Bitcoin Is A Patience Game Right NowAlso Long Drawdowns Rarely End Quickly & The Economy Isn’t Weak... That’s Kind Of A ProblemWelcome to Ecoinometrics’ Friday edition. Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis. Today we’ll cover:

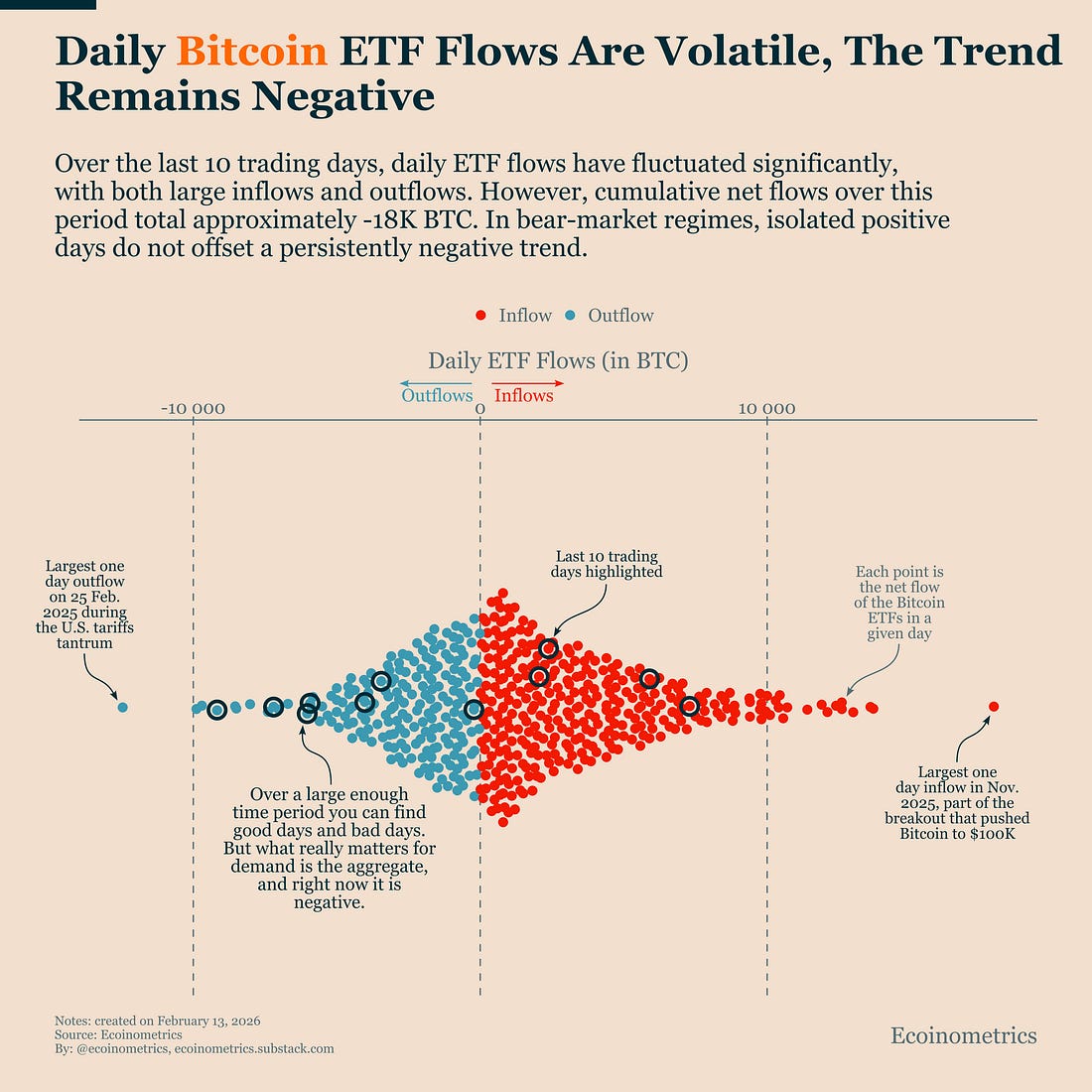

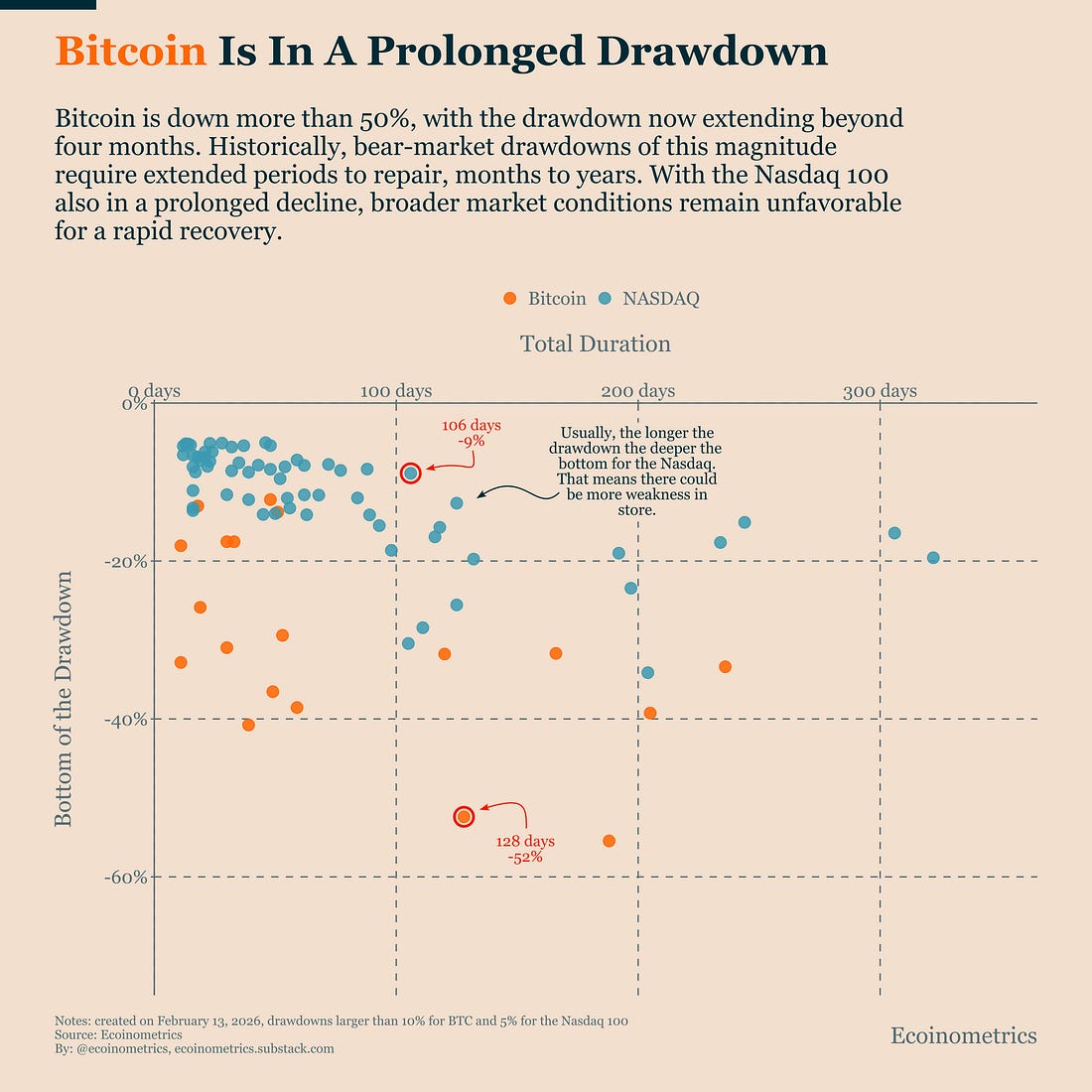

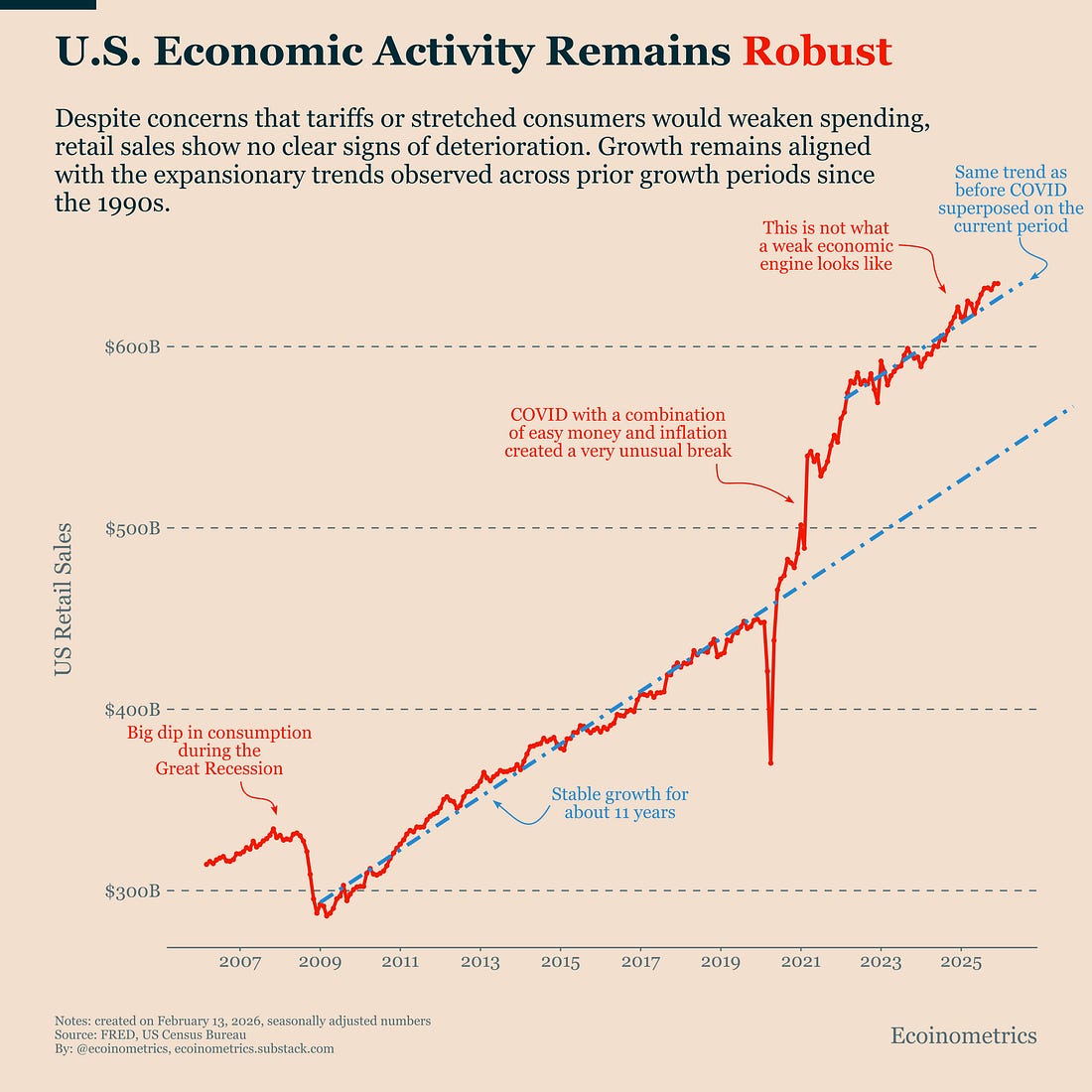

Nothing is breaking but nothing is improving fast enough either. Demand is weak, drawdowns are aging, and policy isn’t turning. That’s the regime we’re in. And it’s a slow moving one. In case you missed it, here are the other topics we covered this week: Get these professional-grade insights delivered to your inbox: Bitcoin Is A Patience Game Right NowIf there’s one lesson worth remembering in a bear market, it’s this: slow down. In bull markets, tops form quickly. Momentum reverses sharply. Trying to reduce exposure near a peak makes sense because the window is short. That’s hard to do, but at least that’s a game worth trying. Bear markets are different. They grind. They fluctuate. They give you good days just to remind you how it used to feel. But durable switch to a recovery phase don’t come out of nowhere. They take time to form. That’s why you need to look at things at the right scale. Take the ETF flows as an example. Over the last 10 trading days, we’ve seen both large inflows and large outflows. Some days look great. Others look ugly. If you zoom in, you can convince yourself something is changing. But when you zoom out just a little, the picture is clear. Cumulative net flows over the last 10 days are roughly –18,000 BTC. In other words, demand in aggregate remains negative. That’s all that matters. In bear-market regimes, isolated positive days don’t mark turning points. What changes regimes is sustained inflow i.e. persistent capital allocation, not a handful of positive clusters here and there. Until that trend shifts, volatility in the flows is just noise. That’s why you need to slow down, zoom out and be patient in this bear market. The turning point will emerge in the big picture for demand, not in the daily fluctuations of the price. Long Drawdowns Rarely End QuicklyNot all drawdowns are the same. Some corrections are sharp and short-lived. Others stretch out, grind lower, and take time to repair. The key difference isn’t just how deep they go, it’s how long they last. The chart below maps historical drawdowns by duration and depth for both Bitcoin and the Nasdaq 100. And there’s a pattern that shows up clearly: the longer a drawdown lasts, the deeper the correction. Bitcoin is now more than four months into its current drawdown, with price down over 50% from the October peak. That magnitude is not unusual by Bitcoin standards, but once a drawdown extends past the 100-day mark, history suggests recovery tends to be measured in months or sometimes years but not in weeks. The Nasdaq 100 is also entering longer-duration territory. And historically, when equity drawdowns stretch beyond three months, they often go deeper before stabilizing. That’s relevant for Bitcoin because it doesn’t operate in isolation, it is deep in the risk-on complex. In periods where U.S. growth stocks are under pressure, correlations actually tighten. And it is difficult to build a sustained recovery in a risk asset while the broader risk-on complex is still adjusting. Could this time be different? Always possible. But historically, when both duration and depth expand together, the probability of a quick v-shaped rebound declines. Your timeline for Bitcoin’s recovery needs to expand. The Economy Isn’t Weak... That’s Kind Of A ProblemThe stock market is one thing. The economy is something else. And for all the talk about a job apocalypse or an AI-driven labor collapse, the hard data simply doesn’t show an economy in distress. Yes, some companies are cutting staff. But most of that looks like normalization after the post-COVID hiring spree, not the start of a broad labor contraction caused by automation. And while inflation remains above target, it clearly hasn’t stopped consumers from spending. The chart below makes that clear, retail sales continue to grow along roughly the same expansion trend we’ve seen since the 1990s. COVID created a violent break (first down, then up) but once the distortion faded, the underlying growth trajectory resumed. This is not what recession looks like. There is no sustained rollover in consumption and no evidence that households have shut their wallets. And that’s where the paradox begins. Because if the economy isn’t cracking, the Fed has no macro pressure to rush into rate cuts. Housing is soft. Debt service costs are high. Government financing is expensive. But the core engine of the U.S. economy (household consumption) is still running. In a world where growth is stable but not accelerating, and policy is not easing, high valuations become harder to justify. Higher-for-longer rates mean future earnings are discounted more aggressively. And when business growth isn’t clearly re-accelerating, investors demand a higher risk premium. I’m not a stock analyst, I’m a macro guy, so I don’t want to dig into the details of why stock investors think valuations are too high. But clearly that combination (stable growth, no policy relief, rising uncertainty) is enough to pressure the risk-on complex. The Nasdaq 100 isn’t falling because the economy is collapsing. It’s adjusting to a regime where earnings growth isn’t strong enough to compensate for the neutral monetary policy. We are no longer in a zero interest rate world. So by the game of correlations, when equities are under pressure, Bitcoin feels it too. Bitcoin doesn’t trade in isolation. In periods where risk appetite compresses and correlations tighten Bitcoin is where investors reduce their risk exposure. So if we want to be a bit provocative about it, the issue isn’t that the economy is weak, it’s that it isn’t weak enough to justify lower rates. Tactical TakeawayBitcoin is not at a turning point and there is no sign yet that capital is reallocating back into risk. Trying to anticipate the bottom in a slow drawdown regime is usually expensive. Without sustained improvement in demand and broader risk appetite, rallies are unlikely to last (if they can even start). The real tactical edge is to wait. Let the trend prove it has changed before committing meaningful capital. That will take a while. That’s it for today. Thanks for reading. Cheers, Nick P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis. Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions. Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights. You're currently a free subscriber to Ecoinometrics. For the full experience, upgrade your subscription. |

Friday, February 13, 2026

Bitcoin Is A Patience Game Right Now

Subscribe to:

Post Comments (Atom)

Popular Posts

-

Also This Is a Correction for Some Assets, a Bear Market for Bitcoin & Bitcoin Is Trading as a Risk-On Asset, Not a Defensive One ͏ ...

-

Can incumbents compete with the big banks? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

The Ethereum Foundation is making big changes to its leadership team. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

Learn why crossings in 30-day vs. 60-day hash rate averages reveal real operational decisions by miners—and historically predict strong Bitc...

-

Macro we can learn from bitcoin's latest obituary ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment