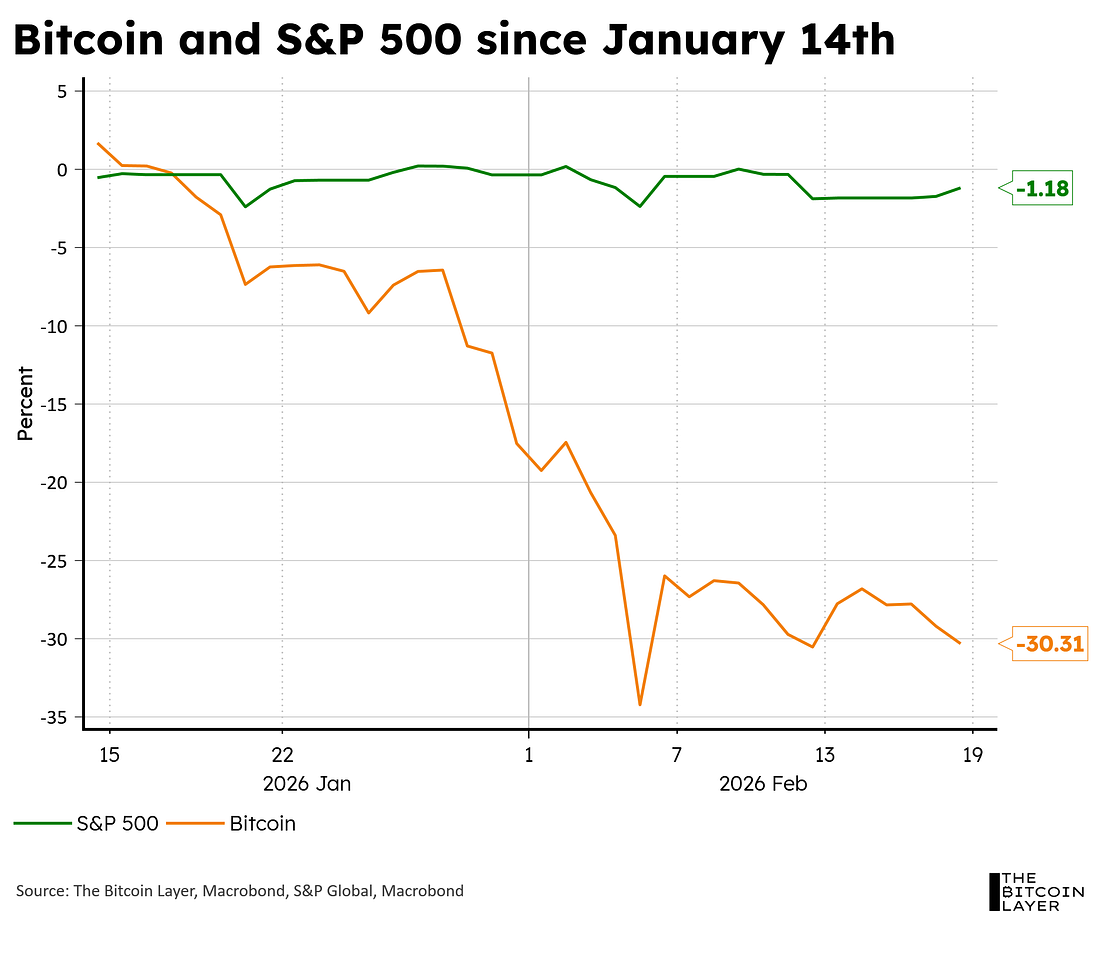

3 Takeaways from FX ConferenceI traveled to Miami to speak on Bitcoin and have to share my impressions.Dear Readers, Liquidity has been trending lower since Christmas, and boy has it punished bitcoin. The stock market is undoubtedly wobbly as well but holding it much better on an absolute return basis since our red dot was confirmed on January 14th: The driver of the liquidity drain is a stronger dollar. After a dramatic Japan-led “rate check” and yen bounce, the yen has once again started selling off and dollar strengthened, all while the dollar catches a secondary Iran-related bid heading into a weekend of possible kinetic event. Today I’ll discuss TBL Liquidity’s current state and outlook over a few time horizons as well as share some thoughts from a large FX mostly buy-side conference I attended last week in Miami. I found reactions to my talk on bitcoin and the name of this firm which was prominently displayed on my conference badge interesting and encouraging, while the discussion surrounding the FX industry at large was equally fascinating. The foundations of money are shifting in ways that are easy to feel but harder to name. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk. In The Debasement Trade, James Lavish explains why currency debasement is structural, why traditional portfolio assumptions are being tested, and why gold tends to move first while bitcoin often moves further as the implications compound. The report covers:

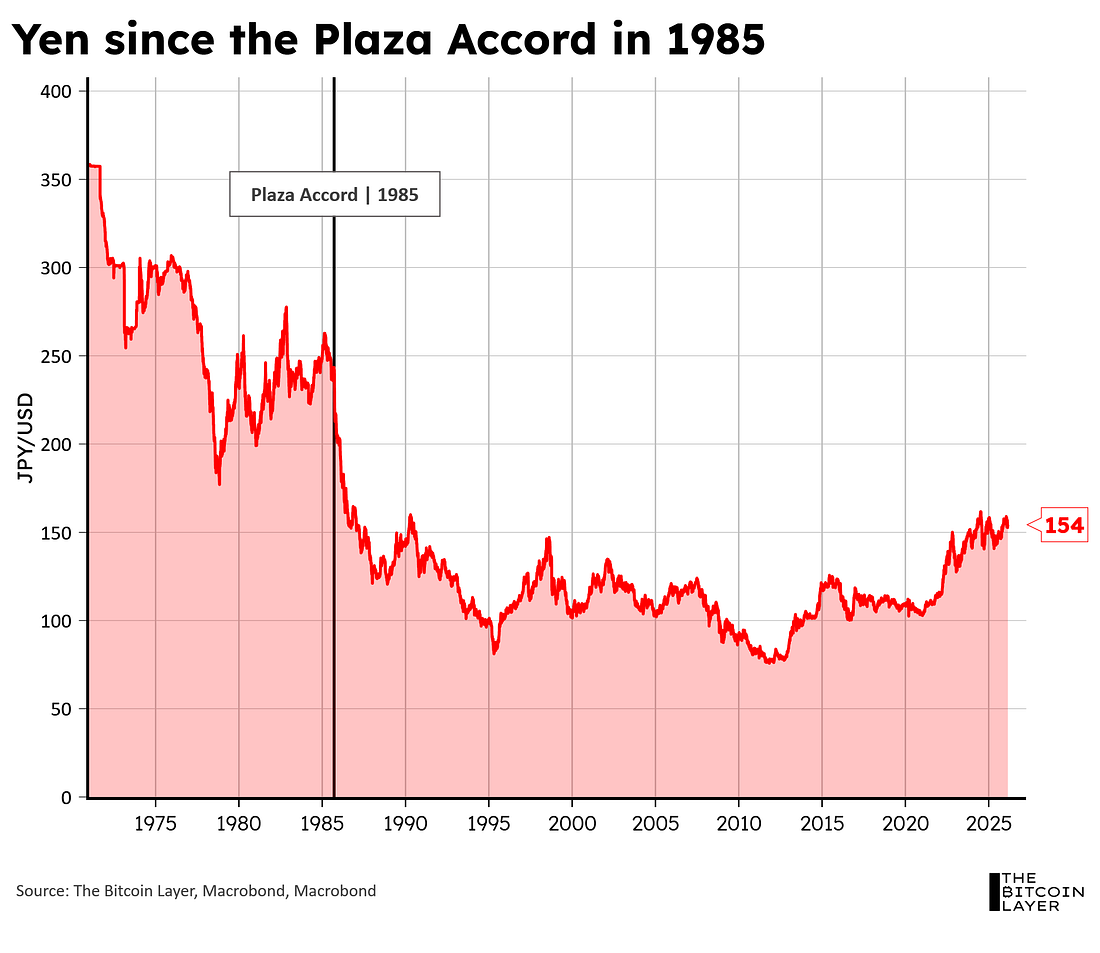

Dollar strength, but what happened to the second Plaza Accord?In 1985, the United States dollar had increased in price relative to the currencies of its trading partners to such a dramatic extent that it forced a reversal by convincing Germany and Japan to help manage the FX pairs the other way. TBL Liquidity followers will know that too strong a dollar just dampens all hopes of supportive credit conditions on which risk markets heavily rely. Subscribe to The Bitcoin Layer to unlock the rest.Become a paying subscriber of The Bitcoin Layer to get access to this post and other subscriber-only content. A subscription gets you:

|

Thursday, February 19, 2026

3 Takeaways from FX Conference

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Bryan's $1M service product, analyzing MegaETH's lackluster performance, LayerZero announcement of blockch...

-

Also This Is a Correction for Some Assets, a Bear Market for Bitcoin & Bitcoin Is Trading as a Risk-On Asset, Not a Defensive One ͏ ...

-

Picking apart our TBL Liquidity Indicator's ability to front-run the recent move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Can incumbents compete with the big banks? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

The Ethereum Foundation is making big changes to its leadership team. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

No comments:

Post a Comment