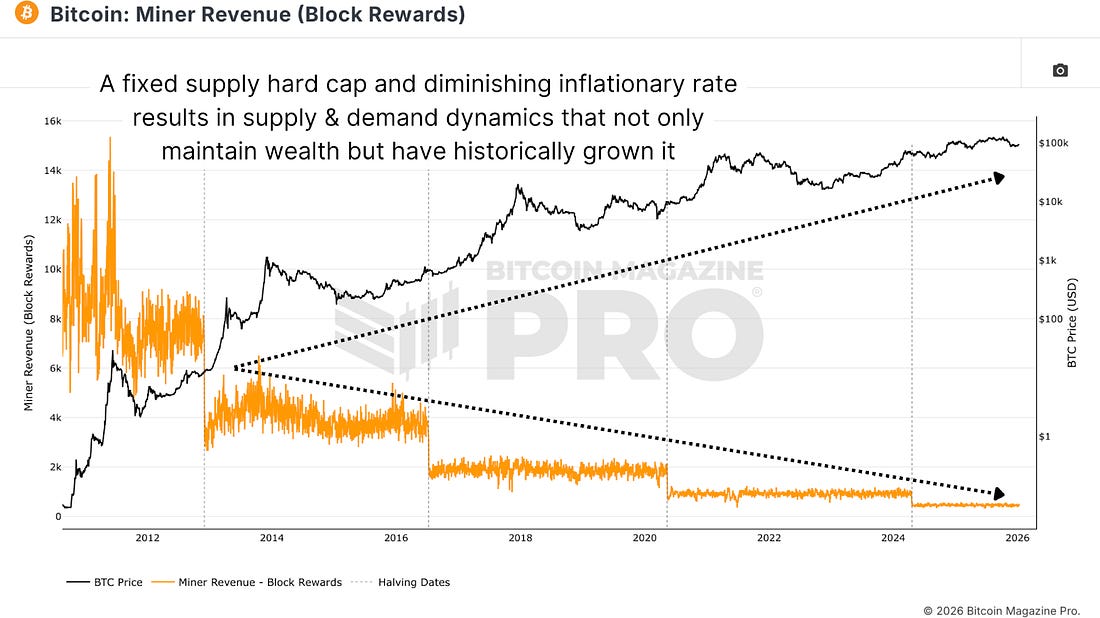

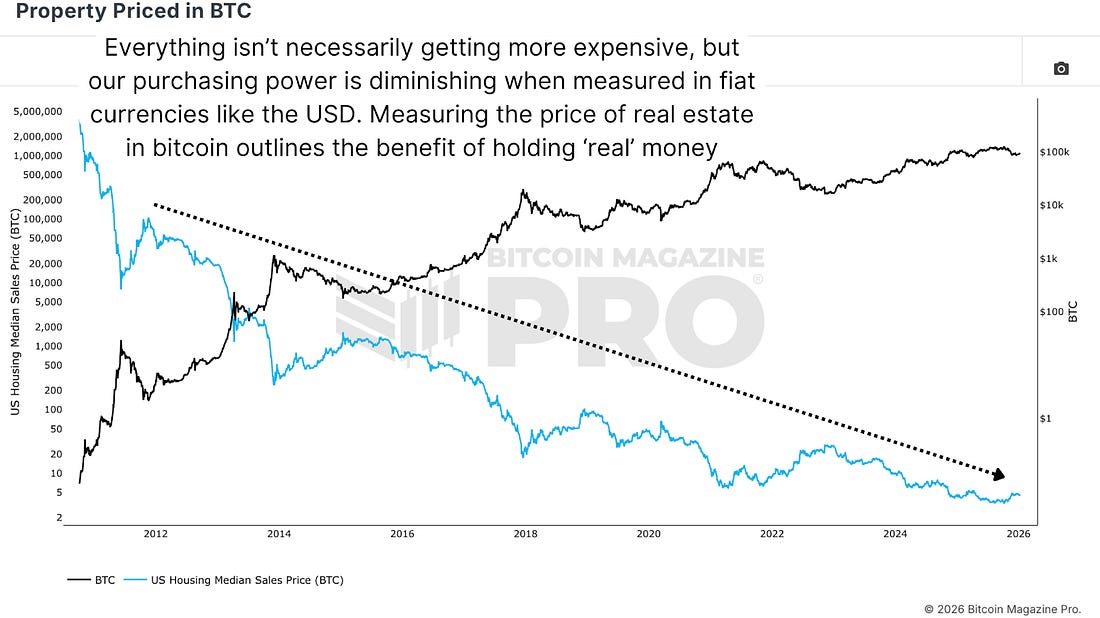

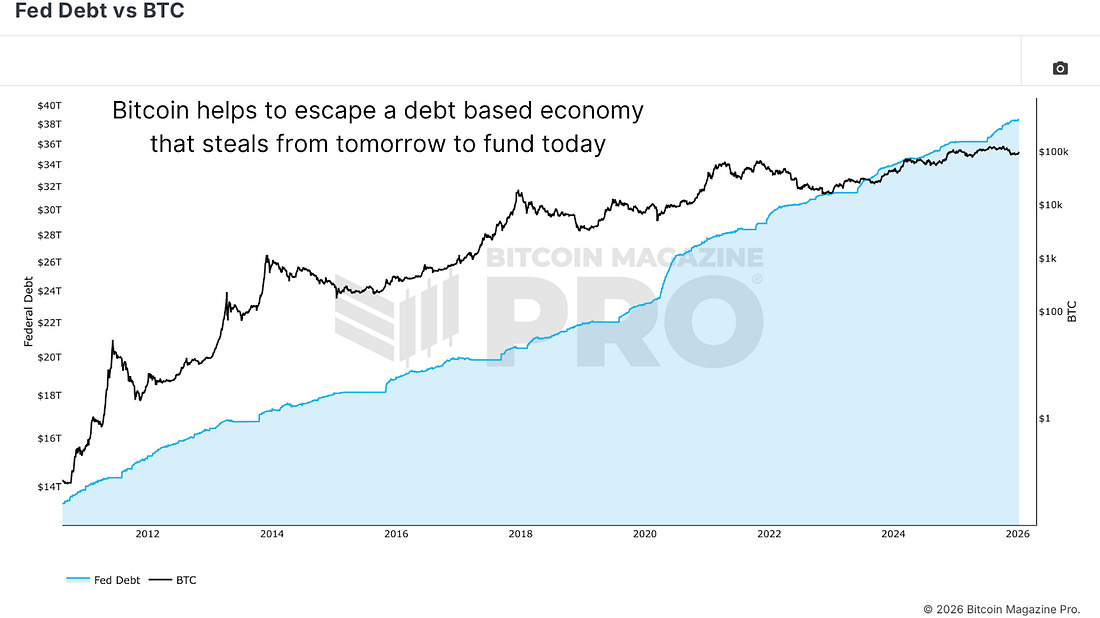

Bitcoin Fundamentals & PurposeHow Bitcoin was born to end reliance on broken systems and deliver the world’s first truly scarce digital moneyBitcoin was created in the ashes of the 2008 financial crisis as a peer-to-peer electronic cash system requiring no trusted third parties. Satoshi Nakamoto’s innovation solved a problem cryptographers had been attempting to solve for decades by creating the first secure digital money that could not be counterfeited, duplicated, or controlled by any single entity. Understanding Bitcoin requires grasping both its revolutionary technology and its role as the world’s best form of money ever created. Bitcoin’s PurposeBitcoin was born on January 3rd, 2009, when the Genesis block was mined, bringing the first bitcoin into circulation. Satoshi left a message in this block that perfectly captures Bitcoin’s purpose: “Times January 3rd 2009 Chancellor on brink of second bailout for banks.” Bitcoin was created to provide an alternative system of monetary transactions that did not rely on central parties or intermediaries that could dictate transactions and control lives. Figure 1: The headline from The Times newspaper, January 3rd, 2009. Bitcoin represented the culmination of decades of work attempting to create a digital currency by cypherpunks (those seeking to use encryption to protect personal data, communications, and finances from government and corporate intrusion). Previous attempts, such as Hashcash in 1997, came close, but Bitcoin was the first to truly succeed and fulfill all the necessary criteria for functional money. The code was fully open source, released on GitHub, allowing anyone to verify, audit, and use Bitcoin however they want. Fixed SupplyBitcoin’s defining characteristic is its fixed supply. There can never be more than 21 million bitcoin created. It is hardcoded into the software itself. Bitcoin cannot be printed, found on asteroids, or discovered underground. This is not a linear inflationary rate but one that decreases roughly every four years through the Bitcoin halving event. In Bitcoin’s early years, approximately 10 million bitcoin came into circulation. Over the next four years, only 5 million more entered circulation. Then 2.5 million. Then 1.25 million. This diminishing inflationary rate means the last fraction of a bitcoin will not enter the network until approximately 2140, over a century in the future. Figure 2: Bitcoin’s periodic halving events limit supply and inflation. Bitcoin’s scarcity creates purchasing power that increases over time. If you bought gold years or decades ago and buried it, that gold bar would buy you roughly similar goods today (maybe a little more, given its recent meteoric rise!). If you buried dollar bills, they would buy significantly less. Real estate measured in US dollars shows house prices rising substantially, but measured in Bitcoin, house prices are decreasing very rapidly. Bitcoin does not just retain purchasing power; it increases it. Figure 3: The value of US property measured in BTC has eroded over time. The SolutionThe current monetary system is debt-driven and unsustainable. The US Federal Debt exceeds $38 trillion, while circulating US dollars total around $22 trillion. This is robbing wealth from future selves by making tomorrow pay for today. This is not fair. The work people put into securing wealth and earning energy is diminishing as purchasing power decreases through inflation. Figure 4: The ever-increasing volume of US Federal Debt. Bitcoin solves this problem. Bitcoin is not printing itself. It is not issuing debt. It is not stealing from the future. It is maintaining and increasing purchasing power throughout time. Gold has performed well as people seek inflation hedges. But Bitcoin, by eliminating the possibility of inflation through its fixed supply, represents the ultimate solution to currency debasement. ConclusionBitcoin’s value ultimately derives from it being energy turned into a commodity in ways never seen before. It represents the best money the world has ever seen because it fulfills all monetary requirements while being controlled by no entity, having perfect scarcity, and operating transparently. As Satoshi’s white paper declared, Bitcoin is a peer-to-peer electronic cash system designed to function without institutional intermediaries. That remains Bitcoin’s revolutionary purpose. For a more in-depth look into this topic, watch our most recent YouTube video here: Bitcoin Masterclass #1 | What Is Bitcoin  Matt Crosby Director of Research & Analytics Bitcoin Magazine ProFor more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro. Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can’t get anywhere else. We don’t just provide data for data’s sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload. Take the next step in your Bitcoin investing journey:

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market! Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions. We sincerely appreciate your support and hope you found this content valuable. Please leave a like and let us know your thoughts in the comments section; we always welcome feedback from our audience! |

Friday, February 6, 2026

Bitcoin Fundamentals & Purpose

Subscribe to:

Post Comments (Atom)

Popular Posts

-

The Bitcoin Market Monitor by Ecoinometrics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Unpacking a brutal weekend for ETH, BTC, and gold. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Your monthly read on Bitcoin’s cycle, from macro to flows. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

From Treasury Titan to Distress Sale? MSTR Down 53% in a Year Amid Extreme Fear ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Institutions are barreling into the stablecoin business; do the trustless crypto-native stablecoin protocols stand a chance? ...

No comments:

Post a Comment