Bitcoin ETF Flows Have Entered a Bear-Market RegimeAlso This Is a Correction for Some Assets, a Bear Market for Bitcoin & Bitcoin Is Trading as a Risk-On Asset, Not a Defensive OneWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

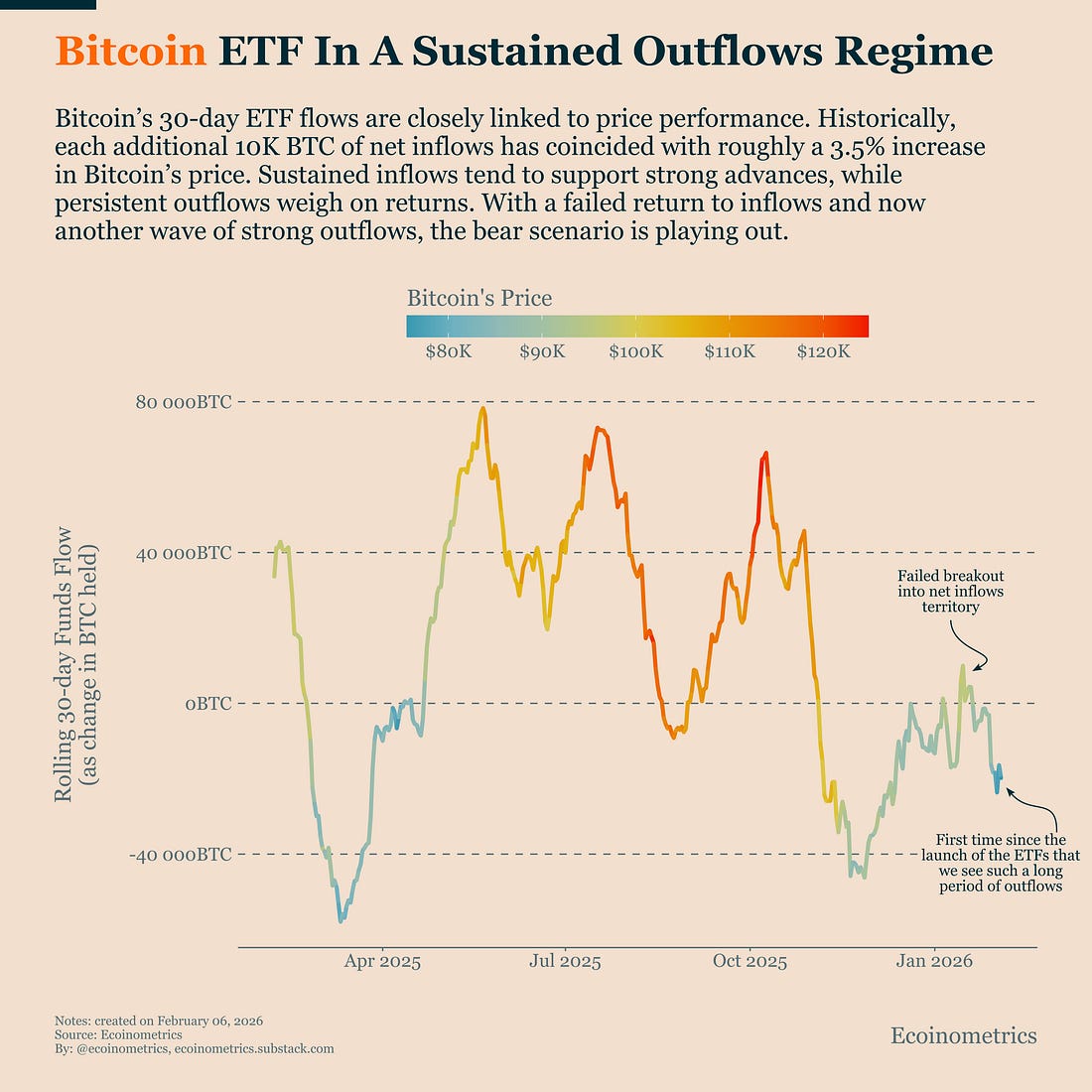

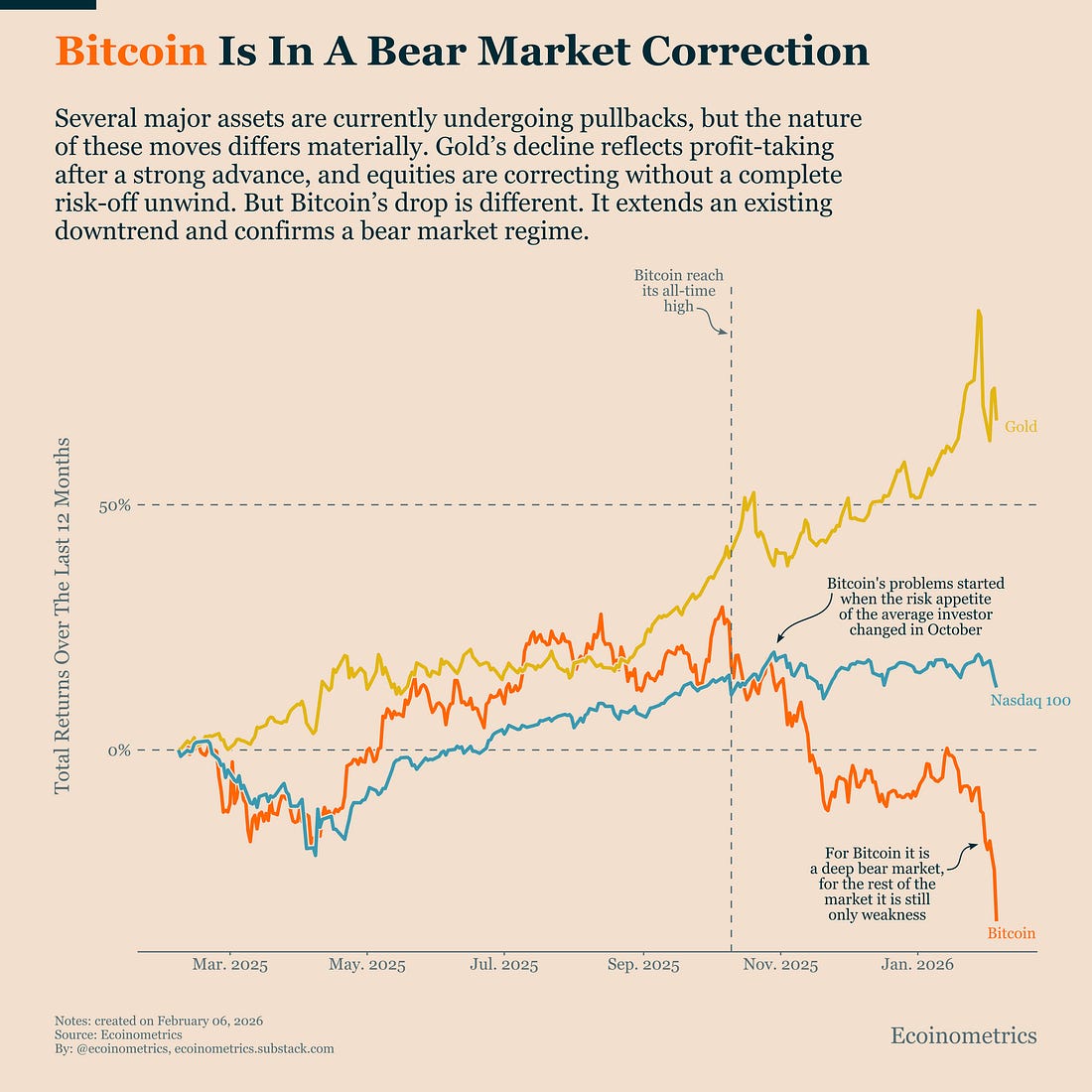

These charts describe a clear shift in regime. Bitcoin is facing declining institutional demand, deeper losses than other major assets in a market structure that ties it closely to risk-on conditions. That’s not the setup for a short-lived dip. It is the anatomy of a bear market. In case you missed it, here are the other topics we covered this week: Get these professional-grade insights delivered to your inbox: Bitcoin ETF Flows Have Entered a Bear-Market RegimeBitcoin is now down roughly 50% from its highs. By any reasonable definition, that is a bear market for the price action. But what’s even more important is that data shows structural forces have also completely shifted to a bear market regime. This is not a selloff driven mainly by leveraged liquidations or short-term positioning. The data shows sustained outflows from spot Bitcoin ETFs, meaning investors are actively reducing exposure rather than being forced out by volatility. That matters because ETF investors tend to operate on longer time horizons. When they step back, it reflects a reassessment of Bitcoin’s medium-term outlook, not just discomfort with short-term price swings. The chart shows this clearly. After a brief attempt to move back into positive territory, ETF flows rolled over again. That breakout failed quickly, and flows have since remained negative. Excluding that short-lived rebound, this is the longest stretch of consistent rolling outflows since the ETFs launched. This is not the setup you see before a fast recovery. Without renewed ETF demand, downside pressure will persist and rallies will struggle to hold. The current flow regime is consistent with bear-market behaviour, not a temporary dip. This Is a Correction for Some Assets, a Bear Market for BitcoinBitcoin’s latest leg down is not happening in isolation. Gold has pulled back, and U.S. tech stocks are also under pressure. On the surface, it looks like another broad market correction. But the similarity largely ends there. What matters is where each asset was coming from before the drawdown. Gold is correcting from a position of strength. It had just made new highs after a rapid advance, and the recent pullback looks like profit-taking following an accelerated move. Even after the decline, gold remains broadly in line with its longer-term trend. U.S. tech stocks are in a more fragile spot. This correction comes after months of sideways price action rather than a strong uptrend. That’s a less comfortable setup for risk assets, but so far the drawdown is still within historical norms. Bitcoin is different. This selloff is not interrupting strength, it is extending weakness. Bitcoin had already lost momentum across multiple dimensions before the latest drop, and this move is pushing it deeper into a bear-market regime. The chart makes that contrast clear: while gold and equities are still experiencing corrections, Bitcoin’s losses are both larger and more persistent. For gold and equities, recovery scenarios remain plausible without a major shift in the macro backdrop. For Bitcoin, that’s not the case. Recoveries from this kind of setup typically require time and a change in underlying conditions, not just a bounce in price. Unless you’re operating on a very long investment horizon, this is not the phase where risk-reward favours stepping in simply because Bitcoin is cheaper than it was a few months ago. In past cycles, the moments when reward clearly outweighs risk have tended to arrive later, after the bear phase has done its work.

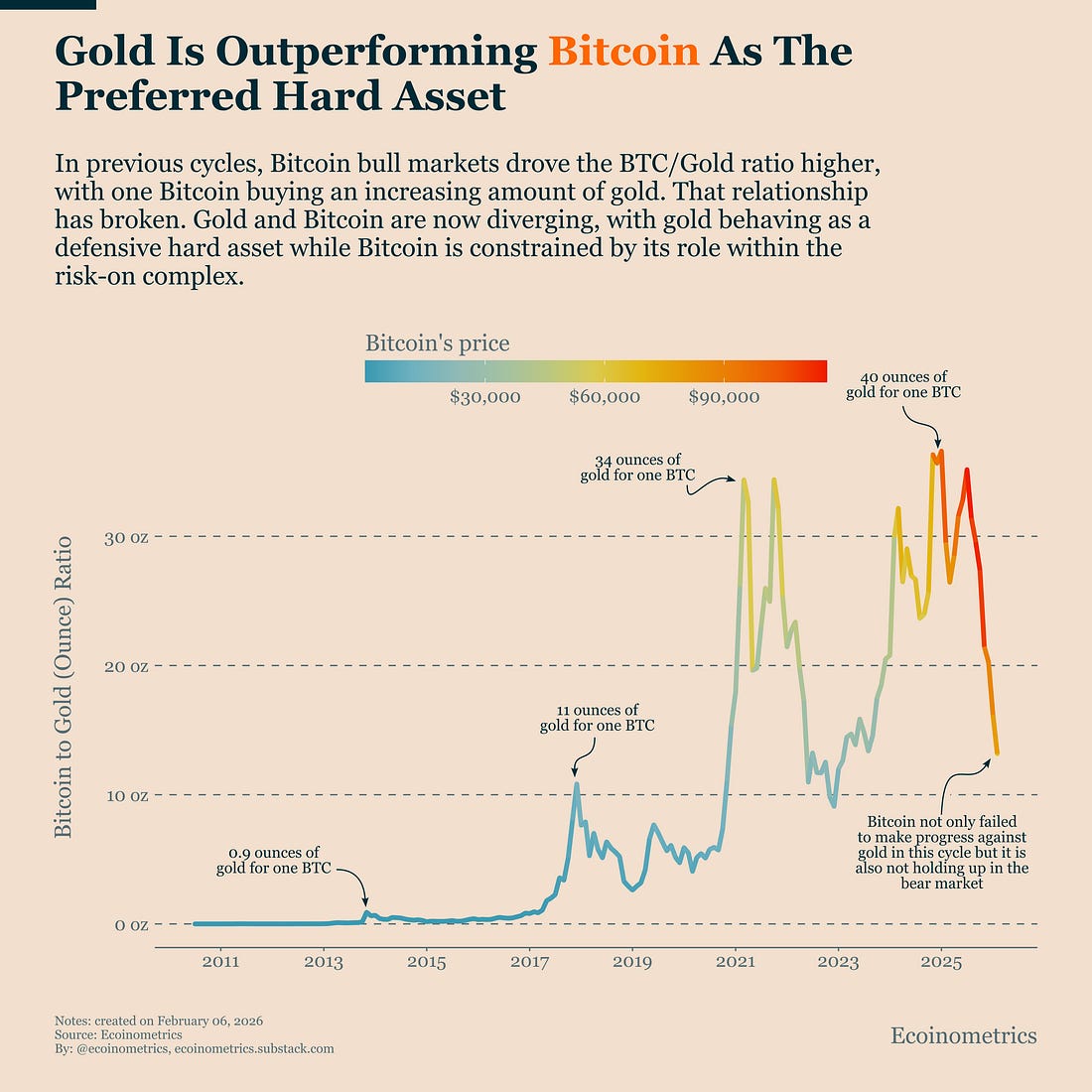

Bitcoin Is Trading as a Risk-On Asset, Not a Defensive OneAfter a full bull-bear cycle, one structural change in Bitcoin’s market has become hard to ignore: Bitcoin is now far more tightly linked to the risk-on complex than in previous cycles. That shift explains a lot of what we’ve seen over the past year. A large share of incremental demand this cycle came through spot Bitcoin ETFs. Those investors overlap heavily with traditional finance portfolios, where Bitcoin sits next to equities and other growth assets rather than replacing gold. In that context, Bitcoin is treated as the more speculative position. When risk is reduced, it is one of the first assets to be cut. Gold, by contrast, benefits from the same risk-off episodes. This portfolio behaviour explains both Bitcoin’s weakness since October 2025 and the tendency for Bitcoin and gold flows to move in opposite directions. For traditional investors, Bitcoin is firmly a risk-on asset and it trades that way. That framing also clarifies what would need to change for Bitcoin to stabilize, let alone recover:

Without those conditions, it’s difficult to see capital rotating back into Bitcoin ETFs in a sustained way. And none of them are in place today.

Tactical TakeawayBitcoin is in a confirmed bear-market regime, where recoveries tend to be slow, uneven, and driven by changes in demand rather than price alone. In this environment, buying weakness simply because Bitcoin is “down a lot” is not a strategy. Without stabilization in ETF flows, improvement in risk appetite, or a cooling of the gold trade, rallies are more likely to fade than to mark durable turning points. For investors, the practical risk right now is not missing the next bull move, it’s deploying capital too early in a market that is still shedding risk. Bear markets usually offer multiple opportunities to re-enter at better risk-reward once conditions start to change. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, February 6, 2026

Bitcoin ETF Flows Have Entered a Bear-Market Regime

Subscribe to:

Post Comments (Atom)

Popular Posts

-

The Bitcoin Market Monitor by Ecoinometrics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Unpacking a brutal weekend for ETH, BTC, and gold. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Your monthly read on Bitcoin’s cycle, from macro to flows. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

From Treasury Titan to Distress Sale? MSTR Down 53% in a Year Amid Extreme Fear ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Institutions are barreling into the stablecoin business; do the trustless crypto-native stablecoin protocols stand a chance? ...

No comments:

Post a Comment