| gm Bankless Nation,

Heading into 2026, is HOOD or COIN the better buy? Today's Issue ⬇️ - 🗣️ Analysis: Robinhood vs. Coinbase 2026?

The two retail trading apps are chasing super app status.

p.s. The Bankless newsletter team will be taking off the next couple of days for the holidays, we'll see you back here in 2026! Sponsor: Uniswap CCA — Fair onchain price discovery for token launches. . . . ANALYSIS Robinhood vs. Coinbase 2026 Battle Royale? The Coinbase versus Robinhood debate has been discussed on multiple occasions by many a spectator — ourselves included. But Coinbase's December 17 System Update gave us reason to revisit it more thoroughly. The company announced commission-free stock and ETF trading with 24/5 availability, native prediction market integration via Kalshi, and a DEX aggregator providing instant access to millions of tokens — a clear push toward becoming an everything app that can match Robinhood's breadth. These announcements elucidate the future Coinbase is building toward, and in doing so, let us more thoroughly size it up alongside Robinhood. Their contested goal is now unmistakable: to become the single place users manage their entire financial life. By owning users’ balances, they own the behavior. But how each is building toward that super app thesis reveals two distinct philosophies — and 2026 will test which foundation proves stronger. HOODRobinhood is building the financial super app the old-fashioned way — by stacking products until users can manage their entire financial life from one platform. Beyond trading stocks, options, and crypto, Robinhood offers a suite of products for its 3.9 million Robinhood Gold subscribers that make it function as a neobank would. Growing 77% year-over-year, the subscription bundles a 3% cashback credit card, 3.25% interest on cash, and 3% IRA matching. All in the same interface are users' paycheck, savings, investments, and daily spending — a data advantage traditional brokerages can't match. This positioning proves particularly fitting when you consider demographics – 75% of Robinhood's 26.9 million funded customers are under 44 years old, a highly mobile-first and “financially conscious” user base. It’s also a base which some, like Omar Kanji of Dragonfly, believe helps position the company as a primary beneficiary of the $10 trillion+ wealth transfer expected over the coming decade, as older generations pass assets to younger ones. Those inheritors will likely consolidate into platforms they already use daily — and Robinhood is making itself very easy to use daily. Beyond the neobank features, Robinhood's revenue lines have diversified considerably. Options trading remains the cash cow. Crypto contributes 21% of total revenue. Net interest income accounts for 35% of revenue. And prediction markets, via Kalshi of course, already generate $100M annualized. - The numbers back this up: transaction-based revenue, up 129% YoY, was driven primarily by crypto

- Record $556M net profit in Q3 – a 271% increase year-over-year

- Flat operating expenses since September 2022

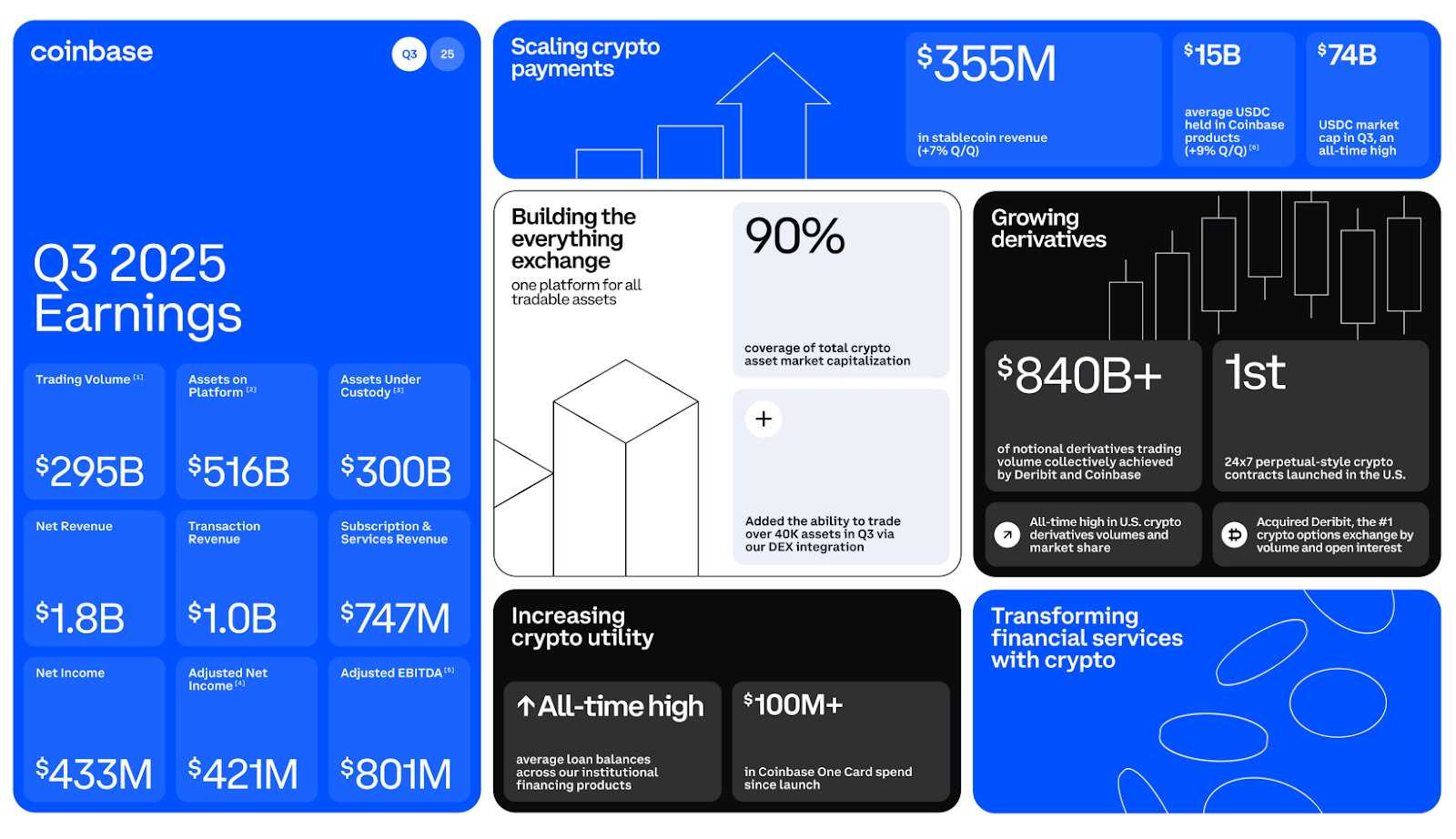

COINCoinbase is also building a super app — but with a distinctly crypto-native flavor and a second layer of ambition underneath. On the front end, Coinbase wants to be the single place users manage their financial life on and offchain, though mostly still the former. The December System Update made this explicit: commission-free stocks and ETFs with 24/5 trading, prediction markets via Kalshi, and continued onchain integrations for instant access to millions of tokens. Add in direct deposits, high-yield savings via USDC lending rates, borrowing up to $5M against BTC (and up to $1M on ETH), and spending via debit to earn crypto rewards — the super app pieces are falling into place. But Coinbase isn't just building for its own users. The grander vision seems to be turning every product it offers into plug-and-play infrastructure that powers everyone else coming onchain. The thesis here is that TradFi incumbents like JP Morgan, Fidelity, and Morgan Stanley won't build their own crypto infrastructure. They'll outsource to Coinbase because it's cheaper, they lack the technical expertise, and Coinbase has 13 years of proven security. Over 200 institutions already use Coinbase's Crypto as a Service platform — meaning users might trade crypto on a traditional bank's front end while Coinbase handles everything behind the scenes. This infrastructure focus extends across the business. Coinbase holds the Bitcoin and Ethereum for most major spot ETFs — a near-monopoly position in crypto custody. They're letting institutions launch their own stablecoins using Coinbase infrastructure. The Echo acquisition brought both fundraising and token issuance in-house. And the Deribit acquisition captured roughly 90% of Bitcoin options open interest. The revenue mix reflects this dual focus. Q3 2025 revenue came in at $1.8B, with subscription and services hitting a quarterly record of $747M (41% of total). Stablecoin revenue from the USDC partnership contributed $354.7M, up 44% year-over-year. Staking brought in $185 million. Custody fees reached ~$143M, driven by record assets under custody exceeding $300B from ETF inflows. Where Robinhood's grander vision is becoming the premier place to do everything related to one's financial life, Coinbase is playing two games at once: building the best crypto super app for its own users while simultaneously becoming the backend that powers everyone else's crypto offerings. The Crypto Strategy DivideBoth companies see crypto as central to their super app ambitions, but their approaches reflect their origins. Robinhood treats crypto as another asset class alongside stocks and options. It's a revenue driver that fits neatly into the existing product suite. The Bitstamp acquisition ($200M) provided global licenses and institutional infrastructure. Tokenized equities — roughly 800 live in the EU, including private companies like OpenAI and SpaceX — expand offerings. The real test will be Robinhood Chain’s success, which should make many of these tokenized equities more versatile (i.e. loans), though we still have few details on the extent of “DeFi” or other onchain activities that the chain will support. Besides this, Robinhood also faces more immediate limitations like token selection. In the U.S., fewer than 50 tokens are available to users on the platform, compared to Coinbase's essentially infinite offerings indirectly (via Jupiter and Base) and 200+ directly supported tokens. Coinbase's crypto approach obviously differs, offering everything from its own L2 to the slew of products mentioned in the last section. It has set the standard for “crypto-specific” offerings, so much so that it looks to be transitioning to focusing now on building the rails for others to use. We have x402 which intends to be the industry standard for Agent to Agent (A2A) payments, as well as Coinbase announcing they’d offer a “Stablecoin-as-a-Service” platform for companies to create whitelisted stablecoins while Coinbase manages all the technical complexities. From issuance, through trading, to custody, Coinbase sits at every stage of the asset lifecycle. What's Coming in 2026Both roadmaps are aggressive — and increasingly overlapping. Coinbase's December 2025 System Update pushed hard into Robinhood’s territory with stock and ETF trading beyond traditional market hours (thanks to tokenization), as well as the announcement of stock perpetuals coming next year. Native Kalshi integration brought prediction markets. And then you have Coinbase Business and Coinbase Tokenize, the former being a crypto-powered all-in-one business operations platform and the latter being an “end-to-end” platform for institutional tokenization. Robinhood's 2026 plans go deeper into crypto infrastructure. Tokenized equities will gain 24/7 trading via Bitstamp in early 2026, then become withdrawable and composable across DeFi by late 2026. On prediction markets, Robinhood is moving from being a distribution partner to launching its own markets. The platform hopes to offer crypto staking, pending regulatory approval. And it also has ambitions to “socialize” trading via Robinhood Social, an upcoming feed where traders post alongside their actual trades and P&L. And, of course, we have Robinhood Chain. The challenge for Robinhood Chain will be building a developer ecosystem — territory where Base already has established momentum. Crypto-native culture is hard to manufacture. The Bottom LinePerhaps the better framing here is "COIN and HOOD" rather than "COIN vs HOOD." These companies occupy different lanes that touch but don't fully overlap. Robinhood is as much a “super app” play as it is a demographic wealth transfer play. With 75% of users under 44 and a full-stack neobank keeping assets on platform, the company is positioned to be the new hub for depositing, spending, investing, and speculating. Coinbase is the technology shift play. The bet is that the global economy moves onchain, and Coinbase becomes the infrastructure layer powering everyone else — from ETF custody to stablecoin backends to Crypto as a Service for traditional banks. Both carry risks. Robinhood's generous Gold incentives (3% matching, 3% cashback, 3.25% interest on cash) are expensive and already showing vulnerability to rate cuts — that rate was 4-5% not long ago, and it's pegged directly to Federal Reserve rates. Tokenization adoption depends on issuer decisions beyond Robinhood's control. For Coinbase, user growth remains a big risk, with monthly users stalled since 2021. And both may be expensive. These stocks have been major winners over the past few years — COIN up roughly 7x, HOOD up 15x from their 2022 lows, as of the time of writing. And despite recent pullbacks from all-time highs, valuations remain elevated after such dramatic run-ups. That should be taken into consideration. Ultimately, while both companies are building financial super apps — and veering into each other’s territory as they do — their visions serve different purposes. - Robinhood is building the all-in-one financial platform — the single place where a user manages their banking, spending, trading, and investing without ever needing to go elsewhere.

- Coinbase is building infrastructure for everyone to come onchain — a crypto super app for its own users, yes, but more importantly, the backend rails that power institutions, fintechs, and traditional banks entering crypto.

One is competing to be your financial home. The other is competing to be the plumbing underneath everyone's financial home. Both can win. FRIEND & SPONSOR: UNISWAP CCA The Uniswap Continuous Clearing Auction is designed for fair price discovery and onchain liquidity bootstrapping at TGE. Tokens are sold continuously over time, eliminating sniping — and proceeds can seed a Uniswap v4 pool for Day 1 liquidity. |

No comments:

Post a Comment