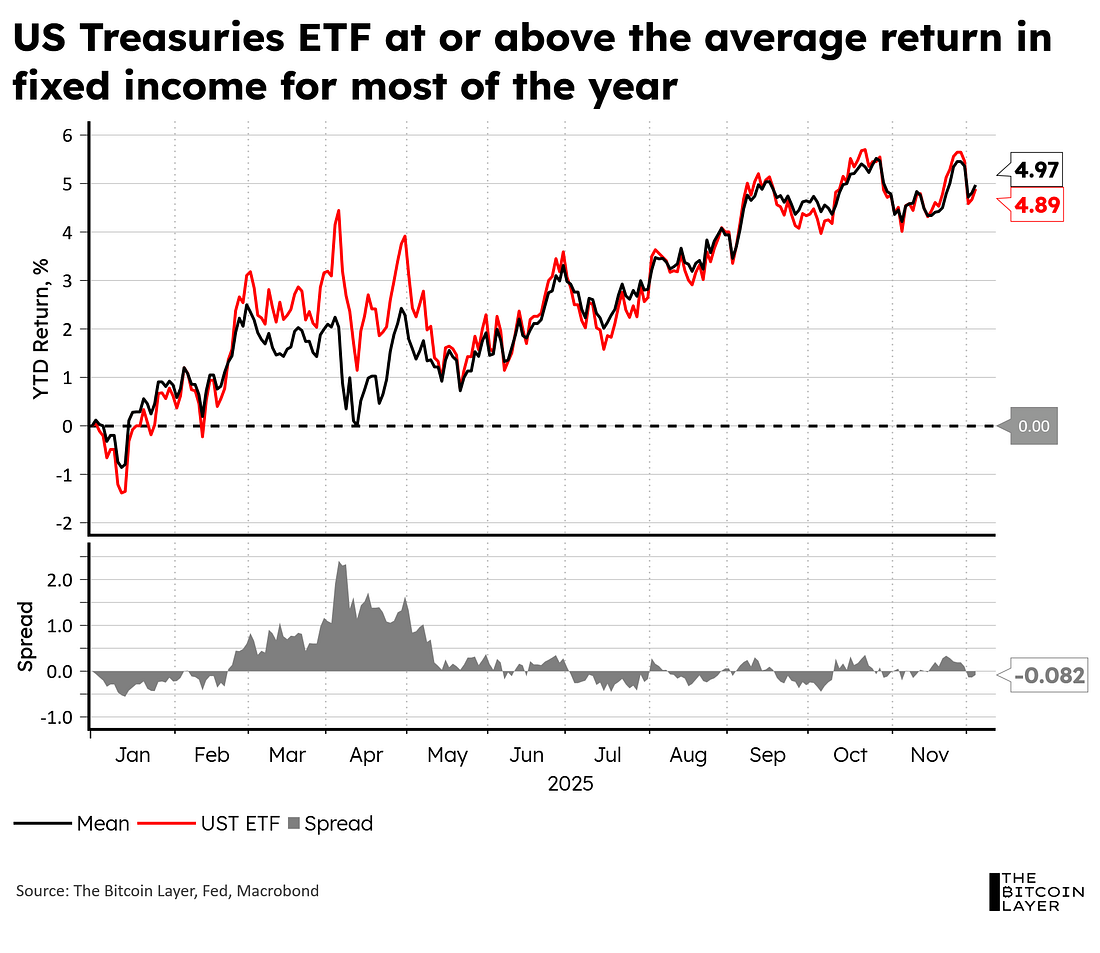

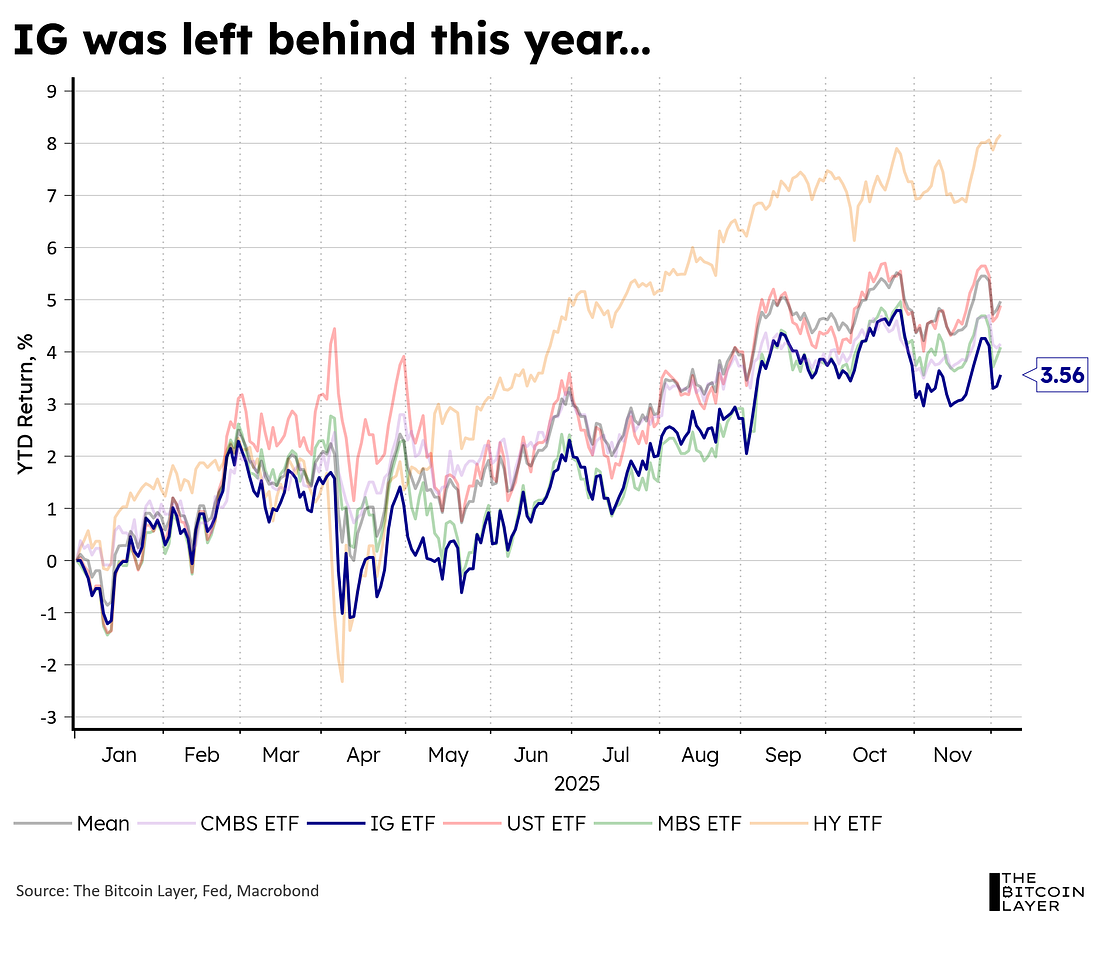

Dear Readers, Last week, we decided to provide our TBL Pros with some more consistent analysis from us via daily charts. One of our charts this week shows the comparative performance of different fixed-income ETFs over 2025. In a rate-cutting year, these assets performed well, returning an average of nearly 5% in 2025: What’s most interesting about this chart, however, is where US Treasuries lie—at or above the average for most of the year. As the risk-free asset of the world, one would expect these to be at the bottom end of the fixed-income performance: One could argue that this is due to a flight to safety investor base, but Investment Grade (IG) ETFs were kicked to the curb (more on this later): So, why was it such a good year for Treasuries? We argue that it is a healthy combination of both rate cuts and a flight to safety. But let’s unpack that in today’s TBL Weekly. Bitcoin forces long-term thinking. Unchained is the leader in collaborative multisig custody and bitcoin-native financial services, securing over $12 billion in bitcoin for more than 12,000 clients — roughly 1 out of every 200 bitcoin sits in an Unchained vault. The model is simple:

This shared-custody framework blends institutional-grade security with the sovereignty of individual key ownership. From that foundation, Unchained offers services for long-term bitcoin strategies: trade directly from your vault, access dollar liquidity through bitcoin-collateralized commercial loans, open a bitcoin IRA while holding your keys, or create business and trust accounts for multi-generational planning. For elevated private-client service, Unchained Signature provides a dedicated account manager, discounted trading, exclusive events, and more. If you’re building a durable bitcoin position and want a custody partner designed for that responsibility, visit unchained.com and use code TBL10 for 10% off your new bitcoin multisig vault. Secure your Bitcoin this holiday. 21% off all Blockstream Jade devices. Our videos are on major podcast platforms—take us with you on the go! Keep up with The Bitcoin Layer by following our social media! The Fed...Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Friday, December 5, 2025

A Good Year for Treasuries: TBL Weekly #164

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's no secret that ETH spent a lot of this cycle on the sidelines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Register for the Live Webinar Today! ...

-

ICOs are everywhere, all of a sudden, right before the holidays. Today, we're scoping out a few noteworthy ones dropping over ...

-

It's been a volatile, headline-grabbing year for crypto, but which DeFi players made the biggest impact in 2025? ...

No comments:

Post a Comment