Institutional Bitcoin Demand Is Losing MomentumAlso Bitcoin Is Trading Near Its ETF-Flows Fair Value & The Dot Plot Confirms Limited Easing and Rising UncertaintyWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

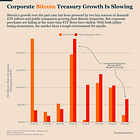

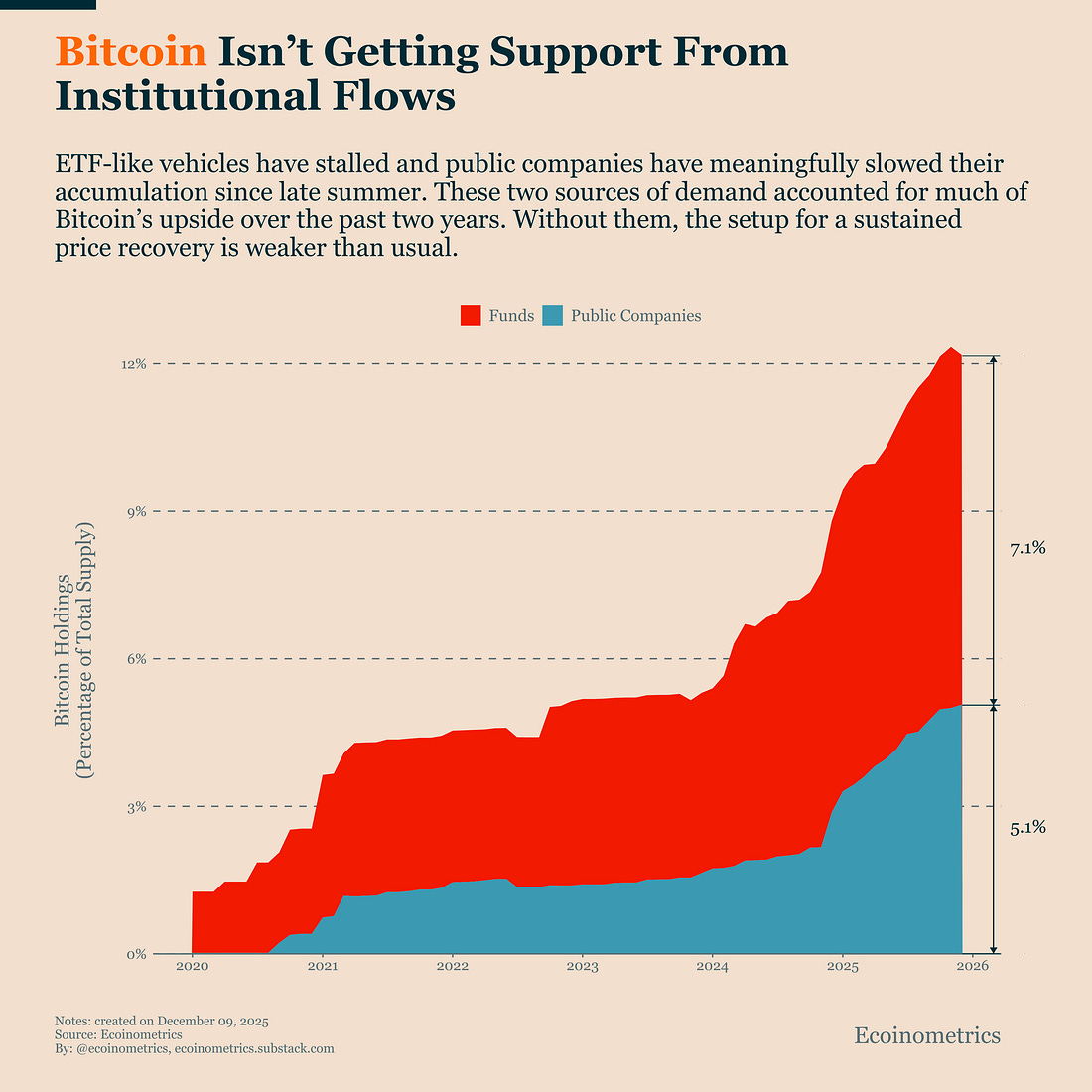

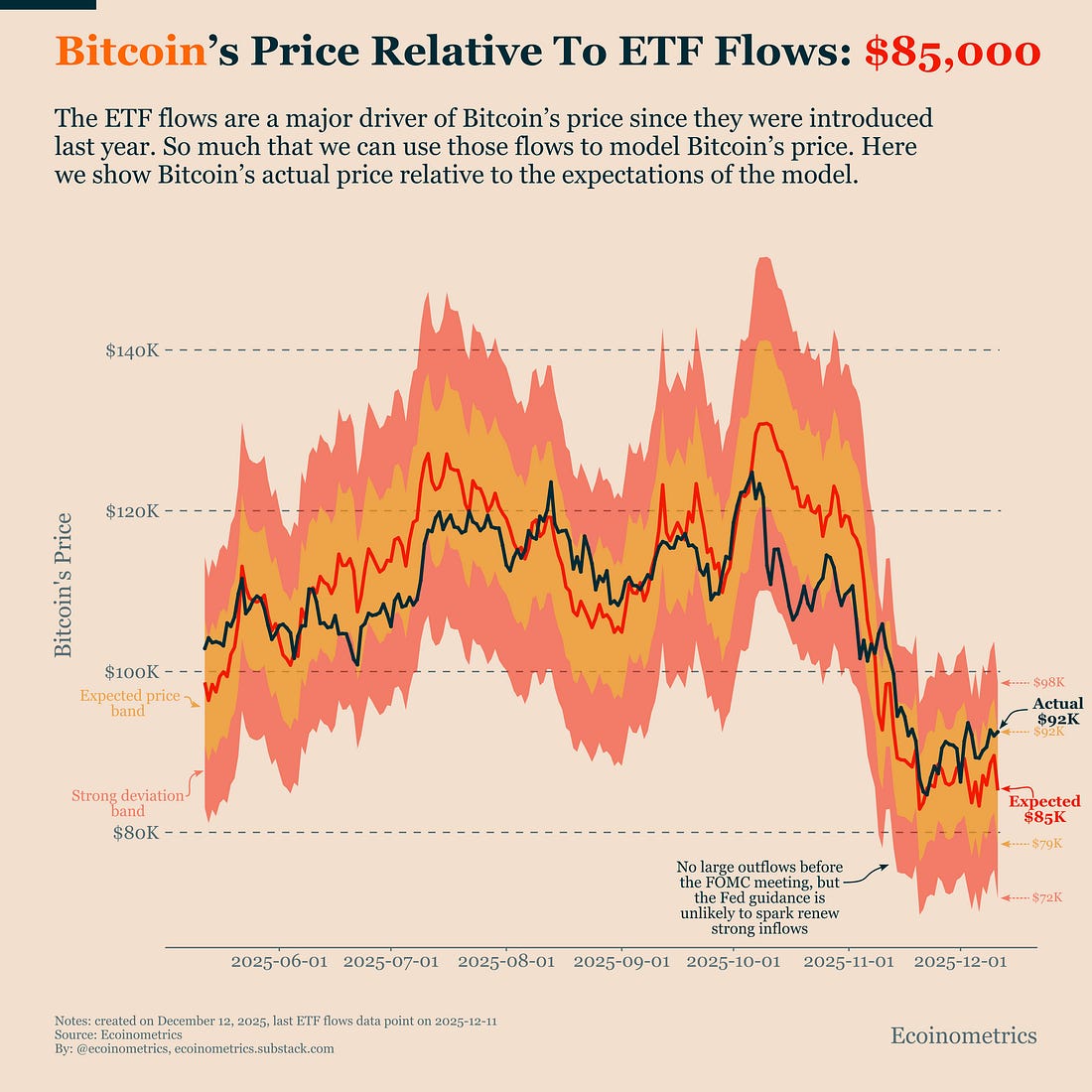

Taken together, these signals point to the same underlying theme: Bitcoin is currently lacking both a strong marginal buyer and a supportive macro catalyst. Institutional demand has stalled, ETF flows are no longer pushing price higher, and the Fed’s guidance keeps risk appetite constrained. In this environment, price stabilization is more likely than a sustained breakout. In case you missed it, here are the other topics we covered this week: Get these professional-grade insights delivered to your inbox: Institutional Bitcoin Demand Is Losing MomentumThis fourth quarter continues to be challenging for Bitcoin. After the strong institutional inflows that supported prices earlier in the cycle, momentum has clearly slowed. The demand trend that lifted Bitcoin over the past two years is no longer accelerating. When we combine public companies with Bitcoin treasuries and ETF-like investment vehicles that hold physical Bitcoin, these institutions now control roughly 12% of total Bitcoin supply. That is a meaningful share of the market. But it has also been largely stagnant over the past few months. Recent spot Bitcoin ETF outflows mean that fund holdings are slightly lower on a month-over-month basis as of December 1. At the same time, public companies appear to have hit an inflection point. The steep accumulation phase that lasted less than a year has faded, and growth is now closer to the slower pace seen before October 2024. This matters because public companies, in particular, acted as a powerful tailwind during Bitcoin’s last advance and a support during periods of weakness. We analyzed this in more detail in Wednesday’s report, with a focus on MicroStrategy. Falling Bitcoin prices combined with balance-sheet pressure on corporate holders amount to a loss of one of Bitcoin’s most important structural supports. Without renewed institutional accumulation, the path to a sustained price recovery becomes materially more difficult. Bitcoin Is Trading Near Its ETF-Flows Fair ValueIf we focus specifically on Bitcoin ETF flows, the situation has not changed meaningfully since last week. Flows remain in a neutral regime, which historically supports price stabilization rather than strong upside or downside moves in the short term. One constructive development is that we did not see a new wave of heavy outflows ahead of this week’s FOMC meeting. That downside risk was present, as investors could have chosen to de-risk further in response to tighter or less dovish Fed guidance. Instead, flows remained stable. This suggests either that selling pressure is becoming exhausted or that November’s outflows already priced in a less supportive Fed backdrop. In both cases, the immediate downside risk from ETF-driven selling appears reduced. As a result, ETF flows are now more likely to follow the baseline scenario outlined in this month’s Bitcoin Market Monitor. That scenario points to a stabilization of Bitcoin’s price within the current model-implied range, rather than a sharp recovery. The chart below shows Bitcoin trading close to its ETF-flows fair value, consistent with a range-bound environment. With ETF flows in a neutral regime and price trading near fair value, Bitcoin is more likely to stabilize within its current range than to sustain a directional move. The Dot Plot Confirms Limited Easing and Rising UncertaintyThere was considerable uncertainty ahead of the Federal Reserve’s December meeting. Markets were looking for clarity on how much further the Fed would be willing to ease as growth slows and inflation remains uneven. In the end, the Fed delivered one final 25bps rate cut for 2025 and broadly followed the path it had already laid out earlier this year. Policy decisions and guidance were consistent with the prior dot plot, offering no meaningful surprise for risk assets. Chairman Jerome Powell also took care to reassure markets that rate hikes are not the base case, even if inflation remains sticky. That messaging helped limit downside risk, but it did not materially improve the outlook either. More importantly, the updated dot plot now signals only one additional 25bps cut for the entirety of 2026. That is a much slower pace of easing than markets were expecting just a few months ago, reinforcing the idea that monetary policy will remain restrictive for longer. The distribution of projections for 2026 makes this even more problematic. While the median sits at 3.375%, the range of individual projections has widened significantly. Markets can price slow growth or tight policy, but they struggle to price uncertainty. When the dots spread out, confidence in any single policy path weakens, and expectations become fragile. As long as inflation and labor market data fail to establish a clear trend, this uncertainty is likely to persist. In that environment, risk appetite is hard to sustain, and Bitcoin flows are unlikely to strengthen enough to support a durable upside move. Tactical TakeawayIn this kind of environment, the biggest risk is not missing upside but misjudging conviction. When markets lack both a strong marginal buyer and macro clarity, patience becomes a positioning advantage. The signal to change posture will come from renewed flows or clearer macro trends, not from price action alone. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. Invite your friends and earn rewardsIf you enjoy Ecoinometrics, share it with your friends and earn rewards when they subscribe. |

Friday, December 12, 2025

Institutional Bitcoin Demand Is Losing Momentum

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Dear Readers, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

It's no secret that ETH spent a lot of this cycle on the sidelines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

ICOs are everywhere, all of a sudden, right before the holidays. Today, we're scoping out a few noteworthy ones dropping over ...

-

HyperLiquid's HIP-3 allows outsiders to deploy perp markets on HyperLiquid. Ethena is taking advantage of that...

-

Also Bitcoin Is Trading Near Its ETF-Flows Fair Value & The Dot Plot Confirms Limited Easing and Rising Uncertainty ͏ ͏ ͏ ...

No comments:

Post a Comment